Intelligent Assistant Embedded Consumer Devices Market Size

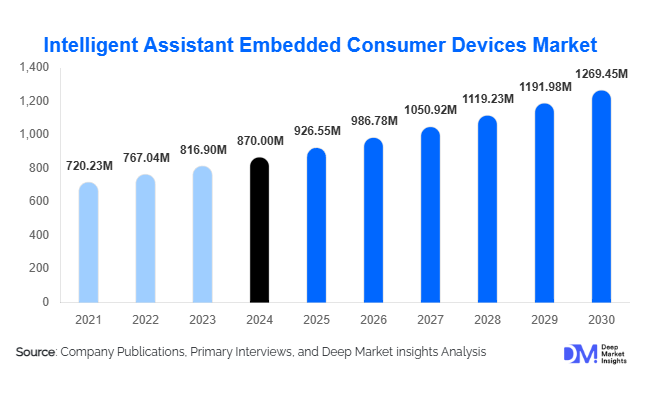

According to Deep Market Insights, the global Intelligent Assistant Embedded Consumer Devices Market was valued at USD 870 million in 2024 and is projected to grow from USD 926.55 million in 2025 to reach USD 1,269.45 million by 2030, expanding at a CAGR of 6.5 % during 2025–2030. Market growth is being propelled by the rising integration of AI-powered assistants across consumer electronics, rapid adoption of smart-home ecosystems, and technological advances in natural language processing (NLP) and on-device AI that enable more intuitive, voice-driven interaction with everyday products.

Key Market Insights

- Embedded intelligent assistants are moving beyond smart speakers into appliances, entertainment systems, PCs, and mobile devices, creating multi-device, voice-driven ecosystems.

- Voice recognition remains the dominant interaction mode, accounting for over one-third of the 2024 market as users increasingly expect hands-free device control.

- North America leads globally with about 35 % market share in 2024, driven by early adoption of AI-enabled home automation and premium smart devices.

- Asia-Pacific is the fastest-growing region, led by China, India, and South Korea, where localized language assistants and affordable devices are accelerating penetration.

- Smart-home appliances dominate by device type, holding roughly a 40 % share in 2024 as consumers upgrade household products with built-in assistants.

- Privacy-enhancing AI and on-device data processing are becoming key differentiators amid rising user and regulatory concerns over data security.

Latest Market Trends

Smart-Home Ecosystem Integration

Manufacturers are increasingly embedding intelligent assistants across smart-home ecosystems, connecting lighting, security, HVAC, and entertainment systems through unified AI interfaces. Consumers can now manage home environments via voice or contextual cues, while manufacturers benefit from ecosystem lock-in and recurring software updates. Integration with standards such as Matter and Zigbee is improving cross-brand compatibility, encouraging multi-device purchases and deeper platform loyalty.

On-Device AI and Edge Processing

A major shift toward edge computing enables intelligent assistants to function with reduced cloud dependency. Devices equipped with on-device AI chips process speech, intent, and contextual data locally, ensuring faster responses, enhanced privacy, and lower bandwidth consumption. This trend supports growth in privacy-sensitive regions and applications where connectivity is inconsistent, and is driving demand for semiconductor innovation in low-power AI processors for consumer devices.

Intelligent Assistant Embedded Consumer Devices Market Drivers

Proliferation of Voice-Enabled Consumer Electronics

Voice control has become a default expectation across smartphones, TVs, appliances, and automobiles. As consumers adopt voice assistants for daily tasks setting timers, playing music, or controlling smart-home systems, OEMs are embedding assistants directly into their devices. This behavioral normalization of voice interaction fuels sustained demand across multiple product categories.

Rapid Expansion of Smart-Home Infrastructure

Growing adoption of connected devices and IoT networks has transformed homes into automated ecosystems. Embedded intelligent assistants serve as the central interface linking disparate devices. The expansion of broadband and 5G connectivity further strengthens this trend by enabling seamless, low-latency communication between devices and the cloud.

Technological Maturity in NLP and Machine Learning

Advances in speech recognition, contextual reasoning, and multilingual NLP have significantly enhanced assistant performance. Improved accuracy and natural responses have increased consumer trust and engagement, supporting device upgrade cycles and brand differentiation.

Market Restraints

Data Privacy and Security Concerns

Always-listening devices raise ongoing privacy debates. Regulatory frameworks such as GDPR and CCPA impose strict compliance requirements on manufacturers. Breaches or misuse of voice data can erode consumer confidence, slowing adoption and elevating compliance costs.

Fragmented Ecosystem and Interoperability Issues

Multiple proprietary ecosystems create compatibility barriers. Consumers experience friction when assistants from different brands fail to coordinate devices or services. This fragmentation limits scalability and increases integration costs for manufacturers aiming to serve cross-platform users.

