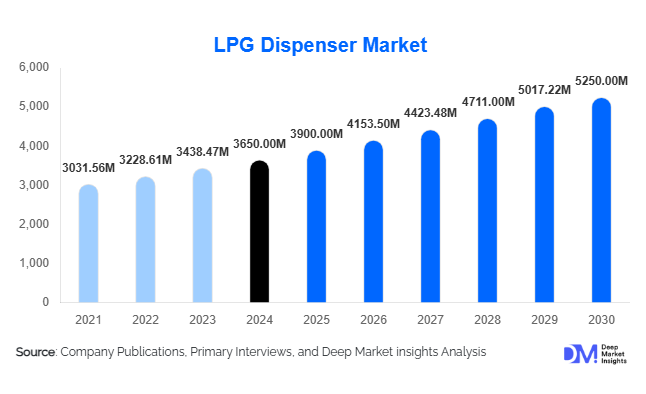

LPG Dispenser Market Size

According to Deep Market Insights, the global LPG dispenser market size was valued at USD 3,650 million in 2024 and is projected to grow from USD 3,900 million in 2025 to reach USD 5,250 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The LPG dispenser market growth is primarily driven by increasing adoption of clean energy solutions, modernization of residential, commercial, and industrial LPG infrastructure, and rising demand for automated and IoT-enabled dispensing systems across developed and emerging economies.

Key Market Insights

- Automation and IoT integration are transforming the LPG dispenser market, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency for commercial and industrial users.

- Industrial and commercial applications are gaining prominence, with factories, restaurants, and transport fleets upgrading to modern dispensers to ensure accuracy, safety, and regulatory compliance.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising LPG consumption in India, China, and Southeast Asia, along with government incentives promoting clean fuel infrastructure.

- Europe and North America continue to lead in high-tech dispenser adoption, with fully automated and digital systems preferred by industrial and commercial users due to safety standards and efficiency demands.

- Propane dispensers dominate the global market, primarily used for residential and commercial cooking applications across developed and developing regions.

- Technological innovations, such as IoT-enabled dispensers, digital meters, and predictive maintenance systems, are enhancing operational reliability and minimizing LPG wastage.

Latest Market Trends

Automation and IoT Integration Driving Market Growth

Modern LPG dispensers are increasingly equipped with automated and IoT-enabled technologies. These systems allow distributors to remotely monitor tank levels, detect leaks, and generate accurate usage reports. Industrial users are adopting smart dispensers to optimize supply chain management, reduce downtime, and ensure compliance with stringent safety regulations. The shift toward automated systems is particularly strong in Europe and North America, where regulatory standards and operational efficiency requirements drive premium adoption. In emerging markets like India and Brazil, semi-automatic to automatic conversion is gaining momentum, with government incentives further accelerating modernization.

Rising Industrial and Commercial Applications

The demand for LPG dispensers is increasingly influenced by commercial kitchens, hotels, and industrial facilities requiring high-volume and accurate dispensing. Food & beverage industries, chemical plants, and transport fleets are investing in digital and automated dispensers to improve operational efficiency and safety. Fleet fueling applications are expanding in countries like Brazil, India, and Mexico, contributing to new market growth avenues. This trend is reinforced by urbanization, increasing restaurant chains, and government initiatives promoting LPG usage in commercial and industrial sectors.

LPG Dispenser Market Drivers

Rising Global LPG Adoption

The growing shift from solid fuels to LPG for residential and commercial use is a key driver of the LPG dispenser market. Increasing awareness of clean energy solutions and government subsidy programs has significantly boosted LPG consumption. Residential applications account for approximately 45% of total dispenser demand in 2024, with India and China as major contributors. Urbanization and household electrification gaps are further enhancing market adoption.

Technological Advancements

IoT-enabled and fully automated dispensers improve accuracy, reduce human error, and enhance safety compliance. Digital meters with real-time monitoring are gradually replacing mechanical systems in developed countries. Predictive maintenance and remote reporting capabilities are driving adoption in industrial and commercial sectors, increasing efficiency and reducing operational losses.

Expansion in Industrial and Commercial Usage

Industries and commercial establishments are upgrading to high-capacity, automated dispensers to meet rising fuel demand. Food & beverage facilities, chemical plants, and manufacturing units contribute nearly 30% of total global dispenser demand. Industrial growth, coupled with government-backed initiatives for clean fuel adoption, is accelerating the replacement of older manual dispensers with modern digital solutions.

Market Restraints

High Capital Investment

Automated and IoT-enabled LPG dispensers involve high upfront costs, limiting adoption among small-scale commercial users in emerging markets. The initial investment requirement is a barrier for smaller operators who often rely on manual or semi-automatic dispensers.

Regulatory Complexity

Compliance with varying national and regional safety standards can pose challenges for global expansion. Different countries have distinct requirements for dispenser calibration, safety features, and certification, complicating cross-border sales and slowing market penetration in some regions.

