Interactive Whiteboard Market Size

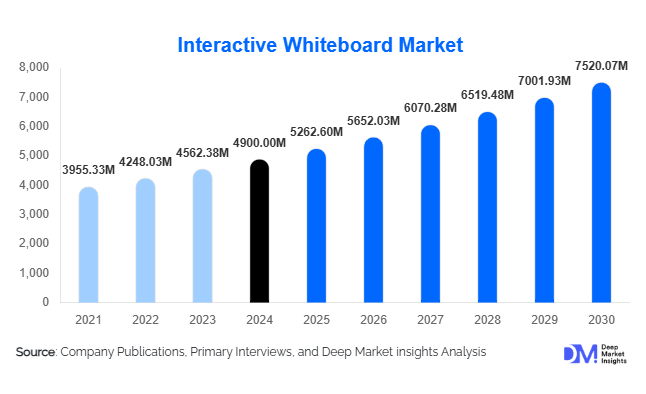

According to Deep Market Insights, the global interactive whiteboard market size was valued at USD 4,900.00 million in 2024 and is projected to grow from USD 5,262.60 million in 2025 to reach USD 7,520.07 million by 2030, expanding at a CAGR of 7.4% during the forecast period (2025–2030). This growth is driven by the rapid adoption of digital learning technologies, increased investment in hybrid collaboration tools across enterprises, and government initiatives promoting smart classroom infrastructure worldwide.

Key Market Insights

- Education remains the dominant application segment, accounting for nearly 65% of global revenue in 2024, driven by accelerated digital classroom programs worldwide.

- Asia-Pacific is the fastest-growing region, expanding at a 9.6% CAGR (2025–2030), led by large-scale education digitization in China and India.

- Corporate adoption is accelerating, with enterprises integrating interactive whiteboards into hybrid meeting and training environments.

- Technological convergence, including AI-powered content interaction, IoT-enabled board management, and cloud collaboration, enhances functionality and recurring software revenues.

- Portable interactive whiteboards are gaining traction for flexibility in classrooms and shared workspaces, capturing over 50% of unit shipments in 2024.

- Falling hardware prices and government-backed digital infrastructure projects are expanding adoption across developing economies.

Latest Market Trends

Integration of AI and Cloud Collaboration Platforms

Interactive whiteboards are evolving beyond touch displays into fully integrated collaboration systems. The latest models feature AI-driven handwriting recognition, voice translation, and auto-summarization functions that enhance teaching and meeting efficiency. Integration with cloud-based collaboration suites such as Microsoft Teams, Google Workspace, and Zoom enables real-time sharing and annotation across devices. Vendors are also adding analytics dashboards that provide insights into student engagement or corporate meeting productivity, transforming whiteboards into smart productivity tools.

Shift Toward Capacitive and Large-Format Displays

Technological advancements have enabled the transition from resistive and infrared boards to capacitive multi-touch systems. Capacitive displays, typically 71–90 inches and above, offer superior responsiveness, multi-user touch capability, and durability, making them ideal for both classrooms and enterprise collaboration rooms. The cost of large-format panels has fallen 25–30% since 2020, accelerating adoption in mid-tier institutions and SMEs. As a result, the 51–70-inch category remains the most popular globally, while demand for 90-inch and larger boards is rising in premium installations.

Interactive Whiteboard Market Drivers

Growing Investment in Digital Education

Governments and private institutions are prioritizing digital learning environments, particularly following the pandemic’s disruption of traditional education. Interactive whiteboards are central to this transformation, enabling visual collaboration, multimedia integration, and hybrid teaching. National initiatives such as Digital India, China’s Smart Education 2025, and Europe’s Digital Schools program are fueling mass procurement of interactive boards for public schools and universities.

Hybrid Work and Enterprise Collaboration Needs

The shift toward hybrid work has elevated demand for collaborative hardware that integrates remote and in-person participants seamlessly. Interactive whiteboards with built-in video-conferencing and annotation capabilities allow teams to co-create in real time, improving meeting productivity. Corporations are standardizing boardroom installations to support cloud-based workflows and virtual training sessions, broadening market scope beyond education.

