Kayak Accessories Market Size

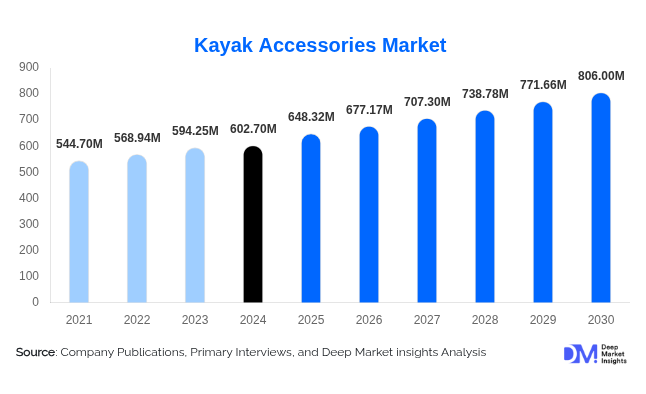

According to Deep Market Insights, the global Kayak Accessories Market size was valued at USD 620.7 million in 2024 and is projected to grow from USD 648.32 million in 2025 to reach USD 806.00 million by 2030, expanding at a CAGR of 4.45% during the forecast period (2025–2030). Market expansion is driven by increasing participation in kayak fishing, rising fleet procurement by rental and tour operators, ongoing product premiumization (lightweight paddles, modular mounting systems), and stronger direct-to-consumer e-commerce adoption across major markets.

Key Market Insights

- Kayak fishing dominates accessory spend fishing-specific mounts, rod holders, and electronics commanding higher ASPs and driving frequent aftermarket purchases.

- Rental & tour operators represent a growing B2B demand pool, purchasing rugged seats, PFDs, and transport solutions in bulk and thereby stabilizing seasonality.

- North America leads the market by absolute value, driven by the large U.S. kayak-fishing community and strong retail and online distribution channels.

- Asia-Pacific is the fastest-growing region in percentage terms, fueled by rising domestic tourism, expanding middle classes, and localization of production.

- Modular mounting systems and compact marine electronics are reshaping purchase patterns. Consumers prefer modular rails that enable multiple accessory attachments.

- Sustainability and eco-materials are becoming purchase filters for environmentally conscious buyers, especially in Europe and APAC premium segments.

Latest Market Trends

Fishing Accessories and Electronics Premiumization

The kayak fishing segment continues to pull overall accessory revenue upward. Demand is strongest for rod holders, pedal-drive compatible mounts, and compact fish-finders/GPS units tailored for small-craft installation. Manufacturers are bundling electronics with mounting kits and offering retrofit solutions for existing kayaks, a trend that increases aftermarket attachment sales and boosts average selling prices.

Modular Track Systems Becoming De Facto Standard

Universal track and rail systems that accept a wide range of accessories (cup holders, cameras, rod holders, fish-finders) are rapidly gaining adoption. These modular systems encourage accessory ecosystems. Once a customer buys into a track standard, they are more likely to purchase additional attachments from the same or compatible manufacturers.

Fleet & Rental Procurement Stabilizing Seasonal Demand

Rental companies, tour operators, and municipal rental programs are purchasing accessories at scale, prioritizing durability, ease-of-service, and replacement-part availability. Fleet procurement cushions manufacturers against retail seasonality and provides repeat-purchase revenue through servicing and parts.

Sustainability and Supply-Chain Localization

Brands are experimenting with recycled resins, reduced-plastic packaging, and nearshoring production to APAC hubs to shorten lead times. This alignment with sustainability preferences and logistics resilience is helping some brands win retail placement and government procurement contracts.

Kayak Accessories Market Drivers

Rapid Growth of Kayak Fishing

Kayak fishing is the single largest driver for accessory revenues because it generates concentrated demand for specialized mounts, electronics, and storage systems. Anglers purchase higher-priced, durable accessories and upgrade electronics more frequently than general recreational paddlers, increasing overall accessory spend.

Expansion of Rental & Tourism Fleets

Municipal programs, tour operators, and resorts are buying rugged, serviceable accessories in volume to support rental fleets. Fleet purchases are less price-sensitive around durability and serviceability, which raises average transaction values and encourages suppliers to provide B2B service contracts and volume pricing.

Direct-to-Consumer Sales and Digital Marketing

D2C channels and social content (how-to installs, fishing demos) accelerate product adoption and allow manufacturers to retain higher margins. Online marketplaces and brand stores simplify SKU proliferation and rapid iteration, enabling targeted launches of premium or niche accessories.

Market Restraints

Seasonality and Weather Sensitivity

Accessory sales remain seasonal in many markets, concentrated in warm-weather months. This seasonality pressures inventory planning, cash flow, and introduces revenue volatility for smaller manufacturers.

Fragmented Market Definitions and Data Uncertainty

Inconsistent definitions across industry reports (kayak accessories vs. kayak-fishing accessories vs. broader paddle-sports equipment) complicate benchmarking and strategic planning. This fragmentation increases risk for entrants and makes precise TAM estimates difficult without bespoke research.

