Knitwear Market Size

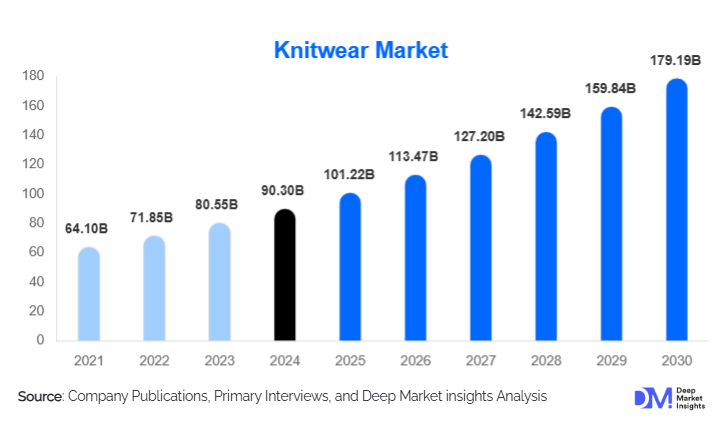

According to Deep Market Insights, the global knitware market size was valued at USD 90.3 billion in 2024 and is projected to grow from USD 101.22 billion in 2025 to reach USD 179.19 billion by 2030, expanding at a CAGR of 12.1% during the forecast period (2025–2030). Growth is driven by the rising global shift toward comfort-oriented apparel, expanding athleisure adoption, and increasing demand for sustainable, responsibly sourced knitwear across regions. Advancements in 3D knitting, seamless production technologies, and the proliferation of digital retail channels are further accelerating global consumption, enabling both premium and mass-market brands to scale their knitwear portfolios.

Key Market Insights

- Sustainable knitwear demand is surging globally, supported by consumer preference for natural fibres, recycled yarns, and low-waste manufacturing systems.

- Natural fibre knitwear continues to dominate due to high adoption of premium cotton, wool, and cashmere, accounting for nearly half of 2024’s total market revenue.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, rapid e-commerce penetration, and strong manufacturing output.

- Digital channels and D2C knitwear brands are reshaping sales dynamics, especially in the U.S., U.K., China, and India.

- Athleisure and everyday casual knit garments remain the highest-demand categories, driven by lifestyle changes and a hybrid work culture.

- Technologies such as 3D knitting, automated yarn selection, and AI-based design optimisation are transforming production efficiency and speed.

Latest Market Trends

Rise of Sustainable and Circular Knitwear

Manufacturers and fashion brands are rapidly integrating sustainability into their knitwear portfolios. Organic cotton, ethically sourced wool, plant-based fibres, and recycled yarn blends are becoming mainstream. Circularity initiatives, such as repair programs, textile recycling, and buy-back schemes, are gaining traction among high-value consumers. Brands increasingly collaborate with fibre innovation companies to integrate low-impact dyes, biodegradable yarns, and water-efficient production methods. Regulatory pressure in Europe and North America is further catalyzing the adoption of eco-compliant knitwear, positioning sustainability as both a consumer expectation and a competitive differentiator.

Technology-Led Transformation of Knitwear Manufacturing

Advanced manufacturing technologies are revolutionizing the knitwear industry. 3D and seamless knitting eliminate fabric waste and reduce assembly times, enabling micro-collection production for fast fashion and premium brands alike. AI-driven design platforms allow faster prototyping, trend prediction, and personalized sizing. Robotics-led knitting machinery in China, Japan, and Germany is reducing labour intensity while improving garment consistency. Digital yarn printing, automated colour matching, and computerized knitting instructions are helping manufacturers meet the high-speed, low-inventory requirements of the modern apparel ecosystem.

Knitwear Market Drivers

Growing Shift Toward Comfort and Casualwear

Consumers are increasingly prioritizing comfort over traditional fashion constructs, driven by hybrid work models, lifestyle shifts, and the rising popularity of athleisure. Knitwear garments, known for stretch, breathability, and versatility, have transitioned from seasonal clothing to year-round wardrobe essentials. This cultural shift is fuelling strong demand for knit tops, hoodies, joggers, and knit dresses, particularly among younger demographics seeking functional yet stylish apparel.

Rapid Expansion of E-commerce and D2C Brands

The digital retail boom is reshaping knitwear consumption. Online-first and D2C labels have gained massive momentum, leveraging influencer-led marketing, personalized fit tools, and ultra-fast design cycles. Global marketplaces also enable small and mid-sized manufacturers to reach international buyers without traditional retail intermediaries. E-commerce adoption is particularly strong in Asia-Pacific, Europe, and North America, enabling the knitwear sector to scale rapidly with lower overheads and better customer targeting.

Advances in Knitting Technology and Fibre Innovation

Technological breakthroughs such as automated knitting machines, smart yarns, functional fibres, and seamless construction have significantly boosted productivity and product innovation. These developments allow brands to introduce performance-focused knitwear with moisture-wicking, temperature-regulating, or compression-based properties. This trend supports growth in athleisure, sportswear, and premium lifestyle segments, where innovation is a key differentiator.

