Levitating Gadgets Market Size

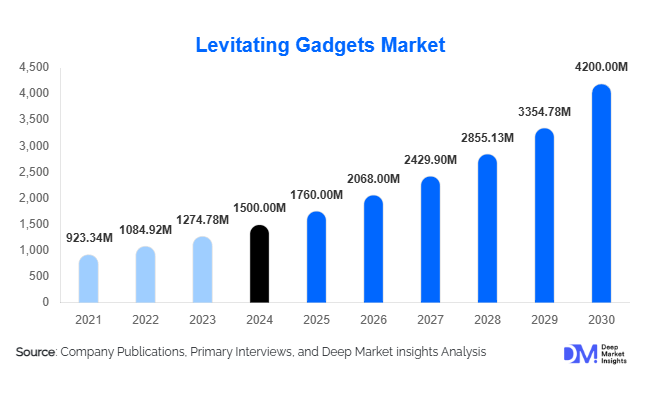

According to Deep Market Insights, the global levitating gadgets market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,760 million in 2025 to reach USD 4,200 million by 2030, expanding at a CAGR of 17.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer interest in futuristic, tech-enabled home and commercial gadgets, continuous advancements in magnetic levitation technology, and rising adoption of smart devices across global households and workplaces.

Key Market Insights

- Levitating gadgets are rapidly integrating smart and AI-enabled features, enhancing user experience through voice control, app connectivity, and adaptive lighting.

- Asia-Pacific is emerging as the fastest-growing regional market, fueled by rising disposable incomes, rapid urbanization, and growing interest in premium technological gadgets in China and India.

- North America dominates market share, with the U.S. and Canada leading demand due to high consumer tech adoption and preference for novelty-driven gadgets.

- Europe is witnessing steady growth, particularly in Germany and the UK, driven by design-conscious consumers and interest in smart home integration.

- Collaboration with interior designers and commercial establishments, including offices, hotels, and restaurants, is positioning levitating gadgets as functional décor and status-enhancing products.

- Technological adoption, including wireless power systems and advanced magnetic levitation mechanisms, is reshaping product offerings and consumer expectations globally.

Latest Market Trends

Smart and AI-Integrated Levitating Devices

Manufacturers are increasingly embedding artificial intelligence and smart functionalities into levitating gadgets. Voice-activated controls, smartphone apps for remote operation, adaptive lighting, and automatic rotation features are becoming standard. This trend not only enhances user convenience but also attracts tech-savvy consumers looking for innovative and connected home devices. Smart integration is particularly appealing for office and commercial applications, where levitating gadgets serve both functional and aesthetic purposes. Companies are also exploring AR/VR features for interactive consumer engagement, creating immersive product experiences before purchase.

Expansion into Emerging Markets

Emerging economies, particularly in the Asia-Pacific and Latin America, are showing increasing interest in high-tech gadgets. Rising middle-class incomes, rapid urbanization, and growing exposure to global tech trends are creating strong demand. Manufacturers are targeting countries such as India, China, Brazil, and Mexico with localized marketing campaigns, affordable models, and region-specific designs. This expansion is also supported by e-commerce platforms that allow consumers in these regions to access products previously limited to developed markets, thereby increasing penetration and brand visibility.

Levitating Gadgets Market Drivers

Technological Advancements in Magnetic Levitation

Continuous innovations in magnetic levitation, wireless power delivery, and lightweight materials have significantly enhanced product performance and reliability. This drives adoption among consumers and commercial users seeking unique, futuristic, and functional devices. Improved levitation stability, energy efficiency, and integration of smart features have expanded applications, including speakers, lamps, planters, and display systems, making levitating gadgets more mainstream and commercially viable.

Consumer Demand for Novelty and Aesthetic Appeal

There is an increasing preference for visually striking, futuristic gadgets in both residential and commercial spaces. Levitating devices combine novelty with practical use, attracting enthusiasts, tech adopters, and interior design-conscious buyers. The social media influence, showcasing these products in lifestyle and décor contexts, further fuels consumer interest and drives market growth.

