Iris Recognition Products Market Size

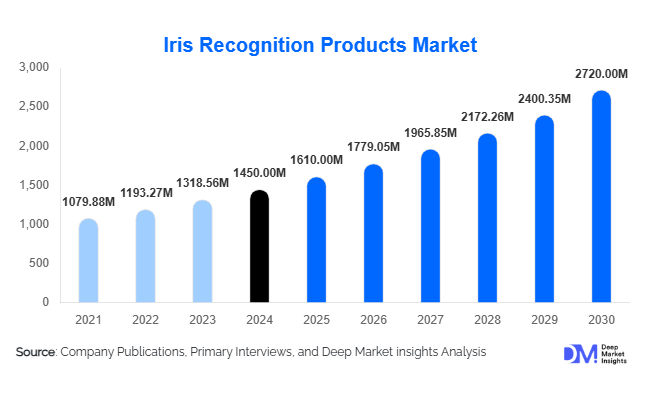

According to Deep Market Insights, the global iris recognition products market size was valued at USD 1,450 million in 2024 and is projected to grow from USD 1,610 million in 2025 to reach USD 2,720 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for high-accuracy biometric authentication, government-led digital ID and security initiatives, and the rising adoption of AI-powered iris recognition technologies in commercial and public sectors.

Key Market Insights

- Government and public sector initiatives are driving large-scale adoption of iris recognition systems, particularly for national identity programs, border security, and e-governance projects.

- Integration with multi-biometric solutions is expanding across enterprises and airports, combining iris recognition with fingerprint and facial recognition to enhance security and operational efficiency.

- North America dominates the market with strong infrastructure readiness and regulatory support for biometric authentication, contributing to 35% of the 2024 market share.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, fueled by smart city initiatives, airport security modernization, and large-scale public sector adoption.

- Technological advancements such as AI-driven analytics, mobile-based iris scanners, and cloud-based deployments are reshaping the market by enabling faster, scalable, and accurate identification.

- BFSI and healthcare sectors are rapidly adopting iris recognition to enhance security, prevent fraud, and streamline patient identification, expanding commercial market potential.

Latest Market Trends

AI and Cloud Integration in Iris Recognition

Companies are increasingly deploying AI-driven iris recognition software integrated with cloud infrastructure to provide high-speed, scalable authentication solutions. Cloud-based systems reduce hardware dependency, enable remote management, and facilitate multi-location deployment, particularly for enterprises and governments. AI enhancements improve accuracy, reduce false positives, and enable real-time analytics for identity verification and fraud detection. Mobile-based iris recognition is also gaining traction, allowing integration into smartphones and laptops for secure financial transactions and access control. These trends reflect a shift toward more flexible, technology-enabled, and user-centric solutions.

Rising Multi-Modal Biometric Adoption

Organizations are deploying iris recognition alongside fingerprint and facial recognition as part of multi-modal security frameworks. Multi-biometric systems provide enhanced accuracy and security, particularly in high-risk environments such as airports, defense, and financial institutions. The trend toward integration supports faster onboarding, better fraud prevention, and improved operational efficiency. Countries with stringent border security regulations are prioritizing these systems to manage increasing passenger volumes while maintaining high-security standards. Demand is also rising in commercial sectors where identity verification is critical, such as banking and healthcare.

Iris Recognition Products Market Drivers

Increasing Security Concerns

The global rise in cyber threats, identity theft, and fraud has created a strong demand for high-accuracy biometric authentication. Iris recognition provides reliable and unique identification, making it a preferred choice for governments, financial institutions, and critical infrastructure operators. This driver is particularly strong in regions with strict security regulations, such as North America and Europe.

Government-Led Digital ID and Security Programs

Public sector investments in national ID programs, e-passports, and border control initiatives are accelerating iris recognition adoption. Projects in India, China, the UAE, and other APAC countries demonstrate large-scale enrollment and deployment, boosting demand for both hardware and software solutions. Governments are also investing in secure data storage and multi-modal systems, driving further market growth.

Technological Advancements in Iris Recognition

Advances in AI, cloud computing, and mobile-compatible devices are enabling faster and more accurate identification. High-resolution iris scanners, analytics-driven software, and integration with existing IT systems allow enterprises and governments to adopt iris recognition solutions at scale, contributing to higher deployment rates and expanding use cases.

Market Restraints

High Initial Deployment Costs

Advanced iris recognition systems require significant upfront investment in hardware and software, which can be prohibitive for small and medium enterprises. The need for high-resolution cameras, AI software, and integration with enterprise systems increases the cost of deployment, limiting adoption in cost-sensitive regions.

Privacy and Regulatory Concerns

Strict data protection regulations, such as GDPR and national biometric data laws, create challenges for deployment. Organizations must ensure secure storage and management of sensitive iris data, adding operational complexity. Privacy concerns among users may also slow adoption, particularly in consumer-facing applications.

Iris Recognition Products Market Opportunities

Expansion Through Government Identity Programs

National digital ID initiatives and e-passport projects provide a significant opportunity for iris recognition companies. Governments are actively investing in large-scale biometric enrollment programs to improve citizen services and security. Such projects create stable, long-term demand for both hardware and software solutions.

Adoption in Healthcare and Banking

Hospitals and banks are increasingly using iris recognition for secure patient identification and fraud prevention. In healthcare, iris scanners reduce errors in patient records and improve operational efficiency, while in banking, they enhance security for high-value transactions and mobile banking applications. These sectors offer significant growth potential as adoption continues to expand.

