Luxury Bathroom Plumbing Fixtures Market Size

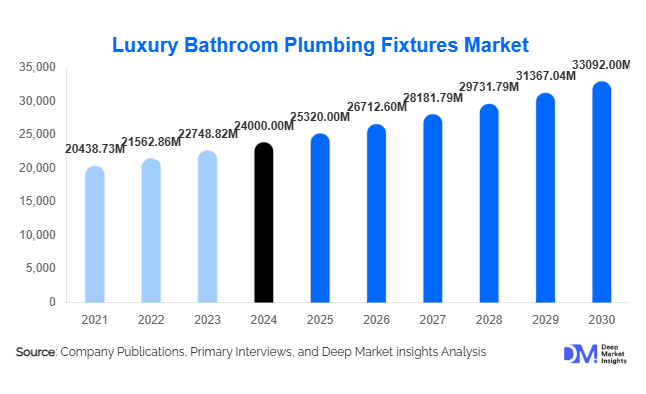

According to Deep Market Insights, the global luxury bathroom plumbing fixtures market size was valued at USD 24,000 million in 2024 and is projected to grow from USD 25,320 million in 2025 to reach USD 33,092.23 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). This growth is driven by the rising global focus on premium home interiors, growing luxury residential construction, and increasing adoption of smart, water-efficient, and designer bathroom fixtures in both residential and commercial sectors.

Key Market Insights

- Luxury faucets and taps dominate the market, accounting for nearly 42% of total revenue in 2024 due to their widespread installation in both new-build and renovation projects.

- Residential applications lead demand, representing about 63% of the market as luxury homeowners invest in spa-like bathroom upgrades and renovations.

- North America holds the largest regional share (32% of global market value), driven by high-end remodeling and luxury hospitality projects.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, growing affluence, and large-scale luxury real estate developments in China and India.

- Smart and connected fixtures, including sensor-activated faucets and digital showers, are transforming modern luxury bathroom experiences.

- Brass and bronze finishes are gaining popularity for their premium aesthetics and long-term durability, capturing a 30% material-based market share in 2024.

Latest Market Trends

Smart and Connected Bathroom Fixtures on the Rise

Manufacturers are increasingly integrating smart technology into luxury plumbing fixtures. Touchless faucets, app-controlled showers, and voice-activated bidet toilets are redefining the bathroom experience. These connected systems not only enhance convenience but also support water conservation through precise flow control. The integration of IoT platforms and AI-enabled usage analytics allows homeowners and hoteliers to monitor water consumption and personalize user experiences. As luxury homes become smarter, smart plumbing fixtures are expected to become a key differentiator in high-end property design.

Sustainability and Water Efficiency as Luxury Standards

Eco-luxury is becoming a defining trend in the market. Consumers are prioritizing sustainable materials, low-flow technologies, and recyclable components without compromising on aesthetics. Leading brands are launching luxury product lines that meet global green building standards such as LEED and WELL certifications. Water-efficient technologies, antimicrobial surfaces, and lifecycle durability are increasingly being perceived as luxury attributes. This convergence of design and sustainability is transforming how architects and developers specify bathroom fixtures in premium projects.

Luxury Bathroom Plumbing Fixtures Market Drivers

Rising Affluence and Premium Home Renovations

Global wealth growth and increasing high-net-worth households are fueling investment in luxury bathrooms. Homeowners are viewing bathrooms as wellness sanctuaries rather than functional spaces. The demand for customized, designer fixtures has surged in new luxury constructions and remodeling projects across North America, Europe, and emerging Asian economies. The renovation boom, particularly in developed nations, continues to drive recurring demand for high-value fixtures such as freestanding bathtubs and designer faucets.

Expansion of Luxury Hospitality and Commercial Infrastructure

Upscale hotels, resorts, spas, and premium offices are increasingly incorporating high-end bathroom designs to enhance guest experience. The luxury hospitality sector is specifying designer faucets, smart showers, and premium bathtubs as standard fittings. These large-scale projects generate significant contract-based orders for luxury fixture manufacturers, providing steady revenue streams and brand visibility.

Technological and Material Innovation

Ongoing innovation in design and materials, such as the use of solid surface composites, premium brass finishes, and antimicrobial coatings, is elevating product differentiation. Technology integration, including digital temperature control and sensor-based operation, adds value for both aesthetic and functional reasons. These advancements allow manufacturers to command higher margins and solidify brand prestige in an increasingly competitive luxury segment.

Market Restraints

High Initial Costs and Long Payback Periods

Luxury bathroom plumbing fixtures are often priced significantly higher than standard options, limiting accessibility in cost-sensitive projects. Developers and homeowners in emerging markets may delay premium fixture adoption due to high upfront investments and longer ROI timelines. This pricing gap restricts penetration in mid-tier residential markets despite rising interest in luxury design.

