Lateral Fitness Equipment Market Size

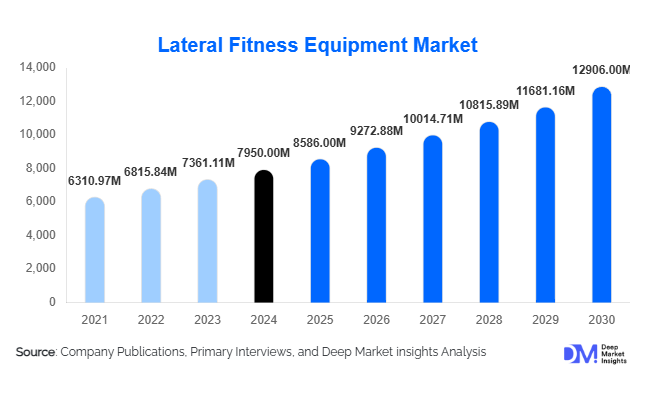

According to Deep Market Insights, the global lateral fitness equipment market size was valued at USD 7,950 million in 2024 and is projected to grow from USD 8,586 million in 2025 to reach USD 12,906 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The market growth is primarily driven by rising health consciousness, increasing adoption of home-based and smart fitness solutions, and growing demand for functional and rehabilitation-focused lateral motion equipment across commercial and residential segments.

Key Market Insights

- Home fitness and smart equipment integration is accelerating adoption, enabling app connectivity, real-time feedback, and subscription-based models that attract tech-savvy consumers.

- Commercial gyms and health clubs dominate the end-use segment, with large-scale equipment purchases for functional and rehabilitation training driving sustained demand.

- North America holds the largest market share (40% in 2024), supported by high gym penetration, disposable income, and early adoption of connected fitness solutions.

- Asia-Pacific is the fastest-growing region, led by India, China, and Southeast Asia, driven by rising urban fitness awareness and gym infrastructure expansion.

- Emerging markets in LATAM and MEA are increasing imports of lateral fitness equipment for commercial gyms, hotels, and rehabilitation centers, creating export opportunities for manufacturers.

- Technological advancements, including IoT-enabled machines, Bluetooth connectivity, and performance tracking, are reshaping consumer engagement and offering premium pricing potential.

Latest Market Trends

Rise of Smart and Connected Equipment

Lateral fitness equipment is increasingly being designed with smart features such as Bluetooth, mobile app integration, and interactive screens. This trend caters to home-based users and gyms seeking differentiated offerings. Connected devices allow users to track performance, follow guided workouts, and participate in virtual fitness challenges. Subscription-based models for connected equipment are emerging, enabling recurring revenue for manufacturers and enhanced user engagement. Additionally, gamification and AI-based recommendations are boosting retention and adoption in both home and commercial segments.

Functional and Rehabilitation Training Adoption

Beyond traditional cardio and strength applications, lateral fitness equipment is increasingly used in rehabilitation and preventive healthcare. Machines designed for lateral motion improve balance, core stability, and mobility, making them attractive for physical therapy clinics and wellness programs targeting older adults. Functional training adoption in gyms and hotels has also expanded demand, with equipment designed to improve lateral movement, agility, and overall body coordination gaining popularity. The growing awareness of injury prevention and personalized fitness routines supports this trend.

Lateral Fitness Equipment Market Drivers

Rising Health and Fitness Awareness

Global consumers are increasingly focused on preventive health and functional fitness. Lateral fitness equipment supports side-to-side movement and balance, appealing to individuals seeking diversified workout routines. The growing popularity of hybrid home-gym and commercial fitness programs further amplifies demand.

Expansion of the Home Fitness Segment

The adoption of home fitness equipment has surged post-pandemic, with consumers seeking convenient, versatile, and compact machines. Smart lateral trainers allow users to replicate gym-level functionality at home, driving growth in the residential segment. Connected features and app integration enhance engagement, further fueling adoption.

