Loft Beds Market Size

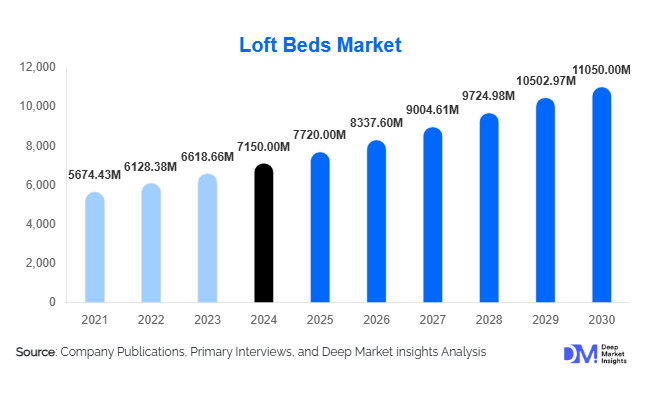

According to Deep Market Insights, the global loft beds market size was valued at USD 7,150 million in 2024 and is projected to grow from USD 7,720 million in 2025 to reach USD 11,050 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The loft beds market growth is primarily driven by increasing urbanization, shrinking residential spaces, and rising demand for multi-functional furniture designs that optimize vertical room space.

Key Market Insights

- Multi-functional and space-saving furniture solutions are in high demand, especially in urban areas with limited living space, making loft beds an ideal solution for small apartments, student dormitories, and co-living arrangements.

- Integration of modular and smart designs, including beds with built-in storage, study desks, and tech-enabled features, is reshaping consumer preferences and driving market adoption.

- Residential applications dominate the loft beds market, while commercial and educational segments, including hostels and student accommodations, are witnessing growing uptake.

- APAC and North America are the key markets, with rising student populations, urban housing development, and increasing disposable income supporting robust demand.

- Technological innovations, such as app-controlled adjustable beds, LED lighting, and modular assembly solutions, are enhancing product differentiation and consumer appeal.

What are the latest trends in the loft beds market?

Shift Toward Multi-Functional Designs

Loft beds are increasingly being designed to serve multiple purposes beyond sleeping. This includes integration of study areas, storage compartments, and modular units that can be customized to fit specific room layouts. These trends are particularly relevant in urban apartments, student housing, and shared living spaces, where efficient utilization of vertical space is essential. Manufacturers are focusing on ergonomic designs, sturdy materials, and aesthetic finishes to appeal to both young adults and children, reflecting a growing preference for practical yet stylish solutions.

Adoption of Smart and Modular Features

With the rise of smart homes, loft beds are incorporating tech-enabled functionalities such as built-in charging stations, LED lighting, adjustable frames, and IoT connectivity. Modular designs allow users to reconfigure or expand the furniture according to changing needs, which enhances long-term usability and consumer satisfaction. This trend appeals strongly to tech-savvy millennials and Gen Z, who prioritize flexible, space-efficient, and interactive furniture solutions.

What are the key drivers in the loft beds market?

Urbanization and Space Optimization Needs

Increasing urban density has led to smaller apartments and shared living arrangements, creating high demand for furniture that maximizes vertical space. Loft beds allow efficient use of floor space, offering sleeping, storage, and work functions in compact rooms. The need for cost-effective and functional furniture in rapidly urbanizing regions such as APAC, LATAM, and parts of Europe is fueling market expansion.

Rising Student and Young Adult Populations

Growth in higher education enrollment and migration to urban centers for work has led to increased demand for student dormitories and small shared apartments. Loft beds are particularly attractive in these environments due to their space-saving and functional design. Markets such as China, India, and the U.S. show strong adoption in residential and institutional segments, driving consistent market growth.

Technological Innovations and Customization

Advancements in manufacturing technologies, modular design software, and the use of eco-friendly materials are enabling companies to produce highly customizable loft beds. Adjustable heights, integrated storage solutions, and smart features enhance consumer appeal. Brands that offer personalized solutions tailored to urban lifestyles are gaining market share, highlighting the role of innovation as a key growth driver.

What are the restraints for the global market?

High Cost of Premium and Modular Designs

While basic loft beds are affordable, advanced models with smart features, modular designs, or premium materials can be cost-prohibitive for many consumers. Price sensitivity in developing regions may slow adoption of high-end products, creating a barrier for manufacturers targeting mid-to-premium segments.

Material and Safety Concerns

Quality, durability, and safety standards are critical in the loft beds market, particularly for children and shared living spaces. Substandard materials, poor assembly instructions, or insufficient safety features can limit consumer confidence and restrict market growth. Regulatory requirements in some regions further add to production and compliance costs, acting as a potential restraint.

