Ice Storage Boxes Market Size

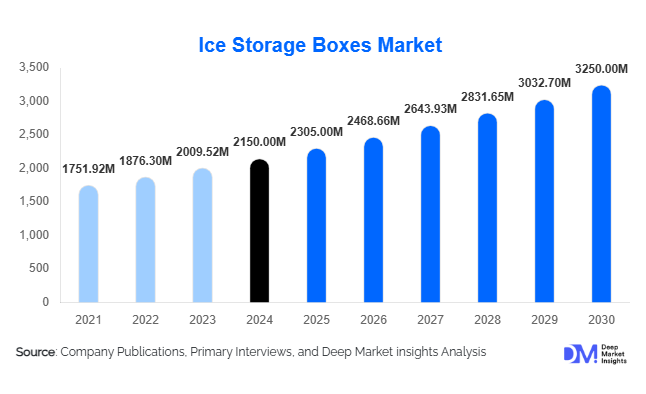

According to Deep Market Insights, the global ice storage boxes market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,305 million in 2025 to reach USD 3,250 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand across the food & beverage, pharmaceutical, and hospitality industries, combined with rising recreational and household usage. Technological advancements in insulation materials and portable designs are further propelling global adoption.

Key Market Insights

- Portable and industrial ice storage boxes are witnessing high adoption, with consumers preferring lightweight, insulated, and easy-to-transport designs for both domestic and commercial applications.

- Plastic-based boxes dominate globally due to their durability, low cost, and corrosion resistance, accounting for approximately 42% of market share in 2024.

- North America leads demand, driven by strong cold-chain infrastructure, recreational usage, and pharmaceutical storage needs, representing nearly 29% of the global market.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, urbanization, and industrial demand in countries like China, India, and Southeast Asia.

- End-use demand is expanding in the food & beverage sector, particularly frozen food distribution and cold-chain logistics, accounting for 45% of global market consumption.

- Technological integration, including eco-friendly materials, smart temperature monitoring, and advanced foam insulation, is reshaping product design and market competitiveness.

Latest Market Trends

Eco-Friendly and Smart Ice Storage Solutions

Manufacturers are increasingly offering ice storage boxes with eco-friendly materials such as biodegradable plastics and advanced composite insulation. Smart solutions with IoT-enabled temperature monitoring, solar-powered options, and energy-efficient designs are gaining traction, particularly in industrial, pharmaceutical, and outdoor applications. These innovations cater to sustainability-focused buyers and industries that require precision temperature control, strengthening market differentiation. Companies integrating smart features are also able to offer premium pricing while addressing regulatory and environmental standards.

Growth of Recreational and Household Use

Portable ice boxes for outdoor activities, picnics, camping, and home use are becoming mainstream. Lightweight, compact, and insulated designs allow extended ice retention and convenience, driving retail and e-commerce sales. The trend is particularly strong in North America and Europe, where consumers prioritize leisure and convenience. Online retail platforms have further enhanced accessibility, enabling direct-to-consumer delivery and custom designs for domestic buyers. Social media influence and outdoor lifestyle trends have contributed to increasing awareness and adoption.

Ice Storage Boxes Market Drivers

Rising Cold-Chain and Industrial Logistics Demand

The growing need for temperature-controlled storage in food, pharmaceuticals, and seafood logistics has significantly boosted demand. Ice storage boxes are critical for transporting perishable goods, ensuring compliance with safety and quality standards. Industrial-grade boxes are designed for durability and extended storage periods, supporting high-volume operations and export-driven industries.

Expansion in Food & Beverage Applications

Frozen food consumption, beverage distribution, and retail operations are major growth drivers. Medium-capacity boxes (20–50 L) are preferred for balancing storage efficiency and portability, capturing around 40% of the market in 2024. Restaurants, cafes, and small-scale retailers increasingly rely on these products for daily operations, stimulating consistent demand across regions.

Recreational and Household Use Growth

Outdoor activities, camping, and home gatherings are propelling portable box sales, particularly in North America and Europe. Lightweight plastic designs with high insulation efficiency are preferred by consumers, making them the most adopted product type globally with 38% share in 2024. Growing consumer awareness of food safety and convenience further supports this trend.

Market Restraints

High Cost of Advanced Insulation Materials

Specialized ice storage boxes with composite or foam insulation are expensive to manufacture, limiting adoption in cost-sensitive regions. Price constraints may hinder the growth of premium and industrial segments in emerging markets.

