Ice Cream Cabinet Market Size

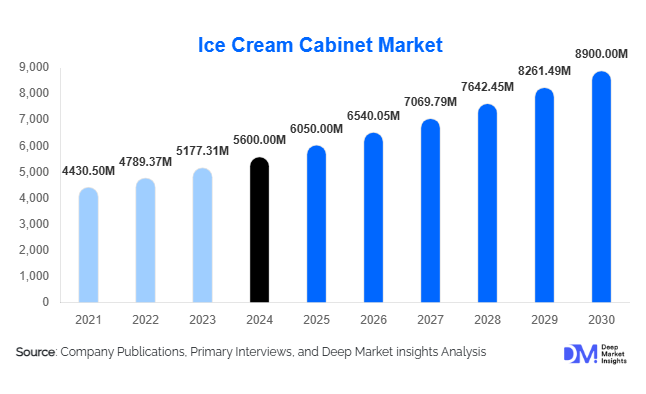

According to Deep Market Insights, the global ice cream cabinet market size was valued at USD 5,600 million in 2024 and is projected to grow from USD 6,050 million in 2025 to reach USD 8,900 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for frozen desserts, the expansion of quick-service restaurants, increasing supermarket penetration, and technological advancements in energy-efficient refrigeration systems.

Key Market Insights

- Demand is rising for energy-efficient and eco-friendly ice cream cabinets, driven by environmental regulations and sustainability initiatives, especially in Europe and North America.

- Emerging markets in APAC and LATAM are witnessing rapid adoption, fueled by urbanization, growing middle-class populations, and modern retail expansion.

- Non-traditional end-use segments such as corporate cafeterias, hospitals, and schools are contributing to incremental demand, diversifying market consumption beyond ice cream parlors and QSRs.

- Technological integration, including inverter cooling, forced-air systems, and digital temperature monitoring, is enhancing product efficiency and reducing operational costs for end-users.

- Online sales and direct B2B distribution channels are increasing, improving reach for manufacturers to small and medium enterprises globally.

- Compact and countertop cabinets are expanding opportunities in small businesses and quick-service outlets due to space and energy efficiency.

Latest Market Trends

Energy-Efficient and Eco-Friendly Cabinets

Manufacturers are increasingly adopting environmentally friendly technologies, including natural refrigerants (R290, CO2), inverter-based compressors, and improved insulation systems. These cabinets consume less energy, align with global sustainability goals, and meet stricter regional regulatory requirements. Demand for such eco-friendly cabinets is growing fastest in Europe and North America, while emerging markets are slowly adopting these solutions as costs decrease and awareness rises. Energy-efficient cabinets also reduce long-term operational expenses for retailers, making them a preferred choice in supermarket chains and hotel chains.

Technological Advancements in Cooling Systems

Ice cream cabinets are moving beyond traditional static cooling, with forced-air and hybrid systems providing uniform temperature distribution and better product visibility. Digital temperature controllers, IoT-enabled monitoring, and smart energy management are being integrated, allowing operators to track performance remotely, prevent spoilage, and reduce maintenance downtime. Premium segments are witnessing high adoption of these features, particularly in high-volume retail outlets and urban quick-service restaurants.

Ice Cream Cabinet Market Drivers

Rising Frozen Dessert Consumption

Global consumer preference for ice cream and frozen desserts is increasing due to lifestyle changes, higher disposable incomes, and rising urbanization. The proliferation of specialty ice cream flavors, artisanal brands, and novelty offerings has expanded the addressable market, prompting retail outlets and QSRs to invest in modern display cabinets to attract customers.

Expansion of Retail and QSR Channels

Rapid growth in supermarkets, hypermarkets, convenience stores, and quick-service restaurants has created high demand for ice cream cabinets. Large chains prefer energy-efficient, high-capacity cabinets to maintain consistent product quality and enhance in-store visibility. The trend is particularly strong in emerging markets such as India, China, and Brazil, where modern retail is growing faster than traditional small shops.

