IQF Impingement Freezer Market Size

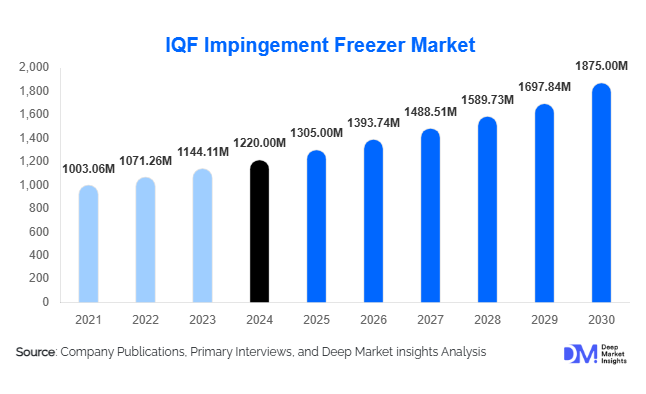

According to Deep Market Insights, the global IQF (Individually Quick Frozen) Impingement Freezer market size was valued at USD 1,220 million in 2024 and is projected to grow from USD 1,305 million in 2025 to reach USD 1,875 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by rising global demand for frozen foods, increasing adoption of automation and energy-efficient freezing technologies, and expansion of cold chain infrastructure in emerging markets.

Key Market Insights

- IQF freezers are increasingly adopted across multiple frozen food segments, including meat, seafood, fruits, vegetables, and ready-to-eat meals, due to their ability to preserve product quality, texture, and nutrients.

- Technological advancements in impingement freezing, such as high-velocity air systems and automated conveyor belts, are improving operational efficiency and throughput for large-scale food processors.

- North America holds a significant share of the market, led by the USA and Canada, due to high consumption of frozen foods and strict quality standards.

- Asia-Pacific is the fastest-growing region, driven by industrialization, rising disposable income, and export-oriented food processing growth in China and India.

- Export-driven demand for frozen seafood and vegetables from APAC to North America and Europe is boosting the adoption of IQF impingement-freezers.

- Integration with energy-efficient and smart technologies, including IoT-based monitoring and automated controls, is reshaping operational efficiency and sustainability in the freezing industry.

Latest Market Trends

Energy-Efficient and Smart Freezing Systems

Manufacturers are increasingly deploying energy-efficient compressors, automated belt systems, and IoT-enabled monitoring in IQF freezers. This reduces operational costs, enhances freezing uniformity, and meets environmental regulations in North America and Europe. The trend is driven by increasing focus on sustainability, as well as corporate initiatives to reduce energy consumption in industrial food processing plants.

Expansion of Export-Oriented Cold Chain Infrastructure

The growing global trade in frozen seafood, meat, and vegetables has created strong demand for high-performance IQF freezers. Countries like China, India, Brazil, and Vietnam are investing heavily in cold storage and processing facilities, ensuring product quality during long-distance shipments. These developments are enabling new market participants to enter export-focused production and logistics.

IQF Impingement Freezer Market Drivers

Increasing Frozen Food Consumption

Urbanization, dual-income households, and convenience food trends are driving global frozen food consumption. IQF freezers help maintain freshness, nutritional value, and product texture, boosting adoption in meat, seafood, and ready-to-eat meal segments. The rising demand for frozen protein products, especially seafood and poultry, is a key growth driver.

Growth of the Food Processing Industry

Rapid expansion of food processing facilities in APAC, Latin America, and the Middle East has accelerated the need for high-efficiency freezing solutions. Large-scale frozen food manufacturers are upgrading plants with IQF impingement-freezers to ensure hygiene compliance, reduce spoilage, and increase production throughput.

Technological Advancements in Freezing Equipment

Innovations such as high-velocity air impingement systems, automated belt configurations, and energy-efficient compressors have enhanced freezer performance and operational efficiency. Companies adopting these technologies gain a competitive advantage while meeting global quality standards.

Market Restraints

High Capital Expenditure

The significant upfront investment required for IQF impingement-freezers limits adoption among small and medium-sized enterprises, potentially restricting market expansion.

Operational Complexity and Maintenance

IQF freezers require skilled operators and regular maintenance to ensure efficiency and product quality. This operational complexity can be a barrier in regions with limited technical expertise or labor shortages.

IQF Impingement Freezer Market Opportunities

Integration with Smart and Energy-Efficient Technologies

Manufacturers can differentiate themselves by adopting IoT-enabled monitoring, automation, and energy-saving systems. This enhances operational efficiency, reduces costs, and aligns with sustainability initiatives, providing opportunities to attract eco-conscious clients in Europe and North America.

Export-Driven Cold Chain Expansion

The growing demand for frozen seafood, vegetables, and ready-to-eat meals in international markets is creating opportunities for IQF freezer manufacturers. Partnerships with logistics providers and export-oriented processing plants allow companies to tap into high-volume export markets.

Emerging Markets Growth

Rapid urbanization, rising disposable incomes, and government investment in food processing infrastructure in Asia-Pacific and Latin America present a lucrative opportunity for new entrants to establish production facilities and expand market presence.