Emerging Markets in Asia-Pacific and MEA

Asia-Pacific and the Middle East & Africa represent high-growth opportunities due to increasing government initiatives, urbanization, and airport security modernization. Countries like India, China, and the UAE are investing heavily in biometric infrastructure, creating substantial demand for global iris recognition solution providers.

Product Type Insights

Iris recognition hardware dominates the market, accounting for approximately 60% of the 2024 market (USD 870 million). The high demand for hardware is driven by the need for high-accuracy, durable sensors in airports, government facilities, and banking environments. Continuous upgrades in hardware, including higher-resolution scanning, faster authentication speeds, and AI compatibility, further fuel adoption. Software solutions, including enrollment management, analytics platforms, and AI-driven algorithms, are rapidly gaining traction, particularly with cloud integration that enables scalable and remote deployments. Services, including system integration, maintenance, and technical support, are increasingly critical for large-scale deployments, supporting long-term adoption across both public and private sectors.

Application Insights

Access control and security applications lead the market with around 40% share, largely due to deployment in government facilities, airports, and enterprise offices. The growth in this application is supported by stringent anti-terrorism regulations and rising concerns around identity theft. Other key applications include border control, banking authentication, healthcare, defense, and consumer electronics. Multi-modal biometric solutions combining iris recognition with fingerprint or facial recognition are gaining prominence, enhancing both security and operational efficiency. AI-driven analytics and cloud-based solutions are increasingly integrated across these applications, improving recognition speed, accuracy, and system scalability, thereby driving higher adoption rates.

End-Use Insights

Government and public sector adoption remains the largest, accounting for 50% of the market, propelled by national ID programs, border security, and e-governance initiatives. The key driver in this segment is compliance with stringent security and anti-terrorism regulations. BFSI (Banking, Financial Services, and Insurance) is rapidly expanding, fueled by the need for fraud prevention and secure customer authentication. Healthcare adoption is also growing due to the requirement for accurate patient identification and efficient medical record management. Commercial enterprises increasingly deploy iris recognition for access control and employee authentication, while consumer electronics are emerging as a significant growth area, with smartphones and laptops integrating mobile-based, contactless iris recognition for secure authentication. Export-driven demand is particularly strong in the Asia-Pacific region, where technology is supplied to developing regions across Africa and LATAM, further reinforcing global adoption trends.

| By Product Type | By Application | By Deployment Type | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the 2024 market (USD 510 million), led by the U.S. and Canada. Growth is driven by strong government initiatives and the high adoption of advanced security solutions across the public and private sectors. Key drivers include large-scale national ID programs, airport security modernization, and BFSI deployment for fraud prevention. High infrastructure readiness, regulatory support, and early adoption of AI and cloud-based biometric technologies favor large-scale deployment of iris recognition systems, making North America the largest regional market globally.

Europe

Europe holds a 25% market share, with Germany, the UK, and France leading adoption. The region’s growth is driven by regulatory compliance in border control, financial sectors, and anti-fraud mandates, which necessitate high-accuracy iris recognition systems. Investments in airport modernization, government digital ID programs, and corporate access control solutions further boost regional demand. Additionally, the adoption of eco-friendly and energy-efficient devices, as well as AI-integrated systems, is emerging as a key differentiator, enabling Europe to maintain steady market growth while emphasizing sustainable technology integration.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 12%, led by China, India, and Japan. Regional drivers include rapid urbanization, the proliferation of smart city initiatives, and increased adoption in banking, healthcare, and public infrastructure projects. National ID programs, airport security modernization, and government subsidies for biometric deployments are supporting widespread adoption. Private sector adoption in hospitals, banks, and commercial enterprises is accelerating growth, while mobile-based iris recognition solutions are increasingly integrated into consumer devices. These factors collectively make Asia-Pacific the most dynamic and rapidly expanding regional market.

Middle East & Africa

Countries such as the UAE, Saudi Arabia, and South Africa are investing heavily in airport security, governmental facilities, and large-scale public safety initiatives, driving regional adoption of iris recognition systems. Investments in infrastructure, modernization of government ID programs, and the deployment of secure authentication solutions in high-risk zones are key drivers. Increasing intra-African adoption of iris recognition technology, particularly for law enforcement and border management, further supports regional market growth, making the Middle East & Africa an emerging opportunity for solution providers.

Latin America

Brazil and Argentina represent emerging markets, with adoption primarily driven by a growing focus on identity management, law enforcement modernization, and banking security. Outbound procurement from Asia-Pacific and North America contributes to technology adoption, while national initiatives to improve digital ID and public security infrastructure provide additional growth opportunities. The increasing need for secure authentication in BFSI and government facilities is expected to expand market penetration in the region over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Iris Recognition Products Market

- IDEMIA

- HID Global

- Iris ID

- Gemalto

- NEC Corporation

- Suprema

- EyeLock

- Princeton Identity

- Aware, Inc.

- Cognitec Systems

- Crossmatch

- ZKTeco

- Delta ID

- IrisGuard

- Fujitsu

Recent Developments

- In June 2025, HID Global launched AI-enabled iris recognition software integrated with cloud-based multi-modal systems for airports in Europe and North America.

- In April 2025, Iris ID partnered with a major Indian bank to deploy iris-based authentication across 1,000 branches, enhancing transaction security and reducing fraud.

- In February 2025, Suprema introduced mobile-compatible iris scanners for healthcare facilities in the Asia-Pacific region, improving patient verification accuracy and operational efficiency.