Intelligent Assistant Embedded Consumer Devices Market Opportunities

Emerging-Market Expansion

Rapid urbanization, increasing disposable incomes, and smartphone proliferation in Asia-Pacific, Latin America, and the Middle East & Africa present major growth opportunities. Localized voice assistants supporting regional languages can unlock vast new consumer bases. Strategic partnerships with telecom operators and e-commerce platforms are facilitating affordable device access.

Next-Generation Embedded Intelligence

Integrating advanced AI features, context awareness, predictive learning, and emotion recognition will differentiate premium devices. Manufacturers investing in AI hardware acceleration and edge-ML frameworks can offer responsive, offline-capable assistants suited for privacy-conscious users, thereby capturing the high-margin segment.

Cross-Industry Collaboration and Service Integration

Partnerships between consumer-electronics OEMs, AI software developers, and cloud providers are unlocking new service ecosystems. Embedded assistants are increasingly linking with e-commerce, healthcare, and mobility services to deliver personalized, transaction-ready experiences directly from household devices.

Product Type Insights

Household Devices, including smart refrigerators, ovens, washing machines, and thermostats, dominate with around 40 % share of 2024 revenues. Consumers increasingly favor appliances with built-in AI assistants for convenience and automation. Mobile devices and smart TVs form the second-largest segment, driven by integration with leading assistants such as Siri, Google Assistant, and Alexa.

Technology Insights

Voice Recognition & Speech Interfaces lead with about 35 % market share in 2024. Mature voice AI frameworks and widespread developer support have made speech recognition the most accessible and reliable interface. Natural-language processing and embedded machine-learning capabilities are expected to gain share through 2030 as on-device AI chips scale.

Application Insights

Household/Residential Use accounts for nearly 60 % of market demand. Consumers prefer seamless, voice-driven device coordination for entertainment, lighting, and climate control. Commercial adoption is growing in hotels, offices, and retail kiosks where embedded assistants enhance customer engagement and service efficiency.

Distribution Channel Insights

Online sales represent about 55 % of the 2024 market as e-commerce platforms dominate smart-device retailing. Online distribution allows real-time product comparisons, easy firmware updates, and bundled ecosystem offers. Offline retail remains relevant for premium appliances requiring demonstrations or installation support.

| By Product Type | By Application | By Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 35 % of the 2024 market, led by the U.S. High consumer spending power, early smart-home adoption, and entrenched players such as Apple, Amazon, and Google drive dominance. Continued upgrades to Wi-Fi and 5G infrastructure sustain market momentum.

Europe

Europe contributes around 22 % of global revenue in 2024. The U.K., Germany, and France lead adoption, supported by strong interest in privacy-compliant AI and sustainability-certified electronics. The EU’s digital-sovereignty agenda promotes domestic AI development and open-standard devices, fostering long-term stability.

Asia-Pacific

Asia-Pacific (25-30 % share in 2024) is the fastest-growing region. China and India are central to volume growth through localized assistants and government-backed smart-manufacturing initiatives. Japan and South Korea lead in advanced AI R&D and semiconductor integration, strengthening regional supply chains.

Latin America

Accounting for 5-10 % of 2024 revenues, Latin America is expanding steadily, with Brazil as the largest market. Rising connectivity, growing middle-class demand for affordable smart appliances, and increased e-commerce penetration support regional growth.

Middle East & Africa

MEA represents 3-5 % of the 2024 share, led by GCC countries and South Africa. Government smart-city initiatives, such as the UAE Vision 2031 and Saudi Arabia’s NEOM project, are driving the adoption of AI-enabled consumer devices for residential and public infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Intelligent Assistant Embedded Consumer Devices Market

- Apple Inc.

- Google LLC

- Amazon.com Inc.

- Microsoft Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Sony Corporation

- Intel Corporation

- Lenovo Group Limited

- HP Inc.

- Dell Technologies Inc.

- Xiaomi Corporation

- Panasonic Corporation

- Bosch GmbH (Home Appliances)

- Philips N.V.

Recent Developments

- In September 2025, Apple Inc. unveiled an upgraded on-device Siri engine enabling offline AI processing for iPhones and Macs, reinforcing privacy compliance and response speed.

- In June 2025, Samsung Electronics expanded Bixby’s integration across home appliances under its SmartThings platform, strengthening cross-device interoperability.

- In March 2025, Google LLC introduced localized Google Assistant support for Hindi and Arabic in smart-home devices, targeting emerging-market expansion.

- In January 2025, Microsoft Corporation partnered with LG to embed Copilot AI across premium smart TVs and PCs for unified productivity and entertainment experiences.