Incense Sticks Market Size

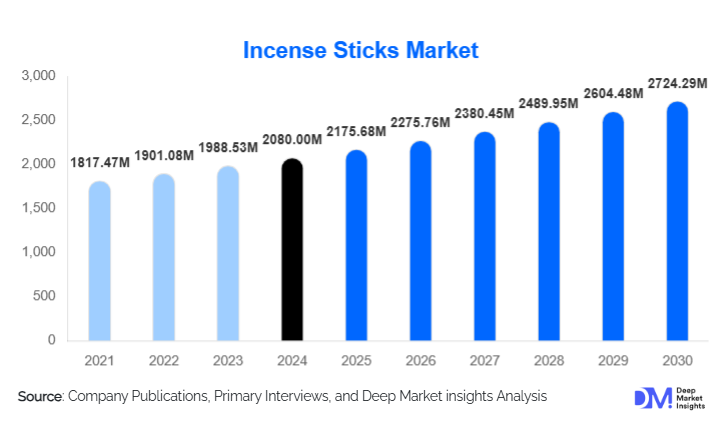

According to Deep Market Insights, the global incense sticks market size was valued at USD 2,080.00 million in 2024 and is projected to grow from USD 2,175.68 million in 2025 to reach USD 2,724.29 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). Growth is driven by rising global adoption of aromatherapy, increasing integration of incense into wellness and meditation routines, and surging export demand for premium, low-smoke, and natural fragrance-based incense products.

Key Market Insights

- Aromatic and scented incense sticks dominate the global market, driven by rising wellness usage and premium fragrance adoption.

- Asia-Pacific leads the global market, accounting for nearly two-thirds of global incense consumption due to deep-rooted cultural and religious practices.

- Export-led growth is accelerating, with strong demand from North America and Europe for natural, eco-friendly, and artisanal incense.

- Low-smoke and bamboo-less incense innovations are becoming mainstream due to indoor air-quality concerns.

- E-commerce distribution is expanding rapidly, enabling direct-to-consumer sales and global reach for artisanal and premium brands.

- Sustainability and natural ingredient sourcing are shaping product and packaging trends across emerging markets.

What are the latest trends in the incense sticks market?

Wellness-Integrated Incense Adoption

Incense usage is expanding beyond traditional religious rituals into wellness, meditation, and aromatherapy. Consumers across North America, Europe, and Asia-Pacific are incorporating incense into self-care routines, mindfulness practices, and holistic lifestyle regimens. This shift is driving demand for natural, therapeutic fragrances, such as sandalwood, lavender, rose, and herbal blends, positioning incense as a lifestyle product rather than solely a cultural or religious accessory. Premium wellness brands are launching curated incense collections, often paired with meditation guides, essential oils, and stress-relief kits.

Eco-Friendly and Low-Smoke Formulations

Growing concerns over indoor air quality are leading to widespread adoption of low-smoke, bamboo-less, and charcoal-free incense sticks. Manufacturers are innovating with cleaner-burning formulations using natural binders, organic resins, and sustainable packaging. Urban consumers, particularly in Western markets, increasingly prefer eco-conscious incense options crafted from responsibly sourced materials. Brands are also introducing certifications related to safety, emissions, and natural ingredient integrity to enhance consumer trust and appeal to wellness-focused demographics.

What are the key drivers in the incense sticks market?

Rising Popularity of Aromatherapy and Wellness

The global surge in mindfulness practices, including meditation, yoga, and holistic health, has significantly increased demand for incense sticks. Wellness consumers prefer incense as a mood-enhancing and stress-relief tool, leading to stronger adoption in households, spas, yoga studios, and wellness retreats. Premium aromatic incense, infused with essential oils and natural botanicals, is now a favored alternative to candles and diffusers, supporting sustained market growth.

Growing Cultural and Religious Usage in Asia-Pacific

In countries like India, China, and Japan, incense remains deeply embedded in daily rituals, festivals, temple ceremonies, and cultural practices. India alone contributes a substantial share of global production and consumption. The consistent and recurring demand for traditional masala and herbal incense forms a stable and resilient market foundation, enabling manufacturers to scale production and extend into export markets.

What are the restraints for the global market?

Health and Indoor Air Quality Concerns

Incense burning can release particulate matter and smoke, raising concerns regarding respiratory risks and indoor air pollution. Health-conscious consumers in urban and developed markets may avoid traditional high-smoke incense products, limiting market growth. Regulatory scrutiny in certain regions may tighten requirements for emissions, ingredient disclosure, and product labeling, challenging manufacturers to adopt cleaner formulations.

Highly Fragmented Production Ecosystem

The incense sticks market is dominated by small and unorganized manufacturers, especially in major producing countries. Fragmentation leads to inconsistent quality, raw-material variability, limited scalability, and compliance challenges for export markets. Smaller units may struggle to invest in upgraded production technology, eco-friendly processes, and regulatory certifications, impeding overall industry modernization.

What are the key opportunities in the incense sticks industry?