Market Opportunities

Smart and IoT-Enabled Dispenser Adoption

The adoption of smart dispensers integrated with IoT technology presents a significant growth opportunity. Remote monitoring, leakage detection, automated reporting, and predictive maintenance allow distributors and industrial users to optimize operations. Early adoption can create differentiation for new market entrants and generate premium pricing opportunities for technology-focused products.

Government Initiatives Promoting LPG Infrastructure

Programs encouraging clean energy adoption in Asia-Pacific, the Middle East, and Latin America create strong opportunities for market expansion. Subsidies, tax incentives, and initiatives similar to India’s “Make in India” promote modernization of LPG dispensing infrastructure, fostering demand for automated and semi-automated dispensers.

Industrial and Commercial Demand Expansion

Increasing LPG consumption in industrial and commercial sectors such as food processing, hotels, and transport fleets is creating demand for high-capacity dispensers. Export-oriented commercial kitchens, fleet fueling infrastructure, and chemical plants in countries like Brazil, India, and China offer untapped market potential, encouraging investment in advanced dispensing solutions.

Product Type Insights

Automatic LPG dispensers dominate the market with a 40% share, primarily in developed regions where precision, safety, and automation are valued. Semi-automatic dispensers maintain relevance in emerging markets due to cost advantages, while manual dispensers continue to serve smaller, low-volume users. IoT-enabled dispensers are gaining traction, especially in industrial and commercial applications, accounting for approximately 28% of the 2024 market share. Propane dispensers represent the largest fuel-type segment with 55% market share, widely used in residential and commercial cooking.

Application Insights

Industrial applications, including chemical plants and manufacturing units, account for 30% of total demand and are expanding due to process heating and large-scale fuel needs. Commercial kitchens and food & beverage establishments account for 35% of dispenser usage, driven by restaurant chains and hotels upgrading to automated systems. Residential usage remains steady but continues to grow in emerging regions, especially in India and China, as households transition from traditional stoves to LPG cooking solutions. Fleet fueling applications are emerging, particularly in Latin America and India, creating new demand avenues for transport-related dispensing solutions.

Distribution Channel Insights

Direct sales and B2B contracts dominate LPG dispenser distribution, particularly for industrial and commercial users. OEM partnerships and government procurement programs drive sales for public infrastructure projects. Digital platforms and manufacturer websites are increasingly used for commercial and residential ordering, while distributor networks remain key in rural and semi-urban regions. Emerging channels include IoT-enabled monitoring subscriptions and maintenance service contracts bundled with dispenser sales.

| By Type | By Technology | By Fuel Type | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 20% of the 2024 market, led by high adoption of automated and IoT-enabled dispensers in the U.S. and Canada. Stringent safety regulations, high operational efficiency standards, and industrial infrastructure investments drive demand. Industrial and commercial applications, including food processing and fleet fueling, are particularly strong in the U.S.

Europe

Europe holds 25% of the market, with Germany, the UK, and France leading the modernization of LPG infrastructure. Adoption is driven by strict safety standards, automation in industrial applications, and commercial kitchens upgrading to digital systems. The region shows a strong preference for premium, automated dispenser solutions.

Asia-Pacific

Asia-Pacific represents 30% of the market and is the fastest-growing region with a CAGR of 7.2%. India and China are key contributors due to rising residential LPG adoption, government initiatives promoting clean fuels, and growing commercial demand. Southeast Asia is also expanding rapidly due to infrastructure development and increased LPG vehicle adoption.

Middle East & Africa

Middle East and Africa account for 15% of the global market. UAE, Saudi Arabia, and South Africa are major contributors, with growth driven by industrial applications and modern infrastructure projects. High-income populations and government-supported LPG adoption programs are boosting commercial and industrial demand.

Latin America

Latin America holds 10% of the global market, with Brazil and Mexico leading in fleet fueling and commercial kitchen applications. Rapid LPG vehicle adoption and expansion of modern urban infrastructure are supporting growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the LPG Dispenser Market

- Gilbarco Veeder-Root

- Tokheim

- Wayne Fueling Systems

- L & T Fuel

- Godrej & Boyce

- Schlumberger

- Zhejiang Qianjiang LPG Equipment

- Apco Industries

- Zoran Gas Dispensers

- Tatsuno Corporation

- Piusi S.p.A.

- Rota Pump

- Techtrol Systems

- Arco Pumps

- Veeder-Root India

Recent Developments

- In March 2025, Gilbarco Veeder-Root launched a series of IoT-enabled LPG dispensers in Europe, integrating predictive maintenance and automated reporting features.

- In April 2025, Tokheim expanded its industrial LPG dispenser portfolio in India, targeting commercial kitchens and fleet fueling applications.

- In June 2025, Wayne Fueling Systems introduced high-capacity, automated propane dispensers for industrial facilities in Brazil and Southeast Asia.