Ice Hockey Equipment Market Size

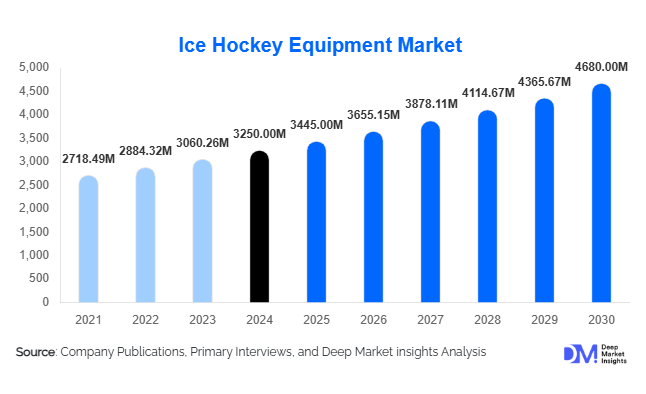

According to Deep Market Insights, the global ice hockey equipment market size was valued at USD 3,250 million in 2024 and is projected to grow from USD 3,445 million in 2025 to reach USD 4,680 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing global participation in ice hockey, rising awareness of player safety, and technological advancements in equipment, materials, and design, which enhance performance while reducing injuries.

Key Market Insights

- Protective gear remains the largest product segment, driven by mandatory league regulations and increasing adoption among youth and professional players worldwide.

- Carbon fiber and composite sticks are gaining prominence, offering lightweight, high-performance alternatives to traditional wooden sticks, appealing especially to professional and semi-professional players.

- North America dominates the market, accounting for 45% of global demand due to established leagues like the NHL and high disposable incomes.

- Europe follows closely with 30% market share, driven by countries such as Sweden, Finland, and the Czech Republic, where ice hockey is widely popular.

- Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea, fueled by government-backed ring development and rising youth participation.

- Technological adoption, including smart helmets, sensor-embedded protective gear, and performance-tracking equipment, is reshaping player safety and equipment preferences globally.

Latest Market Trends

Advanced Protective Gear and Lightweight Equipment

Manufacturers are increasingly focusing on protective gear that combines durability, comfort, and safety. Helmets, pads, and gloves now incorporate high-density foams, carbon fiber reinforcements, and improved ventilation systems. Composite sticks are replacing traditional wooden sticks, offering players better flexibility, strength, and energy transfer. Lightweight skates with ergonomic designs are also gaining popularity among professionals and youth players, driving growth in premium product segments.

Integration of Smart Technologies

Emerging technologies are being embedded into ice hockey equipment to monitor player performance and safety. Smart helmets with impact sensors, wearable pads that track collisions, and performance analytics tools are attracting attention from professional teams, training academies, and amateur leagues. These innovations provide real-time data to coaches and players, improving training effectiveness and injury prevention, and supporting premium pricing strategies for technologically advanced equipment.

Ice Hockey Equipment Market Drivers

Rising Player Safety Awareness

Stricter safety regulations in professional leagues and youth programs are driving demand for high-quality protective gear. Helmets, shoulder pads, and gloves with advanced materials reduce injury risks, boosting market growth across professional, amateur, and recreational players.

Expansion of Ice Hockey Leagues Globally

The growth of professional and amateur ice hockey leagues in North America, Europe, and the Asia-Pacific is stimulating equipment demand. Youth development programs and local tournaments increase recurring purchases of skates, sticks, and protective gear, supporting consistent market growth.

Technological Advancements in Equipment

Innovations such as carbon fiber sticks, lightweight skates, and customizable pads enhance performance and comfort. Players and teams are increasingly willing to invest in premium equipment that improves on-ice performance, creating a profitable segment for manufacturers.

Market Restraints

High Cost of Premium Equipment

The expense of advanced protective gear, carbon fiber sticks, and professional-grade skates limits adoption among recreational and amateur players, particularly in emerging regions. High pricing poses a barrier to market penetration and volume growth.

Seasonal and Geographic Limitations

Ice hockey’s dependence on cold climates and the availability of ice rinks restricts growth in tropical and temperate regions. Seasonal fluctuations in demand also create challenges for inventory management and revenue consistency.

Ice Hockey Equipment Market Opportunities

Emerging Markets Expansion

Asia-Pacific, led by China, Japan, and South Korea, offers significant growth potential. Government initiatives to develop ice rinks, youth programs, and leagues create new demand for professional-grade equipment. Early market entry can establish brand recognition and capture first-mover advantages.

Integration of Wearable Technology

Smart equipment embedded with sensors and performance-tracking systems presents opportunities for premium offerings targeting professional teams, academies, and tech-savvy amateur players. These products provide enhanced safety monitoring, data analytics, and performance optimization.

Sustainable and Eco-Friendly Materials

Consumer demand for environmentally friendly products is growing. Manufacturers using recycled plastics, sustainable textiles, and low-impact production methods can differentiate their offerings, align with regulatory requirements, and command premium pricing.

