Ice Skating Equipment Market Size

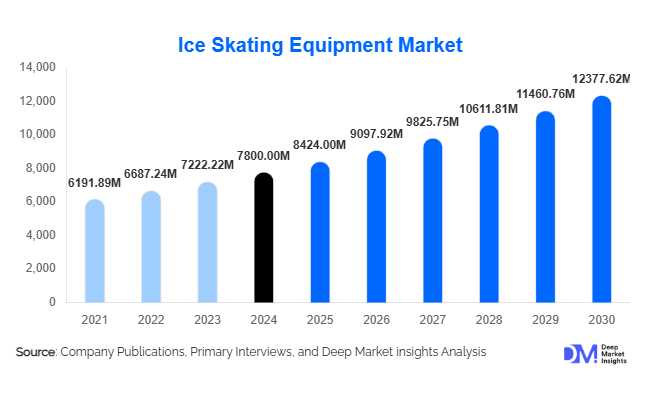

According to Deep Market Insights, the global ice skating equipment market size was valued at USD 7,800.00 million in 2024 and is projected to grow from USD 8,424.00 million in 2025 to reach USD 12,377.62 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). Market growth is primarily driven by rising participation in winter sports, expansion of indoor ice-rink infrastructure in emerging economies, and increasing consumer interest in recreational and professional skating. The adoption of advanced materials, premiumization of equipment, and online retail expansion are reshaping the market’s structure and profitability.

Key Market Insights

- Ice skates remain the dominant product category, accounting for nearly 46% of total market value in 2024, fueled by high replacement cycles and premiumization trends.

- Offline specialty stores lead distribution with 65% market share, supported by the need for professional fitting and in-store expertise.

- North America dominates global demand, holding 43% of the 2024 market, with strong participation in ice hockey and figure skating.

- Asia-Pacific is the fastest-growing region, expanding at an estimated 6–7% CAGR, driven by China’s “ice and snow economy” initiatives.

- Technological advancements such as carbon-composite blades, ergonomic boots, and smart sensors are elevating product performance.

- Rental-fleet and institutional demand from commercial ice rinks and training academies are creating recurring revenue streams for suppliers.

What are the latest trends in the ice skating equipment market?

Premiumization and Custom-Fit Skates

Leading manufacturers are investing in premium product innovation, focusing on lightweight composite materials, enhanced blade geometry, and personalized boot fitting. The move toward custom-fit equipment is reshaping consumer expectations, particularly in competitive figure skating and ice hockey. Premium skates command 20–30% higher prices than standard models, with performance and comfort being key selling points. The introduction of advanced carbon-fiber shells and thermoformable linings has improved both durability and precision, resulting in shorter replacement cycles and higher per-unit value across mature markets.

Digital Retail Expansion and Direct-to-Consumer Sales

E-commerce and omnichannel sales have revolutionized how consumers purchase ice skating gear. While offline retail still accounts for the majority of sales, online platforms are rapidly gaining ground by offering customization tools, virtual fitting guides, and detailed user reviews. Direct-to-consumer (D2C) websites from top brands are enabling global reach and higher margins. The integration of augmented reality (AR) fitting technology and interactive brand apps is enhancing user experience, especially among younger and tech-savvy consumers who favor convenience and transparency.

Rising Institutional Procurement

Commercial ice rinks, sports academies, and school programs are becoming significant buyers of ice skating equipment. The demand for rental skates, safety gear, and maintenance accessories for large fleets has led to long-term supplier contracts. This business-to-business (B2B) segment offers stable, recurring revenue potential. With new ice-rink facilities opening in China, the Middle East, and Southeast Asia, manufacturers are tailoring cost-efficient, durable products designed for heavy institutional use. This trend also supports after-sales opportunities in maintenance, repair, and equipment management services.

What are the key drivers in the ice skating equipment market?

Expansion of Ice-Rink Infrastructure

Governments and private developers are investing heavily in year-round indoor ice-rink facilities, extending participation beyond traditional winter months. In emerging regions like China, the UAE, and South Korea, over 500 new rinks are planned or under construction. This expansion directly boosts equipment demand, as new facilities require rental fleets, protective gear, and accessories, simultaneously fostering recreational and professional skating communities.

Technological Advancements and Safety Focus

Ongoing innovations in skate and protective gear design are enhancing performance and safety. Modern boots utilize lightweight carbon-composite materials, while advanced blades improve maneuverability and energy efficiency. Protective equipment now includes impact sensors and improved ergonomics, aligning with heightened consumer awareness around injury prevention. These developments encourage product upgrades and sustain revenue through premium pricing strategies.

Growth of E-Commerce and Brand Engagement

The digital revolution has transformed the retail landscape for sporting goods. Ice skating brands are leveraging online marketplaces and D2C websites to reach global consumers, supported by influencer marketing and social media campaigns. Online sales are growing at twice the rate of offline sales, with personalization and doorstep delivery becoming critical differentiators. This driver not only widens access but also improves margins for manufacturers, bypassing intermediaries.

What are the restraints for the global market?

High Equipment Costs and Price Sensitivity

Premium skates and protective gear remain expensive, limiting accessibility for entry-level users and emerging markets. High import duties, material costs, and manufacturing expenses add to the price barrier. This price sensitivity, particularly in Latin America and parts of Asia, constrains adoption rates and delays replacement cycles, challenging market expansion among mass consumers.

