Luxury Bath & Body Products Market Size

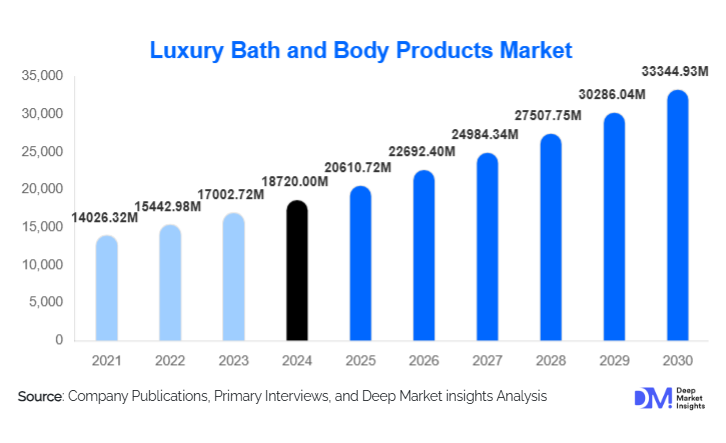

According to Deep Market Insights, the global luxury bath and body products market size was valued at USD 18,720 million in 2024 and is projected to grow from USD 20,610.72 million in 2025 to reach USD 33,344.93 million by 2030, expanding at a CAGR of 10.1% during the forecast period (2025–2030). Growth in this market is primarily driven by rising global interest in wellness and self-care rituals, surging demand for premium and clean-ingredient formulations, and the rapid premiumization of body care products across both online and offline retail channels.

Key Market Insights

- Botanical and clean-ingredient luxury formulations are taking center stage, reflecting consumer preferences for natural, organic, and sustainably sourced body care products.

- Body lotions and creams dominate the product landscape, driven by everyday use, high-margin potential, and the integration of advanced actives and sensorial ingredients.

- North America remains the largest regional market, supported by mature luxury retail networks and high per-capita spending on personal wellness.

- Asia-Pacific is the fastest-growing region, propelled by expanding disposable incomes, digital adoption, and increasing affinity for global luxury brands.

- E-commerce and D2C channels continue to accelerate, offering personalization, refill programs, and subscription-based luxury body care experiences.

- Sustainability-focused innovations, including refillable packaging, upcycled botanicals, and carbon-neutral production, are reshaping competitive dynamics.

What are the latest trends in the luxury bath & body products market?

Rise of Clean, Botanical & Conscious Luxury

Luxury bath and body brands are prioritizing “conscious formulations” by incorporating botanical extracts, essential oils, bio-based actives, and ethically sourced ingredients. Consumer demand for transparency has pushed companies to adopt clean-label formulations free from parabens, sulfates, and synthetic fragrances. Refillable packaging models, eco-friendly materials, and upcycled botanical ingredients are becoming mainstream, enhancing both brand value and sustainability credentials. Many luxury brands are partnering with environmental organizations to support biodiversity preservation, regenerative farming, and ethical supply-chain development.

Technology-Integrated Luxury Body Care

Brands are increasingly leveraging technology to create immersive and personalized luxury experiences. AI-powered skin profiling, virtual texture trials, and scent-layering simulators are becoming common features on D2C websites. Luxury bath lines are offering customized body oils and lotions based on skin type, climate, and user lifestyle inputs. Mobile apps now deliver personalized routines, track skin hydration, and provide ingredient education, while digital loyalty programs enhance consumer engagement. AR-driven try-before-you-buy features, subscription-based deliveries, and smart packaging with QR-based authentication are elevating the luxury body care experience.

What are the key drivers in the luxury bath & body products market?

Growing Consumer Focus on Wellness & Self-Care Rituals

The global shift toward wellness-driven lifestyles is a major driver of luxury bath and body product demand. Consumers increasingly view bath rituals, aromatherapy, and body hydration routines as essential self-care practices. Luxury formulations with calming fragrances, sensory textures, and therapeutic essential oil blends are gaining immense traction. High-income consumers, especially in urban markets, are willing to pay premium prices for products that enhance relaxation, emotional well-being, and daily personal rituals.

Premiumization & Rising Disposable Incomes

Increasing disposable incomes, especially in emerging markets across Asia-Pacific and the Middle East, are driving premium body care purchases. Consumers are gravitating toward sophisticated packaging, high-performing formulations, and heritage luxury brands that deliver exclusivity and quality. The prestige segment also benefits from gifting culture, spa-inspired home rituals, and luxury product discovery through influencers and digital advertising. As consumers increasingly differentiate between basic hygiene and indulgent self-care, the premium body care category continues to expand rapidly.

What are the restraints for the global market?

High Product Pricing & Economic Sensitivity

Luxury bath and body products remain price-restrictive for many middle-income consumers. Economic downturns and inflationary pressures can reduce discretionary spending on non-essential luxury items, slowing market growth. Price sensitivity is particularly evident in cost-intensive product categories that rely on rare botanicals, bioactive ingredients, and premium packaging. Additionally, high import duties in emerging regions may limit affordability and slow category expansion.

Regulatory & Ingredient Compliance Challenges

The luxury bath and body market faces stringent regulatory requirements, particularly concerning clean-ingredient claims, product safety, allergen management, and environmental certifications. Variations in regional regulations complicate global product launches, increasing operational costs for testing, compliance, and reformulation. Limited availability and high costs of certified organic ingredients also pose challenges for brands committed to sustainability and clean beauty standards.

What are the key opportunities in the luxury bath & body industry?