Product Type Insights

Protective gear continues to lead the ice hockey equipment market, accounting for 42% of 2024 sales. This dominance is driven by rising safety awareness, stricter league regulations, and increased adoption among professional, amateur, and youth players. Helmets, shoulder pads, elbow pads, and gloves are particularly critical due to their direct role in injury prevention. Skates follow closely, with innovations in lightweight materials, ergonomic design, and performance-enhancing features driving adoption among professionals and recreational players alike. Sticks are increasingly made from carbon fiber and composite materials, improving durability, shot accuracy, and energy transfer, which appeals to high-level players. Apparel demand is rising due to team branding, personalization options, and fan merchandise, while pucks and accessories are growing steadily, supported by standardized use in training and competitive play.

Material Insights

Advanced materials are shaping market dynamics, with carbon fiber and composite materials dominating 35% of the market share. These materials are particularly preferred for sticks and protective gear due to their high strength-to-weight ratio, enhancing performance while minimizing fatigue and injury risk. Traditional plastics and foam remain important for entry-level equipment, providing affordable options for youth and recreational players. Fabrics and textiles are widely used in apparel and accessories, with performance-focused designs and moisture-wicking technologies enhancing comfort and durability.

Player Level Insights

Professional players account for 38% of market revenue, driven by league mandates, premium equipment requirements, and frequent upgrades to high-performance gear. The youth and amateur segments are experiencing rapid growth, with a 7% CAGR, fueled by increasing engagement programs, school leagues, and recreational participation. Rising parental investment in safety and training programs is also boosting youth equipment demand, creating a strong pipeline for long-term market growth.

Distribution Channel Insights

Specialty retail stores dominate with 40% market share, offering expert advice, personalized fittings, and brand-specific selections. Online retail and D2C channels are rapidly expanding due to convenience, wider product availability, and the ability to customize gear. Sports clubs and associations remain significant B2B channels, providing bulk equipment to leagues, academies, and training programs. General sporting goods stores cater to casual players with affordable, mass-market equipment, helping to broaden market reach.

| By Product Type | By Material Type | By Player Level | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 45%, led by the USA and Canada. The strong ice hockey culture, combined with the presence of major leagues such as the NHL, is a key driver of high equipment demand. Well-established professional and amateur leagues, coupled with high disposable incomes and youth participation programs, further support market growth. The popularity of ice hockey at collegiate and recreational levels drives continuous demand for skates, protective gear, and sticks. Online retail penetration and specialty sports stores offering expert fittings also contribute to robust regional growth.

Europe

Europe accounts for 30% of the global market, with Sweden, Finland, the Czech Republic, and Russia leading demand. The growth is supported by government and private initiatives promoting winter sports, including funding for ice rinks, youth leagues, and professional development programs. Established ice hockey traditions, strong club infrastructures, and league expansions are driving the adoption of high-quality protective gear, sticks, and skates. Emerging markets within Europe, such as Germany and France, are witnessing growing recreational participation, which is boosting mid-range and entry-level equipment sales.

Asia-Pacific

Asia-Pacific is the fastest-growing region, propelled by rising urbanization, increasing middle-class disposable incomes, and government-backed investments in ice rink infrastructure. Key countries such as China, Japan, and South Korea are witnessing increasing youth participation, school programs, and amateur league formations, stimulating demand for both premium and entry-level equipment. Rising exposure to international ice hockey tournaments and awareness campaigns promoting winter sports are additional drivers. Innovations in lightweight skates and composite sticks are particularly appealing to this emerging market.

Latin America

Latin America remains a smaller but growing market, with Brazil, Argentina, and Mexico leading adoption. Growth is primarily fueled by increasing interest in winter sports and the formation of new local and regional leagues. Amateur and recreational players are driving demand for protective gear and affordable skates and sticks. Urban recreational rinks and school programs are contributing to broader participation, creating opportunities for entry-level and mid-range equipment providers.

Middle East & Africa

The Middle East & Africa region remains niche, centered around South Africa for Africa and the UAE, Saudi Arabia, and Qatar in the Middle East. Rising disposable incomes, expanding urban recreational ice rinks, and growing interest among youth populations are key growth drivers. Recreational leagues and school programs are increasing awareness, while urbanization and government support for sports infrastructure facilitate broader market penetration. Premium equipment demand is concentrated among affluent youth, while recreational participants drive the adoption of entry-level gear.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Hockey Equipment Market

- Bauer Hockey

- CCM Hockey

- Warrior Sports

- Easton

- Reebok

- True Temper

- Sherwood

- Mission

- Brine

- Graf

- Tour Hockey

- Vaughn

- KOHO

- CCM USA

- Franklin Sports

Recent Developments

- In March 2025, Bauer Hockey launched a new line of carbon fiber sticks with embedded performance sensors for professional leagues.

- In January 2025, CCM Hockey expanded its youth protective gear range in Asia-Pacific, supporting local league programs and school initiatives.

- In December 2024, Warrior Sports introduced lightweight skates and advanced padding technology to reduce injuries and enhance player agility.