Infrared Sauna Market Size

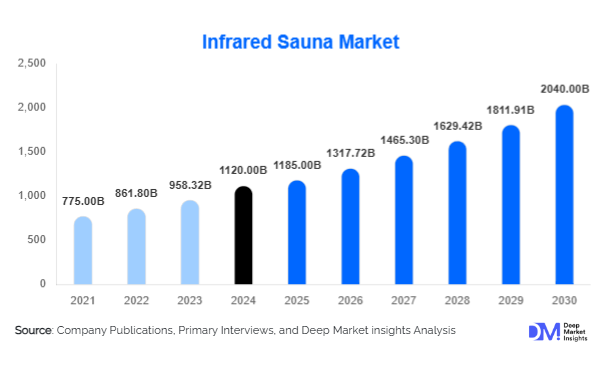

According to Deep Market Insights, the global infrared sauna market size was valued at USD 1,120 million in 2024 and is projected to grow from USD 1,185 million in 2025 to reach USD 2,040 million by 2030, expanding at a CAGR of 11.2% during the forecast period (2025-2030). The growth of the infrared sauna market is driven by rising health and wellness awareness, increasing adoption of at-home wellness solutions, and growing popularity of non-invasive therapies for pain relief and detoxification across both developed and emerging economies.

Key Market Insights

- Health-conscious consumers are increasingly seeking non-invasive, stress-relief, and detoxification solutions, fueling demand for infrared saunas at homes and wellness centers.

- Technological advancements in infrared sauna designs, including full-spectrum, carbon fiber, and portable models, are enhancing consumer adoption worldwide.

- North America dominates the infrared sauna market, with the U.S. accounting for a substantial share due to high disposable income and increasing wellness expenditure.

- Europe is emerging as a fast-growing region, supported by strong adoption in Germany, the U.K., and Scandinavian countries due to wellness-oriented lifestyles and spa culture.

- Asia-Pacific is witnessing rising demand, led by increasing urban middle-class populations in China and India, and the proliferation of fitness and wellness centers.

- Integration of smart and IoT-enabled saunas is shaping consumer preferences, providing personalized experiences and remote monitoring features.

What are the emerging trends shaping the future of the infrared sauna market?

At-Home Wellness Solutions

Consumers are increasingly investing in at-home wellness solutions, driven by lifestyle changes and health consciousness. Infrared saunas designed for domestic use, including compact and portable models, are gaining traction among urban households. The convenience of having a personal wellness space, coupled with the rising awareness of the health benefits of infrared therapy, is encouraging adoption. Manufacturers are offering smart features like app-controlled temperature settings, chromotherapy lights, and automated timers, enhancing consumer engagement and usability. This trend is particularly strong in North America and Europe, where home wellness is a growing lifestyle segment.

Full-Spectrum and Technologically Advanced Saunas

Full-spectrum infrared saunas, which provide near, mid, and far-infrared rays, are increasingly preferred due to their broader therapeutic benefits, including improved circulation, detoxification, and pain relief. Advanced features such as low-EMF technology, Bluetooth connectivity, and energy-efficient heating panels are becoming standard in high-end models. These innovations cater to consumers seeking premium wellness experiences and contribute to market differentiation among leading brands.

What are the key growth drivers that will impact the infrared sauna market?

Rising Health and Wellness Awareness

Growing awareness of health, fitness, and mental well-being is a primary driver for the infrared sauna market. Consumers are increasingly adopting preventive healthcare measures, including regular detoxification, stress management, and muscle recovery routines. Infrared saunas offer non-invasive solutions to address these needs, supporting demand in residential, commercial, and medical applications.

Increasing Adoption in Commercial and Fitness Sectors

Wellness centers, spas, gyms, and medical clinics are increasingly integrating infrared saunas into their offerings to provide holistic services. Commercial adoption is driven by the growing popularity of fitness programs and recovery therapies. Clinics also utilize infrared saunas for pain management and rehabilitation, further expanding market opportunities. High-end gyms and wellness resorts offer premium infrared sauna experiences to attract health-conscious clients, particularly in North America and Europe.

Technological Advancements in Infrared Sauna Design

Innovations such as energy-efficient carbon fiber panels, low-EMF emission technology, and smart sauna solutions with app integration are attracting tech-savvy consumers. Enhanced design, portability, and customizable features have increased appeal for both home and commercial users, enabling new growth avenues and product differentiation.

What are the main challenges restraining the global infrared sauna market?

High Initial Costs

The high upfront cost of infrared saunas, particularly premium full-spectrum and technologically advanced models, remains a barrier for widespread adoption. Although long-term health benefits are recognized, consumers and small wellness centers often perceive the initial investment as prohibitive.

Lack of Awareness in Emerging Markets

In regions such as parts of Asia-Pacific, Africa, and Latin America, limited awareness of infrared sauna benefits and underdeveloped wellness infrastructure can restrict market penetration. Consumers in these regions may prefer traditional wellness therapies over modern infrared solutions, posing a challenge for manufacturers and distributors.