Market Restraints

Raw Material Price Volatility

Knitwear production depends heavily on cotton, wool, synthetic fibres, and specialty yarns. Fluctuations in cotton prices, wool shortages, and rising energy costs disrupt manufacturing economics. Raw material volatility directly impacts pricing strategies, reducing profit margins for both producers and global fashion brands, especially those operating in competitive mass-market categories.

Inventory and Seasonal Risks

Knitwear’s exposure to seasonal trends poses inventory challenges. Rapidly changing fashion cycles, coupled with unpredictable weather patterns, can lead to excess stock or missed sales opportunities. Smaller businesses face heightened risk due to limited working capital and slower supply-chain responsiveness, constraining their ability to scale sustainably.

Knitwear Market Opportunities

Sustainable Fibre Innovation and Eco-Friendly Production

The rapid consumer shift toward eco-friendly fashion presents a significant opportunity. Manufacturers investing in organic cotton, recycled polyester blends, low-impact dyes, and biodegradable yarns can capture premium customer segments. Eco-labelling, carbon footprint transparency, and certifications like GOTS or Responsible Wool Standard (RWS) enhance brand credibility, encouraging adoption among environmentally conscious global consumers.

Digital-First Knitwear Brands and Global E-commerce Growth

The proliferation of social commerce and D2C models is creating enormous market entry opportunities. Young brands can launch digitally, bypassing retail infrastructure and using data-driven design tools to forecast trends. AI-enabled fit prediction, virtual try-ons, and digital personalization allow knitwear brands to differentiate themselves and improve conversion rates. Emerging markets such as India, China, and Southeast Asia offer strong potential due to rapid online apparel adoption.

Functional and Smart Knitwear Expansion

The integration of performance-focused features and smart textile technologies represents a high-growth opportunity. Compression-fit knits, temperature-regulating fibres, anti-odour yarns, and apparel embedded with biometric sensors appeal to fitness, healthcare, and lifestyle segments. These advanced applications enable manufacturers to access high-margin verticals that extend far beyond traditional fashion knitwear.

Product Type Insights

Knit T-shirts and shirts dominate the market, accounting for nearly 35% of the 2024 revenue due to their universal appeal, affordability, and year-round demand. Sweaters and jackets form the next major category, driven by rising premiumization in wool and cashmere products. Sweatshirts and hoodies continue to benefit from the global surge in athleisure, while knit leggings and dresses remain strong performers among women’s apparel. Knit accessories such as scarves, caps, and gloves add supplementary volume, particularly in colder regions.

Application Insights

Outerwear holds the leading share at approximately 40% of the 2024 global knitwear revenue. Consumers increasingly prefer lightweight knit jackets, sweaters, and transitional layers that function across multiple seasons. Innerwear knits maintain consistent demand, especially thermal garments in colder geographies. Sportswear and athleisure knitwear are the fastest-growing applications, supported by compression technology, performance fibres, and lifestyle-driven consumption patterns. Speciality knitwear, including technical and protective applications, is emerging as an attractive niche fueled by innovation.

Distribution Channel Insights

Brick-and-mortar channels dominate with around 60% of the global 2024 share due to consumer preference for tactile evaluation of knit garments. However, online platforms are growing at the fastest rate, driven by improved size guides, virtual try-ons, and influencer-driven marketing. D2C knitwear brands benefit from high-margin digital sales, while multi-brand e-commerce platforms expand cross-border retail access. Hybrid models integrating online ordering with in-store pickup are becoming common in Europe and North America.

Consumer Group Insights

Women account for nearly 45% of global knitwear demand, making them the largest consumer group, driven by diverse apparel categories and rapid trend cycles. Men’s knitwear represents a stable and growing segment, especially in premium basics and athleisure. Kidswear is expanding due to rising birth rates in emerging markets and increasing purchasing power among millennial parents.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents roughly 30% of global knitwear revenue in 2024, with strong demand for premium basics, athleisure, and sustainable cotton knitwear. The U.S. market is highly responsive to digital retail and fashion influencers, making it a prime region for D2C knitwear growth.

Europe

Europe accounts for nearly 25% of 2024 global demand, driven by fashion-conscious consumers in the U.K., Germany, France, and Italy. Strong preference for natural fibres, luxury wool blends, and sustainable sourcing accelerates market expansion. Europe remains a major importer of high-end knitwear and a leading adopter of eco-labels.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by China, India, Japan, and South Korea. Rising income levels, expanding urbanisation, and strong textile manufacturing ecosystems support both consumption and export output. China remains the manufacturing powerhouse, while India is rapidly scaling production and domestic demand.

Latin America

Latin America is emerging as a niche growth region. Brazil and Mexico lead demand due to rising urban middle-class populations and increasing fashion consciousness. Knitted casualwear and lightweight transitional knit garments are particularly popular.

Middle East & Africa

The region shows growing demand for premium casual knitwear, driven by rising disposable incomes in the GCC. Africa’s textile hubs, particularly in Egypt and Ethiopia, are receiving investment for export-oriented knitwear industries. Knit outerwear and modest fashion knitwear trends are shaping demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|