Lithium Battery Flexible Packaging Material Market Size

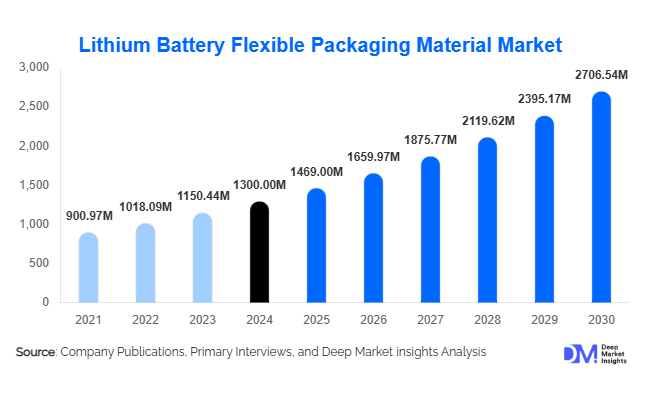

According to Deep Market Insights, the global lithium battery flexible packaging material market was valued at USD 1,300 million in 2024 and is projected to grow from USD 1,469.00 million in 2025 to reach approximately USD 2,706.54 million by 2030, expanding at a CAGR of about 13% during the forecast period (2025–2030). The market growth is primarily driven by the increasing deployment of lithium-ion batteries in electric vehicles (EVs), energy-storage systems (ESS), and portable electronics, the shift to pouch/soft-pack battery formats requiring advanced flexible films, and a rising emphasis on lightweight and high-barrier packaging materials tailored for next-gen battery architectures.

Key Market Insights

- Aluminum-laminated multi-layer films dominate the material composition segment, offering superior moisture/oxygen barrier, thermal resistance, and mechanical durability, making them the preferred packaging choice for high-volume pouch and automotive battery formats.

- Roll stock film leads the packaging-type segment, as battery-cell manufacturers increasingly adopt soft-pack and pouch formats, leading to large volumes of flexible film usage in the cell assembly process.

- The EV/Automotive power battery format is the leading application end-use, reflecting the high volume of cells and modules produced for electric vehicles that demand flexible packaging materials suited for lighter weight and higher energy density.

- Asia-Pacific is the largest regional market, accounting for approximately 65 % of global demand in 2024, primarily fueled by China, South Korea, Japan, and India, where major battery-cell manufacturing plants are located.

- North America and Europe are key growth regions, with supply-chain localization, government incentives for battery manufacturing, and expansion of gigafactories driving increasing demand for specialized flexible packaging films.

- Sustainability and advanced barrier technologies are reshaping the market. Suppliers are increasingly focusing on eco-friendly film structures (recyclable/foil-free), ultra-thin laminates, and high-performance barrier coatings to meet evolving battery requirements and regulatory pressures.

Latest Market Trends

Shift Towards Flexible Pouch/Soft-Pack Formats

The battery industry trend toward pouch-cell and soft-pack formats has accelerated in recent years, particularly in the EV and ESS segments. These formats rely heavily on flexible packaging materials such as aluminum-laminated multi-layer films and polymer laminates, in contrast to traditional rigid metal-can or cylindrical formats. This shift is enhancing energy density and reducing pack weight, and thereby driving demand for specialized flexible packaging. As battery manufacturers ramp up production, the upstream packaging-film market is experiencing strong spill-on growth, with suppliers investing in dedicated film lines and converters upgrading their capabilities to meet battery-industry qualification and safety standards.

Sustainability and Lightweighting in Packaging Materials

As battery systems become more widespread and regulatory scrutiny increases, packaging-film suppliers are under pressure to deliver lighter, thinner, more sustainable materials while maintaining performance in barrier, thermal, and chemical resistance. Innovations such as foil-free flexible wraps, recycled-content laminates, and ultra-barrier coatings are emerging. These material innovations not only address weight and cost optimization but also help battery manufacturers meet emerging recyclability, transport-safety, and lifecycle-emissions objectives. The adoption of such advanced films is gradually moving from pioneering applications into mainstream battery-cell conversion, signaling a structural shift in packaging-material demand.

