IP Network Intercom Market Size

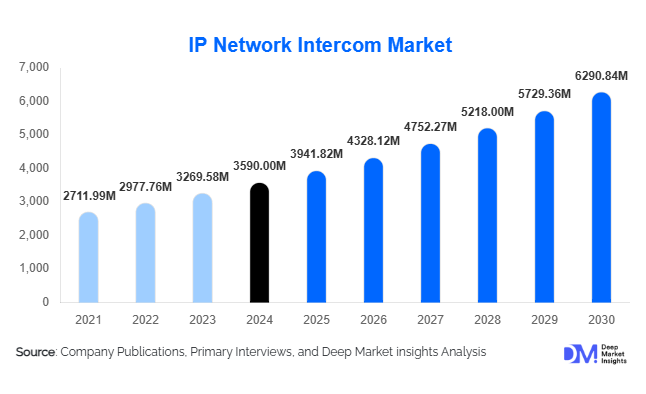

According to Deep Market Insights, the global IP network intercom market size was valued at USD 3,590 million in 2024 and is projected to grow from USD 3,941.82 million in 2025 to reach USD 6,290.84 million by 2030, expanding at a CAGR of 9.8% during the forecast period (2025–2030). The growth of the IP network intercom market is primarily driven by the rising integration of smart building technologies, increasing demand for advanced security and surveillance systems, and the expanding deployment of IP-based communication solutions across enterprise, residential, and industrial sectors.

Key Market Insights

- Growing adoption of IP-based communication systems is driving demand for scalable, flexible, and cost-efficient intercom solutions across smart cities and connected infrastructure.

- Integration with IoT and AI technologies is transforming intercom systems into intelligent access control hubs with enhanced monitoring and automation features.

- Commercial and industrial applications dominate due to increasing security requirements in offices, educational institutions, hospitals, and transportation facilities.

- Residential demand is accelerating as smart home ecosystems integrate IP intercoms for seamless connectivity, video verification, and mobile-based access control.

- Asia-Pacific leads market expansion with strong investments in smart city infrastructure, followed by North America and Europe.

- Technological advancements, including cloud-based management, AI-driven facial recognition, and wireless intercom innovations, are reshaping system capabilities and user experiences.

Latest Market Trends

IoT-Enabled Smart Intercom Systems

Manufacturers are increasingly integrating IoT capabilities into IP network intercoms to enhance real-time monitoring, access control, and data analytics. Smart intercoms now connect with other devices such as video surveillance cameras, door locks, and building management systems, enabling centralized control and improved situational awareness. Cloud integration allows for remote access and system updates, supporting both residential and enterprise use cases. This trend aligns with the growing shift toward connected smart buildings and energy-efficient infrastructure solutions.

AI and Cloud-Based Security Solutions

Artificial intelligence and cloud computing are transforming IP intercom operations through intelligent video analytics, voice recognition, and predictive maintenance. AI-driven features such as anomaly detection and facial identification improve security accuracy and reduce manual intervention. Cloud platforms offer scalable management, remote configuration, and multi-site integration, making them ideal for commercial applications like hospitals, universities, and corporate campuses. As cybersecurity concerns grow, vendors are increasingly incorporating encryption and secure authentication protocols.

IP Network Intercom Market Drivers

Rising Demand for Smart Building Infrastructure

With rapid urbanization and the expansion of smart city initiatives, demand for IP-based communication systems is increasing globally. IP intercoms are essential components in smart buildings, providing advanced communication, visitor management, and emergency response functionalities. Governments and developers are investing in intelligent infrastructure that supports safety, efficiency, and digital control, key factors propelling the adoption of IP network intercoms across commercial and residential environments.

Increased Focus on Security and Access Control

Growing concerns about security and property access management are driving the deployment of IP network intercom systems across multiple sectors. The integration of video, audio, and remote connectivity allows real-time communication and visual verification before granting access. Industries such as healthcare, education, and transportation increasingly rely on these systems for efficient emergency coordination and monitoring, making them vital to modern safety infrastructures.

Market Restraints

High Installation and Integration Costs

Despite technological advancements, the initial installation and integration costs of IP intercom systems remain high, especially for large-scale commercial and industrial projects. Upgrading legacy analog intercom networks to IP-based systems requires significant capital investment in cabling, software, and training. These costs can restrict adoption among small and medium enterprises and low-budget residential developments.

