Laser Safety Protection Eyewear Market Size

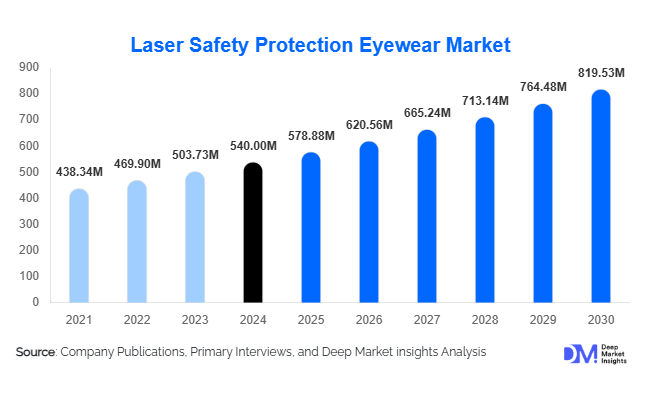

According to Deep Market Insights, the global laser safety protection eyewear market size was valued at USD 540 million in 2024 and is projected to grow from USD 578.88 million in 2025 to reach USD 819.53 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The growth of the laser safety protection eyewear market is primarily driven by increasing adoption of laser technologies across healthcare, industrial manufacturing, defense, and research applications, alongside rising regulatory mandates for workplace safety and personal protective equipment compliance.

Key Market Insights

- Technological advancements in materials and coatings are improving the safety, durability, and comfort of laser protective eyewear, driving adoption across industrial and healthcare settings.

- Regulatory compliance and workplace safety awareness are compelling organizations to invest in certified protective eyewear, boosting demand in both developed and emerging markets.

- Medical and industrial laser applications dominate market demand, with sectors like surgical procedures, laser cutting, and welding accounting for the largest consumption globally.

- North America holds the largest market share due to strict occupational safety standards and widespread adoption of laser technologies across multiple industries.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization, healthcare infrastructure expansion, and rising investments in manufacturing technologies.

- Integration of smart features such as lightweight designs, anti-fog coatings, and augmented reality compatibility is shaping product differentiation and user experience.

Latest Market Trends

Technologically Enhanced Protective Eyewear

Emerging materials, advanced optical coatings, and design innovations are redefining laser safety eyewear. Lightweight frames, anti-fog and scratch-resistant coatings, and adjustable fittings are increasing user compliance. Some high-end models now integrate augmented reality (AR) or digital overlays for industrial applications, allowing users to view worksite data while maintaining eye protection. These advancements are particularly appealing to research labs, healthcare facilities, and precision manufacturing industries, where prolonged use requires comfort without compromising safety.

Regulatory Compliance Driving Adoption

Stringent occupational safety regulations in North America, Europe, and parts of Asia-Pacific are a major factor driving the market. Organizations are increasingly mandated to provide certified laser safety eyewear to personnel working with laser equipment. Compliance with international standards such as ANSI Z136 (U.S.) and IEC 60825 (Europe) ensures product adoption and protects manufacturers from legal liabilities. The rising awareness of laser hazards in emerging economies is also increasing the penetration of certified protective eyewear in these markets.

Laser Safety Protection Eyewear Market Drivers

Expanding Industrial and Medical Laser Applications

Lasers are being increasingly applied in healthcare for surgeries, dermatology, and ophthalmology, while industrial sectors rely on lasers for cutting, welding, and precision manufacturing. This expansion is a primary driver for protective eyewear as organizations prioritize employee safety and operational compliance. Adoption of high-power lasers necessitates protective solutions with specific optical density ratings, further increasing demand for specialized eyewear.

Rising Safety Awareness

Heightened awareness regarding eye injuries caused by laser exposure is encouraging businesses to adopt high-quality protective eyewear. Safety training programs and corporate policies emphasizing eye protection contribute to a growing market. Organizations now view laser safety eyewear as critical to workforce health, reducing liability and improving operational safety culture.

Government and Industry Regulations

Mandatory adherence to safety standards across industrial and healthcare environments is accelerating the adoption of laser safety eyewear. Policies such as OSHA regulations in the U.S. and EU directives on worker safety have increased the need for certified protective gear. Manufacturers complying with these standards gain a competitive advantage in global markets.

Market Restraints

High Production and Material Costs

Advanced protective eyewear involves specialized materials and coatings that increase manufacturing costs. This can limit affordability, especially for small-scale industrial operations or emerging market buyers, restraining market penetration.

Certification Complexity

Obtaining international certifications is a time-consuming and costly process. Smaller manufacturers may face delays entering the market, and end-users might experience limited product availability. Regulatory complexity can slow market growth and create barriers for new entrants.

Laser Safety Protection Eyewear Market Opportunities

Integration with Smart and AR Technologies

There is potential to integrate augmented reality, heads-up displays, and digital monitoring features into laser safety eyewear. This allows for enhanced operational efficiency in industrial and healthcare environments. Companies investing in smart eyewear can differentiate their offerings and capture high-value segments requiring advanced functionality alongside safety.