Commercial Gym and Health Club Growth

Commercial fitness infrastructure is expanding globally, particularly in emerging markets. Health clubs and wellness centers are integrating lateral motion equipment for functional and rehabilitation-focused programs. Upgrading gym fleets and offering differentiated fitness experiences encourage significant equipment purchases.

Market Restraints

High Equipment Cost

Lateral fitness machines, particularly smart and connected models, command premium prices. This can limit adoption among price-sensitive consumers and smaller commercial gyms, restricting market penetration in cost-sensitive regions.

Market Saturation in Developed Regions

Mature markets in North America and Europe face equipment saturation, intense competition, and price pressure. Slower growth in these regions necessitates product innovation and differentiation to maintain market share.

Lateral Fitness Equipment Market Opportunities

Emerging Regional Demand

Emerging markets in APAC, LATAM, and MEA offer significant growth potential due to rising disposable income, urbanization, and expanding fitness awareness. Tailored product offerings, local manufacturing partnerships, and targeted distribution strategies can help manufacturers capture untapped demand.

Rehabilitation and Preventive Health Applications

The aging population and growing preventive healthcare awareness create demand for lateral fitness equipment in physical therapy and rehabilitation. Hospitals, clinics, and wellness centers represent new application segments, driving diversified revenue streams.

Integration of Smart Technologies

IoT-enabled machines, AI-guided workouts, and subscription-based apps allow manufacturers to differentiate offerings. Connected equipment enhances user engagement, loyalty, and recurring revenue opportunities, particularly in home and boutique gym segments.

Product Type Insights

Lateral treadmills dominate the equipment type segment, accounting for 35% of the 2024 market. Their widespread recognition, integration with gait-rehabilitation programs, and smart connectivity features make them the preferred choice for both commercial and home users. Lateral trainers and side-to-side striders are gaining traction due to their popularity for low-impact, multi-plane cardio and lateral conditioning, particularly among sports and rehabilitation users. Lateral ellipticals and cross-trainers appeal to consumers seeking full-body, low-impact workouts, especially premium models with connectivity and performance tracking. Strength and resistance lateral machines are favored for functional and sport-specific lateral movement training, while rehabilitation and medical lateral devices see strong B2B demand due to aging populations and hospital/clinic procurement. Accessories and wearables, such as balance trackers and sensors, are increasingly adopted alongside connected equipment to enhance performance metrics and user engagement.

Application Insights

Lower-body training dominates the application segment (60% of 2024 share) due to the effectiveness of lateral motion equipment in targeting hips, thighs, glutes, and lateral core stability. Functional training is increasingly popular in boutique and cross-training gyms, where lateral motion pieces enhance agility, balance, and strength in multi-plane movements. Sports performance applications are driven by coaches and athletic trainers seeking injury prevention and sport-specific conditioning tools. Rehabilitation and physical therapy usage is also growing, fueled by clinical evidence supporting lateral gait and balance training, leading to increased procurement by hospitals, rehabilitation centers, and insurers.

Distribution Channel Insights

Offline retail channels remain dominant (55% of the 2024 market), particularly for high-ticket and commercial purchases where showroom demonstrations influence buyer decisions. Online direct-to-consumer platforms are growing rapidly, particularly for home fitness users, leveraging bundled software subscriptions, app integration, and premium engagement. Specialty fitness retailers, offering hands-on demo experiences and expert guidance, encourage adoption of higher-priced lateral equipment. Mass retailers cater to price-sensitive buyers and entry-level equipment demand, while institutional procurement, including hospitals and chain gyms, drives stable B2B revenue with tender-based bulk orders.

End-Use Insights

Commercial gyms and fitness clubs represent the largest end-use segment (45% of the 2024 market), driven by the need to differentiate offerings with functional, lateral, and rehabilitation-focused equipment. Home and residential users are growing rapidly, supported by smart equipment adoption and D2C models. Medical and rehabilitation centers are increasingly procuring certified lateral devices for balance, gait, and therapeutic protocols, while sports teams and athletic training facilities adopt equipment for sport-specific conditioning and injury prevention. Export-driven demand from APAC, LATAM, and MEA provides additional growth opportunities for global manufacturers.

