Leather Handbags Market Size

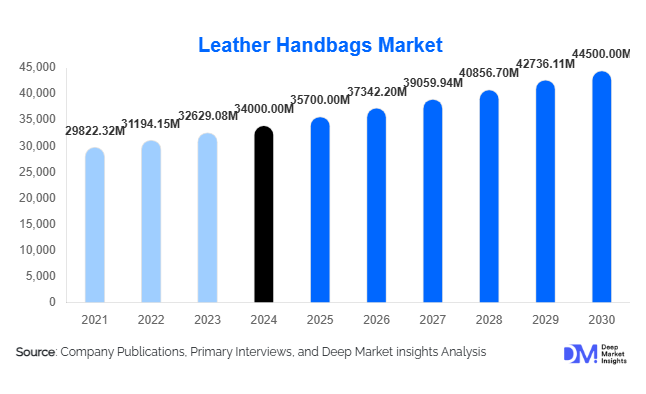

According to Deep Market Insights, the global leather handbags market size was valued at USD 34,000 million in 2024 and is projected to grow from USD 35,700 million in 2025 to reach USD 44,500 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The market growth is primarily driven by rising disposable incomes in emerging economies, increasing premiumization of consumer preferences, expansion of e-commerce and direct-to-consumer channels, and growing demand for luxury and sustainable leather products.

Key Market Insights

- Premiumization is driving higher market value, as consumers shift from mass-market to luxury and premium leather handbags, seeking quality craftsmanship, branded designs, and exclusivity.

- Online and omnichannel retail are transforming sales, enabling brands to reach new markets efficiently and boosting direct-to-consumer engagement through digital platforms.

- Asia-Pacific dominates global demand, led by China, India, and Southeast Asia, while also serving as a hub for mid- to premium-tier manufacturing and exports.

- Europe remains a significant market for luxury leather handbags, with Italy and France leading in production, craftsmanship, and exports.

- Technological integration and sustainability initiatives are reshaping product offerings, including RFID-enabled anti-counterfeit bags, traceable supply chains, and eco-friendly tanning methods.

- Travel retail and duty-free channels continue to support high-value purchases, particularly in luxury and premium segments.

Latest Market Trends

Premiumization and Luxury Focus

Luxury and premium leather handbags are increasingly capturing market value due to higher average selling prices and aspirational consumer preferences. Consumers are trading up from mid-market or synthetic options to genuine and exotic leather, often purchasing limited editions, designer collaborations, and bespoke products. This trend is expanding the market’s total value despite slower growth in unit volume, particularly in APAC and North America. Brands leverage storytelling, heritage, and craftsmanship to differentiate offerings, while the rise of social media and influencer marketing enhances aspirational positioning.

Sustainability and Technology Integration

Environmental awareness, ethical sourcing, and supply-chain transparency are key differentiators for modern consumers. Manufacturers and brands are investing in traceable leather sourcing, low-impact tanning methods, and eco-certified products to meet regulatory and consumer expectations. Technology is also being leveraged to enhance the consumer experience, including RFID tracking, digital authentication, and smart bag features. Blockchain-based traceability ensures authenticity and responsible sourcing, boosting consumer trust and enabling compliance with increasingly stringent environmental regulations.

Leather Handbags Market Drivers

Rising Disposable Incomes and Urbanization

Growing middle- and upper-income populations in APAC, LATAM, and select MEA countries are driving demand for premium and luxury handbags. Urbanization concentrates buyers within reach of retail stores and e-commerce platforms, increasing purchase frequency and brand engagement. Rising disposable income allows consumers to spend on higher-priced leather handbags as a lifestyle and status symbol, positively impacting market value.

Expansion of E-commerce and Omnichannel Retail

E-commerce platforms, brand-owned online stores, and omnichannel strategies have reduced barriers to entry for new consumers while increasing convenience for established buyers. Omnichannel approaches, including reserve-online-pickup-in-store and virtual try-on tools, enhance conversion and repeat purchases. Direct-to-consumer models allow brands to control pricing, margins, and customer engagement, accelerating market growth.

Brand-Led Pricing Power and Premiumization

High-value brands exert strong pricing power through limited editions, collaborations, and heritage-focused offerings. Luxury handbags, particularly in genuine and exotic leather, maintain higher average selling prices, enabling growth in market value even when unit volumes increase moderately. Consumers increasingly favor iconic, high-quality designs that command premium pricing, supporting stable and profitable growth.

Market Restraints

Raw Material Volatility

Leather production is highly sensitive to raw-material costs, including hides and tanning chemicals. Price fluctuations and import tariffs can compress manufacturer margins or increase consumer prices, limiting affordability in mass-market segments. Smaller producers are particularly vulnerable, and supply chain disruptions can adversely affect market growth.

