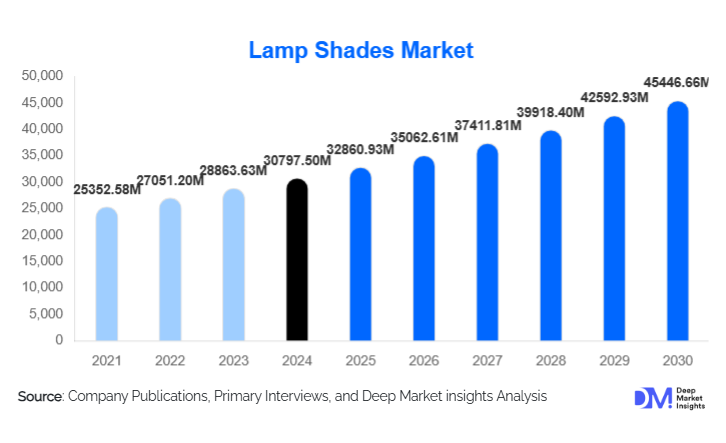

Lamp Shades Market Size

According to Deep Market Insights, the global lamp shades market size was valued at USD 30,797.50 million in 2024 and is projected to grow from USD 32,860.93 million in 2025 to reach USD 45,446.66 million by 2030, expanding at a CAGR of 6.70% during the forecast period (2025–2030). This estimate represents a blended average of market measures with an applied variance of 5–10% to account for inter-report differences and normalization across methodologies. Growth is driven by rising home-decor expenditure, expansion of commercial interiors (hospitality and retail), faster adoption of sustainable materials, and rising penetration of modern distribution channels, including online and direct-to-consumer (D2C) models.

Key Market Insights

- Design-led lighting is reshaping lamp shades from functional accessories into core décor elements, increasing willingness to pay for premium, designer, and custom shades.

- Sustainability and natural-fibre adoption (rattan, bamboo, jute) are accelerating, as environmentally conscious consumers prefer eco-friendly materials and artisanal production methods.

- Commercial demand (hotels, restaurants, retail, offices) is a major revenue driver, with high per-unit spend and a requirement for customized, project-grade shades.

- Online and D2C channels are expanding reach, enabling small designers and importers to scale internationally and increasing the variety available to end consumers.

- Smart-lighting compatibility and LED adoption are creating new product specifications and premium positioning for shades that optimize LED diffusion and colour rendering.

- Asia-Pacific is the fastest-growing region, while North America remains the largest single regional market in value terms.

What are the latest trends in the lamp shades market?

Sustainability & Natural Materials

The lamp shades market is increasingly influenced by sustainable design and natural materials. Consumers and retailers are favoring shades made from bamboo, rattan, jute, recycled fabrics, and reclaimed wood. These materials are marketed on both aesthetic and environmental credentials; suppliers highlight low-carbon sourcing, biodegradability, and artisanal manufacturing. The trend benefits manufacturers in emerging markets with abundant natural-fibre supplies and skilled handicraft communities, enabling export opportunities to developed markets seeking authentic, eco-friendly décor.

Customization & Small-Batch Production

Demand for personalised décor has pushed manufacturers and retailers to offer made-to-order colours, prints, and shapes. Digital printing for fabrics, modular shade components, and online customizers (visual configurators) enable consumers to preview bespoke shades before purchase. Smaller, agile producers can profitably serve niche tastes by running small batches, while larger brands invest in flexible production lines to shorten lead times.

Smart-Lighting Compatibility

As LED retrofits and smart bulbs become ubiquitous, a prominent trend is the development of lamp shades engineered to perform with directional LEDs and tunable white light. Shades that minimize hotspots, enhance diffusion for human-centric lighting, or integrate clips/fixtures for smart modules are gaining preference in both residential and contract markets. This technical compatibility is a differentiator in the premium segment.

Omnichannel Retail & Direct-to-Consumer Growth

E-commerce growth continues to reshape distribution. Established big-box and specialty retailers retain share for mass products, but D2C brands and marketplaces are rapidly growing share for premium and customised lamp shades. Social commerce and influencer-led design trends accelerate discovery, while augmented reality (AR) room previews and improved return policies help reduce online purchase friction.

What are the key drivers in the lamp shades market?

Rising Home Décor Spend and Renovation Activity

Increasing consumer focus on home interiors, amplified by remote work and lifestyle upgrades, is a primary demand driver. Homeowners are investing more in layered lighting and accent pieces to create mood and ambience, and lamp shades are central to this trend because they directly affect light quality and aesthetic finish. Renovation cycles in mature markets and new residential furnishing in emerging markets both contribute to stable replacement and incremental demand.

Commercial Construction & Hospitality Growth

Large-scale commercial projects, particularly hotels, restaurants, branded retail stores, and office refurbishments, represent strong, concentrated demand for premium and custom lamp shades. These projects typically require project procurement, custom finishes, and bulk orders, generating higher average order values for suppliers who can meet specification and lead-time requirements.

Material & Design Innovation

Innovation in materials (sustainable fibres, composite blends) and manufacturing techniques (digital fabric printing, CNC metalwork, 3D-printed frames) enables designers to introduce novel forms and textures. These innovations widen consumer choice, justify premium pricing, and stimulate repeat purchases as trends evolve.

