Independent ISP Chip Market Size

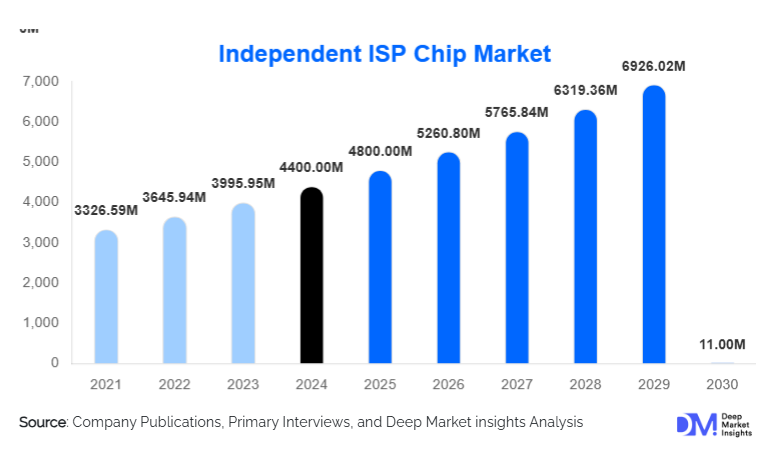

According to Deep Market Insights, the global independent ISP chip market size was valued at USD 4,400 million in 2024 and is projected to grow from USD 4,800 million in 2025 to reach USD 11,000 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for high-quality imaging in consumer electronics, automotive applications, and security systems, alongside advancements in AI-enabled image processing technologies and growing adoption of 5G infrastructure globally.

Key Market Insights

- Standalone ISP chips dominate the market, offering specialized image processing capabilities and accounting for over 56% of the 2024 market share.

- CMOS technology is leading, with 57% of market share, due to its high processing speed and low power consumption, making it ideal for smartphones, cameras, and automotive systems.

- Consumer electronics is the largest application segment, driven by the demand for high-resolution imaging in smartphones, tablets, and cameras.

- Asia-Pacific is the fastest-growing region, led by China and India, benefiting from robust electronics manufacturing and 5G network expansion.

- North America holds a major share, particularly due to high adoption of smartphones, security systems, and automotive applications requiring advanced ISP chips.

- Technological integration, such as AI-enabled real-time image processing and low-light enhancement, is shaping product innovation across end-use sectors.

What are the latest trends in the independent ISP chip market?

AI-Integrated Imaging Solutions

Manufacturers are increasingly integrating AI and machine learning into ISP chips, enabling features like real-time image enhancement, facial recognition, object detection, and intelligent autofocus. These AI-powered capabilities are critical for applications across smartphones, automotive ADAS systems, and security cameras, enhancing both performance and user experience. AI integration also allows for improved computational photography and low-light performance, which are key drivers in high-end consumer electronics.

Rising Adoption in Automotive and Security Systems

The expansion of autonomous vehicles and advanced driver-assistance systems (ADAS) is fueling demand for high-performance ISP chips that process data from multiple camera sensors in real time. Similarly, high-definition surveillance cameras in public and private security applications require advanced image processing, pushing ISP chip development towards higher efficiency, lower power consumption, and faster processing speeds. Security system adoption is particularly strong in regions focusing on smart city initiatives.

What are the key drivers in the independent ISP chip market?

Proliferation of Smart Devices

The widespread adoption of smartphones, tablets, and wearable devices with advanced camera systems is a major driver of ISP chip demand. Consumers increasingly demand high-resolution imaging, computational photography, and low-light performance, encouraging manufacturers to integrate standalone and AI-enhanced ISP chips into devices. As the number of connected devices rises globally, this trend continues to accelerate market growth.

Expansion of 5G Networks

5G technology facilitates high-speed data transmission, enabling real-time image processing in mobile and automotive applications. Faster connectivity allows ISP chips to support advanced applications such as live video streaming, cloud-based computational photography, and AI-assisted object recognition. The global rollout of 5G networks is therefore directly boosting the demand for efficient and high-performance ISP chips.

Advancements in Imaging Technology

Continuous technological innovation in CMOS sensors and image signal processors has resulted in chips that are faster, more power-efficient, and capable of superior image processing. These advancements have widened the adoption of ISP chips in high-end cameras, drones, smartphones, and automotive systems, creating a robust growth trajectory for the market.

What are the restraints for the global market?