Premium Wellness-Focused Incense Lines

There is a substantial opportunity for brands to create premium incense lines centered on wellness, aromatherapy, and relaxation. Products infused with essential oils, therapeutic botanicals, and natural ingredients can cater to growing Western demand. Subscription boxes, designer fragrance collaborations, and luxury incense gift sets can further expand consumer engagement and boost margins.

Export Expansion to High-Value Markets

North America, Europe, and the Middle East represent high-value export markets for natural, artisanal, and ethically sourced incense. Manufacturers in India and Southeast Asia can leverage strong global demand for exotic fragrances and handcrafted incense varieties. With growing interest in cultural wellness practices, export-driven scaling, private labeling, and international e-commerce channels (Amazon, Etsy, Shopify) present major growth avenues.

Product Type Insights

Aromatic/Scented Incense Sticks dominate the market, accounting for approximately 45–50% of global share, driven by increasing demand for scented home-fragrance solutions and wellness applications. These products blend essential oils, modern fragrances, and low-smoke compositions, making them more appealing for indoor environments. Masala/Traditional Incense remains popular in Asia-Pacific for religious and cultural rituals. These hand-rolled products emphasize natural ingredients and longer burn times. Bamboo-less and smokeless incense are rapidly gaining traction, particularly in urban markets with stricter air-quality expectations.

Application Insights

Religious and spiritual use continues to be the largest traditional application, especially in India, China, and Southeast Asia. However, the fastest-growing segments include aromatherapy, meditation, and home fragrance. Commercial establishments such as spas, yoga studios, boutique hotels, and wellness retreats are increasingly adopting premium incense as part of their ambiance and relaxation offering.

Distribution Channel Insights

E-commerce and D2C platforms now lead global growth, enabling direct sales, personalized fragrance curation, and access to global consumers. Traditional retail, including temple shops, general stores, and supermarkets, remains dominant in developing regions. Modern trade, wellness stores, and specialty boutiques are gaining momentum for premium incense offerings. Export distribution channels are crucial for artisans and mid-sized manufacturers scaling globally.

End-User Insights

Households are the largest end-user segment globally, driven by everyday religious rituals and home fragrance usage. Commercial users such as spas, meditation centers, and boutique hotels represent a fast-growing segment, embracing incense as part of curated wellness experiences. Export-driven manufacturing is also a major end-use category, particularly in India, where a significant portion of production is oriented toward international markets.

Age Group Insights

Consumers aged 31–50 form the largest incense-buying demographic due to their interest in wellness and lifestyle enhancement. Younger consumers (18–30) increasingly adopt incense for ambiance, meditation, and social trends tied to mindfulness. Older age groups (51+) typically use incense for traditional, relaxation, or spiritual practices and favor natural, low-smoke variants.

| By Product Type | By Fragrance Category | By Material Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for roughly 60–65% of global incense stick demand, led by India, China, and Japan. India's incense industry is the world’s largest, supported by deep cultural roots, strong domestic consumption, and massive export capacity. China is among the fastest-growing markets, especially for aromatic and wellness-oriented incense products.

North America

North America is one of the largest importers of premium incense, driven by wellness, meditation, aromatherapy, and home-fragrance trends. The U.S. alone represents a market exceeding USD 500 million. Millennials and Gen Z consumers are fueling accelerated growth via online purchase behavior and interest in natural lifestyle products.

Europe

European markets, particularly the U.K., Germany, France, and Italy, are witnessing the rapid adoption of eco-friendly, handcrafted, and natural incense varieties. Sustainability-conscious consumers prefer low-smoke and carbon-neutral products, making Europe a high-potential premium incense destination.

Latin America

Brazil, Mexico, and Argentina represent emerging markets with rising demand for lifestyle and wellness fragrance products. Adoption remains smaller but is steadily growing through aromatherapy, yoga, and spiritual wellness trends.

Middle East & Africa

The Middle East demonstrates a strong cultural affinity for incense and fragrance products, including oud and bakhoor-inspired blends. Africa represents both a consumer and production region, with steady regional demand in South Africa, Kenya, and Nigeria. GCC countries show strong demand for premium and luxury fragrance-infused incense products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Incense Sticks Market

- HEM Corporation

- Nippon Kodo

- Shrinivas Sugandhalaya (Nag Champa)

- ITC Limited

- Mysore Deep Perfumery House (Zed Black)

- N. Ranga Rao & Sons (Cycle Pure)

- Hari Darshan Sevashram

- Moksh Agarbatti Company

- Shoyeido Incense (Japan)

- Balaji Agarbathi Company

Recent Developments

- In 2024, several leading Indian manufacturers expanded low-smoke incense production to meet growing domestic and export demand in North America and Europe.

- In early 2025, multiple premium brands launched eco-friendly incense collections made with organic binders and natural botanicals aimed at wellness consumers.

- In 2025, Japanese brands introduced artisanal incense sets combining traditional craftsmanship with modern fragrance blends for global luxury markets.