Ice Maker Market Size

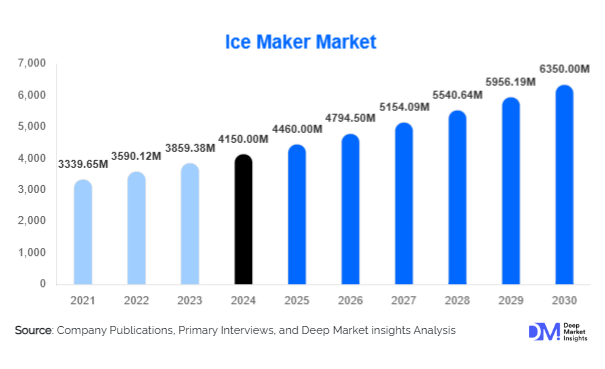

According to Deep Market Insights, the global ice maker market size was valued at USD 4,150 million in 2024 and is projected to grow from USD 4,460 million in 2025 to reach USD 6,350 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025-2030). The ice maker market growth is primarily driven by the increasing demand from commercial and residential sectors, rising adoption of automated and smart kitchen appliances, and the expansion of the food and beverage and hospitality industries worldwide.

Key Market Insights

- Commercial ice makers dominate the market, particularly in hotels, restaurants, and healthcare facilities, due to their high efficiency, consistent ice quality, and hygiene standards.

- Residential adoption is rising, driven by urbanization, higher disposable incomes, and the popularity of compact, energy-efficient, and smart ice makers in households.

- North America holds a significant share, led by the U.S. and Canada, due to a mature food service infrastructure and high demand for premium appliances.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, expanding hospitality and food service industries, and increasing disposable incomes in countries such as India, China, and Australia.

- Technological innovation, including IoT-enabled ice makers, automatic cleaning systems, and energy-efficient designs, is reshaping the competitive landscape and product differentiation.

What are the latest trends in the ice maker market?

Smart and Energy-Efficient Ice Makers

Emerging technologies are transforming the ice maker industry. Smart appliances with IoT integration allow users to monitor ice production remotely, automate cleaning cycles, and optimize energy consumption. Energy-efficient compressors and eco-friendly refrigerants are being adopted to reduce operational costs and carbon footprint, particularly in commercial and institutional settings. These trends appeal to both environmentally conscious consumers and businesses aiming to lower utility expenses while maintaining hygiene and productivity standards.

Expansion in Commercial and Institutional Demand

Commercial demand, including hotels, resorts, hospitals, and food service chains, is a key growth driver. Large-scale operations require consistent, high-quality ice, prompting investments in high-capacity ice makers (>500 kg/day). Additionally, government initiatives and public infrastructure projects, particularly in emerging markets, are increasing institutional demand for ice makers in hospitals, schools, and public food distribution networks. This trend is boosting both regional market penetration and export-driven growth.

What are the key drivers in the ice maker market?

Growing Food & Beverage Industry

The expanding food and beverage sector, including quick-service restaurants, bars, and cafes, is driving demand for ice makers. High-volume operations require hygienic and reliable ice production, particularly for beverages, food preservation, and healthcare applications. This segment accounts for roughly 50% of the overall market demand, emphasizing its critical role in growth.

Urbanization and Rising Disposable Income

Rapid urbanization and higher disposable incomes in emerging economies are increasing residential adoption of ice makers. Urban consumers prioritize convenience, aesthetics, and hygiene, driving growth in the compact and smart residential ice maker segment, which contributes around 25% of global revenue.

Technological Advancements

Innovation in ice makers, including modular designs, automatic cleaning, and smart features, is enhancing operational efficiency and user experience. Commercial buyers are increasingly adopting high-capacity, technologically advanced units, while residential users prefer compact, connected appliances that integrate seamlessly with modern kitchens.

What are the restraints for the global market?

High Initial Investment

High-capacity commercial ice makers require significant upfront capital, limiting adoption among small restaurants and low-margin food service businesses. Budget constraints can delay procurement, impacting overall market penetration.

Maintenance and Energy Costs

Commercial ice makers consume significant electricity and require regular maintenance. Rising energy costs and inconsistent power supply in certain regions can deter buyers, slowing market expansion. Manufacturers addressing these issues through energy-efficient designs and service packages gain a competitive advantage.

What are the key opportunities in the ice maker market?