Technological Innovation and Product Diversification

Manufacturers are introducing specialized cabinets such as chest freezers, dipping cabinets, and countertop solutions tailored for small businesses. Forced-air cooling, eco-friendly refrigerants, and inverter technology enhance energy efficiency and product preservation. These innovations are helping brands differentiate offerings and cater to diverse end-use industries.

Market Restraints

High Capital Costs

Advanced ice cream cabinets, especially those with eco-friendly technologies, require high initial investments. Smaller retailers or emerging markets may find it challenging to adopt such equipment, restricting widespread penetration. This limits growth potential for premium product segments despite increasing demand.

Operational and Maintenance Challenges

Ice cream cabinets require regular maintenance, correct temperature settings, and a consistent electricity supply to ensure product quality. Poor infrastructure, frequent power outages in some regions, and a lack of trained personnel can negatively impact cabinet performance and reduce market adoption in developing regions.

Ice Cream Cabinet Market Opportunities

Emerging Markets Expansion

Countries such as India, China, Brazil, and Southeast Asian nations are witnessing rapid urbanization, rising disposable incomes, and the expansion of modern retail outlets. This creates strong opportunities for cabinet manufacturers to penetrate untapped regions. Establishing local manufacturing and distribution networks can help reduce costs and improve market reach.

Non-Traditional End-Use Growth

Beyond ice cream parlors and QSRs, institutional cafeterias, hospitals, corporate offices, and educational facilities are increasingly offering frozen desserts. This diversification opens new revenue streams, particularly for manufacturers of compact and countertop cabinets suitable for smaller spaces.

Energy-Efficient and Eco-Friendly Product Adoption

Growing environmental awareness and stricter regulations on refrigerants create opportunities for manufacturers investing in green technologies. Energy-efficient cabinets reduce operational costs, making them attractive to large retail chains, supermarkets, and luxury hospitality providers globally. Such products are likely to see higher adoption in Europe, North America, and Japan.

Product Type Insights

Chest freezer cabinets continue to dominate the ice cream cabinet market, capturing approximately 35% of the 2024 share. Their popularity is driven by high storage capacity, energy efficiency, and suitability for large retail environments such as supermarkets and hypermarkets. Scooping and dipping cabinets follow, primarily adopted in ice cream parlors, artisanal dessert outlets, and QSRs due to their convenience for serving and visual product display. Upright cabinets are gaining preference in modern retail stores due to their space-optimization benefits, while countertop and specialty cabinets are increasingly used by small businesses and emerging-market retailers, reflecting a broader trend toward compact, energy-efficient, and flexible designs that fit space-constrained environments.

Application Insights

Ice cream parlors and QSRs remain the leading application, accounting for nearly 45% of market demand in 2024. The segment’s growth is fueled by the rise of artisanal and premium ice cream offerings, which attract consumers seeking unique flavors and high-quality frozen desserts. Hotels, restaurants, and catering services are gradually expanding their adoption of ice cream cabinets to support premium dessert services, while supermarkets and convenience stores are increasingly investing in high-visibility glass-door cabinets to encourage impulse purchases. Institutional applications, including hospitals, schools, and corporate offices, are emerging as incremental growth areas, particularly for compact, energy-efficient cabinets designed for limited spaces.

Distribution Channel Insights

Direct B2B sales dominate the ice cream cabinet market, contributing roughly 50% of 2024 revenue, primarily through sales to supermarkets, QSR chains, and hotel groups. Retail dealers and distributors serve smaller parlors and dessert shops, while online and e-commerce channels are expanding rapidly, especially in emerging markets where digital adoption is accelerating. Manufacturers are increasingly leveraging online platforms to provide installation guidance, remote monitoring, and service subscriptions, which enhances customer engagement, reduces downtime, and strengthens long-term relationships.

