Insulated Dog House Market Size

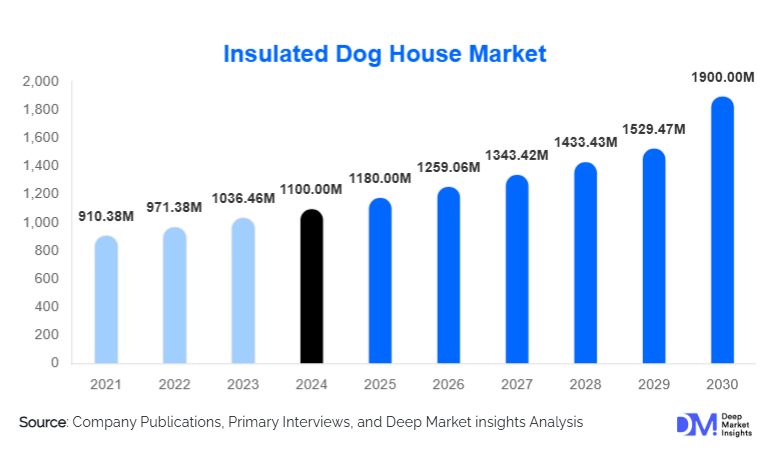

According to Deep Market Insights, the global insulated dog house market size was valued at USD 1,100 million in 2024 and is projected to grow from USD 1,180 million in 2025 to reach USD 1,900 million by 2030, expanding at a CAGR of 6.7% during the forecast period (2025–2030). The market growth is primarily driven by rising pet ownership worldwide, increasing awareness of pet welfare in extreme weather, and the growing demand for premium, eco-friendly, and smart insulated dog houses.

Key Market Insights

- Residential demand dominates the market, with homeowners increasingly investing in insulated dog houses to ensure their pets’ comfort and protection from harsh climates.

- Premium wooden and foam-insulated dog houses are leading the segment, offering durability, aesthetic appeal, and high thermal efficiency.

- North America holds the largest market share, with the U.S. being the primary consumer of high-end insulated dog houses.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes and increasing urban pet adoption in China, India, and Southeast Asia.

- Technological adoption, including IoT-based temperature control, automated ventilation, and smart heating/cooling, is transforming premium offerings.

- Eco-friendly and sustainable materials, such as recycled plastics and treated wood, are becoming increasingly important for environmentally conscious consumers.

What are the latest trends in the insulated dog house market?

Smart & Climate-Adaptive Dog Houses

Manufacturers are increasingly integrating smart technologies into insulated dog houses. Temperature sensors, automated ventilation, heating pads, and remote monitoring features allow pets to remain comfortable in extreme weather conditions. These smart solutions appeal to premium buyers, particularly in regions with cold winters or hot summers. Solar-powered heating systems and retractable vents are emerging as innovative solutions that combine sustainability with comfort, offering added convenience and premium pricing opportunities for manufacturers.

Sustainable & Eco-Friendly Materials

Eco-conscious consumers are driving demand for dog houses made from sustainable materials, such as recycled plastics, engineered wood, and natural fiber composites. Many brands now market certifications or eco-labels highlighting environmental compliance and non-toxic materials. This trend is especially strong in Europe and North America, where buyers prioritize safety and sustainability alongside insulation performance. Combining eco-friendly materials with thermal efficiency allows manufacturers to differentiate products and capture premium market share.

What are the key drivers in the insulated dog house market?

Rising Global Pet Ownership

The increasing number of households owning dogs worldwide is a primary growth driver. Dogs are increasingly treated as family members, prompting owners to invest in insulated dog houses for enhanced comfort and protection. Urbanization, disposable income growth, and changing lifestyles are fueling demand for mid- to high-end insulated dog houses, particularly in North America, Europe, and emerging markets in the Asia-Pacific.

Awareness of Pet Welfare and Safety

Pet owners are more aware of the dangers associated with extreme weather, including heatstroke, hypothermia, and dampness-related health issues. This awareness drives demand for insulated dog houses with superior thermal protection, weatherproofing, ventilation, and hygiene. Government welfare regulations in developed markets further encourage adoption in both residential and commercial applications, such as shelters and kennels.

Innovations in Materials and Design

Advances in insulation materials, such as polyurethane foam, reflective insulation, and hybrid composites, improve thermal performance while maintaining durability and lightweight construction. Manufacturers are also offering customizable designs, modular systems, and premium aesthetics to meet consumer preferences, creating opportunities for product differentiation and higher pricing in the market.

What are the restraints for the global market?