Emerging Industrial and Regional Demand

Rapid industrialization in Asia-Pacific, Latin America, and parts of the Middle East is increasing laser adoption, creating opportunities for protective eyewear. Expanding sectors include manufacturing, automotive, and electronics assembly, where worker safety compliance is becoming mandatory. This growth is expected to continue over the next five years, offering high-return opportunities for manufacturers targeting emerging markets.

Healthcare and Research Expansion

The growing use of lasers in healthcare and research labs provides significant market potential. As hospitals and academic institutions adopt more laser-based technologies, the demand for specialized eyewear is expected to rise. Companies offering lightweight, comfortable, and high-OD protective eyewear are well-positioned to capture this opportunity.

Product Type Insights

Polycarbonate safety glasses dominate the market, accounting for 38% of the 2024 market. Their lightweight design, impact resistance, and broad-spectrum laser protection make them the preferred choice across industrial, healthcare, and research settings. Glass laser safety eyewear is gaining popularity in high-precision medical and laboratory applications due to its superior optical clarity, while thin-film-coated glasses are increasingly adopted in industrial laser cutting processes. Intense pulse light (IPL) protective glasses have niche applications in dermatology and cosmetic laser treatments.

Application Insights

The industrial manufacturing segment leads the market with a 35% share of the 2024 market. Laser-based cutting, welding, and precision processes require consistent and reliable eye protection. Healthcare applications account for 28% of the market, driven by surgical lasers and ophthalmology treatments. Defense and research applications are emerging, particularly with the use of laser technologies in military exercises, telecommunications research, and academic laboratories, contributing to the overall growth trajectory.

Distribution Channel Insights

Direct industrial supply contracts and online B2B platforms dominate distribution. Industrial buyers often purchase in bulk via direct procurement, while smaller labs and hospitals increasingly use online channels to acquire certified protective eyewear. Distributors and authorized dealers cater to regional markets, providing both standard and customized solutions based on specific laser hazard requirements. Subscription-based corporate procurement models are also emerging, particularly in healthcare and manufacturing sectors requiring ongoing safety compliance.

End-Use Insights

Healthcare, industrial manufacturing, and defense are the primary end-use sectors driving growth. Healthcare applications are expanding rapidly, with hospitals and cosmetic clinics adopting specialized eyewear for surgical and dermatological procedures. Industrial applications remain the largest contributor, with laser cutting, welding, and electronics assembly demanding consistent eye protection. Research labs and academic institutions represent a growing niche, particularly in the Asia-Pacific and North American markets, where safety compliance is strictly enforced. Export-driven demand is rising, especially for industrial-grade eyewear manufactured in North America and Europe and exported to emerging economies in APAC and Latin America.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share of the laser safety protection eyewear market at 32% in 2024. The U.S. leads demand due to strict OSHA regulations and widespread adoption of laser technologies in manufacturing and healthcare. Canada contributes a smaller but significant share, driven by medical and research applications. Market growth is supported by government safety initiatives and high industrial automation levels.

Europe

Europe accounted for 28% of the market in 2024, with Germany, France, and the U.K. as the key contributors. Industrial automation, healthcare infrastructure, and strict EU safety directives drive eyewear adoption. Germany, with its advanced manufacturing base, represents the largest single-country market share in Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to industrial expansion, healthcare modernization, and rising safety awareness. China and India are leading contributors, with demand increasing for industrial, medical, and research applications. Southeast Asian countries like Vietnam and Thailand are also emerging as growth markets for laser safety protective solutions.

Latin America

Brazil, Mexico, and Argentina are the main markets in Latin America. Demand is growing slowly but steadily as industrial and medical laser applications expand. Rising awareness of workplace safety and increasing regulatory alignment with international standards are supporting growth.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is adopting protective eyewear in the industrial and medical sectors. Africa is primarily a manufacturing and research niche market, with adoption concentrated in South Africa. Growth is supported by industrial investments and compliance with international safety standards.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Laser Safety Protection Eyewear Market

- Honeywell International Inc.

- Kentek Corporation

- NoIR Laser Company

- Uvex Safety Group

- 3M Company

- Laser Components Inc.

- ThorLabs Inc.

- Delta Plus Group

- OptoTech Corporation

- Schott AG

- Laser Safety Industries

- MediLaser Technologies

- Thorlabs Ltd.

- Lambert Eyewear

- Delta Optical Solutions

Recent Developments

- In March 2025, Honeywell launched a new line of lightweight AR-compatible laser safety glasses for industrial and healthcare applications.

- In January 2025, Kentek Corporation expanded its distribution in Asia-Pacific, targeting high-growth industrial laser markets in China and India.

- In February 2025, NoIR Laser Company introduced IPL-specific protective eyewear for dermatology and cosmetic laser procedures, enhancing product niche offerings.