What Strategic opportunities exist for businesses in the infrared sauna industry?

Integration with Fitness and Rehabilitation Programs

Infrared saunas are increasingly being integrated into fitness and rehabilitation programs for athletes, physiotherapy clinics, and wellness resorts. The combination of sauna therapy with post-exercise recovery, muscle relaxation, and pain management creates cross-sector demand. This trend opens new revenue streams for manufacturers targeting commercial wellness sectors.

Rising Demand in Emerging Markets

Rapid urbanization and rising disposable incomes in emerging economies such as China, India, Brazil, and the Middle East are creating growth opportunities for infrared sauna adoption. Increasing awareness of preventive health and lifestyle wellness, coupled with a growing fitness culture, supports new market expansion. Partnerships with local distributors and fitness centers are expected to accelerate market penetration.

Smart and IoT-Enabled Sauna Solutions

With the increasing adoption of smart home technologies, manufacturers have an opportunity to develop connected infrared sauna solutions. Features such as remote temperature control, usage tracking, and integration with wellness apps enhance user engagement and create differentiation in a competitive landscape. This technological shift is expected to drive consumer preference and encourage premium pricing strategies.

Product Type Insights

Carbon fiber infrared saunas dominate the market due to their energy efficiency, faster heating, and affordability. They accounted for nearly 42% of the global market in 2024, driven by high demand for residential and compact models. Full-spectrum saunas, offering near, mid, and far-infrared benefits, are rapidly gaining traction in premium wellness centers and commercial applications, representing 28% of the 2024 market. Ceramic panel saunas hold a smaller share (around 15%), primarily due to higher costs and slower heating times, while portable and modular saunas are emerging in niche segments for flexible at-home use.

Application Insights

The health and wellness application segment dominates the infrared sauna market, contributing around 50% of revenue in 2024. This includes at-home usage, spa treatments, and commercial wellness centers. Sports recovery and physiotherapy applications are growing, particularly in developed markets, as athletes and medical professionals adopt infrared therapy for rehabilitation and injury management. Weight loss and detoxification-focused applications are also rising, creating cross-sector growth potential in both consumer and commercial segments.

Distribution Channel Insights

Online retail platforms dominate infrared sauna sales, accounting for over 45% of 2024 revenue, due to the convenience of direct-to-consumer ordering and access to multiple brands. Specialty wellness retailers, fitness centers, and spa chains contribute around 35%, particularly in regions with strong commercial adoption. Direct manufacturer sales and showroom channels account for the remainder, primarily in high-end markets where consumers prefer on-site demonstrations and consultations. Emerging subscription and rental models for infrared saunas are creating new avenues for consumer engagement, particularly in urban regions.

End-Use Insights

Residential end users account for the largest share of the infrared sauna market, around 55% in 2024, driven by urban households and wellness-conscious consumers. Commercial end users, including spas, wellness centers, and gyms, represent approximately 30% of the market. Medical and rehabilitation centers are emerging end-use segments, expected to grow at a CAGR of 12-13% during 2025-2030 due to increasing adoption of infrared therapy for pain management and physiotherapy. Export-driven demand is rising, particularly from North America and Europe to Asia-Pacific and Latin America, highlighting global growth potential for manufacturers targeting multiple regions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at 38% in 2024, with the U.S. driving demand due to high wellness awareness, disposable incomes, and spa culture. Canada contributes moderately, with rising adoption in urban centers. The region is expected to continue growing steadily, with premium and home-use saunas leading consumption.

Europe

Europe represents approximately 30% of the market in 2024, led by Germany, the U.K., and Scandinavia. High adoption of wellness therapies, strong disposable incomes, and eco-conscious consumer preferences support growth. The region is also witnessing the rapid adoption of full-spectrum and smart saunas, making it a fast-growing market segment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan leading expansion. Rapid urbanization, rising middle-class populations, and increasing wellness adoption drive growth. CAGR in the region is projected at 13-14% between 2025-2030.

Latin America

Latin America is gradually adopting infrared saunas, with Brazil, Mexico, and Argentina as key markets. Demand is largely driven by urban wellness centers and high-income households.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is growing due to high disposable income and luxury wellness adoption. Africa has limited market penetration but shows emerging potential in South Africa and Nigeria through commercial wellness centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Infrared Sauna Market

- Sunlighten

- Clearlight Saunas

- Health Mate Saunas

- JNH Lifestyles

- Dynamic Saunas

- Radiant Health Saunas

- TheraSauna

- Golden Designs

- Finnleo

- Almost Heaven Saunas

- Maxxus Sauna

- Durherm

- Vital Health Saunas

- Helo Sauna

- Finnmark Saunas

Recent Developments

- In March 2025, Sunlighten launched a new full-spectrum infrared sauna with app-controlled settings and integrated wellness tracking.

- In January 2025, Clearlight Saunas expanded manufacturing in Europe to meet rising demand for premium residential and spa installations.

- In December 2024, Health Mate Saunas introduced portable and low-EMF infrared saunas targeting compact urban homes and fitness studios.