High Product Costs

Insulated dog houses are significantly more expensive than standard, uninsulated models. Premium materials, smart features, and eco-friendly certifications add to production costs, limiting adoption among price-sensitive consumers in emerging markets. Cost remains a barrier for mass-market penetration.

Raw Material Price Volatility and Regulatory Pressures

Fluctuating prices of wood, insulation foam, plastics, and other components can impact profit margins. Additionally, environmental and safety regulations related to materials (e.g., non-toxic coatings, low-VOC insulation) require compliance investments, increasing production complexity and limiting rapid expansion in some regions.

What are the key opportunities in the insulated dog house market?

Integration of Smart and IoT Features

Smart dog houses that monitor temperature, control heating/cooling, and offer remote connectivity present a lucrative opportunity. Consumers in North America and Europe increasingly seek premium solutions that ensure their pets' safety and comfort, creating demand for technology-enhanced products with higher margins.

Expansion into Emerging Markets

Asia-Pacific and Latin America offer high growth potential due to rising middle-class income, urban pet ownership, and exposure to premium products. Localized designs for climate adaptation, affordability, and aesthetics can help manufacturers capture new consumer segments and expand export-driven demand.

Adoption of Sustainable Materials

Eco-friendly insulated dog houses meet growing consumer demand for environmentally responsible products. Manufacturers focusing on recycled plastics, engineered wood, and biodegradable materials can differentiate themselves in competitive markets and comply with evolving environmental standards, creating long-term growth opportunities.

Product Type Insights

Wooden insulated dog houses dominate the market due to their natural aesthetics, superior thermal insulation, and premium appeal. Foam insulation is the preferred choice among manufacturers for its high R-value, lightweight construction, and ease of installation. Medium-sized houses (25–70 lbs) account for the largest segment by volume and value, meeting the needs of the most common pet sizes globally.

Application Insights

Residential applications dominate, accounting for over 70% of the market, driven by homeowners investing in outdoor or garden dog shelters. Commercial applications, including kennels, veterinary clinics, and pet hotels, are growing steadily due to welfare regulations and the need for durable, easy-to-maintain insulated structures. Emerging applications include working dogs, urban terrace installations, and NGO-funded shelter programs.

Distribution Channel Insights

Online retail dominates the market, providing a broad geographic reach and access to multiple variants with detailed specifications. Specialty pet stores, home improvement chains, and direct-to-consumer models remain significant, particularly for premium and customized insulated dog houses. E-commerce platforms enhance convenience, comparison shopping, and timely delivery, accelerating market adoption in both developed and emerging markets.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (35–40%), with the U.S. leading demand for premium, smart, and eco-friendly insulated dog houses. High disposable income, urban pet adoption, and strong welfare awareness drive residential and commercial adoption. Canada represents a smaller but premium-focused market, particularly for cold-weather adaptations.

Europe

Europe accounts for 25–30% of the global market, led by Germany, the UK, France, and Scandinavia. High environmental awareness, strong animal welfare regulations, and a reference for sustainable materials drive demand. Northern European countries also have higher adoption of insulated and climate-controlled designs due to colder weather.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with rising demand from China, India, Japan, Australia, and Southeast Asia. Increasing urban pet ownership, rising disposable income, and exposure to global premium products fuel adoption. Manufacturers are localizing designs to meet climatic conditions and cost sensitivities.

Latin America

Latin America, including Brazil, Mexico, and Argentina, shows growing interest in insulated dog houses. Outbound travel-inspired lifestyles and increasing urban pet adoption are driving mid-range product growth. Affordability remains a key factor in product design and marketing.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is a niche premium market driven by high-income pet owners. Africa remains the home of local production and export of insulated dog houses. Harsh climatic conditions and luxury market focus define growth patterns in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Insulated Dog House Market

- Petmate

- ASL Solutions

- Ware Pet Products

- Blythe Wood Works

- Northland Pet Supply

- Trixie Pet Products

- K&H Pet Products

- Petsfit

- Suncast

- Pets Imperial

- Holly & Joe Pet Products

- Outback Pet Products

- Petmaker

- Petloungers

- Precision Pet Products

Recent Developments

- In March 2025, Petmate launched a premium line of smart insulated dog houses with IoT-enabled temperature monitoring and automated ventilation.

- In January 2025, K&H Pet Products introduced eco-friendly wooden dog houses with recycled foam insulation for the North American market.

- In November 2024, Ware Pet Products expanded manufacturing in Asia-Pacific to meet rising demand for mid-range insulated dog houses, incorporating solar-powered heating features.