Age Group Insights

The 31–50-year age group accounts for the largest market share, combining disposable income with strong engagement in fitness activities. The 18–30-year cohort drives growth in home fitness adoption, smart equipment use, and interactive app-based training. Users aged 51–65 increasingly adopt lateral motion equipment for preventive health, rehabilitation, and functional fitness, while the 65+ segment, although smaller, shows rising demand for low-impact, accessible machines and medical-grade rehabilitation devices.

| By Product Type | By Application | By Distribution Channel | By End-Use | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market (40% share in 2024). High commercial gym penetration, widespread home-fitness adoption, and strong consumer spending on connected equipment drive demand. The U.S. leads regional consumption, followed by Canada. Demand is further fueled by premium subscription-based models, athletic rehabilitation programs, and boutique fitness studios offering multi-plane and lateral training solutions. Growth is supported by increasing awareness of functional and low-impact fitness and high per-capita fitness expenditure.

Europe

Europe accounts for 25% of the market, led by Germany, the U.K., and France. An aging population and strong rehabilitation services market drive demand for lateral devices in hospitals, clinics, and senior-focused wellness programs. Commercial gyms and boutique studios continue to expand functional and lateral motion equipment offerings. Consumers are increasingly eco-conscious and health-oriented, favoring smart, low-impact machines for balance, gait, and core stability training. Steady growth is supported by established fitness infrastructure and insurance reimbursement for rehabilitation equipment.

Asia-Pacific

APAC is the fastest-growing region (20% share in 2024), with India, China, Japan, and Southeast Asia leading demand. Rapid urbanization, rising disposable incomes, and the proliferation of boutique gyms drive market expansion. Home fitness adoption, particularly smart connected equipment, contributes to growth. Rising awareness of preventive health and functional training, combined with emerging sports and rehabilitation programs, enhances equipment penetration. Regional investments in fitness infrastructure, cross-training studios, and hotel wellness centers further accelerate demand.

Latin America

LATAM (8% share) is emerging, with Brazil and Argentina as key contributors. Growth is driven by increasing fitness awareness, expansion of low-cost gym chains, and rising interest in functional training. Price sensitivity limits the adoption of premium devices, favoring economy and mid-range segments. Localized distribution strategies, combined with boutique gyms and wellness programs, provide opportunities for manufacturers to capture market share. Commercial gyms, hotels, and rehabilitation centers are key growth channels.

Middle East & Africa

MEA (7% share) benefits from high-income populations in GCC countries such as the UAE and Saudi Arabia, supporting premium gym equipment, boutique fitness studios, and wellness-focused hotels. Nascent markets elsewhere in Africa offer opportunities in the economy and mid-range devices, as well as institutional procurement in rehabilitation centers and universities. Growing awareness of preventive health and sports performance, combined with emerging boutique gym infrastructure, is supporting the gradual adoption of lateral motion equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lateral Fitness Equipment Market

- ICON Health & Fitness Inc.

- TECHNOGYM S.p.A.

- Johnson Health Tech Co., Ltd.

- Nautilus, Inc.

- Core Health & Fitness LLC

- Cybex International, Inc.

- Impulse (Qingdao) Health Tech Ltd.

- Matrix Fitness

- True Fitness Technology, Inc.

- Bowflex / Life Fitness

- Precor Incorporated

- Star Trac

- Octane Fitness LLC

- ProForm

- Keiser Corporation

Recent Developments

- In 2025, Johnson Health Tech expanded manufacturing capabilities in India to supply connected lateral fitness equipment to the APAC and Middle East markets.

- In early 2025, Technogym launched a series of smart lateral motion treadmills and ellipticals for home and commercial applications, integrating AI-driven workout tracking.

- In 2024, ICON Health & Fitness introduced compact, smart lateral trainers designed for home use, tapping into the fast-growing residential segment in North America and Europe.