Jewelry Cleaning Machine Market Size

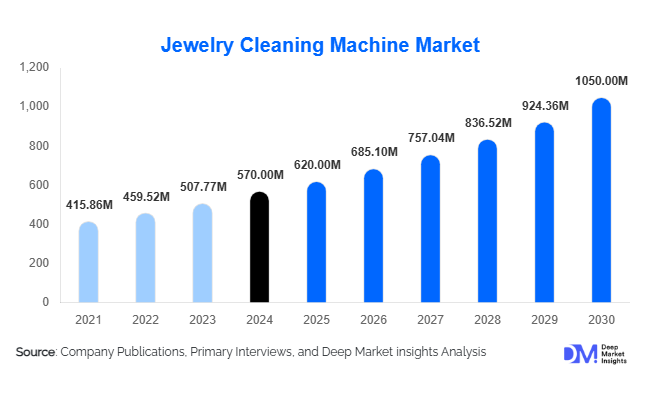

According to Deep Market Insights, the global jewelry cleaning machine market size was valued at USD 570 million in 2024 and is projected to grow from USD 620 million in 2025 to reach USD 1,050 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by rising jewelry ownership globally, the increasing shift toward mechanized cleaning over manual methods, and technological innovations such as smart ultrasonic and hybrid cleaning systems that enhance efficiency and safety.

Key Market Insights

- Ultrasonic cleaning machines dominate the market, accounting for more than half of global revenues in 2024, owing to their ability to clean intricate designs without damage.

- Jewelry retail stores and showrooms lead end-use demand, contributing over one-third of the global market share in 2024.

- Asia-Pacific leads the global market, with nearly 38% share in 2024, driven by large jewelry production hubs in India and China.

- North America and Europe remain mature markets, with steady replacement demand and upgrades toward premium and eco-friendly machines.

- Household/consumer adoption is the fastest-growing segment, reflecting rising disposable incomes and demand for affordable, compact machines sold online.

- Sustainability and eco-conscious designs are reshaping innovation, with closed-loop filtration and green-certified machines gaining traction.

Latest Market Trends

Smart & Connected Cleaning Solutions

Jewelry cleaning machines are increasingly integrating IoT features, app controls, and predictive maintenance capabilities. Retailers and workshops prefer machines that log cleaning cycles, auto-adjust frequencies for different gemstones, and provide service alerts. Consumer-grade machines now feature mobile apps for simplified operation, timers, and eco-modes. This technological shift is also creating opportunities for service-based revenue models, such as subscription cleaning agents and software updates.

Eco-Friendly & Sustainable Cleaning

Growing environmental regulations and consumer awareness are driving the adoption of eco-friendly jewelry cleaning machines. Manufacturers are focusing on low-energy designs, water-saving ultrasonic tanks, and biodegradable cleaning agents. Machines with waste recovery or closed-loop solvent systems are gaining acceptance in Europe and North America, where environmental standards are stringent. Green-certified products command premium pricing and appeal to environmentally conscious jewelry retailers and consumers.

Jewelry Cleaning Machine Market Drivers

Rising Jewelry Ownership and High-Value Purchases

Global demand for gold, diamond, and gemstone jewelry is expanding, particularly in emerging markets. These high-value items require safe cleaning methods to maintain luster and integrity, boosting the adoption of mechanized cleaning machines among both retailers and households.

Shift from Manual to Mechanized Cleaning

Traditional cleaning methods, such as cloth polishing or chemical dips, often risk damaging delicate jewelry. Ultrasonic and steam machines offer precise, safe, and repeatable results, making them increasingly preferred by retailers and consumers. Awareness of machine-based cleaning’s benefits is accelerating market growth.

Technological Advancements Driving Upgrades

New features, including multi-frequency ultrasonic cycles, temperature control, hybrid cleaning options, and smart connectivity, are encouraging customers to upgrade. Premium and mid-tier machines with enhanced functionality are attracting retailers and affluent consumers globally.

