K-12 Furniture Market Size

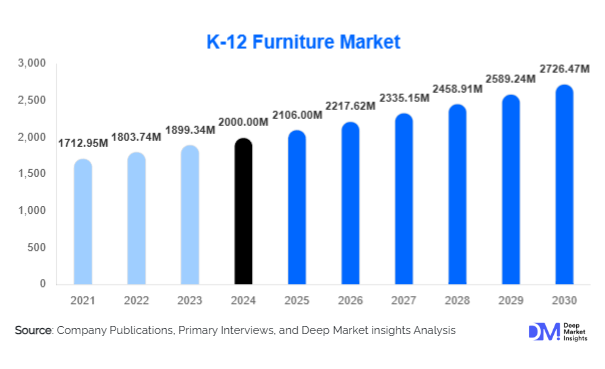

According to Deep Market Insights, the global K-12 furniture market size was valued at USD 2,000 million in 2024 and is projected to grow from USD 2,106 million in 2025 to reach USD 2,726.47 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The market growth is primarily driven by the modernization of educational infrastructure, the rising adoption of ergonomic and sustainable furniture, and the integration of flexible learning environments in K-12 institutions worldwide.

Key Market Insights

- Increasing adoption of ergonomic and technology-integrated furniture in classrooms is enhancing student comfort, learning outcomes, and institutional efficiency.

- The growth of private and international schools globally is driving demand for high-quality furniture solutions that cater to modern teaching methodologies.

- Rising focus on sustainability is leading manufacturers to adopt eco-friendly materials and production methods, aligning with global environmental initiatives.

- North America dominates the K-12 furniture market, with the U.S. accounting for the largest share due to high education budgets and infrastructure modernization programs.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by increasing school enrollments and public investment in educational facilities.

- Technological integration, including adjustable desks, modular furniture, and digital classroom compatibility, is reshaping furniture design and purchasing decisions.

What are the latest trends in the K-12 furniture market?

Modular and Multi-Functional Furniture Gaining Traction

K-12 institutions are increasingly adopting modular furniture that can be reconfigured to support collaborative, hybrid, and digital learning. Movable desks, adjustable chairs, and multi-use storage units allow classrooms to quickly adapt to changing instructional methods. Schools are prioritizing furniture that supports technology integration, including built-in charging stations, cable management, and interactive desk surfaces. This trend reflects a shift from traditional static classroom layouts to dynamic learning environments that enhance engagement and participation.

Sustainability and Eco-Friendly Materials

Environmental consciousness is influencing procurement decisions in the K-12 segment. Manufacturers are utilizing recycled plastics, FSC-certified wood, and low-emission coatings to produce eco-friendly furniture. Green certifications and compliance with international standards are becoming significant factors for schools and government tenders. This trend is particularly prominent in North America and Europe, where sustainability criteria are often mandatory in public procurement, creating opportunities for manufacturers to differentiate their offerings and capture premium pricing.

What are the key drivers in the K-12 furniture market?

Government Investment in Educational Infrastructure

Governments worldwide are increasing budgets for school infrastructure upgrades, including furniture procurement. Programs focused on modernizing public schools, improving classroom ergonomics, and enhancing digital learning environments are driving market demand. For example, initiatives in the U.S., China, and India aim to provide state-of-the-art classroom facilities, which directly boost the K-12 furniture market.

Rising Private School Enrollment

The global increase in private school enrollments is fueling demand for premium, customizable furniture solutions. Private institutions often seek ergonomic, aesthetically appealing, and durable furniture to enhance student experience and institutional branding. This segment is contributing significantly to market growth, particularly in regions like APAC and the Middle East.

Focus on Student Health and Ergonomics

Research highlighting the impact of ergonomics on student posture, concentration, and learning outcomes has led to the widespread adoption of adjustable and ergonomic furniture. Furniture designs now emphasize comfort, movement, and adaptability, making this a major driver in both public and private educational sectors.

What are the restraints for the global market?

