Inflatable Toys Market Size

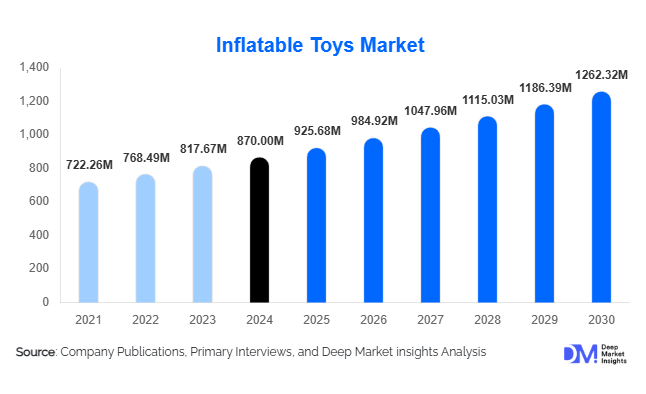

According to Deep Market Insights, the global inflatable toys market size was valued at USD 870.00 million in 2024 and is projected to grow from USD 925.68 million in 2025 to reach USD 1,262.32 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). Market growth is driven by increasing consumer spending on leisure and home entertainment, the expansion of event-rental applications, and continuous innovation in materials and design, enabling safer, more durable, and eco-friendly products.

Key Market Insights

- Inflatable pools dominate global product demand, accounting for over 30% of total sales due to their affordability and family appeal.

- Residential use remains the largest application segment, driven by rising backyard leisure and home-entertainment trends.

- Online retail channels are expanding rapidly, representing about 30% of global sales as e-commerce platforms enable broader accessibility and price transparency.

- Asia-Pacific is the fastest-growing regional market, supported by rising middle-class incomes and growing interest in family leisure activities.

- Eco-friendly materials and sustainable manufacturing are reshaping industry practices, with PVC-free and recycled materials gaining traction.

- Commercial event and amusement applications are emerging as high-margin growth areas as rental companies invest in large-format inflatables for parks and events.

Latest Market Trends

Eco-Friendly and Sustainable Materials

Manufacturers are increasingly shifting toward eco-conscious production, replacing traditional PVC with recyclable and non-toxic materials. Sustainability initiatives include the adoption of water-based inks, biodegradable coatings, and recycled fabrics. This trend responds to growing environmental awareness among consumers and stricter global regulations on plastic usage. Companies investing in sustainable materials not only differentiate themselves but also meet compliance requirements in key markets such as the EU and North America.

Technology-Enabled Inflatables

Integration of technology into inflatable toys is gaining popularity. Smart inflatables featuring built-in lighting, sensors, and Bluetooth connectivity enhance user experience, particularly for interactive play and event applications. Augmented reality (AR) and mobile companion apps are being introduced to extend engagement, allowing users to gamify pool or backyard experiences. Manufacturers are also leveraging automation and 3D digital printing to improve design precision and reduce production waste.

Inflatable Toys Market Drivers

Growing Leisure and Home-Entertainment Expenditure

Rising disposable income and a focus on “fun-at-home” experiences are fueling demand for inflatable toys worldwide. Families are increasingly investing in backyard recreation options such as pools, slides, and bounce houses, particularly after global lockdowns reinforced at-home entertainment culture. Seasonal trends and promotional e-commerce sales continue to bolster this segment.

Expansion of Event-Rental and Commercial Use

The event-rental industry is driving strong B2B demand for large-scale inflatables used in parties, amusement parks, and festivals. Commercial inflatables generate higher margins, with demand for custom-themed structures, obstacle courses, and corporate branding installations. The increasing frequency of public events and outdoor entertainment activities in both developed and emerging markets contributes to sustained growth.

Product Innovation and Thematic Licensing

Product diversification through licensed characters, movie themes, and advanced design elements has elevated the appeal of inflatable toys. Innovations in safety valves, reinforced seams, and durable materials are expanding lifespan and consumer confidence. Collaborations with entertainment brands and film studios continue to generate strong retail momentum globally.

Market Restraints

Safety and Durability Concerns

Safety remains a significant restraint as inflatables pose risks of puncture, air leaks, and injuries if poorly manufactured or used improperly. Regulatory scrutiny, particularly in Europe and North America, is increasing the costs for compliance testing and certification. Maintaining consistent quality across global supply chains presents an ongoing challenge for manufacturers.

Raw-Material Price Volatility

The heavy dependence on PVC, vinyl, and petroleum-derived raw materials exposes manufacturers to price fluctuations. Global polymer price swings and shipping cost variations can significantly impact profit margins. Transitioning to sustainable materials also entails higher initial investment and R&D expenditure.