Product Type Insights

Among product segments, seafood leads the market with 28% share (USD 342 million in 2024), primarily due to export demand and the need to preserve product texture, freshness, and overall quality. The growth of this segment is further supported by the fact that IQF impingement-freezers prevent clumping, retain the natural flavor, and extend shelf life, key requirements for retail and food service channels. Meat and poultry also maintain a significant market share, driven by the rising global demand for protein-rich diets. Fruits, vegetables, ready-to-eat meals, and bakery products are experiencing steady growth as manufacturers diversify frozen offerings to meet evolving consumer preferences and capitalize on the trend toward convenience foods. Segment-specific drivers, such as the superior preservation of freshness for seafood and fruits/vegetables, and the prevention of clumping in retail packaging, are crucial factors enhancing IQF adoption in these product types.

Application Insights

The frozen food manufacturers segment is the largest end-use category (40% share, USD 488 million in 2024) due to high throughput requirements, compliance with stringent quality standards, and the need to minimize product waste. Food processing plants, retail chains, and export-oriented storage facilities are increasingly adopting IQF freezers to maintain operational efficiency and consistent product quality. Emerging applications in plant-based frozen foods, ready-to-eat meals, and bakery products are creating additional opportunities, driven by rising consumer demand for convenience, health-focused diets, and clean-label products. Segment drivers include the adoption of IQF freezers by food processing companies to ensure longer shelf life, higher product consistency, and reduced wastage, critical for competitive advantage in global supply chains.

Distribution Channel Insights

IQF freezers are primarily marketed and sold through direct industrial sales and specialized equipment distributors. Direct sales from manufacturers to large-scale processing plants dominate due to the need for customization, technical support, and installation services. After-sales maintenance and training services further strengthen these relationships. Emerging online industrial marketplaces are gradually entering the space; however, traditional direct and distributor channels continue to dominate because of the complexity, high investment, and operational requirements associated with IQF freezer systems.

| By Freezer Type | By Product Type | By End-Use Industry | By Region |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 32% of the market (USD 390 million in 2024), with the USA (25%) and Canada (5%) as primary contributors. The region's growth is driven by strong consumer demand for frozen ready-to-eat meals, rising consumption of seafood and convenience foods, and well-established food processing infrastructure. Key regional drivers include strict food safety and hygiene regulations, which push manufacturers to adopt high-efficiency IQF impingement-freezers to ensure compliance, maintain product quality, and extend shelf life. Additionally, technological adoption and a strong cold chain ecosystem support the efficient distribution of frozen foods across North America.

Europe

Europe holds a 24% market share, with Germany (8%), France (6%), and the UK (5%) as major contributors. Growth in the region is strongly influenced by sustainability initiatives and energy-efficient freezing systems, which are increasingly mandated by regulatory standards and demanded by environmentally-conscious consumers. Manufacturers are adopting IQF freezers that reduce energy consumption, improve freezing uniformity, and minimize food waste. Rising consumer awareness around fresh-like frozen foods and strict EU hygiene regulations further drive adoption across meat, seafood, fruits, and ready-to-eat meals segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 8%, led by China (10%) and India (4%). Rapid urbanization, rising disposable incomes, increasing industrialization, and a growing middle-class population are key growth drivers. The region is experiencing significant expansion in processed and frozen food consumption, which is boosting demand for IQF impingement-freezers to maintain quality for both domestic and export markets. Investments in cold chain infrastructure, coupled with rising food exports to Europe and North America, are further supporting regional adoption.

Middle East & Africa

This emerging market, with Saudi Arabia (2%) and the UAE (1.5%) leading adoption, is growing due to the increasing presence of fast-food chains and food service sectors requiring high-quality, preserved frozen products. The rise of quick-service restaurants and frozen meal offerings is driving demand for IQF freezers. Additionally, the expansion of retail and food distribution networks, along with investments in modern cold chain facilities, is contributing to the region’s steady market growth.

Latin America

Brazil (3%) and Argentina (1%) are witnessing steady market growth, primarily due to the expansion of industrial food processing facilities and rising consumption of frozen foods. Regional drivers include increasing exports of frozen fruits and vegetables to North America and Europe, which necessitate the use of IQF impingement-freezers to preserve product quality during transit. Adoption is also supported by rising urbanization and demand for convenience foods, particularly in urban and industrial hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the IQF Impingement Freezer Market

- GEA Group

- JBT Corporation

- Baader Group

- Air Products and Chemicals, Inc.

- Mayekawa Mfg. Co., Ltd.

- Unifrigor S.p.A.

- Irinox S.r.l.

- Trepko A/S

- Frigoscandia AB

- Turbofreeze Limited

- Prodelcon S.A.

- Hiperbaric S.A.

- Air Jet Systems

- Starfrost

- Fessmann Maschinenbau GmbH

Recent Developments

- In May 2025, GEA Group launched a new energy-efficient IQF impingement freezer for seafood processors, integrating IoT monitoring and automation for improved throughput.

- In March 2025, JBT Corporation expanded production capacity in Asia-Pacific, targeting the growing frozen seafood and ready-to-eat meal segments.

- In February 2025, Baader Group introduced high-velocity air impingement systems, reducing freezing time and energy consumption for large-scale meat processing plants.