Market Drivers

Acceleration of EV and Energy Storage Deployments

The global drive toward electrification and renewable-energy integration has elevated demand for lithium-ion batteries across several segments. Electric vehicles (EVs) constitute the largest and fastest-growing application, and utility-scale energy-storage systems (ESS) are increasing in prominence. Because flexible-packaging films are integral to pouch/soft-pack battery cells and modules, this growth in battery production directly translates into increased demand for flexible packaging materials. As manufacturers scale production and new gigafactories come online worldwide, the upstream packaging-film market benefits from higher volume, longer-term contracts, and increased converter investment.

Material Innovation and Lightweight/High-Barrier Requirements

Battery-cell manufacturers are continuously pushing for higher energy density, lighter weight, faster charging, and improved safety. These objectives impose stricter requirements on packaging films: lower moisture and oxygen transmission rates (WVTR/OTR), higher puncture/tear resistance, compatibility with high-voltage chemistries, and improved thermal stability. Flexible-film suppliers respond with multi-layer aluminum-polymer laminates, hybrid structures, and specialized coatings. The premium nature of these advanced films allows for higher value-per-unit, thus driving the market’s value growth even beyond simple volume increases.

Regionalization of Supply Chains and Localized Manufacturing

Battery-cell manufacturing is increasingly being localized across regions outside China, notably North America, Europe, and India. To reduce logistics cost, lead-times, currency risk, and support local content requirements, battery-pack and film-packaging suppliers are establishing converting lines and film-manufacturing capacity closer to cell/pack‐manufacturers. This localization trend stimulates demand for flexible packaging materials regionally and opens up new growth corridors for film suppliers that invest in global footprint expansion. It also helps mitigate supply-chain disruptions and aligns with government-incentive programs on battery value-chain localization.

Market Restraints

Volatility in Raw-Material Prices and Cost Pressures

Flexible-packaging films for lithium-ion batteries often incorporate aluminum foil, specialty polymers, and high-performance barrier coatings. Fluctuations in aluminum foil prices and polymer feedstock cost create margin pressures for film suppliers. In a competitive environment where battery-cell manufacturers are cost-sensitive and often look to drive down packaging costs, film suppliers may struggle to pass through increased input costs. This can impact profitability, delay expansion plans, or lead to price renegotiation, thereby potentially slowing market growth.

Lengthy Qualification Cycles and Regulatory/Safety Certification Burden

Battery-cell and pack manufacturers must qualify new packaging-film materials rigorously because of safety, reliability, and transport obligations (e.g., UN 3480/3481, battery-pack certification). Flexible-film suppliers face long lead times, testing requirements, and high costs of qualification before new film types can be accepted in high-volume production. This hurdle can delay adoption of new materials, deter new entrants, and slow innovation roll-out, thereby acting as a restraint on the pace of market growth.

Market Opportunities

Expansion into Emerging Battery Formats and New Applications

While the current market is largely driven by pouch/soft-pack cells in EVs and ESS, emerging battery formats, for example, solid-state batteries, flexible batteries, and high-voltage modules, are gaining traction. These formats require novel packaging solutions (e.g., new barrier structures, foil-free laminates, complex shapes). Film-packaging suppliers that develop next‐generation materials and secure early engagements with cell/pack makers can capture value from these nascent segments. In addition, niche applications such as aerospace, defense, medical, and portable grid-scale modules offer incremental demand growth beyond mainstream automotive and consumer electronics.

Sustainability and Circular Economy–Driven Packaging Solutions

As manufacturers and regulators place stronger emphasis on sustainability, recyclability, low-carbon manufacturing, and material reuse, there is growing demand for eco-friendly flexible packaging materials in the battery value chain. Suppliers can target this opportunity by offering recyclable laminates, reduced-metal content films, thinner gauge materials, and lower-energy manufacturing processes. Additionally, new regulations on battery-pack end-of-life, transport, and disposal will favor packaging-film suppliers that can provide certified sustainable solutions. New entrants specializing in green-film technologies may achieve differentiation and premium positioning.