Competition from Refrigeration Alternatives

Refrigerators and mini-freezers often substitute ice boxes for long-term storage, particularly in residential and retail segments. This restricts market penetration for larger, higher-capacity boxes, posing a challenge for manufacturers to differentiate through portability, insulation, and specialized applications.

Ice Storage Boxes Market Opportunities

Emerging Market Expansion

Rapid urbanization and increasing disposable income in countries such as India, China, and Brazil present significant growth potential. New distribution networks and localized manufacturing can help players capture demand from both domestic consumers and industrial buyers. Emerging markets are particularly receptive to medium-capacity and portable designs, driving overall adoption.

Smart and Sustainable Product Innovations

Integration of IoT-enabled temperature monitoring, solar-powered options, and eco-friendly insulation materials provides opportunities to differentiate and capture premium market segments. These solutions appeal to industrial buyers, healthcare providers, and environmentally conscious consumers, aligning with regulatory and sustainability trends.

Government Cold-Chain Initiatives

Government programs supporting food safety, vaccine storage, and export logistics are boosting market growth. Initiatives like India’s “Make in India” and China’s “Made in China 2025” encourage domestic manufacturing and technological advancement, enabling both new entrants and existing players to expand efficiently in regional markets.

Product Type Insights

Portable ice storage boxes dominate the market, capturing 38% of global share in 2024. Their combination of affordability, portability, and thermal efficiency has made them popular across domestic, recreational, and small commercial applications. Industrial boxes are gaining traction in food and pharmaceutical logistics, driven by durability and compliance with temperature standards. Specialized insulated boxes appeal to premium segments seeking long-duration storage and eco-friendly options.

Material Insights

Plastic-based ice storage boxes are the largest segment, accounting for 42% of market share. High-density polypropylene and polyethylene offer durability, corrosion resistance, and low manufacturing cost. Metal and composite boxes are preferred in industrial and export-oriented applications due to enhanced insulation and longevity. Foam-insulated designs are growing rapidly in pharmaceutical and seafood logistics where extended ice retention is critical.

Application Insights

Food & beverage storage remains the largest application, representing 45% of the global market. Pharmaceuticals and healthcare are emerging rapidly due to cold-chain requirements for vaccines and medicines. Recreational use is growing steadily, particularly in North America and Europe. Industrial applications include seafood and perishable goods transport, supported by medium and large-capacity boxes designed for export markets.

Distribution Channel Insights

Offline retail continues to dominate with a 50% share, particularly through supermarkets and specialty stores. Online platforms are rapidly growing, offering customizable and direct-to-consumer options. Industrial direct sales remain significant for bulk procurement in logistics, food processing, and healthcare sectors. E-commerce growth is fueled by increasing consumer preference for convenience and home delivery.

| By Product Type | By Material | By Capacity | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents 29% of the global market, with strong demand from foodservice, healthcare, and recreational segments. The U.S. leads regional demand due to advanced cold-chain infrastructure, high outdoor activity participation, and robust e-commerce penetration.

Europe

Europe accounts for 25% of the global market share. Germany, France, and the U.K. are major contributors, driven by stringent food safety regulations and widespread adoption in restaurants, hotels, and pharmaceutical logistics. Eco-friendly product adoption is higher in these countries.

Asia-Pacific

APAC is the fastest-growing region at a CAGR of 8.5%, led by China, India, Japan, and Southeast Asian nations. Rising disposable income, industrial demand, and increasing cold-chain infrastructure are primary growth drivers.

Latin America

Brazil and Mexico are leading markets, primarily driven by food & beverage logistics and seafood exports. Growth is moderate but increasing due to urbanization and retail expansion.

Middle East & Africa

Demand is driven by hospitality, seafood exports, and recreational activities. UAE and South Africa are key markets, with government investment in industrial cold-chain infrastructure supporting growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Storage Boxes Market

- Igloo Products Corp.

- Rubbermaid Commercial Products

- Coleman Company, Inc.

- Polar King International

- Pelican Products, Inc.

- Keter Group

- Engel Coolers

- ORCA Coolers

- Grizzly Coolers

- Yeti Holdings, Inc.

- Arctic Zone

- Frost King

- Suncast Corporation

- Stanley PMI

- Dometic Group

Recent Developments

- In July 2025, Igloo Products Corp. launched a new line of eco-friendly portable ice boxes with biodegradable insulation for North America and Europe.

- In May 2025, Coleman Company introduced smart ice storage boxes with IoT-enabled temperature monitoring for industrial and pharmaceutical applications.

- In March 2025, Pelican Products expanded production capacity in China, catering to growing APAC demand for medium and large-capacity industrial ice storage boxes.