What are the key opportunities in the loft beds industry?

Expansion in Urban and Student Housing Solutions

The global trend of urbanization and increasing student populations creates a significant opportunity for loft bed manufacturers. Partnering with universities, hostels, and real estate developers allows manufacturers to supply bulk orders of functional, space-saving furniture. Multi-functional loft beds with study desks, storage, or modular adaptability cater directly to these segments, presenting opportunities for high-volume sales.

Integration of Smart and Eco-Friendly Technologies

Loft beds with integrated IoT devices, adjustable features, and energy-efficient lighting are gaining popularity among tech-savvy consumers. Sustainable materials, such as bamboo and recycled wood, also offer differentiation opportunities. Manufacturers focusing on smart, eco-friendly, and durable designs can capture premium market segments while aligning with growing environmental consciousness.

Government and Institutional Procurement

Educational institutions, hostels, and co-living operators increasingly require bulk furniture solutions optimized for limited space. Government-backed student housing programs in countries like India, China, and parts of Europe create opportunities for manufacturers to supply standardized or modular loft beds in large quantities. Policies supporting domestic manufacturing (“Make in India,” “Made in China 2025”) further incentivize local production, reducing costs and enabling competitive pricing.

Product Type Insights

Storage-integrated loft beds dominate the market, accounting for approximately 28% of the 2024 market share, due to rising demand for space optimization in urban residences. Standard loft beds remain popular among cost-conscious consumers, while study/work loft beds are gaining traction in student dormitories and young adult apartments. Modular designs are emerging as a high-growth segment, reflecting trends toward customization and flexible living spaces.

Material Insights

Wooden loft beds hold the largest share (about 45% of the 2024 market), driven by durability, aesthetics, and consumer preference for eco-friendly furniture. Metal loft beds account for around 30%, favored for durability and ease of assembly. Hybrid (wood + metal) and composite/plastic designs are growing in niche markets focused on modularity and lightweight options, particularly in student housing and children’s rooms.

Application Insights

Residential applications lead the market, representing over 60% of total demand in 2024. Commercial and educational applications, including hostels, co-living spaces, and dormitories, are rapidly growing due to increased student populations and urban housing needs. Multi-functional and smart loft beds are increasingly preferred in these applications, highlighting a trend toward design innovation and space efficiency.

Distribution Channel Insights

Offline retail remains significant, accounting for roughly 55% of sales, primarily through furniture stores and specialty retailers. Online platforms are growing rapidly, supported by e-commerce penetration and digital marketing, capturing around 35% of the market. Contract and institutional sales, including bulk orders to universities and co-living operators, contribute the remaining 10% and are expected to grow fastest due to large-volume procurement opportunities.

| By Product Type | By Material | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25% of the 2024 loft beds market, with the U.S. leading demand due to high urbanization rates, student housing, and disposable income. Multi-functional and smart loft beds are particularly popular, reflecting strong adoption of modular and tech-enabled furniture solutions.

Europe

Europe holds roughly 23% of the 2024 market, with Germany, the U.K., and France driving growth. Increasing urban density, student populations, and eco-conscious consumer preferences support demand. Modular and storage-integrated loft beds are gaining prominence in this region, contributing to steady market expansion.

Asia-Pacific

APAC is the fastest-growing region, particularly in India, China, and Japan. Rising student populations, urban apartments, and co-living spaces fuel rapid adoption. Manufacturers focusing on affordable, durable, and multi-functional designs are likely to benefit most from this growth.

Latin America

Demand is gradually increasing, especially in Brazil, Mexico, and Argentina, driven by urban housing and shared living trends. Budget-friendly and modular loft beds are preferred in this region.

Middle East & Africa

These regions show growing demand in urban centers and educational institutions. UAE and South Africa are leading markets due to high disposable incomes and modernization of student accommodations, while other African countries see moderate adoption focused on functionality and affordability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Loft Beds Market

- IKEA

- Wayfair

- American Furniture Classics

- Viva Kids

- Maxtrix Kids

- Pottery Barn Kids

- Babyletto

- Lifetime Kidsrooms

- Step2

- Shuttle

- Blue Jay

- Delta Children

- RTA Furniture

- South Shore

- Modway

Recent Developments

- In March 2025, IKEA launched a new modular loft bed series with built-in storage and adjustable workstations, targeting urban apartments in Europe and APAC.

- In January 2025, Wayfair introduced smart loft beds with integrated charging stations and LED lighting, catering to tech-savvy young adults in North America.

- In November 2024, American Furniture Classics expanded its storage-integrated loft bed line in the U.S., offering customizable options for children and teenagers.