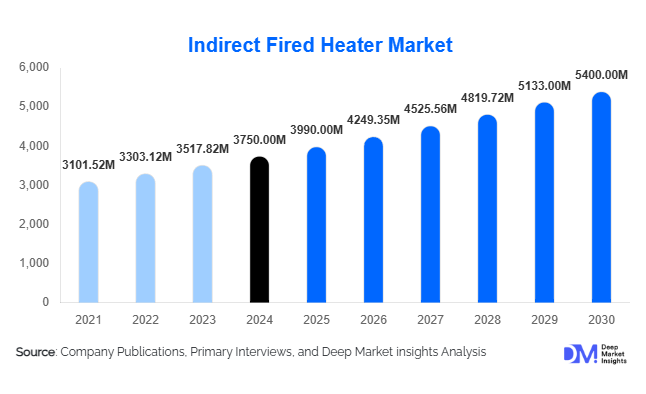

Indirect Fired Heater Market Size

According to Deep Market Insights, the global indirect fired heater (IFH) market size was valued at USD 3,750 million in 2024 and is projected to grow from USD 3,990 million in 2025 to reach USD 5,400 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The IFH market growth is primarily driven by rising industrialization, increasing adoption of energy-efficient heating solutions, stringent emission regulations, and expanding applications across oil & gas, chemical, food processing, and power generation industries worldwide.

Key Market Insights

- Industrial applications dominate, particularly in oil & gas and chemical sectors, due to high demand for precise, contamination-free heating solutions.

- Technological integration is transforming IFHs, with IoT-enabled controls, predictive maintenance systems, and modular designs improving efficiency and reducing operational costs.

- North America holds a major market share, driven by the USA and Canada, where environmental compliance and industrial modernization are key growth factors.

- APAC is the fastest-growing region, led by China and India, due to rapid industrialization and infrastructure expansion.

- Fuel efficiency and low-emission designs are increasingly prioritized across all regions, encouraging the adoption of natural gas and LPG-based IFHs.

- Export-driven demand is significant, with North America and Europe supplying IFHs to emerging markets in APAC and the Middle East.

Latest Market Trends

Shift Toward Energy-Efficient and Low-Emission Heaters

Manufacturers are increasingly focusing on designing indirect-fired heaters that meet stringent environmental regulations. Natural gas-based IFHs are gaining traction due to low emissions, higher energy efficiency, and reduced operational risks. Modular and skid-mounted designs allow for easier installation and maintenance, catering to industrial clients looking to optimize processes while reducing carbon footprints. Digital control systems are also becoming standard, enabling precise temperature regulation and reducing energy wastage.

Integration of Digital and IoT Technologies

Advanced monitoring and automation technologies are redefining IFH operations. IoT-enabled heaters provide real-time data on temperature, fuel consumption, and equipment performance. Predictive maintenance reduces downtime and operational costs. Industries such as oil & gas and petrochemicals are increasingly adopting these solutions to improve process efficiency. Additionally, remote monitoring allows for centralized control of multiple heater units, which is critical for large-scale industrial plants.

Indirect Fired Heater Market Drivers

Rising Industrialization and Process Heating Demand

The growth of industries like oil & gas, chemical, and food processing has created significant demand for indirect-fired heaters. High-capacity IFHs are essential for refining, chemical reactions, and thermal processing, ensuring safe and contamination-free heating. Industrial expansion in APAC and the Middle East has further strengthened market demand, particularly for medium- to high-capacity heaters.

Regulatory Push for Low-Emission Solutions

Environmental regulations globally are encouraging the adoption of indirect-fired heaters, which offer better exhaust control and reduced emissions compared to direct-fired systems. Compliance with emission standards drives upgrades to more energy-efficient, digital-controlled heaters, boosting market growth across North America and Europe.

Technological Advancements and Automation

Integration of advanced control systems, IoT-based monitoring, and modular designs improves operational efficiency, safety, and reliability. These features reduce downtime and fuel consumption, making IFHs attractive for large industrial applications. Predictive maintenance and automation are emerging as critical drivers for technology-driven adoption.

