Line Printer Market Size

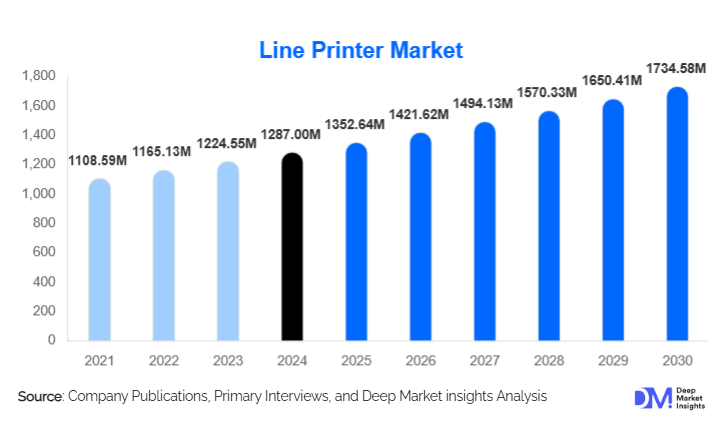

According to Deep Market Insights, the global line printer market size was valued at USD 1,287 million in 2024 and is projected to grow from USD 1,352.64 million in 2025 to reach USD 1,734.58 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030). The line printer market growth is primarily driven by increasing industrial automation, rising demand for high-volume and multi-part document printing, and expansion of managed print services (MPS) and consumables revenue streams in the enterprise and logistics sectors.

Key Market Insights

- Line matrix printers dominate the market, offering high-speed, durable printing solutions for manufacturing, logistics, and banking environments.

- Consumables and service contracts represent a growing revenue share, as organizations increasingly adopt subscription-based models for ribbons, spare parts, and predictive maintenance services.

- North America and APAC are the largest markets, with the USA, China, and India accounting for the majority of demand due to logistics, industrial, and banking applications.

- APAC is the fastest-growing region, driven by industrial modernization, warehouse automation, and growing e-commerce distribution centers.

- Technological integration, including network connectivity, cloud telemetry, and ERP/WMS integration, is enhancing enterprise adoption and total cost of ownership advantages.

- Logistics, transportation, and manufacturing remain the top end-use segments, accounting for the bulk of hardware and consumables demand globally.

What are the latest trends in the line printer market?

Industrial Automation and High-Volume Printing

Enterprises are increasingly integrating line printers into automated production and logistics workflows. High-speed line matrix printers support continuous-form printing, multi-part documents, and integration with ERP and warehouse management systems (WMS). The demand is particularly strong in e-commerce fulfillment centers, logistics hubs, and manufacturing plants where uptime, reliability, and low cost-per-page are critical. Vendors are introducing IoT-enabled printers with telemetry, predictive maintenance, and real-time consumables tracking, strengthening operational efficiency and extending product lifecycle.

Managed Print Services (MPS) and Consumables Subscription

OEMs are shifting focus from hardware-only sales to recurring revenue streams through MPS and consumables subscription models. Ribbons, spare parts, and service contracts now represent a substantial portion of lifetime revenue from installed line printers. Organizations benefit from predictable maintenance, reduced downtime, and centralized fleet management, while vendors secure steady cash flows. SaaS-based dashboards, remote alerts, and analytics for multi-site printer fleets are becoming key differentiators, increasing the stickiness of enterprise purchases and boosting demand for networked line printers.

What are the key drivers in the line printer market?

Low Total Cost of Ownership for High-Volume Printing

Line printers, particularly line matrix units, provide the lowest cost-per-page solution for enterprises with heavy printing requirements. Durable mechanical components and high-yield ribbons reduce operational expenses, making them the preferred choice for logistics, banking, and manufacturing applications. Long lifespans and minimal downtime further enhance the total cost of ownership, encouraging continued investment in these systems.

Durability and Reliability in Harsh Environments

Designed for continuous operation in challenging industrial conditions, line printers withstand dust, humidity, temperature fluctuations, and high-volume workloads. Their ability to print multi-part and continuous forms reliably positions them as critical assets for production floors, warehouses, and enterprise back-offices. Organizations value uptime and service coverage, driving preference for high-speed, cabinet-style models.

Modern Connectivity and ERP/WMS Integration

Recent printer generations incorporate Ethernet networking, cloud telemetry, and ERP/WMS compatibility, enabling centralized fleet management and predictive maintenance. Integration with enterprise software reduces workflow interruptions and supports real-time monitoring of consumables and performance. These features make line printers increasingly indispensable for large-scale, multi-site operations.

What are the restraints for the global market?

Digitization and Paperless Initiatives

Growing adoption of electronic document management, e-invoicing, and digital workflows reduces the volume of required printed output. While mission-critical sectors still need hard-copy documents for regulatory or operational purposes, overall hardware demand growth is tempered. Vendors must focus on consumables, service contracts, and niche applications where printing is mandatory.