Wellness-Integrated Luxury Bath Experiences

The convergence of wellness and luxury beauty presents substantial growth opportunities. Brands are developing aromatherapy-infused bath oils, sleep-enhancement body butters, adaptogen-based washes, and spa-grade at-home treatment kits. This segment appeals to health-focused consumers seeking stress relief, mental rejuvenation, and holistic well-being. Retailers and spas are increasingly partnering with luxury bath brands to create co-branded wellness packages, seasonal ritual kits, and personalized self-care subscriptions.

Sustainable & Refillable Luxury Business Models

Sustainability-driven innovations are unlocking new revenue streams. Refillable luxury packaging systems, biodegradable formulas, and zero-waste manufacturing approaches differentiate brands in a crowded market. Upcycled ingredients, derived from food waste, floral residues, or agricultural by-products, are gaining attention for both environmental and storytelling value. Clean beauty certifications and ESG-focused product lines appeal strongly to younger consumers, strengthening brand loyalty while opening pathways to premium pricing.

Product Type Insights

Body lotions and creams dominate the luxury bath & body products market, driven by high daily usage, strong hydration benefits, and premium formulation capabilities. These products frequently incorporate ceramides, hyaluronic acid, plant oils, and fine fragrances, contributing to high repeat-purchase rates. Body oils are gaining momentum due to the rising popularity of aromatherapy and wellness rituals. Luxury body washes and shower gels remain core essentials, supported by sensorial experiences and fragrance integration. Additional categories such as bath salts, scrubs, and bath bombs continue to grow as part of holistic spa-at-home experiences.

Application Insights

Personal use remains the largest application segment, fueled by the rise in home-based wellness and premium self-care routines. Gifting applications are growing rapidly, supported by luxury packaging, holiday collections, and premium discovery sets. Hospitality and spa channels represent an influential B2B application, with luxury hotels and wellness resorts increasingly partnering with premium bath brands to elevate guest experiences. Export-driven applications, especially for European and American luxury brands, are expanding across Asia and the Middle East due to strong consumer affinity for international prestige products.

Distribution Channel Insights

Offline retail, particularly specialty stores and luxury department stores, continues to dominate distribution, driven by the importance of sensory testing and experiential shopping. However, online channels are the fastest-growing segment, supported by brand-owned D2C platforms, e-commerce marketplaces, subscription boxes, and virtual consultation tools. Social media, influencer-led marketing, and online sampling programs play a major role in driving discovery and conversion. Travel retail and spa boutiques also serve as important luxury touchpoints across global markets.

Consumer Type Insights

Women represent the largest consumer segment in the luxury bath and body category, driven by self-care adoption and preference for ingredient-rich formulations. Men’s luxury body care is emerging as a high-growth niche, with increasing demand for grooming-oriented and unisex formulations. Wellness-oriented consumers and eco-conscious buyers, often Millennials and Gen Z, are influencing brand strategies with their preference for sustainable, clean, and ethically sourced products. High-income consumers across urban centers continue to drive premium and ultra-premium category growth through frequent repurchases and seasonal gifting.

Age Group Insights

Consumers aged 25–45 account for the largest market share, combining rising disposable incomes with a strong interest in wellness-driven and ingredient-conscious luxury products. Young adults aged 18–24 drive trend adoption through social media and influencer engagement, preferring clean-label, vegan, and sensorial product experiences. Older consumers aged 46–65 represent a stable premium customer base, valuing anti-aging actives, moisturizing benefits, and clinically validated body care formulations. The 65+ demographic increasingly adopts luxury products for comfort, hydration, and sensitivity-focused benefits.

| By Product Type | By Ingredient Type | By Price Tier | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market for luxury bath and body products, led by the United States. High consumer awareness of clean beauty, strong adoption of wellness lifestyles, and a mature prestige retail ecosystem support continued growth. Department stores, specialty boutiques, and spa partnerships remain crucial distribution channels. U.S. consumers show strong engagement with premium seasonal collections, fragrance-infused body care, and sustainable product lines.

Europe

Europe remains a dominant force in luxury bath and body care, supported by long-standing heritage brands in France, the U.K., and Italy. The region’s strong preference for botanical formulations, luxury fragrances, and organic certifications drives premium positioning. Sustainable packaging, cruelty-free claims, and eco-driven product lines resonate deeply among European consumers. Tourism and travel retail further support sales of artisanal and fragrance-led bath products.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by expanding middle-class affluence in China and India, strong e-commerce penetration, and rising demand for international premium brands. Chinese consumers show a preference for fragrance-driven and premium-packaged products, while Indian consumers are adopting luxury body care as part of modern wellness routines. Japan, South Korea, and Australia contribute steady demand through established beauty and wellness cultures.

Latin America

Latin America is experiencing steady growth in luxury bath and body products, particularly in Brazil and Mexico. Increasing urbanization and interest in premium beauty imports are supporting category expansion. Gifting culture and online retail adoption are gradually boosting demand, although economic volatility continues to influence discretionary spending in this region.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, represents a high-potential market driven by high-income populations and a strong affinity for luxury personal care. Demand is concentrated in fragrance-rich, indulgent body care products. Africa, while smaller in market share, shows rising adoption in South Africa and Nigeria, supported by growing urban wellness trends and increasing availability of international brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Bath & Body Products Market

- The Estée Lauder Companies Inc.

- Chanel Limited

- Augustinus Bader

- Diptyque

- Aromatherapy Associates

- Tata Harper

- Omorovicza

- This Works

- Bamford

- Chantecaille

Recent Developments

- In March 2025, Diptyque introduced a new line of refillable luxury body care products featuring upcycled rose and citrus extracts to support circular beauty initiatives.

- In January 2025, Estée Lauder Companies expanded its clean body care portfolio by launching a biotech-driven hydration series leveraging lab-grown botanical actives.

- In October 2024, Aromatherapy Associates partnered with leading international spas to debut a wellness-focused bath oil collection tailored to sleep, relaxation, and mood elevation.