Insect Screen Market Size

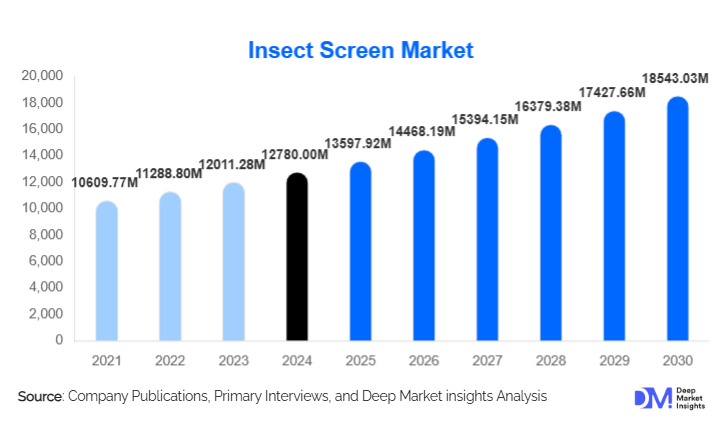

According to Deep Market Insights, the global insect screen market size was valued at USD 12,780 million in 2024 and is projected to grow from USD 13,597.92 million in 2025 to reach USD 18,543.03 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The insect screen market growth is primarily driven by rising health awareness related to insect-borne diseases, increasing residential and commercial construction, and the growing adoption of premium retractable and smart insect screen systems across global markets.

Key Market Insights

- Growing focus on health, hygiene, and indoor air quality is boosting the adoption of insect screens in residential and institutional buildings.

- Retractable and motorized insect screens are gaining strong traction due to enhanced aesthetics, convenience, and compatibility with smart homes.

- Asia-Pacific leads the global market, driven by rapid urbanization, higher insect prevalence, and expanding middle-class homeownership.

- North America exhibits strong replacement and retrofit demand supported by home improvement spending and established building standards.

- Fiberglass mesh remains the most widely used material, though premium aluminium and stainless-steel meshes are gaining share.

- Online and DIY distribution channels are expanding rapidly as consumers prefer easy-to-install, cost-effective screen kits.

Latest Market Trends

Premium Retractable and Smart Screens on the Rise

Consumers are increasingly transitioning from traditional fixed insect screens to retractable, pleated, and motorised systems that blend aesthetics with functionality. These screens offer greater convenience, disappear when not in use, and integrate seamlessly with large patio doors and modern architectural designs. Manufacturers are introducing remote-controlled, sensor-operated, and automated systems compatible with smart-home ecosystems. This evolution elevates consumer experience while creating higher-margin opportunities for manufacturers and installers.

Shift Toward Eco-Friendly and High-Performance Materials

Sustainability is reshaping product development in the insect screen market. Makers are adopting recyclable aluminium frames, low-VOC coatings, and durable, UV-resistant mesh materials. Advanced stainless-steel and coated mesh solutions are emerging to provide enhanced ventilation, tear resistance, and long service life, especially in coastal or industrial settings. Simultaneously, eco-conscious consumers are driving demand for biodegradable and environmentally friendly screening materials in residential and institutional applications.

Insect Screen Market Drivers

Surging Demand for Healthy and Pest-Free Indoor Environments

Growing awareness of vector-borne diseases such as dengue, malaria, and Zika has significantly increased the adoption of insect screens in tropical and subtropical regions. Households and commercial properties are prioritising pest-control solutions that support natural ventilation without compromising comfort. Governments and health agencies are also promoting insect barriers in public buildings, schools, and hospitals to reduce disease transmission. This shift has made insect screens a standard component of new construction and renovation projects.

Expansion of Residential and Commercial Construction

Booming construction activity, particularly in Asia-Pacific, Latin America, and the Middle East, is fueling the installation of insect screens in newly built homes, apartments, hotels, and commercial spaces. Rising disposable incomes and the desire for improved living standards are accelerating the adoption of higher-end products such as retractable and pleated screens. In mature markets like North America and Europe, home renovation and energy-efficient retrofits are driving replacement demand, strengthening long-term market growth.

Market Restraints

Price Sensitivity in Developing Regions

High initial costs of premium and motorised insect screen systems limit their penetration in low-income and price-sensitive markets. Consumers in developing countries often rely on cheaper alternatives such as mosquito nets, insecticides, or low-quality mesh products, which slows adoption of durable, high-performance screens. Installation complexity and lack of standard window dimensions in older buildings further increase costs, restricting widespread uptake in retrofit applications.

Maintenance and Replacement Challenges

Insect screens require periodic cleaning, mesh replacement, and frame repairs, factors that may discourage adoption among consumers unfamiliar with long-term maintenance obligations. In areas with harsh climates, humidity, or dust, mesh materials deteriorate more rapidly, increasing upkeep costs. Moreover, non-standardised openings in older buildings demand customised fabrication, raising installation times and complicating large-scale adoption.