Regulatory and Sustainability Challenges

Compliance with environmental regulations, animal welfare standards, and international trade restrictions imposes additional costs and complexity. Brands must invest in sustainable sourcing, traceability, and clean production technologies, which may strain smaller players and limit expansion into regulated markets.

Leather Handbags Market Opportunities

Geographic Expansion in APAC and MEA

Rapid economic growth in China, India, Southeast Asia, and GCC countries offers significant market opportunities. Rising middle-class wealth, increased brand awareness, and local production clusters support both domestic sales and exports. International brands can capitalize on regional demand through flagship stores, e-commerce, and travel retail channels, while domestic manufacturers can scale exports to high-value international markets.

Premiumization and Customization

There is increasing demand for personalized and limited-edition handbags. Custom monogramming, bespoke leather options, and collaborations with designers allow brands to differentiate offerings and capture higher value. New entrants with artisan capabilities can enter niche segments, targeting consumers seeking unique, high-quality products at premium price points.

Sustainable and Tech-Integrated Products

Consumers are increasingly valuing eco-friendly production, traceable sourcing, and smart technology features. Brands integrating RFID tracking, blockchain-based authenticity certificates, and sustainable materials are gaining a competitive advantage. Investment in these areas offers long-term growth potential and aligns with evolving consumer preferences for ethical, innovative, and durable leather products.

Product Type Insights

Satchels and shoulder bags dominate the market, accounting for approximately 28% of the 2024 market value. Their combination of utility, premium pricing, and brand positioning makes them highly attractive globally. Backpacks and crossbody bags are gaining popularity in urban and younger demographics, whereas clutches and evening bags serve the luxury niche. Trend analysis shows steady premiumization, with luxury satchels commanding higher ASPs and generating the bulk of market revenue.

Application Insights

Fashion and luxury retail remain the largest end-use application (68% market share in 2024), followed by corporate/business use and travel/leisure segments. Emerging applications include tech-integrated handbags with smart compartments, RFID security, and power banks. Rental and resale platforms are also creating secondary market demand, expanding overall consumption and lifecycle value of leather handbags.

Distribution Channel Insights

Offline channels account for 55% of global market value, led by flagship stores, department stores, and specialty boutiques. Online channels are the fastest-growing, offering direct-to-consumer sales, marketplaces, and digital marketing opportunities. Brands are leveraging interactive websites, social media, and subscription models to engage consumers and expand reach.

End-User Insights

Women dominate consumption (82% share), with men and unisex segments growing gradually. Luxury and premium handbags are increasingly popular among women aged 31–50, while younger consumers (18–30) drive demand for affordable, trend-driven products. Older demographics (51–65+) continue to invest in high-quality, premium handbags, particularly for work and travel purposes.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 22% of the market, with the U.S. as the largest consumer. Strong brand awareness, high disposable incomes, and e-commerce adoption drive market growth. Travel retail and duty-free purchases contribute significantly to the luxury segment revenues.

Europe

Europe accounts for 26% of the market. Italy and France dominate production and exports, particularly in the luxury segments. Growth is supported by heritage brands, tourism, and increasing interest in sustainable and ethically produced leather handbags.

Asia-Pacific

APAC is the largest and fastest-growing region (38% market share). China, India, and Southeast Asia lead in both demand and manufacturing. Rising middle-class wealth, urbanization, and increasing e-commerce penetration support premium and luxury handbag adoption.

Latin America

LATAM holds 6% of the market. Brazil and Argentina are key consumers, with demand focused on mid-range and luxury handbags. Economic volatility and import tariffs limit growth, but affluent segments continue to purchase premium products.

Middle East & Africa

MEA accounts for 8% of the market. GCC countries (UAE, Saudi Arabia) drive luxury demand, while Africa remains primarily a production hub for export markets. Intra-regional luxury consumption is growing steadily.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Leather Handbags Market

- LVMH

- Kering

- Hermès International

- Chanel

- Prada Group

- Tapestry, Inc.

- Capri Holdings Limited

- Richemont

- Salvatore Ferragamo S.p.A.

- Longchamp

- Mulberry

- Fossil Group, Inc.

- Valentino

- Bally

- Michael Kors (Capri Holdings parent-level)

Recent Developments

- In 2025, LVMH launched limited-edition leather handbags with blockchain-based traceability for sustainable sourcing.

- In 2025, Prada expanded its direct-to-consumer online platform across APAC, increasing premium handbag sales and customer engagement.

- In 2025, Hermès introduced smart leather handbags integrating RFID and power-bank compartments, targeting tech-savvy luxury consumers.