Cybersecurity and Data Privacy Concerns

As intercom systems become more connected through IoT and cloud platforms, cybersecurity risks such as hacking, data breaches, and unauthorized access have increased. Ensuring robust encryption, multi-layer authentication, and secure network architecture is essential but adds complexity and cost to implementation. Concerns over data protection regulations in regions such as Europe (GDPR) and North America also pose compliance challenges for manufacturers and system integrators.

IP Network Intercom Market Opportunities

Integration with Smart Home Ecosystems

The rising popularity of home automation offers vast opportunities for IP intercom vendors. Modern intercoms are being designed to integrate seamlessly with smart assistants like Alexa, Google Home, and Apple HomeKit. This integration enables homeowners to manage door access, communicate with visitors, and monitor properties remotely using mobile apps or voice commands, boosting convenience and security in the residential segment.

Expansion in Emerging Economies

Developing regions in Asia-Pacific, Latin America, and the Middle East are witnessing the rapid construction of residential complexes, office spaces, and public infrastructure. Governments promoting digital transformation and smart city projects are creating new opportunities for IP network intercom adoption. Local manufacturers and integrators are capitalizing on this growth through cost-effective solutions and public-private partnerships.

Product Type Insights

Video intercoms dominate the market, offering visual identification and enhanced access control capabilities for both residential and enterprise applications. Audio-only intercoms continue to serve smaller facilities and cost-sensitive installations, while wired intercoms maintain popularity in large-scale buildings requiring stable connections. Wireless and hybrid models are gaining traction for retrofitting and flexible deployments, providing scalability and easier integration with IoT networks.

Application Insights

Commercial and industrial applications lead the market, driven by corporate offices, hospitals, educational institutions, and government facilities adopting intercoms for communication and security. The residential sector is experiencing rapid growth due to the rise of smart home ecosystems and gated community developments. Transportation and logistics hubs are also adopting IP intercoms to improve operational coordination and passenger safety.

Distribution Channel Insights

Direct sales and system integrators account for a significant portion of revenue, as businesses prefer customized installations. Online channels and OEM partnerships are expanding, enabling manufacturers to reach global customers through e-commerce and digital distribution platforms. Value-added resellers and distributors continue to play a critical role in offering localized technical support and maintenance services.

End-User Insights

Enterprises represent the largest end-user segment, investing in intercom systems for secure communication and access management. Residential users are emerging as a fast-growing group due to increasing smart home adoption. Public infrastructure applications, including airports, metro stations, and government facilities, are expected to see strong growth fueled by safety mandates and modernization projects.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a leading market for IP network intercom systems, driven by high security standards, smart building adoption, and the strong presence of global manufacturers. The U.S. and Canada continue to see large-scale deployments across corporate campuses, educational institutions, and residential complexes.

Europe

Europe exhibits strong demand supported by stringent building safety regulations and the rising focus on sustainable, connected infrastructure. Countries such as Germany, the U.K., and France are investing heavily in IP-based building communication systems integrated with green building initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by urbanization, large-scale smart city projects, and rising construction activity in China, Japan, South Korea, and India. Local manufacturers offering cost-efficient solutions are contributing to rapid regional adoption.

Middle East & Africa

Infrastructure development and increasing smart city projects in the UAE, Saudi Arabia, and South Africa are driving the adoption of IP network intercom systems. The focus on enhancing security in the commercial and hospitality sectors further supports market expansion.

Latin America

Emerging economies such as Brazil, Mexico, and Chile are gradually adopting IP intercom systems, particularly within commercial and high-end residential sectors. Government investments in public safety and transportation infrastructure are expected to boost demand over the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the IP Network Intercom Market

- Axis Communications AB

- Commend International GmbH

- Zenitel Group

- Legrand

- Panasonic Holdings Corporation

- 2N Telekomünikasyon (An Axis Company)

- Fermax

- ButterflyMX

Recent Developments

- In July 2025, Axis Communications launched an AI-powered IP intercom line featuring integrated video analytics and touchless access for enterprise buildings.

- In March 2025, Zenitel introduced its new cloud-managed intercom platform designed for smart building ecosystems.

- In January 2025, Legrand expanded its IP intercom product range with modular systems supporting IoT and mobile app integration for residential complexes.