In-Car Infotainment System Market Size

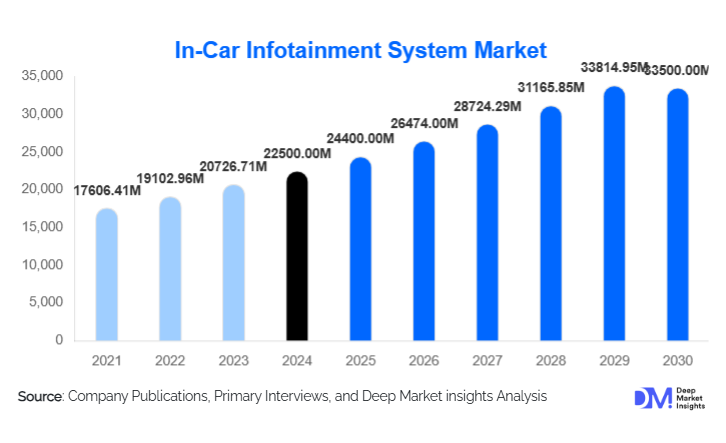

According to Deep Market Insights, the global in-car infotainment system market size was valued at USD 22,500 million in 2024 and is projected to grow from USD 24,400 million in 2025 to reach USD 33,500 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for connected and smart vehicles, rising adoption of electric vehicles with advanced digital cockpits, and regulatory mandates promoting connectivity and safety features in automobiles.

Key Market Insights

- Consumer preference for large, high-resolution displays and advanced connectivity is driving demand, with OEM-installed systems dominating over aftermarket solutions due to seamless integration and higher reliability.

- Asia-Pacific leads the market in volume, with China, Japan, and India driving growth due to rising vehicle production, growing EV adoption, and increasing demand for premium infotainment features.

- Software-defined vehicles and over-the-air (OTA) update capabilities are emerging as key differentiators, allowing automakers and suppliers to offer subscription-based services, content updates, and personalization.

- North America and Europe remain important markets for premium infotainment systems, driven by stringent safety regulations, higher consumer purchasing power, and adoption of advanced connectivity and digital cockpit solutions.

- Technological integration, including Android Automotive OS, 5G/V2X communication, augmented reality (AR) heads-up displays, and AI-powered voice assistants, is reshaping in-car experiences globally.

- Aftermarket upgrades and retrofitting opportunities are expanding in mature markets, enabling vehicle owners to enhance infotainment systems without purchasing new cars.

What are the latest trends in the in-car infotainment system market?

Software-Defined Vehicles and Subscription-Based Models

Automakers are increasingly shifting toward software-defined platforms, integrating infotainment systems with over-the-air (OTA) updates and subscription-based services. Features such as navigation updates, streaming services, and AI-powered voice assistants are being offered as recurring revenue streams. This trend allows for continuous improvement of user experience without hardware replacement, encourages long-term customer engagement, and reduces obsolescence. Automotive software ecosystems, including Android Automotive OS, are gaining prominence due to their flexibility and extensive app ecosystem, driving uniformity across vehicle models and enhancing connectivity features.

Electrification and Digital Cockpit Integration

The rapid adoption of electric vehicles (EVs) is creating demand for more advanced infotainment systems. EVs require detailed battery management, energy consumption monitoring, and charging station integration, all of which are facilitated by high-resolution digital cockpits. OEMs are adopting large, panoramic displays, AR heads-up displays, and domain controllers to provide immersive experiences. Digital cockpits are also becoming key differentiators in luxury and mid-premium segments, offering a seamless combination of entertainment, navigation, and vehicle performance monitoring.

What are the key drivers in the in-car infotainment system market?

Rising Consumer Demand for Connectivity and UX

Consumers increasingly expect a seamless, smartphone-like user experience in vehicles. Demand for voice control, real-time navigation, streaming services, and over-the-air updates is rising sharply. High-resolution display units, advanced communication modules, and OS integrations are now key selling points for new vehicles. Display units alone accounted for approximately 41% of the market in 2024, highlighting the emphasis on immersive visual experiences.

Regulatory Mandates and Safety Standards

Governments are enforcing regulations for driver safety, emergency call systems, and connected vehicle standards (e.g., V2X). Compliance requirements for cybersecurity, data privacy, and display safety are driving automakers to adopt advanced infotainment systems. These regulations ensure that vehicles integrate navigation, connectivity, and safety features while maintaining compliance with national and international standards.

Electrification and EV Adoption

EVs and hybrid vehicles require advanced infotainment systems to provide drivers with critical information such as range, charging status, and energy consumption. This trend is further accelerated by government incentives for EV adoption and growing consumer awareness of sustainable transportation. Premium EVs often feature panoramic displays, augmented reality HUDs, and connected services, boosting the infotainment market in the high-value segment.

What are the restraints for the global market?

High Component Costs and Supply Chain Constraints

High-quality display panels, domain controllers, and 5G/V2X modules significantly increase system costs. Fluctuations in semiconductor and raw material prices, coupled with global supply chain disruptions, can limit adoption in cost-sensitive vehicles. Entry-level and budget vehicles, particularly in emerging markets, are most affected by these cost pressures.

Fragmented Software Ecosystem and Integration Challenges

The automotive infotainment ecosystem remains fragmented, with multiple OS platforms, varying app support, and inconsistent update policies. Ensuring compatibility, interoperability, and cybersecurity across hardware and software platforms is a major challenge. These issues can slow adoption and affect user satisfaction, particularly in regions with stringent privacy regulations.

