Indoor Exercise Bike Market Size

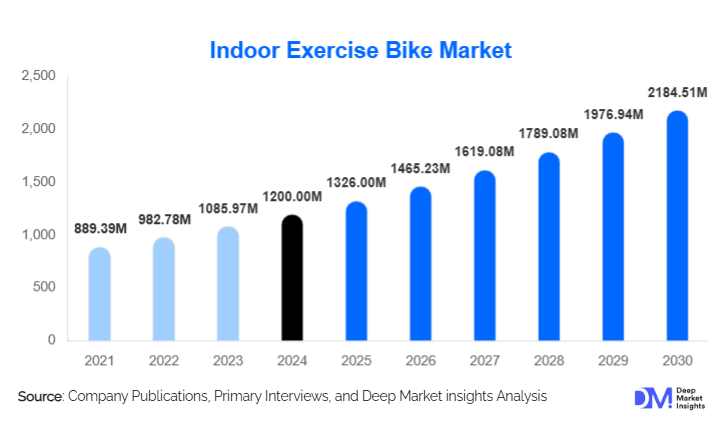

According to Deep Market Insights, the global indoor exercise bike market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,326.00 million in 2025 to reach USD 2,184.51 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The indoor exercise bike market growth is primarily driven by increasing health awareness, rapid adoption of connected fitness technologies, and the rising popularity of home-based workout solutions across both developed and emerging economies.

Key Market Insights

- Smart and connected indoor bikes are transforming the fitness landscape, integrating hardware with software, streaming content, and app-based coaching.

- Home-use exercise bikes dominate market revenues, supported by hybrid workout models that combine convenience with affordability.

- North America leads global market share due to high disposable income, fitness culture, and the presence of premium brands.

- Asia-Pacific is the fastest-growing regional market, driven by urbanization, rising health awareness, and growing middle-class incomes.

- Subscription-based fitness ecosystems are emerging, offering recurring revenue opportunities for manufacturers and app developers.

- Technological advancements such as AI-based coaching, VR training, and real-time performance analytics are reshaping consumer engagement.

What are the latest trends in the indoor exercise bike market?

Rise of Connected Fitness Ecosystems

Indoor exercise bikes are increasingly integrated into connected fitness ecosystems that combine physical equipment with digital content. Manufacturers are partnering with fitness apps, wearable tech companies, and streaming platforms to deliver interactive workout experiences. This shift enables users to access live classes, personalized coaching, and social competition features from home. Connected bikes not only enhance engagement but also create recurring revenue streams through subscription models, significantly increasing lifetime customer value. As consumers prioritize convenience and interactivity, connected ecosystems are redefining how fitness is consumed globally.

Expansion of Affordable Smart Bikes

As premium smart bikes gain traction, mid-range and affordable connected models are entering the market to capture broader demographics. Brands are localizing designs for emerging economies by offering compact, cost-effective bikes equipped with essential connectivity features. This trend supports democratization of home fitness and accelerates penetration in price-sensitive markets. The emergence of modular hardware, allowing future upgrades of screens, sensors, and smart consoles, is further driving adoption among first-time buyers and small fitness studios.

What are the key drivers in the indoor exercise bike market?

Growing Focus on Health, Fitness, and Lifestyle Diseases

The rising prevalence of lifestyle disorders such as obesity and diabetes is motivating consumers to embrace regular exercise. Indoor cycling offers a low-impact cardiovascular workout suited for all ages, making it one of the most popular home-fitness choices. Governments and employers are also promoting preventive healthcare and corporate wellness initiatives, indirectly boosting market growth.

Acceleration of Home-Based Workouts

The post-pandemic fitness landscape has permanently shifted toward hybrid and home-based workout routines. Consumers now value flexibility, time efficiency, and the ability to exercise without relying on gym memberships. Indoor bikes, offering compact size and digital connectivity, are among the most purchased home-fitness products globally, driving long-term market expansion.

Integration of Technology and Immersive Training Experiences

AI-powered coaching, virtual reality cycling environments, and gamified fitness challenges are enhancing the indoor riding experience. Advanced resistance controls, performance tracking, and live leaderboards create personalized and competitive workouts. This tech-driven engagement has led to increased equipment replacement cycles and premiumization of the product category.

What are the restraints for the global market?

High Upfront Costs and Affordability Concerns

Premium smart indoor bikes can cost several thousand dollars, which limits accessibility in developing markets. Ongoing subscription fees for connected services add to ownership costs, deterring potential buyers. As a result, brands are under pressure to balance innovation with affordability and explore financing or rental models to broaden reach.

Intense Competition and Market Saturation in Developed Economies

In mature markets like North America and Western Europe, saturation of high-end equipment and competition from alternative fitness modalities, such as treadmills, rowing machines, and outdoor cycling, pose challenges. Maintaining differentiation through innovation and content partnerships remains essential for sustained growth.

What are the key opportunities in the indoor exercise bike industry?