High Development Costs

R&D costs for designing advanced ISP chips are substantial, particularly for small and mid-sized manufacturers. The complexity of AI integration, high-resolution processing, and low-power consumption requirements increases development and manufacturing expenses, which can limit new entrants and reduce profit margins.

Intense Market Competition

The ISP chip market is highly competitive, with numerous players striving for technological differentiation. Price pressures, rapid innovation cycles, and overlapping applications create challenges for sustaining profitability. Companies must continuously invest in R&D to maintain competitiveness while managing costs effectively.

What are the key opportunities in the independent ISP chip market?

Integration with AI and Machine Learning

There is significant growth potential for ISP chips that integrate AI and ML to support real-time image processing, object recognition, and enhanced low-light performance. These chips can cater to a wide range of industries, including consumer electronics, automotive, and security systems, enabling manufacturers to develop differentiated solutions for premium device segments.

Automotive Applications

The autonomous vehicle market and ADAS adoption are increasing demand for high-performance ISP chips capable of processing multi-camera systems in real time. Manufacturers can leverage this trend to develop specialized chips that address automotive safety, navigation, and infotainment systems.

Security and Surveillance Systems

The growing need for advanced surveillance systems, particularly in smart cities and industrial applications, presents opportunities for ISP chip manufacturers. High-definition cameras with enhanced image processing capabilities are increasingly in demand, driving the market for standalone and AI-enabled ISP chips.

Product Type Insights

Standalone ISP chips dominate the market due to their high-performance image processing capabilities and flexibility across multiple applications. These chips accounted for over 56% of the 2024 market, outperforming integrated solutions within smartphones and consumer electronics. The focus on dedicated processing units for automotive, security, and industrial imaging is reinforcing the leadership of standalone ISP chips globally.

Application Insights

Consumer electronics remain the largest application segment, driven by high-resolution smartphone cameras, tablets, and professional cameras. Automotive imaging applications are growing rapidly, especially in autonomous vehicles and ADAS. Security and surveillance applications are also expanding due to increasing smart city initiatives and industrial monitoring needs. Emerging applications in drones, AR/VR devices, and medical imaging further diversify the market demand.

End-Use Insights

The consumer electronics segment leads in demand, but automotive and security system applications are the fastest-growing end-use segments. Export-driven demand is significant for countries like China, South Korea, and Taiwan, which manufacture ISP chips for global smartphone, automotive, and industrial device markets. Automotive end-use industries are expected to grow at a 10% CAGR, while consumer electronics maintain steady expansion at an 8–9% CAGR over the forecast period.

| By Product Type | By Application | By Technology |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for a substantial share of the ISP chip market, primarily due to high adoption of smartphones, security systems, and automotive imaging technologies. The U.S. represents the largest single-country market, accounting for ~22% of the global market in 2024, with demand driven by AI-based camera systems and autonomous vehicle technology.

Europe

Europe, led by Germany and the U.K., holds approximately 18% of the 2024 market. Growth is driven by automotive imaging and industrial surveillance systems, with Germany’s automotive sector being the largest end-user of high-performance ISP chips. Europe is witnessing steady CAGR growth due to smart city and automation initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. China accounts for a large portion of market growth, benefiting from its electronics manufacturing and 5G deployment. APAC’s CAGR is projected at 11% during 2025–2030, with increasing demand from consumer electronics and automotive applications.

Latin America

Brazil, Mexico, and Argentina are emerging markets for ISP chips, particularly in consumer electronics and surveillance sectors. Growth is slower but expected to pick up with rising smartphone penetration and industrial automation.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is adopting advanced security and surveillance systems, while Africa’s demand is mostly from mobile devices and industrial applications. Regional CAGR is moderate, supported by smart city and infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Independent ISP Chip Market

- STMicroelectronics

- ON Semiconductor

- Socionext

- OmniVision Technologies

- Samsung Electronics

- Sony Semiconductor

- Intel

- NXP Semiconductors

- Texas Instruments

- Qualcomm

- MediaTek

- HiSilicon

- Analog Devices

- Renesas Electronics

- Broadcom

Recent Developments

- In March 2025, STMicroelectronics launched an AI-enhanced ISP chip for automotive cameras, improving real-time object detection in ADAS applications.

- In January 2025, OmniVision Technologies introduced a low-power CMOS ISP for mobile devices, enabling better low-light performance and HDR imaging.

- In February 2025, Socionext announced a partnership with a leading security system provider to integrate advanced ISP chips for high-definition surveillance cameras.