What are the key opportunities in the in-car infotainment system market?

Integration of AI and Personalized User Experiences

Artificial intelligence enables adaptive interfaces, voice control, and predictive recommendations based on user behavior. Personalized infotainment experiences improve customer engagement and allow OEMs to offer premium services, such as custom navigation, media preferences, and driver assistance features. This trend opens avenues for subscription-based revenue models and continuous software monetization.

Emerging Regional Demand and EV Growth

Asia-Pacific and emerging markets such as India, Southeast Asia, and Latin America offer strong growth potential due to rising vehicle ownership, increasing disposable income, and government EV incentives. Suppliers that can localize features, provide affordable connectivity, and adapt software for regional languages and services are well-positioned to capture market share.

Product Type Insights

Display units dominate the global market, particularly high-resolution touchscreens, AR heads-up displays, and panoramic dashboards. Audio and entertainment units are also growing rapidly due to demand for premium sound systems. Navigation units integrated with real-time traffic, mapping, and EV charging information remain essential. Software platforms, particularly Android Automotive OS, are increasingly defining value, enabling OTA updates, app integration, and personalized experiences. OEM-installed infotainment systems remain dominant (70–80% of the 2024 market), while aftermarket upgrades are gaining traction, especially in mature markets with aging vehicles.

Application Insights

Passenger cars account for the majority (70–80%) of market demand due to high production volumes and consumer expectations for connected, immersive infotainment experiences. Light commercial vehicles are adopting infotainment systems for navigation, telematics, and driver comfort, while heavy commercial vehicles are integrating basic infotainment for driver safety and productivity. EVs are driving innovation, particularly in digital cockpits and connected services. Aftermarket retrofitting is a growing application, allowing owners to upgrade older vehicles with advanced infotainment features.

Distribution Channel Insights

OEM installations dominate, offering seamless integration and warranty-backed systems. Aftermarket upgrades and retrofit solutions are growing, particularly in regions with mature vehicle fleets. Suppliers and automotive electronics companies are leveraging direct OEM partnerships, e-commerce platforms, and service subscriptions to expand market reach. The rise of connected services, subscription-based software, and cloud integration is changing distribution models from hardware-centric to service-oriented approaches.

End-Use Insights

Passenger cars remain the largest end-use segment, with SUVs and mid-premium sedans driving high demand for advanced infotainment features. Light commercial vehicles are the fastest-growing segment due to fleet operators integrating navigation, telematics, and driver assistance. EV manufacturers are emerging as a high-value end-use segment, using infotainment systems as a differentiator. Aftermarket consumers seeking upgrades also contribute to growing demand, particularly in mature regions such as Europe and North America.

| By Product Type | By Operating System / Software Stack | By Installation Type | By Vehicle Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant share (15–25%) due to high consumer expectations, premium vehicle sales, and regulatory mandates for connectivity and safety features. The U.S. drives growth with strong adoption of EVs and luxury digital cockpits, while Canada follows closely with premium vehicle demand. Mexico contributes through vehicle assembly and export-focused production.

Europe

Europe accounts for 20–25% of the market, driven by Germany, the U.K., France, and Italy. Strict safety regulations, growing EV adoption, and consumer preference for premium infotainment systems are key drivers. Eastern European markets are showing rapid growth as OEMs establish production hubs and localize components.

Asia-Pacific

Asia-Pacific is the largest market (33–36%), led by China, Japan, and India. China dominates in volume due to high vehicle production and EV adoption. India and Southeast Asia are the fastest-growing regions, fueled by increasing disposable incomes, rising vehicle ownership, and demand for mid-premium and advanced infotainment systems. Japan and South Korea continue to demand premium, technology-driven solutions.

Latin America

Latin America holds a smaller share (<10%) but is growing, with Brazil, Mexico, and Argentina leading demand. Outbound vehicle component imports and local assembly for OEMs drive adoption. Consumers favor adventure and premium infotainment packages, gradually expanding market penetration.

Middle East & Africa

Africa remains central to vehicle assembly and OEM demand, while the Middle East, led by the UAE, Saudi Arabia, and Qatar, is a key growth market due to high-income populations and luxury vehicle preference. Intra-African demand is also rising, with fleet operators and regional vehicle sales contributing to growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the In-Car Infotainment System Market

- Harman International

- Robert Bosch GmbH

- Continental AG

- Panasonic Corporation

- Alps Alpine Co., Ltd.

- Denso Corporation

- Visteon Corporation

- LG Electronics, Inc.

- Aptiv PLC

- Pioneer Corporation

- Clarion

- Sony Corporation

- Hyundai Mobis Co., Ltd.

- Desay SV Automotive

- JVCKENWOOD Corporation

Recent Developments

- In May 2025, Harman International announced the launch of an advanced digital cockpit platform with integrated AR HUDs and AI-driven personalization, targeting premium EVs in Europe and North America.

- In March 2025, Panasonic Corporation expanded its automotive infotainment division in Asia-Pacific, establishing new R&D centers in India and China focused on connected car solutions and 5G integration.

- In January 2025, Robert Bosch GmbH unveiled its next-generation communication module supporting V2X and 5G connectivity, aimed at OEMs integrating autonomous driving and advanced infotainment features.