Kayak Accessories Market Opportunities

Deepening Product Specialization for Kayak Fishing

There is clear upside for companies that develop purpose-built fishing mounts, integrated electronics bundles, and pedal-drive compatibility kits. Co-branding with kayak-fishing influencers and OEM tie-ups for factory-fitted mounts can accelerate adoption and justify premium pricing.

Fleet Services and B2B Solutions

Offering fleet-focused packages, durable accessories, predictable spare-parts supply, scheduled servicing, and multi-year warranties allows suppliers to secure steady, high-value contracts with rental operators, municipalities, and tour companies. This transforms seasonal retail revenue into recurring B2B revenue streams.

Technology Integration & D2C Growth

Integrating low-power GPS, Bluetooth fish-finder linkage, and modular electronics with robust mounting systems creates high-margin product lines. Coupling R&D with digital D2C distribution and strong content marketing (installation guides, how-to videos) shortens sales cycles and improves lifetime customer value.

Product Type Insights

Within the accessory mix, fishing accessories (rod holders, mounts, fish-finder brackets) represent the largest dollar share (20% of the 2024 market) because they command higher ASPs and frequent aftermarket purchases. Life jackets and safety gear are also major contributors (15%), driven by regulation and fleet purchases. Premium composite paddles and ergonomic seating systems attract higher margins and are preferred by touring and expedition segments. Commodity items such as soft roof pads and basic dry bags remain high-volume, low-margin categories that serve entry-level buyers.

Application Insights

Key applications are kayak fishing, recreational day paddling, touring/expedition use, whitewater, and sea/expedition kayaking. Kayak fishing is the fastest-growing application due to elevated aftermarket purchases and electronics penetration. Touring/expedition users favor seating systems, storage upgrades, and premium paddles, while rental operators prioritize safety gear and transport solutions. Emerging niche applications include photography-specific mounts and small-craft scientific sampling kits for environmental research.

Distribution Channel Insights

Specialty outdoor retailers and D2C e-commerce are the dominant channels. Specialty shops provide hands-on fitting and high-touch sales for premium accessories, while online channels enable broad SKU offering and rapid customer feedback. OEM partnerships (factory-fit accessory bundles) and B2B fleet procurement (rental companies, tour operators) are important for scale. Marketplaces and online retailers accelerate reach but compress margins compared with direct brand sales.

End-User Insights

Individual consumers are the largest end-user group by unit volume, but rental/tourism operators are growing fastest in dollar terms due to bulk purchases. Professional anglers and competitive paddlers are high-value users with a willingness to invest in premium gear. Institutional buyers (parks departments, recreation centers) purchase PFDs, seats, and transport systems for fleet programs. New end-use verticals include eco-research outfits and small boat survey firms purchasing specialized mounting and electronics kits.

Age Group Insights

Primary buyer ages are 31–50 years, combining higher disposable income with an appetite for performance and experiential use. Younger buyers (18–30) drive demand for budget-friendly accessories and social-media–oriented products (compact cameras, mounts). Older buyers (51+) are a valuable segment for premium comfort products (ergonomic seats, inflatable PFDs) and guided/fleet experiences where convenience and safety are priorities.

| By Product Type | By Kayak Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market (38% of global, USD 235.9M in 2024), led by the U.S. Strong participation in kayak fishing, broad retail networks, and widespread rental operations support accessory demand. High ASPs for electronics, composite paddles, and modular mounting systems sustain healthy margins. Fleet purchases and municipal programs further amplify B2B volumes.

Europe

Europe accounts for 25% of the market ( USD 155.2M). Demand centers on touring, sea-kayaking, and stringent safety standards that drive PFD and safety-accessory sales. Major markets include the UK, Germany, and France. European consumers show a strong preference for sustainable materials and certified safety gear.

Asia-Pacific (APAC)

APAC represents 22% of the global market ( USD 136.6M) and is the fastest-growing region in percentage terms. Growth drivers include rising domestic tourism (China, Southeast Asia), increasing outdoor participation, and manufacturing localization. Australia and Japan are mature, high-ASP markets, while China and Southeast Asia are growth engines from a smaller base.

Latin America

LATAM (8%, USD 49.7M) is an emerging market with growing interest in kayak fishing and adventure tourism, particularly in Brazil and Mexico. Per-capita spend is lower than in mature markets but is expected to rise with improved distribution and tailored, cost-sensitive product offerings.

Middle East & Africa

These regions (7%, USD 43.4M) show niche demand driven by resort procurement, marinas, and luxury tourism. Africa also represents a growing intra-regional market for expedition and tour operators. Growth is linked to tourism infrastructure investments and resort fleet purchases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Kayak Accessories Market

- YakAttack

- YakGear

- Railblaza

- NRS (Northwest River Supplies)

- Scotty

- Hobie

- Thule

- Yakima

- Malone

- Wilderness Systems

- Garmin (marine electronics)

- Sea to Summit

- Pelican (hard goods & accessories)

- Lifetime Products

- Jackson Kayak

Recent Developments

- Manufacturers continue to release compact, low-power fish-finders and integrated mounting kits designed specifically for kayaks, improving adoption among anglers.

- Several accessory brands have expanded direct fleet-service offerings and warranty programs to capture B2B rental and tour-operator customers.

- Producers are increasingly piloting recycled-resin components and reduced packaging to align with growing sustainability preferences in key markets.