High Cost of Premium Furniture Solutions

The adoption of high-quality ergonomic or technology-integrated furniture can be cost-prohibitive, especially for public schools in developing regions. Limited budgets restrict procurement, often leading to reliance on traditional, low-cost furniture solutions.

Supply Chain and Raw Material Challenges

Fluctuating raw material prices, especially for wood, metals, and plastics, can impact production costs and lead times. Manufacturers must navigate global supply chain disruptions, which may delay deliveries and affect market growth.

What are the key opportunities in the K-12 furniture market?

Smart and Digital Furniture Integration

The integration of technology into furniture, such as desks with embedded charging ports, interactive whiteboards, and modular smart boards, presents an opportunity for differentiation. Schools seeking to implement digital learning tools are driving demand for such furniture solutions, particularly in developed regions like North America and Europe.

Expansion in Emerging Markets

Emerging economies in the Asia-Pacific and Latin America are witnessing rapid school construction and modernization. The rising youth population and government spending on education infrastructure create a strong growth opportunity for furniture manufacturers. Local manufacturing and assembly in these regions can reduce costs and improve market penetration.

Public-Private Partnerships and ESG Initiatives

Collaboration between governments and private manufacturers to promote sustainable furniture solutions is expanding. Manufacturers participating in ESG-aligned projects, including eco-friendly production and community engagement, can capture higher-value contracts and strengthen brand positioning in the market.

Product Type Insights

Classroom furniture dominates the K-12 market, accounting for approximately 45% of the 2024 market share. Desks and chairs remain the most widely purchased products due to their universal application in all school types. The trend toward modularity, ergonomic design, and adaptability has driven sustained demand for this segment globally, with both public and private institutions increasingly replacing traditional furniture with multi-functional solutions.

Material Insights

Wood-based furniture leads the material segment, holding around 38% of the 2024 market share. Its durability, aesthetic appeal, and sustainability credentials make it preferred in developed regions. MDF and plywood are also widely used in cost-sensitive markets, balancing quality with affordability.

End-Use Insights

Public K-12 schools represent the largest end-use segment, accounting for roughly 52% of global demand in 2024. However, private schools and international institutions are growing faster, driven by demand for premium, ergonomic, and tech-integrated furniture. Export-driven demand from emerging markets is also rising, providing opportunities for global manufacturers to expand their footprint.

| By Product | By End-user | By Procurement | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (30% in 2024), with the U.S. leading demand due to high government spending on school infrastructure and ergonomic upgrades. Canada also shows consistent demand for eco-friendly and modular furniture.

Europe

Europe accounts for about 25% of the market, with Germany, the U.K., and France leading due to modernization initiatives and emphasis on sustainability. The region is seeing increasing adoption of technology-integrated furniture in classrooms.

Asia-Pacific

APAC is the fastest-growing region (8.1% CAGR), driven by China and India, where new school constructions and rising student enrollments boost furniture demand. Governments are investing heavily in modern K-12 infrastructure, creating significant opportunities for local and international manufacturers.

Latin America

Brazil and Mexico are key contributors, with growth fueled by urban school expansions and modernization programs. Demand is emerging in private institutions seeking ergonomic and digital-ready furniture.

Middle East & Africa

UAE, Saudi Arabia, and South Africa are the main markets, with demand driven by private schools, government school modernization projects, and rising awareness of ergonomic furniture. The region shows moderate growth potential for high-end, sustainable furniture solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the K-12 Furniture Market

- Steelcase Inc.

- Herman Miller Inc.

- KI Furniture

- HON Company

- Virco Inc.

- Smith System

- School Specialty

- ECR4Kids

- Global Furniture Group

- Gopak

- Virco

- Interstuhl

- Fisher & Paykel

- Izzy + Liv

- Horeca Select

Recent Developments

- In 2024, Steelcase launched a line of modular, adjustable classroom furniture designed for hybrid learning environments in the U.S.

- In 2023, Herman Miller expanded its eco-friendly classroom furniture portfolio in Europe, utilizing recycled wood and low-emission finishes.

- In 2025, KI Furniture introduced smart desks with integrated digital interfaces, targeting private and international schools in the Asia-Pacific.