IP Cameras Market Size

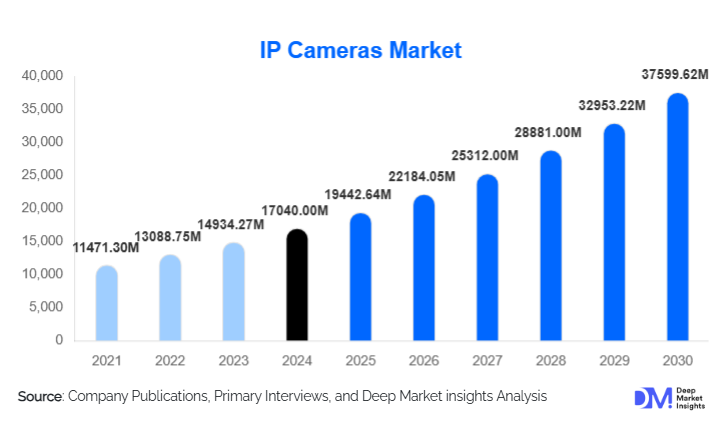

According to Deep Market Insights, the global IP cameras market size was valued at USD 17,040 million in 2024 and is projected to grow from USD 19,442.64 million in 2025 to reach USD 37,599.62 million by 2030, expanding at a CAGR of 14.1% during the forecast period (2025–2030). Growth in the IP cameras market is primarily driven by rapid adoption of AI-powered video analytics, smart city infrastructure expansion, and rising demand for high-resolution surveillance solutions across residential, commercial, and public sectors.

Key Market Insights

- AI integration and edge-based video analytics are transforming traditional surveillance, enabling real-time threat detection, anomaly alerts, and automated monitoring.

- Hardware remains the dominant revenue segment, accounting for over 75% of market value in 2024, driven by continuous sensor, lens, and AI-chip innovations.

- Commercial applications lead global adoption, with retail, corporate facilities, hospitality, and BFSI sectors deploying large-scale surveillance networks.

- Asia-Pacific dominates the global IP camera market with nearly 45–50% share, supported by smart city investments and large-scale public safety deployments.

- Cloud-based VSaaS (Video Surveillance-as-a-Service) is accelerating as enterprises shift toward subscription models and scalable remote-monitoring platforms.

- Data privacy and cybersecurity compliance are becoming central to product procurement, especially in Europe and regions with stringent data protection regulations.

What are the latest trends in the IP cameras market?

Rise of AI-Driven and Edge Analytics Cameras

The IP cameras market is witnessing a significant shift toward AI-enabled devices capable of processing data on the edge. Embedded AI chips now support capabilities such as object detection, facial recognition, behavioral analysis, and anomaly detection, all without relying solely on cloud computation. This trend enables faster response times, reduced bandwidth consumption, and smarter camera networks. Enterprises and governments increasingly prefer AI-enabled devices for applications such as crowd monitoring, smart traffic management, perimeter protection, and industrial safety automation.

Cloud-Based VSaaS and Hybrid Surveillance Models

Cloud storage and VSaaS platforms are becoming mainstream as organizations migrate from on-premises NVRs to flexible, subscription-based video management solutions. Hybrid models that combine local storage with cloud analytics offer cost efficiency, scalability, and disaster resilience. Cloud-based monitoring also enables small and medium enterprises (SMEs) to deploy professional-grade surveillance with minimal upfront investment. Vendors are integrating AI analytics dashboards, remote device health monitoring, and encrypted cloud archiving to differentiate offerings.

What are the key drivers in the IP cameras market?

Increasing Global Security Concerns and Smart City Investments

Rising crime rates, public safety initiatives, and national security requirements are creating strong demand for advanced surveillance. Governments worldwide are investing heavily in surveillance infrastructure for smart cities, traffic management, emergency response systems, and urban monitoring. These initiatives rely on high-resolution IP cameras integrated with AI-driven analytics, positioning surveillance technology as a critical urban management tool.

Technological Advancements in Imaging, Connectivity, and Analytics

Advancements in 4K/8K imaging, low-light performance, thermal and infrared sensors, and AI-enabled chips are accelerating market growth. Integration with IoT ecosystems, 5G connectivity, and edge computing enhances real-time performance while lowering bandwidth needs. Enterprises leverage these innovations to improve operational efficiency, automate monitoring tasks, and gain insights beyond security, such as customer behavior analysis in retail and productivity monitoring in industrial settings.

What are the restraints for the global market?

Data Privacy and Cybersecurity Concerns

IP cameras, being network-connected, face inherent cybersecurity risks such as hacking, unauthorized access, and data breaches. Strict regulations such as GDPR and evolving national data protection laws impose complex compliance requirements on manufacturers and integrators. Public resistance to mass surveillance, especially in Western markets, also limits widespread deployment in certain environments. Ensuring encrypted communication, secure firmware, and regular updates is essential, but increases development costs.

High Storage, Bandwidth, and Infrastructure Costs

High-resolution video (including 4K and thermal feeds) generates massive data volumes that require substantial storage and network bandwidth. Cloud storage costs, limited internet infrastructure in developing regions, and expensive network upgrades can significantly raise the total cost of ownership. For many SMEs and residential users, these recurring costs act as adoption barriers, particularly for large multi-camera installations.

What are the key opportunities in the IP cameras industry?