Regional Supply-Chain Localization and Strategic Partnerships

With governments in many regions offering incentives for battery-cell manufacturing (for example, in India under “Make in India”, or in North America via tax credits and gigafactory investment), there is an opportunity for flexible-film suppliers to establish local converting/manufacturing capacity close to battery-cell plants. By doing so, suppliers can reduce logistics costs, provide quicker turnaround, enhance responsiveness, and secure long-term supply contracts. Partnerships or joint-ventures with cell-makers, converters, or regional pack integrators present further opportunity to embed into the supply-chain early and capture growing regional demand.

Product Type Insights

Aluminum-laminated films dominate the global lithium battery flexible packaging material market, accounting for the majority of total demand in 2024. Their superior barrier properties against moisture, oxygen, and solvents make them indispensable for high-performance pouch and prismatic cell designs. The use of aluminum-laminated films ensures optimal chemical stability and mechanical strength, critical for long cycle life and safety in EV and ESS applications. Polymer-only multilayer films are gaining gradual traction in applications prioritizing lightweight and lower cost, particularly for small consumer electronics and low-capacity cells. Hybrid films, which combine aluminum and enhanced polymer layers, are emerging as a transitional solution to balance performance with recyclability. The growing industry emphasis on sustainability and recyclability is likely to fuel R&D into non-metallic or recyclable composite film alternatives over the next decade.

Application Insights

The automotive (EV and hybrid) segment leads global demand, driven by the rapid adoption of electric mobility across Asia-Pacific, North America, and Europe. Flexible packaging materials are integral to pouch-cell configurations in EVs due to their weight reduction, space efficiency, and robust protective capabilities. Energy Storage Systems (ESS) represent the fastest-growing application, with increasing deployment in residential, commercial, and grid-level storage solutions supporting renewable integration. Consumer electronics remains a steady contributor, underpinned by smartphones, laptops, and wearables, though its share is gradually declining as EV demand accelerates. Emerging applications in medical, aerospace, and defense batteries are fostering niche demand for ultra-durable, high-temperature films with stringent reliability standards, opening new frontiers for specialty manufacturers.

Distribution Channel Insights

Direct sales to cell and module manufacturers dominate distribution, with long-term supply contracts ensuring material consistency and technical compliance. These strategic partnerships enable joint development of next-generation films tailored for evolving battery chemistries and form factors. Specialized material distributors serve smaller or regional manufacturers, providing logistical flexibility and smaller-volume procurement. Meanwhile, OEM collaborations are expanding as automotive giants and battery producers vertically integrate their supply chains to secure critical materials. Online B2B procurement platforms are still nascent but are gradually facilitating cross-border trade, particularly among second-tier suppliers and startups. Additionally, government procurement frameworks in regions such as China and India are encouraging localized sourcing to strengthen domestic supply ecosystems.

End-User Type Insights

Battery manufacturers represent the core end-user base, consuming over 75% of flexible packaging materials for pouch and prismatic cell production. Gigafactory expansions by key players in China, South Korea, and Europe have sustained high-volume demand for premium-grade aluminum-laminated films. Automotive OEMs are increasingly involved in co-development initiatives to enhance packaging performance and reduce costs per kilowatt-hour. Energy storage integrators and system developers are also emerging as active end-users, particularly in large-scale ESS applications that demand reliable long-term sealing performance. Secondary end-users include electronics assemblers and R&D institutions developing next-generation solid-state and semi-solid batteries requiring flexible yet highly stable encapsulation materials.