Declining Display Costs and Technology Advancements

Improved display manufacturing has reduced the average selling price of large touch panels and improved durability. Multi-touch capacitive screens and integrated LED modules enhance visual quality and user experience, while AI and IoT features enable remote management and automatic software updates. This technological progress makes interactive whiteboards more accessible and cost-efficient for mass deployment.

Market Restraints

High Initial Investment Costs

Interactive whiteboards require significant upfront spending on hardware, installation, and software licensing. Budget limitations in developing regions and small institutions hinder widespread adoption. Although prices are falling, the total cost of ownership, including maintenance and training, remains a concern for many schools and SMEs.

Limited Content and Ecosystem Support

Hardware alone offers limited value without interactive content, teacher training, and software integration. Many institutions underutilize whiteboards due to a lack of curriculum-aligned software or inconsistent technical support. This gap in ecosystem maturity restrains full ROI realization and repeat purchases.

Interactive Whiteboard Market Opportunities

Government Digital-Education Initiatives

Across Asia, Africa, and Latin America, governments are launching nationwide digital-education programs to bridge learning gaps. Procurement of interactive whiteboards for public schools represents a multi-billion-dollar opportunity. Companies that form public-private partnerships (PPPs) and offer customized solutions aligned with local curricula stand to gain significantly from this trend.

Hybrid Work Transformation in Enterprises

Corporate meeting spaces are undergoing a digital overhaul. Interactive whiteboards enable seamless collaboration between in-office and remote employees, making them essential tools for modern enterprises. Vendors who integrate cloud ecosystems, annotation software, and AI-enabled analytics can capture a larger share of enterprise CapEx budgets in the coming years.

Emerging Markets and Localized Manufacturing

Rapid urbanization and education expansion in countries like India, Indonesia, and Brazil are creating a new wave of demand for cost-effective interactive whiteboards. Government initiatives such as “Make in India” and “Made in China 2025” are encouraging local production, reducing import dependence, and fostering price competitiveness. This creates attractive entry points for new manufacturers and regional OEM partnerships.

Segment Insights

Technology Segment: Resistive membrane touch technology held a 43% share in 2024, dominating primarily due to its affordability, durability, and ease of maintenance in education applications. However, capacitive multi-touch boards are projected to gain rapid traction in premium segments, driven by enhanced touch sensitivity, multi-user interaction capabilities, and improved user experience. The growing adoption of advanced features such as AI-assisted handwriting recognition, gesture control, and cloud-based content sharing is further fueling demand for capacitive boards in both corporate and higher education environments.

Form Factor: Portable and mobile interactive whiteboards commanded a 53% share in 2024, reflecting a strong preference for flexibility and mobility in dynamic learning and workplace environments. Institutions and enterprises benefit from shared use across multiple rooms, cost efficiency, and the ability to reconfigure spaces quickly. The increasing trend of hybrid learning and flexible office setups acts as a key driver for portable IWBs, as they allow users to seamlessly integrate interactive tools into various classroom and meeting layouts.

Projection Technique: Front projection systems accounted for 62% of the market in 2024 due to lower installation costs and compatibility with existing projector infrastructure. These systems remain highly attractive for budget-conscious schools and small enterprises. Additionally, the ease of upgrading front-projection systems with interactive overlays, without replacing full display hardware, supports continued adoption.

Screen Size: The 51–70-inch category captured the largest share of 2024 sales, balancing visibility, usability, and cost-effectiveness for classrooms and mid-sized corporate meeting rooms. Larger screens (70–90 inches and above) are increasingly preferred in premium education and enterprise applications to accommodate more viewers, support group collaboration, and enhance interactivity in hybrid setups.

Application: Education dominated the market with a 65–68% share in 2024. This segment is driven by widespread smart-classroom deployments, government funding for digital learning initiatives, and growing demand for interactive teaching tools. Corporate adoption is rising steadily, particularly in innovation centers, meeting rooms, and training facilities, as organizations seek to improve collaboration efficiency. Government and vocational training programs further contribute to the growing market base.

