Kitchen Garbage Disposals Market Size

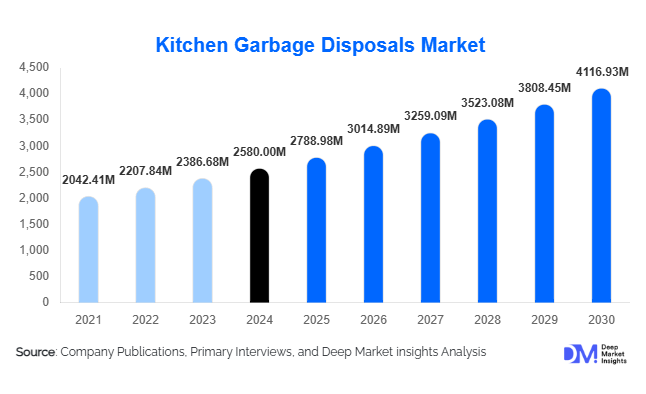

According to Deep Market Insights, the global kitchen garbage disposals market size was valued at USD 2,580 million in 2024 and is projected to grow from USD 2,788.98 million in 2025 to reach USD 4,116.93 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for modern kitchen appliances, increasing urbanization, growing awareness of sanitation, and the adoption of eco-friendly waste management solutions across residential and commercial kitchens.

Key Market Insights

- Residential kitchens dominate the market, driven by urban households seeking convenient waste disposal solutions and energy-efficient devices.

- Commercial and institutional kitchens are emerging as high-growth segments, fueled by hygiene regulations, operational efficiency, and regulatory compliance for organic waste management.

- North America holds the largest share, led by the U.S. and Canada, due to high disposable income, established infrastructure, and strong adoption of smart kitchen technologies.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, rising disposable income, and increasing awareness of modern kitchen appliances.

- Technological integration, such as IoT-enabled disposals, noise reduction systems, and energy-efficient motors, is reshaping consumer adoption and product differentiation.

- Sustainability trends, including eco-friendly disposables and municipal support for waste management, are increasing product relevance in both developed and emerging markets.

Latest Market Trends

Technological Advancements in Kitchen Garbage Disposals

Emerging technologies in the kitchen garbage disposals market are enhancing efficiency, convenience, and safety. Continuous feed and batch feed units now incorporate noise reduction systems, energy-efficient motors, and smart connectivity features that allow integration with home automation systems. These innovations appeal to tech-savvy consumers seeking both performance and sustainability. Additionally, compact disposals are being designed for urban apartments and small kitchens, supporting water conservation and low-energy usage, which aligns with global sustainability initiatives.

Growing Adoption of Eco-Friendly Waste Management

Consumers and municipalities are increasingly adopting kitchen garbage disposals as a method to reduce food waste and manage organic waste efficiently. Disposals that support composting or minimize environmental impact are gaining traction in both residential and commercial segments. Manufacturers are collaborating with local authorities to integrate disposals into waste management programs, driving market growth through regulatory compliance and environmental awareness campaigns.

Kitchen Garbage Disposals Market Drivers

Urbanization and Modern Lifestyle Adoption

Rapid urbanization and the rise of high-rise apartments are driving demand for compact and efficient kitchen garbage disposals. Modern households increasingly prioritize convenience, hygiene, and smart kitchen solutions, making disposals an essential appliance. Rising construction of new residential complexes in emerging markets such as India and China also supports the residential segment growth.

Regulatory Support for Waste Management

Governments worldwide are promoting eco-friendly organic waste management through subsidies, regulatory mandates, and public awareness campaigns. Such initiatives encourage the adoption of kitchen garbage disposals, particularly in urban centers and commercial kitchens, creating a favorable market environment.

Technological Innovation and Product Differentiation

Smart kitchen integration, energy efficiency, and noise reduction are increasing consumer preference for high-performance disposals. Continuous feed and IoT-enabled units, coupled with easy maintenance, appeal to both residential and commercial users, supporting market expansion. Manufacturers are also focusing on ergonomics, durability, and design aesthetics to attract premium consumers.