Rising Disposable Incomes and Premium Spending

Higher disposable incomes, especially in North America and the Asia-Pacific, are enabling consumers to invest in premium, innovative gadgets. Affluent buyers seek unique home décor items, office enhancements, or gift items with technological flair, supporting sustained demand growth.

Market Restraints

High Manufacturing Costs

The complexity of magnetic levitation technology, precision components, and integration of smart features increases production costs. This makes pricing higher compared to conventional gadgets, limiting adoption among budget-conscious consumers.

Limited Awareness in Emerging Regions

Despite growing global interest, many consumers remain unaware of levitating gadgets or their applications. Lack of understanding of benefits and usage can slow market penetration, particularly in developing countries.

Levitating Gadgets Market Opportunities

Smart Home and IoT Integration

As homes and offices increasingly adopt IoT-enabled devices, levitating gadgets present opportunities to integrate into smart ecosystems. Combining levitation with AI, app control, and energy-efficient designs can attract tech-savvy consumers and create premium product lines compatible with broader smart home systems.

Collaborations with Interior Designers and Commercial Spaces

Levitating gadgets as aesthetic and functional décor offer potential for partnerships with architects, interior designers, and commercial establishments such as hotels, restaurants, and offices. These collaborations can drive bulk adoption and elevate the product’s status as a premium lifestyle accessory.

Emerging Market Expansion

Targeting Asia-Pacific and Latin America offers substantial growth potential. Tailored marketing, localized pricing, and region-specific designs can increase market penetration, while rising disposable incomes in these regions support premium gadget purchases.

Product Type Insights

Levitating speakers dominate the market, offering high-quality 360-degree sound and futuristic aesthetics. They accounted for 35% of the 2024 market share, appealing to both residential and commercial segments. Floating light bulbs follow closely, combining functionality with visual appeal, and levitating planters are growing due to novelty and eco-conscious design trends.

Application Insights

Residential users remain the largest application segment, driven by home décor, entertainment, and gifting demand. Commercial applications, including offices, restaurants, and hotels, are expanding, leveraging levitating gadgets as unique décor elements. The gift market is also significant, supporting sales through e-commerce and specialty retailers.

Distribution Channel Insights

Online platforms dominate sales, offering product variety, reviews, and direct manufacturer access. Retail electronics stores and specialty décor outlets provide tactile experiences and brand visibility. E-commerce growth in emerging markets is enhancing accessibility and boosting penetration.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share (40%) of the global market, led by high adoption in the U.S. and Canada. Strong consumer tech adoption, high disposable incomes, and demand for innovative décor products support growth. Levitating speakers and smart home-compatible devices are particularly popular.

Europe

Europe accounts for 25% of the global market. Germany, the UK, and France lead adoption, with consumers favoring design-conscious gadgets integrated with home automation. Growing environmental awareness and energy-efficient designs are supporting market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India leading adoption due to rising middle-class income, urbanization, and online retail penetration. Premium gadgets and mid-tier models are both gaining traction.

Latin America

Brazil and Mexico are early adopters, driven by urban tech enthusiasts and e-commerce accessibility. Growth is slower than in Asia-Pacific, but emerging rapidly among niche premium segments.

Middle East & Africa

High-income countries in the Middle East (UAE, Saudi Arabia) show strong demand for luxury gadgets. African adoption is primarily concentrated in urban commercial spaces with growing interest in decorative and tech-driven applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Levitating Gadgets Market

- Flyte

- Floately

- Levitating X

- INOVAXION

- Arx Pax

- Mag-Lev

- HoverWorld

- Maglev Tech

- Levitatec

- Levito

- NeoMag

- SpinFloat

- HoverGadgets

- Floatonix

- Magnetic Design Labs

Recent Developments

- In March 2025, Flyte launched a new AI-integrated levitating lamp series with adaptive lighting and smartphone control.

- In February 2025, Floately expanded its levitating speaker line to include energy-efficient wireless charging and customizable LED displays.

- In January 2025, Levitating X partnered with interior designers to supply commercial-grade levitating décor for luxury hotels and office spaces.