Indoor Humidifier Market Size

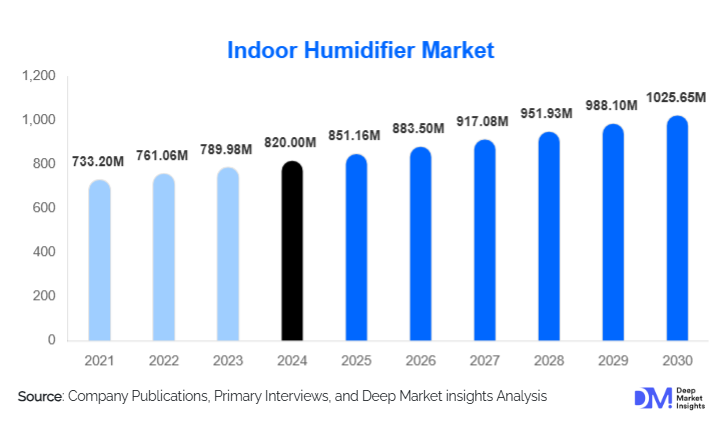

According to Deep Market Insights, the global indoor humidifier market size was valued at USD 820 million in 2024 and is projected to grow from USD 851.16 million in 2025 to reach USD 1,025.65 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The indoor humidifier market growth is primarily driven by the rising awareness of indoor air quality, increasing adoption of smart home appliances, and growing demand for residential and healthcare humidification systems.

Key Market Insights

- Ultrasonic humidifiers dominate global sales, supported by their quiet operation, energy efficiency, and low maintenance needs.

- Portable humidifiers account for the largest installation segment, driven by affordability, ease of use, and rapid household penetration.

- Online sales channels are expanding rapidly, benefiting from strong e-commerce ecosystems and growing smart-appliance demand.

- Asia-Pacific is the fastest-growing regional market, led by increasing disposable income, urbanization, and high prevalence of dry indoor environments.

- Healthcare humidification demand is surging as hospitals and clinics prioritize regulated humidity levels for patient comfort and infection control.

- Technological innovation, including IoT connectivity, automated humidity control, and predictive maintenance, is reshaping product design and user experience.

What are the latest trends in the indoor humidifier market?

Smart & Connected Humidifiers Gain Momentum

Smart humidifiers equipped with Wi-Fi connectivity, humidity sensors, and mobile app integration are transforming how consumers manage indoor environments. Users can monitor humidity levels remotely, set automated schedules, and leverage AI-enabled insights to enhance comfort and energy efficiency. Integration with smart-home ecosystems such as Google Home, Alexa, and Apple HomeKit is becoming standard, attracting tech-savvy consumers. Predictive maintenance alerts, such as filter replacement or tank refill reminders, further enhance convenience and product longevity. This trend is particularly prominent in urban markets where digitally connected home appliances are increasingly mainstream.

Hybrid Air Quality Systems Emerge

Manufacturers are introducing hybrid devices that combine humidification with air purification, dehumidification, or aromatherapy to offer all-in-one indoor wellness solutions. These multifunctional systems address multiple air quality concerns simultaneously, appealing to health-conscious consumers. HEPA filters, UV-C sterilization, and antimicrobial tank coatings are being integrated to prevent bacterial growth and enhance safety. As consumers continue to prioritize home health and hygiene, hybrid systems are expected to gain significant market traction, particularly in premium residential segments.

What are the key drivers in the indoor humidifier market?

Growing Awareness of Indoor Air Quality

Heightened attention to respiratory health, allergy triggers, and dry air discomfort is driving widespread adoption of humidifiers across residential and commercial environments. Consumers increasingly recognize the benefits of maintaining optimal humidity levels for reducing dry skin, sinus irritation, and static electricity. Public health campaigns, combined with the rise of remote work, have amplified demand for healthy indoor environments. This health-driven momentum is also expanding humidifier use in hospitals, clinics, and eldercare facilities.

Technology-Driven Product Differentiation

Technological advancements have significantly elevated product functionality and consumer appeal. Smart sensors, digital humidity displays, energy-efficient ultrasonic technology, and auto shut-off safety systems allow more precise control and enhanced user experience. Manufacturers are also introducing quiet-operation designs, filterless technologies, and antimicrobial materials to address customer pain points related to maintenance and hygiene. These features are positioning indoor humidifiers as essential components of modern smart homes and workplace wellness environments.

What are the restraints for the global market?

Maintenance Requirements and Hygiene Concerns

Humidifiers require regular cleaning, descaling, and filter replacement to prevent microbial growth, mineral buildup, and performance degradation. Many consumers find this maintenance cumbersome, which disrupts long-term usage and reduces repurchase rates. Poorly maintained units can become health hazards, leading to mold or bacterial emission, factors that create hesitancy among certain consumers. This remains one of the most significant market challenges, particularly for low-cost models with limited maintenance support.

Competition from Alternative Air Quality Solutions

Standalone humidifiers face competition from integrated HVAC systems, air purifiers with humidification functions, and whole-home humidity control solutions. In regions with advanced building infrastructure, HVAC systems are often preferred due to their convenience and minimal maintenance. Additionally, cost-sensitive households may opt for alternative solutions or forgo humidification altogether unless driven by medical need. This competitive landscape poses restraints to market expansion, especially in developed economies.

What are the key opportunities in the indoor humidifier industry?

Healthcare-Centric Humidification Solutions

The healthcare segment represents a high-growth opportunity as hospitals, clinics, eldercare centers, and rehabilitation facilities increasingly adopt humidity control technologies. Regulated humidity can significantly improve patient comfort, support respiratory therapies, and prevent equipment degradation. Manufacturers can tap into this opportunity by developing medical-grade humidifiers with precise control mechanisms, antimicrobial construction, and compliance with healthcare standards. Long-term contracts for installation, monitoring, and maintenance offer recurring revenue potential.

