Laser Protective Goggles Market Size

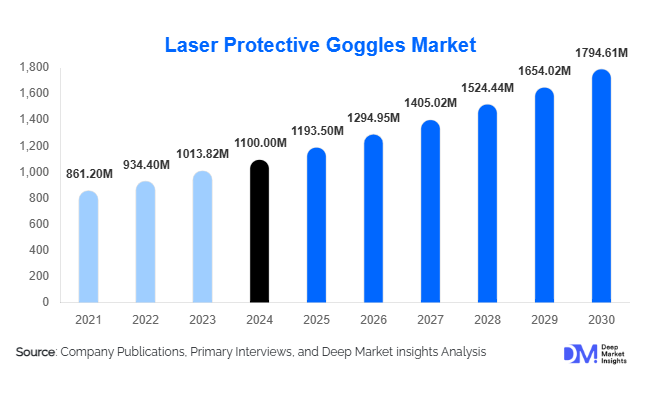

According to Deep Market Insights, the global Laser Protective Goggles Market was valued at USD 1,100 million in 2024 and is projected to grow from USD 1,193.50 million in 2025 to reach USD 1,794.61 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). This growth is primarily driven by the rising use of laser systems across industrial manufacturing, healthcare, defense, and scientific research sectors, coupled with the enforcement of stringent occupational safety standards worldwide. Increasing laser integration in medical treatments, expanding industrial automation, and the ongoing modernization of defense technologies are creating a robust and sustained demand for certified laser protective eyewear.

Key Market Insights

- Polycarbonate laser protective goggles dominate the market, accounting for approximately 55% of total revenue in 2024 due to their lightweight and cost-efficient characteristics.

- Industrial and manufacturing applications represent around 45% of global demand, driven by the rise of laser welding, cutting, and additive manufacturing processes.

- Reusable goggles lead product segmentation, with over 60% market share, owing to long-term cost efficiency and environmental sustainability.

- North America leads the global market with a 35% share, while Asia-Pacific is the fastest-growing region (9–12% CAGR), fueled by industrial expansion in China and India.

- Growing regulatory compliance under ANSI Z136 and EN 207 standards is accelerating the adoption of certified protective eyewear worldwide.

- Technological advancements such as multi-wavelength filtration, smart sensors, and ergonomic designs are redefining product performance and user comfort.

Latest Market Trends

Integration of Smart Technologies in Protective Eyewear

Manufacturers are increasingly integrating smart technologies into laser protective goggles to enhance safety and user experience. Innovations include built-in sensors for exposure detection, optical density adjustment, and Bluetooth-enabled connectivity for usage tracking. These technologies are particularly valuable in research and defense applications, where real-time data on laser exposure and operator protection levels are critical. Smart goggles with adaptive lens systems capable of switching optical densities across multiple wavelengths are entering commercial use, promising better versatility and longer product lifecycles.

Rising Demand for Multi-Wavelength and Hybrid Filters

The growing diversity of laser systems, from CO₂ and Nd: YAG to diode and excimer lasers, has driven demand for multi-wavelength protection. Hybrid filter goggles combining dielectric coatings and polymer substrates provide broad-spectrum coverage, reducing the need for multiple pairs of goggles in multi-laser environments. This trend is particularly evident in hospitals, research institutions, and industrial settings where multiple laser wavelengths are in use simultaneously.

Laser Protective Goggles Market Drivers

Proliferation of Lasers Across Industries

The rapid adoption of lasers in medical surgery, dermatology, industrial manufacturing, and defense systems is a primary growth driver. Industrial automation, utilizing laser welding and cutting, coupled with the rise of laser-based medical treatments, is driving sustained demand for certified protective eyewear.

Strengthening Safety Regulations and Compliance Standards

Regulatory enforcement under frameworks such as ANSI Z136 (U.S.) and EN 207/208 (Europe) mandates certified eyewear for laser operators. Growing corporate compliance with occupational safety norms has led to the replacement of uncertified goggles, boosting demand for high-quality, certified products.

Material and Design Innovation

Technological innovations such as anti-fog coatings, lightweight polycarbonate frames, and ergonomic designs are improving comfort, durability, and optical clarity. Prescription-compatible goggles and models with enhanced side protection are becoming standard across the industry.

Market Restraints

High Cost and Limited Awareness in Developing Regions

Certified laser goggles with advanced coatings and multi-wavelength protection remain expensive for smaller clinics and factories in emerging markets. Low awareness of laser hazards and insufficient training in workplace safety further slow adoption, particularly across Asia and Africa.

