Luxury Activewear Market Size

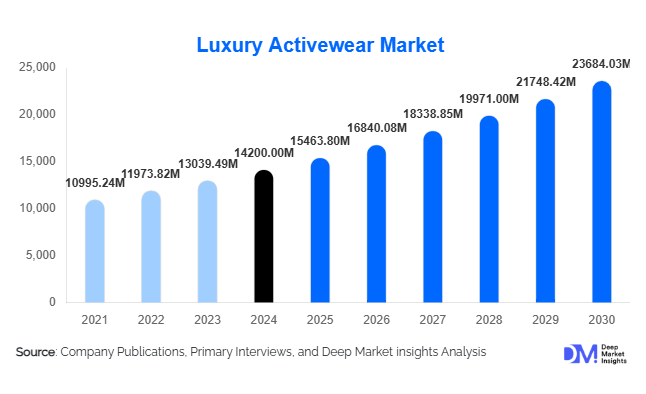

According to Deep Market Insights, the global luxury activewear market size was valued at USD 14,200 million in 2024 and is projected to grow from USD 15,463.8 million in 2025 to reach USD 23,684.03 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). The luxury activewear market growth is primarily driven by rising health and wellness awareness among affluent consumers, the premiumisation of athleisure fashion, and the rapid adoption of e-commerce and digital-first retail models by luxury apparel brands.

Key Market Insights

- Luxury activewear is evolving from niche fashion into a mainstream lifestyle segment, combining high-performance functionality with premium design aesthetics.

- Women’s luxury activewear dominates the market, accounting for over half of global sales, driven by boutique fitness culture and athleisure fashion trends.

- Online direct-to-consumer (D2C) channels are capturing around 40% of total revenue, reflecting digital transformation in luxury apparel retail.

- Bottom activewear (leggings, yoga pants, joggers) represents the largest product category, accounting for roughly 35% of total global market share in 2024.

- Asia-Pacific is the fastest-growing regional market, led by expanding affluence and fitness awareness in China, India, and South Korea.

- Technological innovation and sustainability integration, including recycled fabrics and smart textiles, are reshaping competitive differentiation.

Latest Market Trends

Premiumisation and Fashion–Function Integration

Luxury activewear brands are blurring the line between fitness apparel and high fashion. The segment’s success stems from merging technical performance features such as compression, stretch, and sweat-wicking with couture-inspired styling and brand prestige. Designer collaborations and limited-edition capsule collections, such as luxury yoga pants, statement jackets, and high-fashion sneakers, have transformed activewear into an aspirational wardrobe essential. Consumers increasingly view these products as an expression of lifestyle identity, not just gym attire, leading to a surge in high-margin categories.

Sustainability and Material Innovation

Growing consumer awareness around sustainability is pushing luxury activewear brands to innovate through eco-friendly textiles, recycled polyester, and traceable supply chains. Biodegradable fabrics, plant-based dyes, and closed-loop production are gaining popularity. This shift aligns luxury positioning with environmental responsibility, appealing to conscious consumers willing to pay a premium for ethical products. Brands integrating sustainability into brand narratives, through certifications and transparency, are achieving stronger customer loyalty and pricing power.

Digital-First Retail and Personalisation

The rapid digitisation of luxury fashion is reshaping distribution models. Direct-to-consumer websites, mobile commerce, and virtual try-on tools are transforming how consumers experience premium activewear. Luxury brands are adopting AI-driven size recommendations, 3D body scanning, and personalised membership models to strengthen engagement. Influencer marketing and social commerce are major growth catalysts, particularly among Gen Z and millennial consumers who prioritise authenticity and digital convenience.

Luxury Activewear Market Drivers

Health and Wellness Lifestyle Expansion

Affluent consumers increasingly prioritise holistic health, encompassing fitness, mindfulness, and lifestyle aesthetics. The rise of boutique fitness studios, yoga retreats, and wellness travel has accelerated demand for premium activewear that delivers both style and performance. This driver underpins long-term demand resilience across major economies.

Premiumisation and Brand Differentiation

Luxury activewear benefits from the ongoing premiumisation of apparel markets. Consumers now expect design excellence, exclusivity, and advanced materials even in workout wear. Leading brands leverage heritage, storytelling, and collaborations with high-fashion designers to create scarcity and elevate perception, fueling repeat purchases and strong brand loyalty.

Growth of E-Commerce and Digital Channels

Online luxury retail adoption has surged, allowing brands to bypass traditional wholesale channels and connect directly with global consumers. D2C models improve margins, enable personalised experiences, and offer end-to-end control over brand image. This digital evolution is particularly vital in expanding reach across emerging markets, where luxury retail infrastructure remains limited.

Market Restraints

Economic Sensitivity and High Pricing

Despite affluent target consumers, luxury activewear is vulnerable to macroeconomic uncertainty and fluctuating discretionary spending. Premium pricing limits broader adoption, particularly in emerging economies where consumer purchasing power remains uneven. Inflationary pressures and currency fluctuations also affect imports and pricing stability.