Digital Integration and Subscription Ecosystems

Manufacturers can expand beyond hardware sales by creating integrated fitness ecosystems that generate recurring revenue through app subscriptions, data analytics, and personalized training programs. This convergence of fitness and technology offers strong monetization potential and increases customer loyalty.

Emerging Market Expansion

Rising disposable incomes and urban lifestyles in Asia-Pacific, Latin America, and the Middle East are unlocking significant growth potential. Affordable, compact, and connected bikes designed for smaller homes can capture these expanding markets. Localization strategies, including multilingual app support and regional fitness content, are key differentiators for new entrants.

Commercial Fitness & Corporate Wellness Programs

Growth in boutique cycling studios, physiotherapy centers, and corporate wellness facilities presents a major opportunity. Companies can target commercial-grade equipment sales, offer leasing solutions, and develop service contracts for regular maintenance, tapping into institutional demand beyond consumer markets.

Product Type Insights

Smart/Connected indoor exercise bikes dominate the market, accounting for approximately 45% of global revenue in 2024. These models deliver real-time performance tracking, live classes, and entertainment integration through Bluetooth or Wi-Fi connectivity. The smart segment’s leadership is driven by its ability to blend physical training with digital engagement, resulting in higher user retention and brand loyalty. Standard mechanical bikes still serve cost-sensitive consumers, while commercial-grade bikes are gaining traction in gym chains upgrading their cardio equipment portfolios.

Resistance Mechanism Insights

Magnetic resistance bikes hold the largest share among resistance types, representing about 35% of product revenues in 2024. Their silent operation, durability, and precision control make them ideal for residential environments. Belt-drive and air-resistance bikes continue to attract niche segments such as high-intensity trainers and boutique studios focused on performance-oriented workouts.

Application Insights

Home-use applications dominate global demand, representing around 55% of total market value in 2024. The surge in home-based workouts and the availability of compact, connected solutions are propelling this segment’s dominance. The commercial segment, comprising gyms, rehabilitation centers, and wellness studios, is also expanding as health clubs upgrade equipment to attract digitally engaged members.

Distribution Channel Insights

Online sales channels account for roughly 40% of global indoor bike revenues in 2024. E-commerce platforms, direct-to-consumer websites, and social commerce campaigns are becoming the primary purchase points for consumers seeking convenience and price transparency. Offline specialty fitness stores and distributors still play a crucial role in high-value commercial installations and after-sales service contracts.

| By Product Type | By Connectivity & Technology | By End User | By Distribution Channel | By Resistance Mechanism |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, contributing approximately 35% of global revenue in 2024. The U.S. leads this growth, supported by a robust home-fitness culture, premium consumer spending, and established connectivity infrastructure. Leading brands such as Peloton and Nautilus continue to dominate with advanced subscription ecosystems and strong brand loyalty.

Europe

Europe holds about 25% market share in 2024, with the U.K., Germany, and France as major contributors. Growing focus on sustainable fitness, boutique studio expansion, and hybrid home-gym models are driving steady demand. The region’s mature consumer base values quality, reliability, and data-driven performance analytics, sustaining premium pricing across segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 20% of 2024 revenues and projected to grow at a 12–15% CAGR through 2030. China and India are key growth drivers, propelled by urbanization, rising fitness awareness, and expanding middle-class incomes. Localized manufacturing and e-commerce proliferation are enhancing accessibility to affordable connected bikes in the region.

Latin America

Latin America represents about 10% of the market, led by Brazil and Mexico. Economic recovery, online retail expansion, and government wellness programs are supporting moderate growth. Affordability remains critical, prompting manufacturers to introduce entry-level models tailored to regional budgets.

Middle East & Africa

With around 10% market share, this region is emerging as a premium market segment. GCC countries, especially the UAE and Saudi Arabia, are investing in high-end fitness infrastructure, driving demand for commercial-grade smart bikes. South Africa and Nigeria show rising adoption through health-club growth and the import of affordable Asian models.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Indoor Exercise Bike Market

- Peloton Interactive Inc.

- Brunswick Corporation

- Nautilus Inc.

- Precor Incorporated

- Keiser Corporation

- Technogym S.p.A.

- Johnson Health Tech Co., Ltd.

- BH Fitness S.A.

- Assault Fitness

- SOLE Fitness

- Sunny Health & Fitness

- Mad Dogg Athletics Inc.

- iFit Health & Fitness Inc.

- Core Health & Fitness LLC

- Life Fitness

Recent Developments

- In June 2025, Peloton launched a new AI-powered personalized training suite integrated with its Bike+ model, enabling adaptive resistance and real-time form correction.

- In April 2025, Technogym introduced its “Ride Live” connected platform, partnering with leading cycling instructors to deliver interactive virtual classes for both home and studio users.

- In February 2025, Johnson Health Tech announced the expansion of its manufacturing plant in Taiwan under the “SmartFit 2025” program to increase export capacity to North America and Europe.