What are the restraints for the global market?

Increasing Competition from Integrated Lighting Solutions

Advances in lighting fixtures with integrated diffusers and minimalistic, lamp-free designs present a substitution risk to traditional shades. In some modern fixtures, the shade is built into the luminaire or replaced by engineered diffusers, reducing the need for aftermarket shades and squeezing demand in certain segments.

Price Sensitivity & Import Competition

The lamp shades market contains a significant low-cost import component. Price-sensitive mass segments face intense competition from commoditised suppliers, especially in regions where shipping and tariffs make imported, low-cost shades attractive. This puts downward pressure on pricing for commodity lines and compresses margins for mid-tier suppliers unless they differentiate by design, sustainability, or service.

What are the key opportunities in the lamp shades market?

Smart & LED-Optimised Shade Lines

Designing lamp shades specifically for LED and smart fixtures, optimizing diffusion, thermal behaviour, and aesthetic interaction with tunable light, is a significant opportunity. Brands that certify performance with LED modules or partner with smart-lighting platforms can command premium positioning and appeal to tech-forward consumers and architects specifying project lighting.

Sustainable & Artisanal Product Ranges

There is a strong opportunity in launching eco-certified ranges that combine natural fibres, low-VOC finishes, and transparent supply chains. Collaborations with local artisans and limited-edition, handcrafted lines can attract design-conscious buyers in premium retail and hospitality segments. This also supports export-oriented manufacturing hubs by adding value to raw material exports.

Project & Contract Business Expansion

Focusing on B2B channels, hotel chains, restaurant groups, retail rollouts, and office fit-outs gives manufacturers access to large orders and recurring business. Suppliers that offer specification support, quick prototyping, and reliable logistics become preferred partners for interior designers and procurement teams, unlocking higher volumes and predictable revenue streams.

Product Type Insights

The product landscape divides into wall, table, floor, pendant/chandelier, and specialty/outdoor shades. Wall lamp shades currently capture the largest single share due to widespread application in residential accent lighting and hospitality corridors, where space efficiency and ambient layering are prioritized. Table and floor shades remain important for bedside and task lighting, while pendant/chandelier shades are key in dining and commercial spaces where statement fixtures are required. Specialty outdoor and weather-resistant shades are a small but growing niche aligned with outdoor living trends and hospitality terraces.

Application Insights

Applications span residential, commercial, and institutional settings. Commercial applications (hotels, restaurants, retail, offices) account for a disproportionate share of revenue due to the need for custom designs and bulk procurement. Residential applications drive large unit volumes, particularly in refurbishment markets, with growing interest in mid-range to premium shades for living areas, bedrooms, and dining spaces. Institutional demand (healthcare, educational facilities) tends to prioritize functional, standardized shades that meet safety and hygiene standards.

Distribution Channel Insights

Distribution is split among online retail, specialist lighting/home décor stores, big-box/home improvement retailers, and direct/project procurement. Online channels are the fastest-growing segment because of broader selection, customization tools, and improved logistics. Specialist stores remain important for high-touch, curated purchases and designer-led collections. Big-box retailers dominate mass, price-sensitive segments. Contract and project channels are critical for commercial scale and recurring orders.

Consumer Type Insights

Consumer segments differ by purchase motive: design-seeking buyers demand premium, bespoke shades; value buyers purchase mass, functional shades; and sustainability-minded customers prioritize eco materials and local craftsmanship. Interior designers and architects are key influencers in the commercial and upper-end residential segments. Millennial and Gen-Z buyers often choose digitally native D2C brands and value social proof, sustainability claims, and AR previews.

Age Group Insights

Buyers aged 30–50 represent the largest spend cohort, combining purchasing power with active home improvement and design interest. Younger buyers (18–30) drive demand for affordable, trend-driven designs and fast replacement cycles, while the 50+ group is a steady source of premium purchases, particularly for comfort and curated home environments.

| By Product Type | By Material Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest single regional market in value terms, representing roughly 30–35% of global demand in 2024. High disposable incomes, strong renovation and replacement cycles, and a large premium segment (designer and custom shades) explain the region's share. The U.S. leads market value with significant commercial procurement in hospitality and retail remodels.

Europe

Europe accounts for approximately 22–26% of the global market in 2024. Demand is shaped by strong design traditions, sustainability preferences, and steady refurbishment activity. Countries such as Germany, the UK, France, and Italy are major value centres due to high per-unit spend on premium and artisanal shades.

Asia-Pacific

Asia-Pacific is the fastest-growing region (estimated CAGR 8–9% through 2030) and held about 25–30% of global value in 2024. Rapid urbanisation in China and India, expanding hospitality projects across Southeast Asia, and a growing middle class purchasing curated home décor are key growth drivers. The region is also a major manufacturing and export hub for lamp shades.

Latin America

Latin America holds roughly 8–10% of the global market. Growth is supported by urban residential furnishing and increasing commercial fit-outs, led by Brazil and Mexico. The region is a developing export market for both domestic production and imported design products from Asia and Europe.

Middle East & Africa

MEA accounts for around 5–7% of global demand, with the Gulf Cooperation Council (GCC) countries and South Africa driving premium hospitality and high-end residential demand. Large hospitality and tourism projects in the Gulf region contribute to demand for customised, luxury lampshade solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|