Laser Safety Glasses Market Size

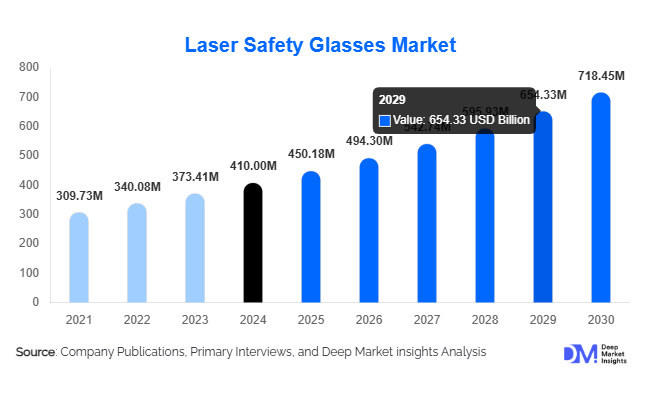

According to Deep Market Insights, the global laser safety glasses market size was valued at USD 410 million in 2024 and is projected to grow from USD 450.18 million in 2025 to reach USD 718.45 million by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The market growth is driven by the expanding use of high-powered lasers across medical, industrial, and research sectors, coupled with increasing safety regulations and awareness regarding laser protection standards.

Key Market Insights

- Rising adoption of laser technology in healthcare and manufacturing is significantly boosting demand for certified laser protection eyewear.

- Stringent occupational safety regulations by organizations such as ANSI and OSHA are driving compliance-based demand across laboratories and production facilities.

- Asia-Pacific dominates global production due to rapid industrialization and a growing base of laser equipment manufacturers in China, Japan, and South Korea.

- North America and Europe lead in safety standard adoption, emphasizing certified eyewear for medical, defense, and R&D laser applications.

- Technological innovations, including lightweight polycarbonate lenses and advanced absorption filters, are enhancing comfort and protection levels.

Latest Market Trends

Integration of Advanced Materials for Improved Protection

Manufacturers are focusing on developing laser safety glasses using advanced composite and polycarbonate materials that offer enhanced absorption and visibility without compromising comfort. Innovations include wavelength-specific coatings and wraparound frames designed to protect users from indirect reflections and scattered beams. Additionally, smart eyewear with embedded sensors is emerging, capable of monitoring laser exposure levels and alerting users in real time.

Rising Demand from Healthcare and Aesthetic Applications

The growing use of lasers in dermatology, ophthalmology, and cosmetic treatments has driven significant demand for certified laser safety eyewear among medical professionals. Hospitals, clinics, and laser therapy centers are increasingly investing in high-quality protective gear to comply with international safety standards. This surge in medical laser adoption is expected to continue, supported by advancements in laser-assisted surgery and skin rejuvenation technologies.

Laser Safety Glasses Market Drivers

Expanding Industrial Laser Applications

Rapid growth in industrial laser applications such as cutting, welding, and engraving is a major driver of the laser safety glasses market. As high-power laser systems become more affordable and widespread, ensuring operator safety has become a key operational priority. Manufacturers and workshops are investing in certified protective eyewear to comply with industrial safety protocols, minimizing risks associated with accidental laser exposure.

Regulatory Enforcement and Safety Awareness

Government and industry-specific safety standards are reinforcing the use of laser protective eyewear in workplaces. Regulatory bodies such as the American National Standards Institute (ANSI Z136) and European EN 207/208 directives have established stringent compliance frameworks. The growing awareness among employers and employees regarding eye safety during laser operations is propelling market expansion globally.

Market Restraints

High Cost of Certified Laser Eyewear

Laser safety glasses with advanced protection filters can be expensive, particularly for small-scale manufacturers and laboratories. The high cost associated with compliance-certified eyewear, especially those customized for specific wavelengths, limits adoption in developing regions. Additionally, counterfeit or uncertified products in the market undermine trust and pose safety risks, affecting market growth.

Lack of Standardization in Emerging Markets

Inconsistencies in laser safety standards and limited regulatory enforcement in several emerging economies restrain market development. The absence of clear certification guidelines often leads to the use of substandard eyewear, compromising safety and hindering international product trade.

Laser Safety Glasses Market Opportunities

Smart Laser Eyewear and IoT Integration

Emerging opportunities lie in smart laser eyewear integrated with sensors and IoT connectivity. These advanced models can detect exposure levels, log operational data, and provide visual or audio alerts when laser thresholds are exceeded. Such innovations are expected to gain traction in high-risk industrial and medical environments, where real-time monitoring is critical.

Expansion in Asia-Pacific Manufacturing Hubs

The rapid industrial growth across China, India, and Southeast Asia presents a substantial opportunity for laser safety eyewear manufacturers. Expanding local laser manufacturing ecosystems and favorable government initiatives to enhance workplace safety are creating long-term growth prospects for both domestic and international suppliers.

Product Type Insights

Absorptive laser safety glasses dominate the market, widely used across medical and industrial applications due to their affordability and effectiveness against multiple laser wavelengths. Reflective and interference-based safety glasses are gaining traction for high-precision applications requiring narrow wavelength protection. Custom wavelength-specific glasses are increasingly in demand across research institutions and laboratories dealing with specialized laser systems.

Application Insights

The industrial segment accounts for the largest market share, followed by medical and research applications. Laser cutting, welding, and engraving drive industrial demand, while healthcare applications continue expanding due to increased use of cosmetic and surgical lasers. The defense and aerospace sectors also represent emerging high-value segments, particularly for laser targeting and optical communication systems.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains a key market, supported by advanced healthcare infrastructure and strict OSHA and ANSI compliance requirements. The U.S. leads the region, with growing adoption across research labs, aerospace, and defense sectors.

Europe

Europe is the second-largest market, driven by strong enforcement of EN 207/208 standards. Germany, the U.K., and France lead in both manufacturing and research-related laser safety applications, supported by active participation in EU-funded safety programs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for a major share of global production. Rapid industrialization, expansion of medical laser applications, and rising exports from China and Japan are propelling market growth. India and South Korea are also emerging as key demand centers due to increased government emphasis on worker safety.

Latin America & the Middle East

Steady growth is observed in Brazil, Mexico, and the UAE, where healthcare and industrial sectors are adopting laser-based technologies. Rising safety awareness and international partnerships are expected to expand regional market penetration over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Laser Safety Glasses Market

- Honeywell International Inc.

- Uvex Safety Group

- NoIR Laser Company

- Univet S.r.l.

- Phillips Safety Products Inc.

- Thorlabs Inc.

- Laservision USA

Recent Developments

- In August 2025, Uvex Safety Group launched a new range of polycarbonate-based laser safety eyewear with enhanced visibility and reduced weight, targeting the healthcare segment.

- In May 2025, NoIR Laser Company introduced customizable wavelength-specific glasses with smart coatings optimized for multi-laser environments.

- In March 2025, Honeywell expanded its industrial safety portfolio by integrating AI-based exposure tracking features into its laser protection eyewear line.