Supply Chain and Raw Material Volatility

Manufacturers face challenges from fluctuating costs of premium materials such as brass, bronze, and specialty alloys. Geopolitical uncertainties, shipping costs, and trade tariffs further impact profit margins. Maintaining consistent quality and timely delivery amid these constraints remains a major challenge for global suppliers.

Luxury Bathroom Plumbing Fixtures Market Opportunities

Smart Bathroom Integration and IoT Expansion

Integration of smart home technologies with luxury bathroom fixtures represents a major opportunity. Connected showers, sensor faucets, and app-managed water control systems are gaining momentum among luxury consumers. Partnerships between fixture manufacturers and smart home solution providers can create differentiated product ecosystems, driving premium pricing and customer loyalty.

Emerging Market Expansion in Asia-Pacific and the Middle East

Emerging economies, particularly in the Asia-Pacific and the Middle East, offer substantial growth potential due to rising luxury housing projects, tourism-driven hospitality expansion, and urban affluence. Localization of production, cultural design customization, and regional brand alliances will be key success factors. Manufacturers that establish local showrooms and service networks in these high-growth markets stand to gain long-term competitive advantage.

Sustainable Luxury Product Development

The intersection of luxury and sustainability is reshaping consumer perception. Brands that can deliver eco-friendly, high-performance fixtures such as water-efficient faucets and recyclable materials are likely to dominate future market share. Government incentives for green buildings and eco-labeling schemes further accelerate adoption in both residential and commercial projects.

Product Type Insights

Faucets & Taps lead the global market, representing approximately 42% of total revenue in 2024 (≈USD 10.1 billion). Their dominance stems from widespread use in every luxury bathroom, frequent replacement cycles, and the growing popularity of designer and touchless faucets. Other major product categories include luxury shower systems, freestanding bathtubs, and designer sinks, each benefiting from innovations in design and smart control technology.

Material Insights

Brass and Bronze Finishes accounted for about 30% of the market in 2024. Their durability, aesthetic appeal, and corrosion resistance make them preferred materials for high-end consumers and hospitality specifiers. Composite stone and solid surface materials are also gaining momentum for luxury bathtubs and basins, offering a blend of craftsmanship and sustainability.

Application Insights

Residential installations dominate with a 63% share of the global market (USD 15.1 billion in 2024). Demand is primarily driven by luxury housing developments and high-end renovations. The hospitality sector follows as a key end-user, with luxury hotels and resorts specifying premium fixtures as part of design identity. Commercial spaces such as executive offices and wellness centers represent a smaller but rapidly growing niche focused on experience-driven design.

| By Product Type | By Material Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 32% share (USD 7.5 billion in 2024). The U.S. dominates, supported by affluent homeowners, high renovation rates, and established luxury fixture brands. Luxury hospitality developments and commercial remodeling projects continue to sustain growth.

Europe

Europe accounts for about 26% of the global market (USD 6.2 billion in 2024). Germany, the U.K., France, and Italy are major contributors, driven by high design consciousness and the presence of heritage brands. Sustainable luxury trends are shaping demand, with a strong focus on water-saving and eco-certified fixtures.

Asia-Pacific

Asia-Pacific holds roughly a 25% share (USD 6.0 billion) and is the fastest-growing region with a CAGR above 6%. China leads with robust luxury real estate development, while India is emerging as a lucrative market driven by expanding high-income households. The hospitality boom in Southeast Asia further boosts regional demand.

Latin America

Latin America contributes about 5% (USD 1.1 billion), with Brazil, Argentina, and Chile leading consumption. Growth is supported by increasing urbanization and renovation of upscale residential properties, though overall adoption remains limited compared to developed regions.

Middle East & Africa

This region represents approximately 4% of global revenue (USD 0.9 billion). The GCC countries, particularly the UAE and Saudi Arabia, drive demand through luxury hotel and residential projects. Rapid urban transformation and government-backed infrastructure programs support continued expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Bathroom Plumbing Fixtures Market

- Kohler Co.

- Moen Incorporated

- Delta Faucet Company

- Grohe AG

- TOTO Ltd.

- American Standard Brands

- Cera Sanitaryware Limited

- Bradley Corporation

- Hansgrohe SE

- Dornbracht AG & Co.

- Roca Sanitario S.A.

- LIXIL Group Corporation

- Matco-Norca

- Aquabrass

- Little Giant

Recent Developments

- In June 2025, Kohler launched a new range of AI-integrated smart faucets and showers featuring water-use analytics and personalized presets for luxury homeowners.

- In April 2025, Grohe announced the expansion of its sustainable product line with recycled brass fixtures designed to reduce carbon footprint by 30%.

- In February 2025, TOTO introduced a next-generation luxury bidet toilet incorporating UV sterilization and app-based hygiene monitoring.