Emerging Market Expansion & Smart-Home Integration

Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to expanding middle-class populations, urban lifestyles, and rising health awareness. Affordable smart humidifiers tailored to price-sensitive markets can accelerate adoption. Additionally, integration with smart-home ecosystems enables manufacturers to capture the growing segment of consumers investing in connected living spaces. Partnerships with HVAC companies, home appliance brands, and e-commerce platforms can further accelerate market penetration.

Product Type Insights

Ultrasonic humidifiers dominate the product landscape owing to their silent operation, energy efficiency, and compact design. These models are widely preferred for bedrooms, offices, and nurseries, making them the leading segment globally. Evaporative humidifiers appeal to households seeking lower maintenance systems, while warm-mist and vaporizer types remain popular in colder climates for their soothing warm output. Steam-to-steam humidifiers are gaining traction in industrial and healthcare settings that require precise humidity control. As consumer expectations shift toward smart, low-maintenance solutions, ultrasonic and hybrid models are expected to maintain leadership.

Application Insights

Residential applications account for the largest share of the indoor humidifier market, driven by growing consumer interest in wellness-oriented home environments. Healthcare applications are expanding rapidly as hospitals adopt humidity management to support patient care. Commercial spaces, such as offices, hotels, and retail spaces, are integrating central humidification systems to enhance occupant comfort and comply with indoor air quality standards. Industrial applications, particularly in textiles, wood processing, and pharmaceuticals, rely on humidifiers to stabilize manufacturing conditions, ensuring product quality and equipment efficiency.

Distribution Channel Insights

Online platforms dominate sales, supported by the rapid growth of e-commerce, the availability of customer reviews, and the convenience of home delivery. Tech-focused consumers increasingly prefer online channels for purchasing smart humidifiers and comparing features. Offline retail, including appliance stores, specialty HVAC outlets, and hypermarkets, continues to attract buyers who prefer in-person evaluation. Direct B2B sales are strong in healthcare and industrial segments where customized installation and service contracts are required. Subscription-based filter replacement services and brand-operated online stores are emerging as new revenue models.

End-User Insights

Residential users remain the primary end-user segment, especially households in cold or dry environments where seasonal humidity control is essential. Healthcare facilities form the next major segment, driven by rising patient care standards and humidity-regulated environments. Commercial buildings such as offices, hotels, and educational institutions are expanding demand through HVAC-integrated humidification. Industrial users, ranging from printing to textiles, represent a stable, high-value segment requiring reliable, large-capacity humidification systems to ensure production consistency.

Age Group Insights

Consumers aged 31–50 represent the largest purchasing segment, driven by higher disposable incomes and increased focus on home wellness. The 18–30 demographic is fueling demand for smart, portable humidifiers, especially among renters and young professionals working remotely. Older demographics (51–70) seek humidifiers for health and comfort reasons, prioritizing quiet operation and ease of maintenance. Parents of infants and young children also represent a key buyer group, contributing significantly to nursery humidifier sales.

| By Product Type | By Installation Type | By Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents one of the largest markets, with strong adoption in both residential and commercial segments. High awareness of indoor air quality, cold seasonal climates, and widespread use of HVAC systems support humidifier installation. The region shows strong demand for smart-home-compatible models, with the U.S. leading innovations in connected humidification. Healthcare facilities in the region also invest heavily in regulated humidity systems for infection control and respiratory support.

Europe

Europe exhibits steady demand, especially in countries with colder climates such as Germany, France, and the U.K. The region favors energy-efficient and low-maintenance humidifiers, driven by strict environmental regulations and consumer preference for sustainable appliances. Growing adoption of air quality standards in commercial buildings and healthcare facilities further supports market expansion. Portable humidifiers remain highly popular for residential use across Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, led by China, India, Japan, and South Korea. Rapid urbanization, rising middle-class income, and increasing focus on home comfort are major growth drivers. Smart humidifiers are gaining traction among tech-forward consumers in East Asia, while affordable portable humidifiers are expanding across South Asia. The healthcare sector, especially in Japan and South Korea, also plays a significant role in adopting advanced humidification systems.

Latin America

Latin America is gradually adopting indoor humidifiers, especially in Brazil, Mexico, and Chile. Demand is driven by increasing awareness of respiratory health, seasonal climate variations, and the expansion of residential construction. E-commerce platforms are boosting product accessibility, while commercial and hospitality sectors are beginning to integrate humidity control into their indoor wellness initiatives.

Middle East & Africa

The Middle East’s extremely dry climate creates natural demand for humidifiers, particularly in luxury residential buildings, commercial complexes, and hotels. Countries such as the UAE and Saudi Arabia exhibit strong adoption of smart and premium humidifiers. In Africa, market penetration remains lower but is rising in South Africa, Kenya, and Nigeria, supported by growing urbanization and increasing investment in healthcare and hospitality infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Indoor Humidifier Market

- Honeywell International Inc.

- Dyson Ltd.

- Philips Domestic Appliances

- Boneco AG

- Aprilaire

- Vornado Air

- Venta Air Technologies

Recent Developments

- In March 2025, Dyson launched a new AI-driven smart humidifier designed to optimize indoor humidity using real-time sensor data and app-based automation.

- In January 2025, Honeywell expanded its humidification product line with hybrid ultrasonic–evaporative models aimed at improving energy efficiency in residential environments.

- In October 2024, Philips introduced a healthcare-focused humidifier series featuring antimicrobial tank coatings and precision humidity controls for clinical applications.