Laundry Drying Cabinets Market Size

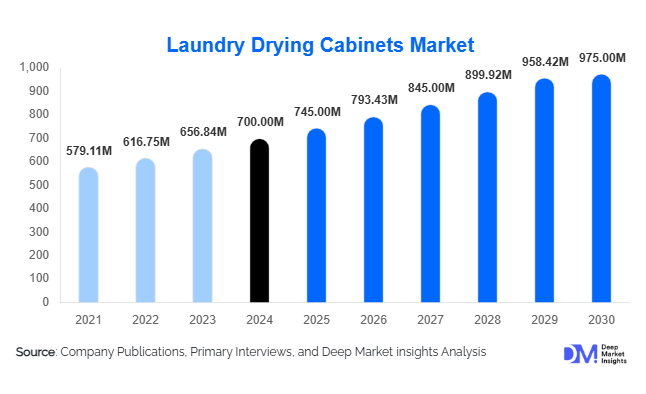

According to Deep Market Insights, the global laundry drying cabinets market size was valued at USD 700 million in 2024 and is projected to grow from USD 745 million in 2025 to reach USD 975 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of energy-efficient appliances, rising demand for fabric-care solutions in both residential and commercial sectors, and growing urbanization that limits outdoor drying space.

Key Market Insights

- Energy-efficient and smart drying cabinets are gaining traction, with heat-pump and IoT-integrated models increasingly preferred for both residential and commercial users.

- Commercial laundries and hospitality sectors dominate demand, leveraging drying cabinets for faster, gentler, and hygienic fabric drying solutions.

- Europe holds the largest market share, driven by regulatory mandates for energy efficiency and high consumer awareness of fabric care appliances.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and the adoption of premium household appliances in China, India, and Southeast Asia.

- North America maintains a stable demand, with U.S. and Canadian users favoring high-efficiency and built-in models for space-constrained homes.

- Technological adoption, including smart sensors, remote monitoring, and predictive maintenance, is reshaping user convenience and appliance efficiency.

Latest Market Trends

Energy-Efficient & Smart Drying Solutions

Manufacturers are increasingly focusing on heat-pump and energy-efficient drying cabinets that reduce electricity consumption without compromising performance. Smart features, such as IoT connectivity, remote monitoring, humidity sensors, and programmable cycles, are becoming standard in premium and mid-tier models. This trend is particularly popular in commercial laundries and luxury households, where energy costs, convenience, and fabric care are critical considerations. Integration with smart home systems and mobile applications further enhances customer experience, offering real-time notifications, predictive maintenance alerts, and optimized drying cycles tailored to specific fabrics.

Urbanization Driving Residential Adoption

Urban living with limited outdoor drying space is creating significant demand for compact, wall-mounted, or built-in drying cabinets. Residential users increasingly prioritize appliances that save space while providing gentle drying for delicate garments, footwear, and premium fabrics. Smaller urban apartments and high-rise buildings in Asia-Pacific and Latin America are major adoption hubs. Manufacturers are responding with multi-functional, aesthetically designed cabinets suitable for modern interiors, making indoor drying an attractive alternative to traditional line drying or bulky tumble dryers.

Laundry Drying Cabinets Market Drivers

Rising Demand for Fabric Care and Hygiene

Consumers and commercial operators are increasingly aware of the need to maintain fabric quality, prevent shrinkage, and preserve delicate textiles. Hotels, spas, and healthcare facilities adopt drying cabinets to meet hygiene standards and ensure gentler drying than traditional tumble dryers. The surge in premium apparel and technical fabrics, which require specialized drying, also drives market adoption.

Energy Efficiency Regulations

Government-mandated energy efficiency standards, particularly in Europe and North America, are encouraging the shift toward heat-pump and low-energy drying cabinets. Incentives, rebates, and stricter compliance requirements are pushing manufacturers to innovate energy-saving solutions, which in turn accelerates market penetration in both residential and commercial segments.

Market Restraints

High Initial Cost and Maintenance

Premium drying cabinets, particularly heat-pump and steam models, are expensive to purchase and install compared to traditional dryers. Maintenance, including servicing heating elements, sensors, or steam modules, adds to operating costs, limiting adoption among price-sensitive consumers and small-scale commercial users.