Market Restraints

High Upfront Costs

Advanced machines, particularly hybrid or industrial-grade models, involve significant initial investments, which can deter small jewelry shops or independent service providers. This limits penetration in cost-sensitive markets.

Maintenance & Service Challenges

Sophisticated machines require regular calibration, spare parts, and technical servicing. In regions lacking robust after-sales networks, operational downtime and maintenance costs can hinder adoption, slowing market expansion.

Jewelry Cleaning Machine Market Opportunities

Expansion in Emerging Markets

South Asia, Southeast Asia, and parts of Latin America present untapped demand. Jewelry is culturally significant in these regions, yet mechanized cleaning remains underpenetrated. Affordable, modular machines tailored to local needs can unlock growth.

Integration of Smart & IoT Features

Smart cleaning machines with app integration, usage analytics, and predictive maintenance offer strong differentiation. Retailers and households alike benefit from enhanced control, efficiency, and a lower risk of jewelry damage. IoT-enabled devices also create potential for subscription-based revenue models.

Sustainable & Eco-Friendly Products

Environmentally conscious consumers and regulations are pushing demand for green-certified machines. Manufacturers adopting energy-efficient designs, water conservation features, and biodegradable cleaning agents can capture premium segments while aligning with sustainability goals.

Product Type Insights

- Ultrasonic machines lead the market, capturing 55–60% of global revenues in 2024. Their ability to clean micro-settings makes them the most trusted technology.

- Benchtop units dominate capacity-based demand, with 35% market share, due to affordability and suitability for small retailers.

- Mid-tier pricing tier is most popular, accounting for 45% of global demand, as it balances affordability and features.

Application Insights

Jewelry retail stores accounted for 40% of global demand in 2024, as they rely heavily on machines to maintain inventory appeal and offer complimentary cleaning services. Jewelry manufacturing and repair services are also major applications, while the household/consumer segment is the fastest-growing, supported by online sales of compact ultrasonic cleaners.

Distribution Channel Insights

Specialist distributors dominate B2B sales, holding 40% market share, owing to their expertise and after-sales service. Online platforms are rapidly growing, particularly for consumer-focused benchtop units. Direct OEM sales to large jewelry chains are also expanding, while bundled subscription models are emerging for consumables and maintenance.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for 22% of the global market in 2024, driven by high jewelry ownership and early adoption of premium machines. The U.S. dominates regional demand, with replacement and upgrade cycles fueling steady growth.

Europe

Europe held 18% of the market in 2024. Strong demand for eco-friendly cleaning systems and high-value jewelry sales in Germany, the U.K., and Italy underpin growth. Eastern Europe is showing catch-up adoption of affordable benchtop units.

Asia-Pacific

Asia-Pacific leads the global market with a 38% share in 2024. India and China are the primary drivers, supported by jewelry manufacturing and high consumer demand. The region is also the fastest-growing, with a projected CAGR of 12–14% through 2030.

Latin America

Latin America represented 6% of the global market in 2024, led by Brazil and Mexico. Growth is fueled by increasing consumer spending and the expansion of retail jewelry chains, though economic volatility remains a challenge.

Middle East & Africa

The region held 7% share in 2024, with the UAE and Saudi Arabia dominating due to high jewelry ownership and luxury culture. South Africa is another notable market, supporting demand through its gold and diamond industry.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Jewelry Cleaning Machine Market

- Magnasonic

- Crest Ultrasonics

- iSonic

- Blitz Manufacturing

- Simple Shine

- Skymen Cleaning Equipment

- Fosmon

- Smartclean

- Shenzhen Dekang Cleaning Electronic Appliance

- Leelasonic

- Gesswein

- Sharpertek

- Elma Ultrasonic

- Omegasonics

- Komet USA

Recent Developments

- In May 2025, Magnasonic launched an upgraded consumer ultrasonic cleaner with mobile app integration for household users.

- In April 2025, Crest Ultrasonics introduced a hybrid ultrasonic-steam machine aimed at professional jewelers in North America and Europe.

- In February 2025, Skymen announced the expansion of its manufacturing facility in Shenzhen, focusing on eco-friendly ultrasonic transducers.