Raw Material Cost Volatility and Supply Chain Complexity

Dependence on specialised fabrics (nylon, spandex, recycled synthetics) and sustainable sourcing adds to cost volatility. Disruptions in global logistics, tariffs, and certification requirements for eco-materials can squeeze margins and delay launches. Maintaining quality and sustainability simultaneously is a complex and costly challenge for luxury manufacturers.

Luxury Activewear Market Opportunities

Emerging Market Expansion

Rising disposable incomes in APAC, the Middle East, and Latin America offer lucrative expansion potential. Fitness adoption in these regions is accelerating, with affluent millennials seeking aspirational brands. Localised collections, climate-adaptive fabrics, and culturally attuned marketing can unlock long-term demand in these high-growth economies.

Sustainable and Smart Textile Integration

Material innovation, recycled fibres, biodegradable elastane, and smart fabrics with moisture or temperature sensors present major differentiation opportunities. Aligning luxury positioning with sustainability will attract eco-aware consumers and strengthen ESG credentials. Investments in R&D and supplier partnerships can yield a competitive advantage through product innovation.

Direct-to-Consumer Premium Experiences

Luxury consumers increasingly demand personalised shopping experiences. Integrating virtual consultations, custom tailoring, limited online drops, and digital community memberships enhances exclusivity and retention. Brands that combine D2C convenience with experiential storytelling and premium service will capture higher lifetime value.

Product Type Insights

Bottom Activewear, including luxury leggings, yoga pants, and joggers, dominates the market, accounting for around 35% of total revenue in 2024. The product category benefits from versatility and the growing trend of “gym-to-street” fashion. The Top Activewear and Outerwear segments are expanding as consumers seek complete premium activewear wardrobes that bridge performance and lifestyle use. Swimwear and innerwear remain niche but lucrative segments in luxury resort and leisure markets.

Material Type Insights

Polyester (including recycled variants) holds the largest material share at approximately 30% of global luxury activewear revenue in 2024. The material’s durability, colour fastness, and moisture-management properties make it ideal for luxury applications. Spandex and nylon blends are gaining traction for enhanced flexibility, while cotton-rich and neoprene fabrics are emerging in lifestyle collections for their comfort and premium touch.

Distribution Channel Insights

Online direct-to-consumer platforms lead the market, generating about 40% of revenue in 2024. Premium e-commerce portals and brand websites enable global reach and personalised shopping journeys. Offline retail, including luxury department stores and flagship boutiques, remains vital for experiential marketing and high-touch consumer engagement. Hybrid omnichannel strategies integrating digital showrooms and appointment-based fittings are becoming standard in the luxury activewear ecosystem.

End User Insights

Women dominate the luxury activewear segment, accounting for nearly 55% of global demand. The trend is driven by female participation in boutique fitness and the fashionisation of athleisure. Men’s luxury activewear is growing steadily as brands introduce tailored fits and minimalist aesthetics. The kids’ segment remains niche but shows potential in high-income markets for coordinated family athleisure collections.

| By Product Type | By Material Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global luxury activewear market, representing approximately 30% of 2024 revenue. The U.S. is the primary contributor, supported by a strong fitness culture, high disposable income, and the dominance of established brands such as Lululemon and Nike. Canada exhibits a growing preference for eco-friendly luxury athleisure lines.

Europe

Europe accounts for about 22% of global market share, with the U.K., Germany, France, and Italy driving premium demand. The region’s heritage in luxury fashion and high sustainability awareness supports steady growth. Collaborations between luxury houses and sports brands are boosting the segment’s visibility and adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 25% of the 2024 market value. China, Japan, South Korea, and India are key growth drivers, propelled by urbanisation, rising fitness participation, and expanding middle-class affluence. Increasing social-media influence and celebrity-led fitness trends are fuelling premium activewear adoption.

Middle East & Africa

The Middle East & Africa region represents around 12% of the 2024 global market value. High-net-worth consumers in the UAE and Saudi Arabia are investing in luxury wellness lifestyles, while South Africa is emerging as a local hub for premium athleisure retail. Expanding luxury malls and fitness culture are accelerating growth.

Latin America

Latin America contributes about 11% of the global luxury activewear market, with Brazil, Mexico, and Argentina leading. Growing urban wellness culture and digital access are stimulating premium apparel demand, though price sensitivity remains a constraint in lower-income brackets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Activewear Market

- Lululemon Athletica

- Nike Inc. (Premium lines)

- Adidas AG

- Under Armour Inc.

- Puma SE

- ASICS Corporation

- Columbia Sportswear

- Sweaty Betty

- Fabletics

- Tory Sport

- PE Nation

- Outdoor Voices

- Koral

- Gymshark

- Vuori

Recent Developments

- In July 2025, Lululemon announced a new sustainable fabric collection made from recycled ocean plastics, reinforcing its leadership in eco-luxury activewear.

- In April 2025, Adidas partnered with luxury designer Stella McCartney to launch an AI-designed athleisure capsule using 100% recycled polyester.

- In February 2025, Vuori secured additional funding to expand its European footprint with new flagship stores in London and Paris, focusing on premium men’s activewear lines.

- In January 2025, Puma unveiled a “Made in Europe” capsule that integrates advanced temperature-adaptive fabric technologies for high-performance luxury training wear.