Inflatable Toys Market Opportunities

Emerging Market Expansion

Rapid urbanization and income growth in Asia-Pacific, Latin America, and Africa create untapped potential for inflatable toy penetration. Tailored products for tropical climates and local distribution partnerships offer entry opportunities. Localization strategies and affordable pricing models are critical for success in these high-growth regions.

Institutional and Commercial Adoption

Schools, resorts, and event companies are increasingly incorporating inflatable structures for play zones, brand activations, and temporary installations. This institutional adoption offers consistent, bulk-volume demand and encourages repeat business through rental and maintenance contracts.

Innovation in Design and Smart Integration

Next-generation inflatables with integrated sensors, LED lighting, or AR interfaces can capture premium segments. Eco-design combined with functional innovation—such as quick-inflate technology and puncture-resistant coatings—will enable differentiation in an otherwise price-competitive market.

Product Type Insights

Inflatable pools lead the market with about 32% share of 2024 revenue, followed by bounce houses and inflatable slides. Pools dominate due to their universal household appeal and affordability. Meanwhile, commercial slides and bounce houses command higher ASPs and strong rental demand. Novelty floats and character inflatables continue to thrive in online channels, driven by social-media aesthetics and seasonal gifting trends.

Material Insights

PVC-vinyl remains the dominant material, representing roughly 70% of total production. Its durability, flexibility, and cost efficiency make it the preferred choice for mass manufacturing. However, alternative materials like vinyl-coated polyester and eco-friendly composites are expected to gain incremental share as sustainability pressures rise.

End-Use Insights

The residential/home-use segment captures nearly 60% of total demand. Families seek convenient, portable play options for backyards and pools. The commercial/event-rental segment is the fastest-growing application, supported by the rise of event planners, festivals, and amusement centers investing in reusable, large-scale inflatables. Institutional purchases from schools and resorts are emerging as a promising sub-segment with recurring revenue potential.

Distribution Channel Insights

Online retail continues to expand rapidly, accounting for about 30% of global sales in 2024. E-commerce enables direct-to-consumer engagement, lower overheads, and customization options. Offline channels, including toy stores and hypermarkets, still hold a substantial presence, particularly for impulse purchases and seasonal sales. Hybrid models integrating online ordering with offline pickup are increasingly common in mature markets.

Age Group Insights

Children aged 3–12 years represent the largest consumer base, driving over half of the total demand. Teens and family users contribute significantly to premium and novelty inflatables, while adult leisure users sustain growth in larger pool and relaxation products. Manufacturers are increasingly targeting cross-age family products that enhance safety and shared play experiences.

| By Product Type | By Material Type | By Age Group | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 35% share in 2024, led by the United States. High disposable income, a strong culture of outdoor leisure, and mature rental/event infrastructure support steady growth. The region also drives innovation through licensed products and eco-material adoption.

Europe

Europe accounts for roughly 20–25% of global revenue. Seasonal demand peaks during summer, supported by strong regulations ensuring product safety. Western Europe, particularly the U.K., Germany, and France, emphasizes sustainable materials and child-safety compliance. Growth remains stable at 4–5% CAGR.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a 6–7% CAGR. China and India lead growth, supported by rising disposable incomes, urbanization, and digital retail penetration. Japan and Australia represent mature, high-spend consumer bases. Regional production hubs in China and Vietnam supply both domestic and export markets.

Latin America

Latin America holds about 5–7% market share, with Brazil and Mexico as key contributors. Increasing youth population, urban leisure culture, and e-commerce adoption are propelling moderate growth. Local manufacturers are emerging to serve domestic demand and regional exports.

Middle East & Africa

The region contributes a 3–5% share and shows rising demand from Gulf nations investing in resorts and entertainment infrastructure. In Africa, growing tourism and youth demographics foster early-stage opportunities for inflatables used in parks and schools.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Inflatable Toys Market

- Bestway Group

- Intex Recreation Corporation

- Funboy LLC

- Jump Orange

- Yolloy Outdoor Product Co. Ltd.

- BigMouth Inc.

- Omega Inflatables Factory

- Joyin Inc.

- Little Tikes

- Swimways Corporation

- Airhead Sporting Goods

- FunTown Recreations

- General Inflatables

- Banzai International

- Jump Splash Manufacturing

Recent Developments

- May 2025 – Intex Recreation Corporation unveiled a new line of eco-friendly inflatable pools made from recycled PVC and water-based inks to reduce carbon footprint.

- April 2025 – Bestway Group expanded its manufacturing facility in Vietnam, adding automated digital-printing and precision-welding lines to meet global demand.

- February 2025 – Funboy LLC launched a smart-inflatable collection integrated with LED lighting and Bluetooth audio systems, targeting premium consumers.