Insect Screen Market Opportunities

Technologically Advanced Smart Screening Systems

The rise of smart homes presents a significant opportunity for manufacturers to introduce IoT-enabled insect screens featuring sensors, remote controls, and automated retraction. These solutions align with premium residential developments and luxury commercial spaces, offering enhanced convenience and seamless integration with home-automation platforms. Smart insect screens also appeal strongly to tech-savvy homeowners seeking modern design and enhanced functionality.

Growing Demand for Sustainable Construction Solutions

Green building certifications and eco-conscious construction practices are creating new demand for insect screens made from recyclable or biodegradable materials. Manufacturers offering low-carbon production, environmentally friendly mesh coatings, and energy-efficient ventilation advantages can differentiate strongly in the market. Public infrastructure projects, including schools and healthcare facilities, are increasingly specifying eco-safe and durable screen systems, expanding long-term opportunity.

Product Type Insights

Retractable insect screens dominate the market owing to their superior convenience, space-saving design, and premium appeal. These systems are popular in modern residential developments with large openings and sliding doors. Fixed screens remain widely used in budget and mid-range installations due to low cost and easy availability. Pleated screens are gaining momentum in commercial and industrial settings due to enhanced durability. Magnetic and DIY snap-on screens continue to attract cost-conscious consumers seeking quick installation solutions without professional assistance. Motorized screens represent a fast-growing premium niche, supported by rising smart-home integration.

Application Insights

Residential applications account for the largest share of insect screen installations, driven by home construction, modernization, and rising consumer awareness regarding indoor comfort. Commercial applications, including hotels, restaurants, offices, and retail spaces, are rapidly adopting high-performance and aesthetically refined screen systems. Industrial settings such as warehouses and food-processing units require durable, contamination-resistant screens to ensure compliance with hygiene standards. Agricultural and greenhouse applications are expanding as farmers adopt mesh solutions to protect crops and livestock from pests while maintaining ventilation.

Distribution Channel Insights

Indirect sales through dealers, distributors, and retail outlets dominate the insect screen market, particularly for mid-range and budget installations. The rapid rise of e-commerce platforms is reshaping consumer buying behavior, with DIY screen kits and customizable online ordering becoming mainstream. Direct sales channels remain important for large commercial and industrial projects, where specialized installation expertise is required. Online product configurators, virtual measuring tools, and video-assisted installation guides are driving digital engagement and simplifying customer decision-making.

End-User Insights

Homeowners and residential builders represent the core customer base for insect screens, with growing preference for premium retractable and aesthetically integrated systems. Commercial property developers, including hospitality chains and restaurant operators, prioritize durable, visually appealing screens that align with interior design. Institutional users such as hospitals, schools, and government buildings adopt insect screens to meet health, safety, and compliance standards. Agricultural end-users rely on insect screens to safeguard crop environments, reduce pesticide use, and improve yield quality.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America maintains a strong demand driven by high home-improvement spending, established building regulations, and widespread adoption of window and door screens. The U.S. leads the region with a large retrofit market supported by DIY culture and digital retail channels. Increased preference for high-end retractable and motorized screens is supporting premium segment growth.

Europe

Europe shows a strong interest in energy-efficient, sustainable building materials, driving the adoption of eco-friendly insect screens. Countries such as Germany, the U.K., and Italy lead installations, particularly in hospitality and residential refurbishments. The region is transitioning toward advanced pleated and retractable systems that complement minimalist architectural trends.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing regional market, supported by rapid urbanization, rising disposable incomes, and high insect prevalence. China and India lead demand, while Japan, South Korea, and Southeast Asia show a strong inclination toward premium and smart screen technologies. Residential construction booms and government-backed housing programs significantly strengthen regional market expansion.

Latin America

Countries such as Brazil, Mexico, and Argentina are experiencing increasing adoption of insect screens as households prioritize protection from pests and heat. Affordability remains important, boosting demand for fiberglass and magnetic screens. Commercial installations in hospitality and retail environments are gradually increasing as awareness rises.

Middle East & Africa

High temperatures and insect prevalence make insect screens increasingly essential across the Middle East & Africa. GCC countries, including the UAE and Saudi Arabia, are adopting premium retractable systems in modern residential and commercial developments. African nations are witnessing rising installations in public health buildings and homes to reduce the spread of vector-borne diseases, supported by government initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Insect Screen Market

- Saint-Gobain ADFORS

- Phifer Incorporated

- Magicseal

- American Screen Company

- Excel Design Studio

- Freedom Retractable Screens

- Progressive Screens

- RajFilters

- Pronema

- Larson Manufacturing

Recent Developments

- In March 2025, Saint-Gobain ADFORS introduced a new eco-friendly fiberglass mesh line with enhanced UV resistance and recyclable components.

- In January 2025, Phifer Inc. expanded its retractable screen manufacturing facility in Alabama to meet rising U.S. replacement demand.

- In November 2024, Freedom Screens launched its next-generation motorized insect screen system compatible with major smart-home automation platforms.