Battery Type Insights

Lithium-ion (Li-ion) batteries account for the majority of packaging material consumption, owing to their ubiquitous presence across EV, ESS, and consumer electronics markets. Within Li-ion chemistries, NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate) batteries are primary consumers of flexible films, with LFP dominating volume production in China and NMC gaining traction in performance-oriented EVs. Solid-state batteries represent a fast-emerging category, projected to grow at a CAGR exceeding 20% through 2030, as flexible packaging materials evolve to meet solid electrolyte compatibility requirements. Lithium-metal and lithium-sulfur batteries remain in pilot-scale development but are expected to create new material demand niches in the latter half of the decade, spurring innovation in ultra-thin, heat-resistant film structures.

Material Insights

Among base materials, nylon (PA), polypropylene (PP), and polyethylene (PE) form the primary polymer layers in flexible film laminates, selected for tensile strength, adhesion, and chemical resistance. The inclusion of aluminum foil as a core layer ensures superior gas and moisture barrier performance, essential for battery stability and safety. Recent developments in fluoropolymer coatings and nanocomposite barriers are enhancing performance while reducing total film thickness, supporting lighter, more efficient packaging. Manufacturers are also investing in recyclable and halogen-free material systems to meet tightening environmental regulations and OEM sustainability targets, particularly across the EU and Japan.

Age of Technology Insights

Conventional wet-process lithium-ion battery packaging remains the mainstream, but the market is progressively shifting toward advanced dry-process-compatible films that can withstand higher operating temperatures and different electrolyte chemistries. Dry-electrode and solid-state technologies require packaging that maintains seal integrity under greater mechanical stress and chemical exposure. This technological evolution is prompting material innovation, encouraging partnerships between packaging suppliers and next-generation battery developers. The market’s transition stage, balancing mature technologies and experimental packaging solutions, creates significant opportunities for material science advancement and intellectual property expansion through 2030.

| By Product Type | By Application | By Distribution Channel | By Material Composition | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Analysis

Asia-Pacific (APAC)

Asia-Pacific accounts for approximately 65 % of the global lithium battery flexible packaging-film market in 2024 ( USD 845 million). Within APAC, China is the largest country market due to its dominant battery-cell manufacturing capacity and strong OEM ecosystem. South Korea and Japan follow as significant players with advanced film and cell manufacturing. India is emerging rapidly, supported by government incentives and increasing battery-manufacturing localization. China remains the largest in absolute size; India is projected to be one of the fastest-growing country markets over 2025-2030.

North America

North America is estimated to hold around 25 % of the global market in 2024 ( USD 325 million). The United States is the key country here, driven by large investments in gigafactories, demand for EV battery manufacturing, and increasing localization of supply chains for packaging films. North America is likely one of the fastest-growing regions in terms of CAGR over the forecast period.

Europe

Europe holds around 20 % of the global market in 2024 ( USD 260 million). Germany and France lead within the region, supported by strong automotive industries and regulatory pressure on battery-pack production localization. Growth in Europe is also helped by policies aiming to build a domestic battery-value-chain, which stimulates demand for flexible packaging films.

Latin America (LATAM)

Latin America currently shows a smaller share (single-digit percentage) but is a growing market, particularly in Brazil, Chile, and Mexico. These countries are increasing battery- and EV-investment, as well as renewable-energy storage, which will raise demand for flexible packaging films.

Middle East & Africa (MEA)

The Middle East & Africa also holds a modest share in 2024 (approximately 10 %), but possesses growth potential. Countries such as the UAE, Saudi Arabia, and South Africa are beginning to invest in battery manufacturing, renewable energy, and export hubs, which may increase demand for battery-packaging films in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lithium Battery Flexible Packaging Material Market

1. DNP (Japan)

2. Showa Denko (Japan)

3. Youlchon Chemical (South Korea)

4. Selen (China)

5. Zijiang New Material (China)

6. Daoming Optics (China)

7. Crown Material (China)

8. Jiangsu Huagu New Materials (China)

9. Jysuda (China)

10. FSPG (China)

11. Wazam (China)

12. Leeden (China)

13. Hangzhou First (China)