Expansion of Cloud-Based Surveillance and AI Analytics Services

The growing preference for subscription-based surveillance services opens major opportunities for cloud-native providers. VSaaS platforms offering remote monitoring, automated alerts, analytics dashboards, and flexible cloud archives appeal to both enterprises and consumers. Vendors can generate recurring revenue while reducing customer onboarding friction. AI-driven analytics-as-a-service is emerging as a high-margin opportunity as companies seek insights without heavy on-site hardware investment.

Emerging Market Penetration and Local Manufacturing

Asia-Pacific, Latin America, and Africa present strong growth potential due to urbanization, increasing security spending, and government-led surveillance deployments. Local manufacturing initiatives, such as Make in India, support cost reduction, supply chain resilience, and regulatory compliance. Manufacturers expanding into emerging markets with cost-optimized camera lines, integrated analytics, and cloud connectivity will capture substantial new revenue streams.

Product Type Insights

Fixed IP cameras dominate the market due to affordability and widespread use across commercial and residential environments. PTZ (pan-tilt-zoom) cameras support long-range monitoring for government and industrial applications, while infrared and thermal IP cameras hold a leading value share (around 44–45%) due to their suitability for low-light and high-security environments. Ultra-HD and fisheye/360° cameras are gaining traction as organizations adopt panoramic and high-resolution imaging for large-area surveillance with fewer devices. Demand for AI-enabled models is rising sharply across all categories.

Application Insights

Commercial surveillance remains the largest application segment, contributing over 65% of global demand. Retail, BFSI, hospitality, and office spaces use IP cameras for security, customer analytics, and loss prevention. Public safety agencies deploy IP cameras for smart city monitoring, traffic analytics, and law enforcement. Industrial users rely on IP cameras for safety compliance, remote inspections, and process monitoring. Residential adoption continues to grow with smart home ecosystems, mobile app-based monitoring, and cloud storage integrations.

Distribution Channel Insights

Online platforms and direct-to-consumer (D2C) channels dominate camera purchases, especially in residential and SME markets. Enterprises and government clients still rely heavily on system integrators, security distributors, and certified solution providers for large-scale deployments. Cloud-based service subscriptions, device leasing, and VSaaS models are emerging as key distribution channels, shifting the market toward recurring revenue. Manufacturers increasingly leverage digital platforms with interactive configuration tools and AI-based device recommendation engines.

End-User Insights

Enterprises constitute a major share of end-user demand due to large-scale deployment requirements across corporate buildings, retail chains, and industrial sites. Governments are major buyers driven by public safety and urban surveillance projects. Residential users represent a growing segment fueled by IoT home security solutions with mobile accessibility. Transportation and critical infrastructure operators (airports, rail networks, energy utilities) are adopting high-specification IP cameras for round-the-clock monitoring and compliance requirements.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is a mature market characterized by early adoption of cloud-based surveillance, strong corporate security investments, and high demand for AI-enabled cameras. The U.S. leads regional growth with advanced IT infrastructure, stringent security standards, and widespread commercial adoption. Enterprises increasingly prefer VSaaS and hybrid-cloud models, while public agencies deploy smart surveillance solutions for traffic and emergency response management.

Europe

Europe shows steady demand growth supported by GDPR-driven focus on secure, compliant, and encrypted surveillance systems. The region prioritizes data privacy, edge analytics, and sustainability in surveillance deployments. The U.K., Germany, and France remain leading adopters, especially in corporate security, transportation, and public safety. Vendors offering certified and privacy-focused solutions are gaining strong traction.

Asia-Pacific

Asia-Pacific dominates the global IP camera market, accounting for nearly 45–50% of total revenue. China leads in both manufacturing and consumption, while India and Southeast Asia drive rapid adoption through smart city initiatives and expanding commercial security needs. High urbanization rates, affordable device availability, and large-scale government surveillance programs contribute to APAC’s leadership position. Investments in 5G and cloud infrastructure further accelerate IP camera integration.

Latin America

Latin America is experiencing gradual but steady growth led by Brazil, Mexico, and Chile. Rising urban crime, increasing adoption of modern security solutions, and expanding commercial sectors are key drivers. Government-led projects for city surveillance and transportation security offer new opportunities for vendors. Market penetration remains lower than APAC and North America, but long-term potential is strong.

Middle East & Africa

The Middle East is investing aggressively in mega-projects, smart cities, and high-security infrastructure, particularly in the UAE, Saudi Arabia, and Qatar. Africa is also expanding adoption, especially in South Africa, Kenya, and Nigeria, driven by urbanization and rising public safety needs. The region prefers advanced IP cameras with strong cybersecurity features and robust performance in harsh environments. Government initiatives and infrastructure modernization are key growth catalysts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the IP Cameras Market

- Hikvision

- Dahua Technology

- Axis Communications

- Bosch Security Systems

- Hanwha Vision (Hanwha Techwin)

- Avigilon (Motorola Solutions)

- Vivotek

Recent Developments

- In May 2025, leading manufacturers expanded their AI-enabled camera portfolios, integrating edge processing for real-time analytics across commercial and public safety deployments.

- In April 2025, several global vendors launched upgraded VSaaS platforms featuring enhanced cybersecurity, encrypted cloud storage, and predictive analytics dashboards.

- In February 2025, multiple APAC manufacturers announced new cost-optimized IP cameras designed for emerging markets, supporting smart city and SME adoption with hybrid cloud compatibility.