Competition from Refurbished Equipment and Alternative Technologies

The refurbished line printer market and alternative printing technologies, such as high-speed thermal or laser printers, pose challenges to new unit sales. Price-sensitive buyers may extend the life of older devices or adopt lower-cost alternatives, compressing margins for OEMs. Companies must emphasize reliability, TCO, and integrated solutions to maintain market share.

What are the key opportunities in the line printer industry?

Industrial Modernization and Greenfield Upgrades

Emerging markets in APAC and LATAM are investing in industrial and warehouse modernization, creating strong demand for high-speed, networked line printers. OEMs can leverage financing bundles, MPS, and IoT-enabled solutions to support the replacement of legacy equipment and expand presence in these growing regions.

Consumables and Service Monetization

Recurring revenue from ribbons, spare parts, and maintenance services provides a significant growth opportunity. Subscription-based models and fleet monitoring platforms allow vendors to increase margins while offering enterprises cost predictability and operational efficiency. Digital tools and remote diagnostics are increasingly important for differentiating offerings.

Integration with ERP and Supply Chain Ecosystems

Line printers that integrate with ERP and warehouse management systems streamline operational workflows, enhance data traceability, and reduce manual interventions. IoT-enabled devices support Industry 4.0 initiatives, and specialized printing solutions for multi-part and continuous forms ensure compliance in regulated industries like banking, utilities, and logistics.

Product Type Insights

Line matrix printers dominate the market, preferred for high-speed, durable printing of multi-part documents in industrial and enterprise settings. Cabinet or floor-standing units account for the majority of revenue due to higher capacity and robustness. Desktop and portable line printers serve niche, low-volume, or specialized applications. Consumables and managed services now represent a meaningful portion of overall market revenue, with recurring contracts enhancing profitability for OEMs.

Application Insights

Logistics, transportation, and manufacturing are the largest applications for line printers, driven by the need for high-volume, multi-part, and continuous-form printing. Banking and financial services maintain a stable demand for check and transaction printing, while government and healthcare sectors require reliable document output for regulatory compliance. Emerging applications include packaging-line documentation, regulatory traceability, and fulfillment-center labeling integrated with ERP/WMS systems.

Distribution Channel Insights

OEM direct sales dominate enterprise procurement, supported by system integrators and VARs for multi-site or ERP-integrated deployments. Distributors and regional resellers serve SMEs and cost-sensitive buyers. Refurbishers capture a smaller share but influence competitive pricing. Subscription and managed service models are increasingly utilized to maintain recurring revenue streams. Digital platforms and SaaS dashboards enhance engagement and fleet monitoring capabilities.

End-Use Insights

Logistics and transportation, manufacturing, and banking dominate line printer consumption. E-commerce fulfillment centers and industrial facilities drive replacement and expansion demand. Emerging industries, including food & beverage traceability and automated packaging, present growth opportunities. Export-oriented manufacturing hubs in APAC contribute to strong regional demand, supporting consumables and service revenue streams.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 30% of the 2024 market (USD 386 million). The U.S. leads due to dense logistics networks, banking operations, and replacement cycles. Demand is driven by enterprise fleet upgrades, warehouse automation, and managed services adoption. Canada follows similar patterns but at a lower absolute volume.

Europe

Europe represents 20% of the 2024 market (USD 257 million). Demand is concentrated in manufacturing and logistics hubs, with premium spend on energy-efficient models and regulatory compliance. Growth is moderate, supported by stable industrial and banking sectors.

Asia-Pacific

APAC is the fastest-growing region, 36% of the 2024 market (USD 463 million). China and India drive expansion via warehouse modernization, e-commerce, and industrial automation. Japan and South Korea show steady demand for specialized enterprise solutions. Regional growth is fueled by greenfield distribution centers and industrial upgrades.

Middle East & Africa

MEA accounts for 8% of the 2024 market (USD 103 million). Demand is concentrated in government procurement and logistics hubs, with strong growth in GCC countries due to industrial and warehousing expansions.

Latin America

LATAM accounts for 6% of the 2024 market (USD 78 million), led by Brazil and Mexico. Demand is largely replacement-driven and sensitive to capital expenditure cycles. Modernization of distribution networks provides moderate growth opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Line Printer Market

- Hewlett-Packard (HP)

- Canon Inc.

- Seiko Epson Corporation

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corporation

- Lexmark International, Inc.

- Kyocera Corporation

- Konica Minolta, Inc.

- Oki Electric Industry Co., Ltd.

- Printronix

- Fujitsu

- Sharp

- Toshiba Tec

- TallyGenicom

Recent Developments

- In March 2025, Printronix introduced a new high-speed line matrix printer series with integrated cloud telemetry and predictive maintenance for industrial customers.

- In February 2025, Epson expanded its enterprise line printer portfolio with networked and IoT-enabled solutions tailored for logistics and manufacturing sectors.

- In January 2025, HP launched subscription-based consumables programs for line printers, combining ribbons, service contracts, and remote fleet monitoring to improve the total cost of ownership for large enterprises.