End-Use Insights

Supermarkets and QSRs are the fastest-growing end-use segments, experiencing annual expansions of 6–8% in ice cream cabinet installations. Ice cream parlors maintain a significant market share, but modern retail formats and chain QSR expansion are intensifying competition. Institutional use, including corporate offices, hospitals, and educational campuses, is emerging as a growth avenue, creating incremental demand for compact, countertop, and energy-efficient cabinets. Export-driven demand is particularly strong in countries such as China and Italy, which manufacture high-quality, commercial-grade cabinets for global markets.

| By Product Type | By Capacity | By Door Type | By Technology | By End Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America represents approximately 28% of the global ice cream cabinet market in 2024, led by the U.S. and Canada. Market growth is underpinned by a strong ice cream consumption culture, high consumer spending, and the prevalence of modern retail chains. Advanced foodservice sectors, including QSRs and institutional catering, also drive cabinet demand. Energy-efficient and premium display cabinets are particularly favored, aligning with regulatory standards and consumer expectations for sustainable and visually appealing solutions.

Europe

Europe accounts for around 25% of the 2024 market, with Germany, France, and the U.K. as key contributors. Growth is strongly influenced by strict energy efficiency and sustainability regulations, which encourage the adoption of eco-friendly and inverter-based ice cream cabinets. The region also benefits from established retail infrastructure, a sophisticated QSR landscape, and rising consumer preference for premium frozen desserts. These factors collectively support continued market expansion, particularly for environmentally compliant and energy-optimized cabinet solutions.

Asia-Pacific

APAC is emerging as the fastest-growing region for ice cream cabinets, driven by rapid urbanization, rising disposable income, and the expansion of modern retail and QSR chains in India, China, Southeast Asia, and Japan. Demand is particularly strong for compact and countertop cabinets in smaller cities, while premium and large-capacity cabinets are increasingly adopted in metropolitan areas. The growth of convenience stores and the rising popularity of premium and artisanal ice cream products are additional regional drivers fueling cabinet sales.

Middle East & Africa

MEA shows steady growth, with the UAE, Saudi Arabia, and South Africa leading adoption. Key drivers include a growing tourism and hospitality sector, rising disposable incomes, and the expansion of luxury and premium hotel chains. These developments increase demand for high-quality display and storage cabinets to serve frozen desserts in hotels, resorts, and restaurants. Intra-regional trade and government support for retail infrastructure also contribute to market expansion.

Latin America

LATAM is gradually expanding, with Brazil and Argentina leading demand for commercial-grade cabinets in supermarkets, QSRs, and ice cream parlors. The rising popularity of branded frozen desserts, the entry of international retail chains, and increasing urbanization are key drivers. Smaller countries are catching up through imports and modernization of retail networks, creating additional growth opportunities for both premium and standard ice cream cabinet models.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Cream Cabinet Market

- Hussmann Corporation

- True Manufacturing Co., Inc.

- Gram Commercial A/S

- Foster Refrigerator

- Turbo Air Inc.

- ISA S.p.A.

- Fagor Industrial

- Beverage-Air

- Electrolux Professional

- Arneg Group

- Vendo Company

- Bonnet Névé

- Liebherr Group

- Blue Air

- Kairak

Over the past five years, these companies have focused on R&D, expanding distribution networks, and introducing inverter and forced-air cabinets. Pricing trends are influenced by energy-efficiency features, cabinet size, and technology adoption, with premium models commanding higher margins. M&A activity has been moderate, primarily targeting technological upgrades and regional expansion.

Recent Developments

- In March 2025, Hussmann Corporation launched a new line of eco-friendly ice cream cabinets with natural refrigerants in Europe, targeting supermarkets and QSRs.

- In January 2025, True Manufacturing expanded its production facility in the U.S. to accommodate growing demand for high-capacity chest and dipping cabinets.

- In February 2025, Gram Commercial introduced IoT-enabled monitoring for commercial cabinets, enhancing energy efficiency and predictive maintenance for global clients.