Market Restraints

High Initial Capital Expenditure

Indirect-fired heaters have higher installation and commissioning costs compared to conventional direct-fired units. Small and medium enterprises may find it challenging to adopt IFHs, limiting penetration in cost-sensitive regions.

Dependence on Fuel Prices

Fluctuating prices of natural gas, diesel, and LPG impact operational costs, which may slow adoption in regions with volatile fuel markets or limited subsidies.

Indirect Fired Heater Market Opportunities

Expansion in Emerging Industrial Markets

APAC, the Middle East, and Latin America present substantial growth opportunities. Rapid industrialization, infrastructure projects, and refinery expansions in China, India, Saudi Arabia, and Brazil are boosting demand for IFHs. Market entrants and existing players can leverage lower entry barriers and growing industrial bases to capture market share.

Advanced Technology Integration

IoT-enabled heaters, predictive maintenance systems, and modular designs offer opportunities for differentiation. Retrofitting existing plants with advanced IFHs or upgrading older units can provide cost-effective solutions while enhancing efficiency and safety.

Regulatory and Sustainability-driven Adoption

Governments are incentivizing low-emission and energy-efficient heaters. Players focusing on compliance with stringent environmental standards and offering eco-friendly solutions can gain a competitive edge and access sustainability-conscious industries.

Product Type Insights

Industrial indirect-fired heaters dominate the market, accounting for 55% of the 2024 market share. Their high adoption in the oil & gas and chemical industries is due to large-capacity requirements and the need for precise heating. Commercial and residential IFHs are smaller segments, growing steadily in construction and small-scale industrial applications. The trend toward modular, digitally controlled units is increasing adoption across industrial and commercial sectors.

Application Insights

Oil & gas remains the largest end-use industry, contributing approximately 35% of global demand. Chemical and petrochemical industries follow, at around 28%, requiring precise temperature control for reactions and thermal processes. Emerging applications include food & beverage, power generation, and metal processing. Modular heaters are being adopted in temporary industrial plants, enhancing operational flexibility and boosting export-driven demand in APAC and the Middle East.

Distribution Channel Insights

Direct industrial sales dominate the IFH market, particularly for large-capacity units. Authorized distributors and engineering procurement contractors (EPCs) are key channels for mid-range and smaller units. Online inquiries and OEM partnerships are emerging as supplementary channels, especially in APAC and Europe, offering digital quotations and order tracking for industrial clients. The focus is on direct B2B sales due to customization and technical specifications requirements.

| By Product Type | By Fuel Type | By Heat Output / Capacity | By End-Use Industry | By Technology / Design |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market, with the USA leading demand due to refinery expansions, chemical plants, and emission compliance upgrades. Canada follows, with industrial heating and energy efficiency driving adoption.

Europe

Germany and the UK collectively account for 20% of the market. Strong environmental regulations, digital automation, and industrial modernization are key drivers. Countries like France and Italy are adopting modular and IoT-enabled IFHs.

Asia-Pacific

China and India are the fastest-growing markets, registering 8–9% CAGR, driven by petrochemical, refinery, and food processing sector expansions. Southeast Asia is also witnessing the rising adoption of modular and energy-efficient heaters.

Middle East & Africa

Saudi Arabia and the UAE lead the market due to refinery growth and large-scale industrial projects. Demand is linked primarily to oil & gas, chemical processing, and power generation.

Latin America

Brazil and Argentina are leading the LATAM market, supported by refinery and industrial expansions. The CAGR in this region is moderate at around 6%.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Indirect Fired Heater Market

- Baker Hughes

- Honeywell International

- John Zink Hamworthy Combustion

- Smithco

- Thermax Limited

- Riello

- L&T Technology Services

- Flame Engineering

- Global Heat Transfer

- Parker Hannifin

- Fives Group

- Cleaver-Brooks

- Trane Technologies

- Daikin Industries

- Sulzer Ltd

Recent Developments

- In Q1 2025, Honeywell International launched an IoT-enabled IFH solution for chemical processing, integrating predictive maintenance and energy monitoring.

- In Q2 2025, Thermax Limited expanded its modular heater manufacturing facility in India to cater to increasing APAC demand.

- In Q3 2025, John Zink Hamworthy introduced low-emission natural gas IFHs for refinery applications in the Middle East, aligning with environmental compliance mandates.