End-Use Insights

Educational institutions are the primary consumers of interactive whiteboards, fueled by the transition toward digital and hybrid learning frameworks. Global spending on smart classroom infrastructure is expected to grow at 8% CAGR through 2030, supporting the adoption of interactive whiteboards as core teaching tools. Corporate end-use demand is expanding in parallel, driven by hybrid work models and the need for collaboration tools in meeting rooms, training centers, and innovation labs. Export-driven growth is particularly notable in Asia, where manufacturers supply interactive whiteboards to Africa and Latin America under education aid and infrastructure development programs.

| By Product Type | By Screen Size | By Form Factor | By Application | By Projection Technique |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of global revenue in 2024. The U.S. leads due to early adoption in K-12 schools and corporate enterprises. The region benefits from strong technological infrastructure, high digital literacy, and significant government funding for education technology. Drivers for growth include widespread corporate digitization, the replacement of legacy boards with multi-touch systems, and the integration of collaborative software in offices and classrooms. However, growth is moderate due to market maturity, with replacement cycles and software upgrades providing the primary revenue streams.

Europe

Europe remains a key market, with strong penetration in Germany, the U.K., and France. Growth is driven by government-backed digital education initiatives, heavy emphasis on STEM programs, and corporate training modernization. Replacement cycles for older interactive boards are fueled by the adoption of capacitive multi-touch systems and larger-format displays. Investments in teacher training programs, blended learning curricula, and standardized digital tools also act as regional drivers, encouraging the adoption of interactive whiteboards across both public and private institutions.

Asia-Pacific (APAC)

Asia-Pacific is the fastest-growing region with a projected CAGR of 9.6% (2025–2030). China and India dominate due to nationwide smart-education programs, government-funded digital school initiatives, and the rapid expansion of private school networks. Regional drivers include increasing government initiatives for digital education, rising middle-class school enrollment, and large-scale investments in hybrid corporate workspaces. Japan, South Korea, and Australia represent mature markets, continuing to upgrade from older boards to advanced interactive and collaborative displays. India is expected to be the fastest-growing country globally, driven by both government schemes and private sector digital learning adoption.

Latin America

Latin America shows steady adoption in Brazil and Argentina, supported by public education investments, private school digitization, and import-driven supply chains. Regional growth is primarily driven by foreign aid-funded education programs, rising awareness of technology-enhanced learning, and the adoption of hybrid corporate training solutions. The demand for cost-effective front-projection interactive boards and portable units is particularly strong, given budget constraints in schools and SMEs.

Middle East & Africa (MEA)

MEA is an emerging market with notable potential in the GCC countries and South Africa. Growth is driven by smart education initiatives in the UAE and Saudi Arabia, government programs promoting digital literacy, and donor-backed education infrastructure projects in African nations. Regional drivers include rising private school adoption, government funding for classroom technology, and corporate digitization in urban centers. While the regional share is currently small, high CAGR rates reflect the rapid modernization of education systems and increasing investment in training and enterprise collaboration technology.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Interactive Whiteboard Market

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Microsoft Corporation

- ViewSonic Corporation

- Epson Corporation

- Ricoh Company Ltd.

- Promethean Limited

- Panasonic Corporation

- BenQ Corporation

- Boxlight Corporation

- Hitachi Ltd.

- SMART Technologies ULC

- Newline Interactive Inc.

- Cisco Systems Inc.

- Google LLC

Recent Developments

- June 2025 – Samsung Electronics launched a new interactive display series with AI-powered gesture recognition and cloud sync for education institutions in the Asia Pacific.

- May 2025 – Microsoft integrated Teams Whiteboard collaboration features with its Surface Hub product line to enhance hybrid workplace collaboration.

- March 2025 – SMART Technologies announced a strategic partnership with Google for cloud classroom integration and AI-driven analytics for education deployments.

- February 2025 – Epson Corporation introduced eco-efficient laser projection interactive systems targeted at low-cost education markets in Africa and Latin America.