Large Capacity Ski Travel Bag Market Size

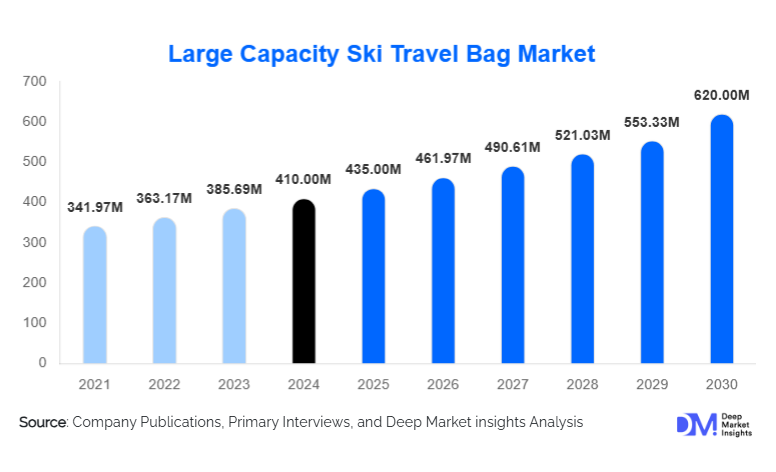

According to Deep Market Insights, the global large-capacity ski travel bag market size was valued at USD 410 million in 2024 and is projected to grow from USD 435 million in 2025 to reach USD 620 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). Market growth is driven by the rising popularity of winter sports, the expansion of ski tourism infrastructure, and the increasing demand for durable, sustainable, and high-capacity gear transportation solutions among both professional and leisure skiers.

Key Market Insights

- Non-wheeled soft ski travel bags dominate the global market, accounting for over 55% of revenue share in 2024 due to affordability, lightweight design, and easy storage.

- Multi-pair and extra-large capacity bags lead the size category, catering to families, professionals, and frequent travelers requiring multi-gear storage.

- Polyester remains the most used material type, while recycled and eco-blended fabrics are emerging as the fastest-growing sub-segment amid sustainability trends.

- North America holds the largest market share, supported by established ski infrastructure and high discretionary spending.

- Asia-Pacific is the fastest-growing regional market, with China, Japan, and India showing surging interest in winter sports and travel accessories.

- Premiumization and smart technology integration, such as GPS tracking and modular compartments, are transforming the product landscape.

What are the latest trends in the large capacity ski travel bag market?

Eco-Friendly and Sustainable Materials

Manufacturers are increasingly adopting recycled polyester, bio-nylon, and water-based coatings to reduce environmental impact. Sustainability certifications and eco-labels are becoming key differentiators, appealing to environmentally conscious consumers. Brands are marketing repairable, recyclable designs that extend product life cycles, with some introducing “buy-back” or refurbishment programs. This shift aligns with broader outdoor gear industry efforts toward carbon neutrality and circular production models.

Wheeled and Modular Design Innovations

Convenience-driven innovations are reshaping the market. Wheeled ski travel bags, featuring telescopic handles and reinforced frames, are gaining traction among frequent travelers. Modular designs that allow users to adjust compartments or detach sections for boots, helmets, or accessories are emerging as premium offerings. These customizable features enhance usability, justify higher price points, and reflect a growing demand for multi-purpose travel solutions.

What are the key drivers in the large capacity ski travel bag market?

Growing Winter Sports Participation and Adventure Tourism

Global participation in skiing and snowboarding is increasing due to expanding winter tourism and enhanced accessibility to ski resorts. As more consumers travel domestically and internationally for winter sports, the demand for protective, high-capacity bags that can safely transport skis and gear has surged. Countries such as China, India, and Japan are witnessing rapid growth in ski tourism, further driving equipment and accessory sales.

Rising Disposable Incomes and Premium Product Demand

Higher spending power, particularly among middle- and upper-income travelers, supports the shift toward premium gear. Consumers are willing to invest in lightweight, durable, and stylish ski travel bags equipped with advanced protection and smart storage features. Premium brands emphasizing durability, material innovation, and aesthetic appeal are expanding their market presence, especially in Europe and North America.

What are the restraints for the global market?

High Manufacturing and Logistics Costs

The cost of high-grade materials such as ballistic nylon, waterproof laminates, and reinforced zippers contributes to elevated product pricing. Rising freight and logistics expenses also constrain manufacturers’ margins. These factors make premium bags less accessible in emerging markets, restricting overall market penetration.