Space Constraints and Awareness Gaps

Limited space in apartments or small commercial laundries poses challenges for the installation of larger units. Additionally, awareness about the advantages of drying cabinets is still low in some emerging regions, where consumers rely on conventional drying methods.

Market Opportunities

Integration of IoT and Smart Controls

IoT-enabled drying cabinets offer remote control, predictive maintenance, and fabric-specific drying cycles. These innovations provide convenience for residential users and efficiency for commercial operations, opening new revenue streams for manufacturers who can differentiate with smart technology features.

Expansion in Emerging Urban Markets

Asia-Pacific, Latin America, and the Middle East are experiencing rapid urbanization, driving demand for space-efficient indoor drying solutions. Rising disposable incomes and awareness of premium appliances create opportunities for both local and global players to introduce mid-to-high-end drying cabinets tailored for these markets.

Product Type Insights

Heated-air drying cabinets dominate the market, accounting for over 55% of the 2024 revenue share, due to lower cost, simple design, and widespread commercial adoption. Heat-pump and steam cabinets are gaining traction in premium segments due to energy efficiency and advanced fabric-care capabilities. Portable and compact models are increasingly preferred in residential applications where space constraints are critical.

Application Insights

Commercial laundries, hotels, and healthcare facilities remain the largest application segment, representing over 50% of the 2024 market share. Residential adoption is growing rapidly, especially in urban areas, as users seek gentle, space-efficient drying solutions. Specialized applications include laboratories, cleanrooms, sports gear drying, and luxury clothing care.

Distribution Channel Insights

Direct B2B sales dominate commercial procurement, while appliance retail stores and online platforms lead residential sales. E-commerce platforms are growing rapidly by enabling transparent pricing, reviews, and easy home delivery. Institutional procurement for hospitals, hotels, and government facilities is also a significant channel.

End-User Insights

Commercial users (laundries, hotels) represent the largest share of demand, driven by capacity requirements and operational efficiency. Residential users are the fastest-growing segment, particularly in urban and premium markets. Emerging niches include healthcare, laboratories, and boutique fashion outlets requiring delicate fabric handling.

| By Product Type | By End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe is the largest market, contributing approximately 44% of global revenue in 2024. Countries such as Germany, the UK, France, and Italy are key drivers due to strict energy efficiency regulations, high consumer awareness, and premium product adoption. Heat-pump and built-in cabinets are widely adopted, with commercial laundries leading demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to record double-digit growth in select markets. China, India, Japan, and Southeast Asia are key contributors, driven by urbanization, rising disposable income, and increasing adoption of modern household appliances. Compact and multi-functional designs are gaining traction in densely populated cities.

North America

North America accounts for around 25% of the 2024 market, with the U.S. as the dominant country. Residential and commercial users prefer built-in and high-efficiency models. Growth is steady, supported by disposable income and energy efficiency regulations.

Latin America

Latin America holds a smaller share (5–10%) but is growing steadily, with Brazil, Mexico, and Argentina driving demand in urban residential and commercial sectors. Cost sensitivity remains a challenge, but rising urban middle-class incomes support premium adoption.

Middle East & Africa

The region is witnessing gradual growth, with countries such as the UAE, Saudi Arabia, and South Africa investing in commercial and residential drying solutions. Climate-driven indoor drying demand and rising urbanization are key growth factors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Laundry Drying Cabinets Market

- Electrolux Professional

- LG Electronics Inc.

- Whirlpool Corporation

- Miele & Cie. KG

- ASKO / Gorenje

- Primus (Alliance Laundry Systems)

- V-ZUG AG

- Samsung Electronics Co. Ltd.

- Coway Co. Ltd.

- Podab

- Bosch / BSH Hausgeräte

- Haier Group

- Panasonic Corporation

- Siemens (Home Appliances)

- Fisher & Paykel Appliances Ltd.

Recent Developments

- In June 2025, Miele launched a heat-pump drying cabinet with IoT integration in Europe, aimed at premium residential users, emphasizing energy savings and fabric-care features.

- In March 2025, LG Electronics expanded its commercial laundry cabinet line in North America, including smart sensors for optimized drying cycles in hotels and hospitals.

- In January 2025, Electrolux introduced a compact, wall-mounted drying cabinet in Asia-Pacific, targeting urban households with limited space and high energy-efficiency needs.