Proliferation of Counterfeit and Non-Compliant Products

Unregulated distribution of counterfeit and substandard goggles undermines consumer confidence and exposes operators to risk. Lack of uniform enforcement of standards across regions remains a critical challenge for market participants and regulators.

Laser Protective Goggles Market Opportunities

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing increased adoption of laser-based technologies in manufacturing and healthcare. Localized production of certified eyewear and alignment with regional safety standards can unlock significant growth potential for global and regional manufacturers.

Product Innovation Through Technology Integration

Manufacturers are exploring advanced designs that combine multi-wavelength protection, smart sensors, and real-time exposure monitoring. Such features enhance operational safety in high-risk environments, offering differentiation and premium pricing opportunities in a competitive market.

Regulatory and Compliance-Driven Replacement Cycles

Stricter enforcement of workplace safety laws and periodic certification renewals are driving continuous replacement cycles. This presents recurring revenue potential for established brands offering compliant, documented, and certified protective eyewear solutions.

Product Type Insights

Reusable laser protective goggles lead the product type segment with a 60% share in 2024, supported by widespread adoption in industrial and medical facilities. Disposable goggles are primarily used in short-duration procedures or controlled lab environments. Integrated face-shield systems, which combine goggles with visors, are gaining traction in defense and aerospace applications where comprehensive protection is crucial. Prescription-compatible goggles are also growing rapidly, particularly in the medical sector, where professionals require both corrective and protective eyewear.

Application Insights

The industrial and manufacturing sector dominates, accounting for approximately 45% of global demand in 2024. Applications span laser cutting, welding, engraving, and additive manufacturing, especially in the automotive and electronics industries. The healthcare sector is the fastest-growing application area, projected to expand at a CAGR above 10%, driven by increasing laser-based surgeries and cosmetic treatments. Defense and aerospace applications contribute significantly to high-value demand, with research institutions also emerging as niche buyers for multi-wavelength protective goggles.

Material Insights

Polycarbonate-based goggles account for 55% of market revenue due to their balance of lightweight construction, optical clarity, and affordability. Glass filters, though offering high optical density, are limited by weight and fragility. Hybrid thin-film coated goggles are an emerging category, combining the durability of polymers with the precision of dielectric coatings, offering multi-laser protection suitable for laboratories and high-tech manufacturing environments.

| By Product Type | By Wavelength Range | By End-Use Industry | By Lens Material | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 35% share (USD 385 million in 2024), driven by high laser deployment in healthcare, defense, and advanced manufacturing. The U.S. dominates regional demand owing to strong regulatory enforcement and widespread adoption of fiber and diode lasers. Canada also contributes significantly through its expanding medical laser treatment facilities and research institutions.

Europe

Europe holds approximately a 25% share (USD 275 million in 2024). Germany and the U.K. represent key markets with mature industrial bases and robust safety compliance frameworks. Demand is reinforced by strong enforcement of EN standards and the widespread use of laser systems in precision manufacturing and medical technology sectors.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, accounting for around 20% of the global share in 2024 (USD 220 million). China and India lead regional growth due to expanding industrial automation and healthcare modernization. Japan and South Korea are mature markets focusing on high-performance optical safety products, while Southeast Asia is emerging as a cost-effective manufacturing hub for mid-tier products.

Latin America

Latin America represents approximately 7% of the market (USD 77 million in 2024). Brazil and Mexico are leading markets where industrial laser use is expanding in the automotive and electronics sectors. Awareness campaigns and local distribution partnerships are helping to increase the penetration of certified eyewear products gradually.

Middle East & Africa

MEA holds roughly 6% market share (USD 63 million in 2024). The GCC countries, especially Saudi Arabia and the UAE, are investing heavily in defense and healthcare sectors, which indirectly fuels demand for laser safety eyewear. South Africa remains a leading African market due to its strong manufacturing and medical sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Laser Protective Goggles Market

- Honeywell International Inc.

- Laservision

- Uvex Group

- Kentek Corporation

- Phillips Safety Products, Inc.

- NoIR LaserShields

- Laser Safety Industries

- Global Laser Ltd.

- 3M Company

- MCR Safety

- Edmund Optics

- OptiSource

- Access Technologies (PIP)

- Revision Military

- Gentex Corporation

Recent Developments

- In March 2025, Honeywell launched a new line of smart laser protective eyewear integrated with real-time exposure sensors for industrial and medical applications.

- In February 2025, Uvex Group introduced its hybrid multi-wavelength goggles with advanced dielectric coatings targeting the European manufacturing sector.

- In January 2025, Kentek Corporation expanded its North American distribution network by partnering with major industrial safety suppliers to meet rising demand across laser manufacturing hubs.