Market Restraints

High Initial Purchase Costs

The upfront cost of high-quality kitchen garbage disposals, particularly continuous feed and smart models, remains a restraint. Price-sensitive consumers in emerging markets often opt for low-cost alternatives or manual waste disposal methods, limiting broader adoption.

Maintenance and Installation Challenges

Complex installation requirements, plumbing compatibility, and periodic maintenance are potential barriers. Consumers may be hesitant to adopt disposals without professional support, especially in regions with limited service infrastructure, potentially slowing market growth.

Kitchen Garbage Disposals Market Opportunities

Rising Demand in Emerging Economies

Urbanization and disposable income growth in countries like India, China, and Southeast Asia are driving residential demand. Affordable, compact, and energy-efficient units can tap into apartment complexes and urban households, presenting significant growth opportunities.

Integration with Smart Home Technologies

IoT-enabled disposals integrated with smart home systems, voice control, and automated monitoring attract tech-savvy consumers. Manufacturers can leverage smart kitchens to offer subscription-based maintenance services and energy consumption insights, creating recurring revenue streams.

Sustainable Waste Management Solutions

Products that facilitate composting or eco-friendly waste reduction are increasingly favored by municipalities and commercial kitchens. Partnerships with governments and smart city projects provide manufacturers with opportunities to position disposables as critical sustainability tools.

Product Type Insights

Continuous feed disposals dominate the market, holding around 55% of the 2024 market share. Their ease of use, widespread availability, and suitability for residential kitchens contribute to their leading position. Batch feed disposals are gaining traction in premium households and commercial setups due to safety features and regulatory compliance. Compact and small disposals are emerging in urban apartment markets, growing steadily with the rise in space-constrained living environments.

Power Rating Insights

1–2 HP units lead globally, representing approximately 50% of the market. This range offers an optimal balance of performance, noise levels, and energy efficiency, making it suitable for both residential and small commercial applications. High-power units (>2 HP) are primarily used in commercial kitchens with heavy food waste volumes, whereas

Application Insights

Residential kitchens account for more than 60% of the market, driven by urban households adopting modern appliances. Commercial kitchens in hotels, restaurants, and cafeterias represent the next largest segment, showing double-digit growth due to regulatory compliance and efficiency requirements. Institutional applications, such as schools and hospitals, are gradually adopting disposables to improve hygiene and food waste management.

Distribution Channel Insights

Offline retail remains the primary channel, accounting for nearly 55% of sales, with specialty appliance stores and large retail chains leading. Online retail and e-commerce are growing rapidly due to convenience, transparent pricing, and home delivery, representing nearly 30% of market sales. Direct B2B sales are significant in commercial and institutional applications, providing customized solutions for bulk installations.

| By Product Type | By Power Rating | By Installation Type | By Application / End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share (35% of the 2024 market) due to high disposable income, smart home adoption, and mature distribution networks. The U.S. leads demand, supported by government incentives for eco-friendly appliances and rising smart kitchen trends.

Europe

Europe accounts for 28% of the 2024 market, driven by Germany, the UK, and France. Eco-conscious consumers, regulatory mandates for waste management, and high adoption of premium disposables support growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in India, China, Japan, and Australia. Rapid urbanization, rising disposable income, and increasing awareness of hygiene and sanitation practices are driving adoption.

Latin America

Brazil, Argentina, and Mexico are leading adoption, particularly in urban residential kitchens. Outbound knowledge transfer from North America supports premium product awareness, albeit at smaller volumes.

Middle East & Africa

Urban areas in the UAE, Saudi Arabia, South Africa, and Egypt are showing rising demand for premium disposables, driven by modern kitchen development and hygiene-conscious consumers. Commercial and luxury residential adoption is gradually increasing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Kitchen Garbage Disposals Market

- InSinkErator

- Whirlpool

- GE Appliances

- Moen

- KitchenAid

- Franklin Electric

- Emerson Electric

- Faber

- Broan-NuTone

- Waste King

- Blendtec

- Bosch

- Elba

- Hafele

- Elica