Seasonal Demand and Climate Uncertainty

Sales of ski travel bags are heavily seasonal, peaking during winter months. This cyclical demand leads to inventory management challenges for retailers. Moreover, unpredictable snowfall and shorter winters due to climate change are impacting ski tourism in traditional markets, posing a long-term risk to sustained growth.

What are the key opportunities in the large capacity ski travel bag industry?

Sustainable Product Differentiation

Brands that commit to eco-friendly materials, ethical sourcing, and carbon-neutral manufacturing can capture the growing segment of environmentally aware consumers. Partnerships with sustainable outdoor gear initiatives and transparent supply chains can boost brand equity and command premium pricing.

Expansion in Emerging Winter Sports Markets

Asia-Pacific, Latin America, and parts of Eastern Europe present lucrative opportunities as governments invest in ski resort development and tourism infrastructure. Localized production and pricing strategies can help global players penetrate these fast-growing regions, where first-time ski travelers represent untapped potential.

Product Type Insights

Non-wheeled ski travel bags lead the market in 2024 with over 55% share due to lightweight design and affordability, preferred by recreational skiers. Wheeled variants, however, are expected to record the highest CAGR through 2030, driven by convenience and growing air travel for ski tourism. Hybrid and foldable designs are also gaining popularity among urban consumers seeking space-efficient options.

Material Type Insights

Polyester remains the dominant material type, offering a cost-effective balance of strength and flexibility. Meanwhile, specialized waterproof laminates and recycled blends are seeing accelerated adoption, particularly in the premium segment. Manufacturers are increasingly experimenting with reinforced nylon composites and TPU coatings for enhanced durability and weather resistance.

End-User Insights

Amateur ski enthusiasts represent the largest end-user group, accounting for around 45% of market value in 2024. Professional athletes and rental operators form a smaller but higher-margin segment, demanding top-tier durability and transport efficiency. Family travelers are emerging as a key growth demographic, seeking multi-pair capacity and organized storage solutions for group trips.

Distribution Channel Insights

Specialty sporting goods stores lead global distribution with about 40% market share, supported by consumers’ preference to inspect size and material quality in person. However, online retail and direct-to-consumer (D2C) channels are growing rapidly, accounting for over 35% of 2024 sales. Digital platforms offering product customization, virtual size guides, and sustainability information are driving online engagement.

| By Product Type | By Material Type | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the market with a 30–35% share in 2024, driven by strong skiing participation in the U.S. and Canada. Premium brands such as Dakine, Thule, and Burton hold a significant presence. Growth remains steady due to high income levels and a well-established ski tourism infrastructure.

Europe

Europe represents around 25–30% of global revenue, supported by mature ski destinations across France, Switzerland, Austria, and Scandinavia. European consumers exhibit a strong preference for sustainable and design-centric products. Premium brands continue to thrive amid high brand loyalty and an established winter sports culture.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR of 7–9% through 2030. Expansion of ski resorts in China, Japan, South Korea, and India, along with rising disposable incomes, is boosting demand. Local production and brand partnerships are expanding rapidly to meet domestic needs.

Latin America

Latin America holds a modest 5–8% share, with Chile and Argentina leading due to their established ski tourism sectors. Growth remains niche but positive, supported by regional tourism campaigns and adventure travel trends among affluent consumers.

Middle East & Africa

Although smaller in volume, the Middle East & Africa region is seeing rising demand from high-income consumers and indoor skiing destinations in the UAE and Saudi Arabia. Premium imports dominate, and the region is expected to exhibit stable growth driven by luxury travel preferences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Large Capacity Ski Travel Bag Market

- Burton Snowboards

- Dakine Inc.

- Rossignol Group

- Head Sport GmbH

- Salomon Group

- Black Diamond Equipment Ltd.

- Sportube

- Nitro Snowboards

- Thule Group

- Atomic (Amer Sports)

Recent Developments

- In June 2025, Burton introduced a new line of eco-engineered ski travel bags made from 100% recycled polyester and featuring water-based coatings to reduce chemical emissions.

- In April 2025, Dakine announced the launch of its modular “Pro-Series” travel bags with detachable boot compartments and RFID luggage tracking features.

- In March 2025, Rossignol unveiled its premium wheeled ski bag range designed for professional athletes, emphasizing lightweight reinforcement and weatherproof construction.

- In January 2025, Thule expanded its outdoor gear portfolio with a sustainable ski travel collection made from Ocean-Bound recycled plastics.