Infrastructure and Seasonal Constraints

Ice skating participation is still concentrated in colder climates or regions with developed rink networks. Limited infrastructure in tropical and developing economies restricts consumer reach. The cost of maintaining ice facilities is high, making rink availability seasonal or geographically limited. Without strong infrastructure support, potential growth in equipment sales remains unrealized in many countries.

What are the key opportunities in the ice skating equipment industry?

Emerging Markets and Infrastructure Investment

The construction of indoor ice-rinks in Asia-Pacific, the Middle East, and Latin America presents a major expansion opportunity. National sports initiatives and tourism projects, such as China’s “Ice and Snow 2030” policy, are fostering large-scale demand for rental fleets, beginner skates, and protective equipment. Manufacturers that establish partnerships with new rink operators or local distributors can gain an early competitive advantage in these emerging territories.

Smart and Connected Equipment

Integration of IoT and wearable technology is opening new growth avenues. Smart insoles and sensor-equipped blades can track performance metrics such as stride power and balance, appealing to both professional athletes and enthusiasts. These innovations support data-driven training and provide differentiation in a competitive market. The convergence of sports technology and skating equipment is anticipated to form a USD 300 million niche by 2030.

Rental-Fleet and Subscription Models

New business models offering equipment leasing and subscription-based access are gaining traction among consumers and ice-rink operators. Instead of outright purchases, rinks and clubs prefer leasing high-quality gear with maintenance included. For manufacturers, this model ensures predictable revenue streams, product lifecycle control, and enhanced brand loyalty through recurring interaction with customers.

Product Type Insights

Ice skates dominate the global market with approximately 46% of total revenue in 2024. The category includes figure, hockey, recreational, and speed skates, catering to both professionals and amateurs. Advanced boot materials, customizable designs, and performance-oriented blade structures are driving growth within this segment. Protective gear and safety equipment are gaining traction due to heightened safety awareness among youth and training academies, while accessories and maintenance equipment continue to support aftermarket demand, accounting for roughly 20% of total revenue.

Distribution Channel Insights

Offline retail remains the leading channel with around 65% market share in 2024, driven by the need for professional fitting and physical product testing. Specialty sporting goods stores dominate in North America and Europe. However, the online and direct-to-consumer segment is expanding rapidly, expected to exceed 35% share by 2030. This growth is driven by digital marketing, AR fitting tools, and influencer-led brand visibility, which appeal to younger and urban consumers globally.

End-User Insights

Personal and recreational users represent approximately 85% of market demand in 2024, driven by leisure skating and family-oriented activities. Professional and competitive users account for about 10%, representing figure skaters, hockey players, and speed skaters who purchase high-end, customized gear. The remaining 5% stems from commercial and institutional users such as rink operators and schools. The commercial segment is expected to post the fastest growth through 2030 as new rinks in APAC and the Middle East expand fleet procurement programs.

| By Product Type | By End User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 43% share in 2024. The U.S. dominates due to its strong hockey culture, extensive rink network, and high consumer spending power. Canada remains a major contributor, with widespread grassroots hockey participation driving continuous demand for new equipment. Growth is steady at around 5% CAGR, supported by product innovation and replacement demand.

Europe

Europe holds nearly 30% of global revenue, led by countries such as Germany, the U.K., France, and the Nordics. Established figure skating traditions, winter tourism, and eco-friendly product initiatives underpin market stability. European consumers exhibit a strong preference for sustainability-certified products and locally manufactured gear, driving innovation in recyclable materials and ethical production.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of approximately 6–7%. China leads growth, backed by government-driven sports infrastructure development and rising participation in ice sports following the Winter Olympics. Japan and South Korea show strong performance in premium product adoption, while Australia is emerging as a niche recreational market. APAC is projected to increase its global share to nearly 28% by 2030.

Latin America

Latin America accounts for 5–7% of market value, with Brazil and Argentina being key contributors. While infrastructure is still limited, mall-based ice rinks and entertainment complexes are gradually introducing ice sports to new consumers. Growth is projected at around 5.5% CAGR through 2030 as accessibility improves and imports of entry-level equipment rise.

Middle East & Africa

MEA contributes roughly 5% of global sales but is among the fastest-growing in relative terms. The UAE, Saudi Arabia, and South Africa are leading adopters, supported by tourism projects and indoor recreational developments. Government-backed sports diversification programs are expected to further increase demand for ice-skating equipment over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Skating Equipment Market

- Bauer Hockey

- CCM Hockey

- Jackson Ultima Skates

- Riedell Skates

- Edea Skates

- Graf Skates AG

- Wifa Skates

- Van der Wegen Skates

- Roces Srl

- Powerslide Skates

- Botas Skates

- MK Skates

- Salomon

- Winnwell Hockey

- SSUSA

Recent Developments

- In May 2025, Bauer Hockey launched a new carbon-composite hockey skate line featuring enhanced ankle support and a lighter blade chassis to improve agility and energy transfer.

- In April 2025, Jackson Ultima introduced an AI-powered custom-fit system in its flagship stores, enabling 3D scanning and instant configuration for professional skaters.

- In February 2025, Edea Skates announced expansion into Southeast Asia through strategic retail partnerships, targeting growing figure skating academies in Malaysia and Singapore.