Technological Innovation and Smart Appliances

IoT-enabled smart ice makers, self-cleaning mechanisms, and energy-efficient systems present significant opportunities. Companies investing in R&D can capture premium residential and commercial segments, offering differentiated, high-margin products.

Emerging Regional Demand

Countries such as India, Vietnam, Saudi Arabia, and Brazil are witnessing rising urbanization and hospitality sector expansion, driving commercial and residential ice maker demand. Early entrants in these markets can benefit from first-mover advantages and higher growth potential.

Government and Institutional Projects

Public infrastructure spending in healthcare, education, and defense sectors is increasing the demand for commercial ice makers. Initiatives like “Make in India” and “Made in China 2025” support domestic manufacturing, reducing import dependency and creating opportunities for local and global manufacturers to expand production and market share.

Sustainable and Eco-Friendly Solutions

Eco-conscious consumers and regulatory mandates are creating demand for energy-efficient and environmentally friendly ice makers using low-GWP refrigerants. Green products offer market differentiation and appeal to environmentally conscious buyers, particularly in Europe and North America.

Product Type Insights

Cube ice makers dominate the market, accounting for 45% of global market share in 2024, due to their versatility, consistent ice quality, and broad applicability across commercial and residential sectors. High-capacity commercial ice makers (>500 kg/day) contribute 40% of total revenue, driven by hospitality and healthcare sector demand. Residential compact ice makers are gaining popularity in urban households for convenience and smart features.

Application Insights

The food and beverage sector is the leading application, comprising 50% of global market demand. Hotels, restaurants, and bars are primary consumers. Emerging applications include supermarkets, cloud kitchens, and packaged ice for cold-chain logistics. Healthcare applications are also growing, driven by hygiene requirements for hospitals and pharmaceutical storage.

Distribution Channel Insights

Direct B2B sales dominate commercial ice maker distribution, while residential appliances are increasingly sold through online platforms, specialty retailers, and D2C websites. Subscription-based models and maintenance service contracts are emerging for commercial buyers. Social media and digital marketing are influencing consumer preferences, particularly among younger residential buyers.

End-Use Insights

Commercial end-use dominates at 55% of the market, led by hospitality, healthcare, and retail food sectors. Residential usage contributes approximately 25% and is growing steadily. Emerging applications include supermarkets, cloud kitchens, and food delivery services requiring packaged ice. Export-driven demand from the US, Europe, and China to the Middle East and Africa supports market growth.

| By Product Type | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for USD 1,150 million in 2024 (28% of the global market). The U.S. and Canada lead due to mature food service sectors, disposable incomes, and premium appliance adoption. Growth is projected at 6% CAGR through 2030.

Europe

Europe represents 25% of the global market share, with Germany, France, and the UK driving demand. Germany is the fastest-growing European market at 6.5% CAGR, supported by technological adoption and hospitality sector expansion.

Asia-Pacific

APAC is the fastest-growing region (8% CAGR), led by India, China, Japan, and Australia. Urbanization, disposable income growth, and hospitality infrastructure expansion are key growth drivers. Smart and compact ice makers are increasingly adopted in residential segments.

Middle East & Africa

UAE, Saudi Arabia, and South Africa lead regional demand, supported by tourism, luxury hotels, and high-income populations. The UAE is the fastest-growing country in the region. Growth is projected at 7.2% CAGR.

Latin America

Brazil and Mexico are key markets, accounting for 10% of the global share, with moderate growth (5-6% CAGR) driven by restaurants and food service chains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Maker Market

- Hoshizaki Corporation

- Scotsman Ice Systems

- Manitowoc Company, Inc.

- Brema Ice Makers

- Follett Corporation

- Uline

- Liebherr Group

- Ice-O-Matic

- Blue Air

- Simag

- Kairak

- Everest Ice Makers

- Polar Ice Systems

- True Manufacturing Co., Inc.

- Coldline

Recent Developments

- In March 2025, Hoshizaki launched a new line of energy-efficient commercial ice makers with IoT integration for remote monitoring and automated cleaning.

- In January 2025, Scotsman Ice Systems expanded production in Asia-Pacific to meet rising residential and commercial demand, particularly in India and China.

- In February 2025, Manitowoc introduced smart cube ice machines with eco-friendly refrigerants, catering to high-capacity hospitality and healthcare applications.