Hybrid Devices Market Size

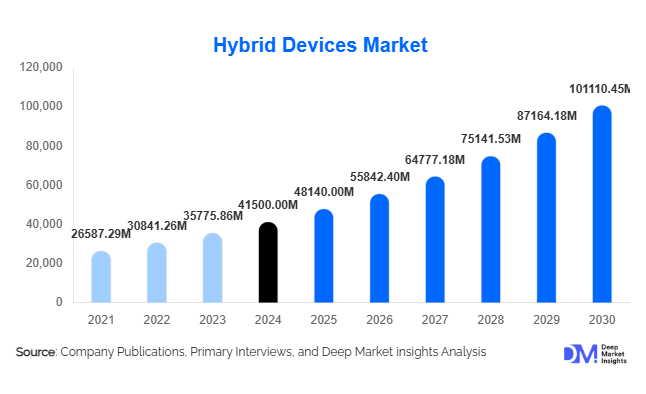

According to Deep Market Insights, the global hybrid devices market size was valued at USD 41,500.00 million in 2024 and is projected to grow from USD 48,140.00 million in 2025 to reach USD 101,110.45 million by 2030, expanding at a CAGR of 16.0% during the forecast period (2025–2030). The hybrid devices market growth is primarily driven by increasing adoption of multifunctional devices across consumer electronics, healthcare, automotive, and industrial sectors, growing digitization, and technological innovations integrating AI, IoT, and hybrid battery systems.

Key Market Insights

- Hybrid laptops, foldable smartphones, and wearables are becoming mainstream, offering consumers enhanced functionality and connectivity.

- Hybrid automotive devices are gaining prominence with the rise of connected vehicles and hybrid electric vehicles, particularly in North America and Europe.

- Asia-Pacific emerges as the fastest-growing market, driven by increasing disposable incomes, smartphone penetration, and urbanization in India, China, and Southeast Asia.

- Technological integration, including AI-enabled wearables, dual-OS devices, and IoT-enabled industrial sensors, is reshaping product capabilities and user engagement.

- Industrial adoption of hybrid devices for automation, predictive maintenance, and monitoring is expanding, particularly in manufacturing and healthcare.

- Consumer preference for multifunctionality and compactness is driving innovation in foldable, 2-in-1, and dual connectivity devices.

Latest Market Trends

Convergence of Consumer and Industrial Applications

Hybrid devices are bridging the gap between consumer electronics and industrial applications. Devices like hybrid laptops, IoT-enabled wearables, and hybrid sensors are being adopted in manufacturing, logistics, and healthcare for automation, monitoring, and real-time data analytics. The trend of multifunctionality enables end users to leverage a single device for both personal and professional use, increasing productivity and cost-efficiency.

Advances in Hybrid Battery and Foldable Technologies

Emerging battery technologies, including lithium-ion hybrid systems and solid-state hybrid batteries, are extending device runtime while maintaining compact form factors. Foldable displays and 2-in-1 devices are driving demand in the consumer electronics segment, offering portability without compromising performance. Companies are investing heavily in R&D to improve the durability, flexibility, and energy efficiency of hybrid devices, responding to growing user expectations for multifunctional solutions.

Hybrid Devices Market Drivers

Rising Demand for Multifunctional Devices

Consumers and enterprises are increasingly adopting devices that serve multiple purposes, reducing the need for separate devices and improving efficiency. Hybrid laptops, foldable smartphones, and wearable devices are meeting this demand, particularly among professionals, students, and tech-savvy millennials. This trend is further amplified by remote work, mobile computing, and smart healthcare solutions, where multifunctionality reduces hardware costs and optimizes performance.

Technological Advancements in Connectivity and AI

Integration of AI, machine learning, and hybrid connectivity (e.g., 5G, Wi-Fi/Bluetooth) is enhancing device functionality, enabling real-time data processing, predictive analytics, and automation. Smart wearables and IoT-enabled hybrid devices are increasingly used in healthcare, industrial monitoring, and automotive applications, driving market growth and creating premium product segments.

Expansion of Hybrid Automotive Devices

The increasing adoption of connected vehicles and hybrid electric vehicles is boosting demand for infotainment systems, sensors, and control modules. Governments promoting electric mobility and smart transport infrastructure, especially in North America and Europe, are further propelling the adoption of hybrid automotive devices, contributing to market growth.

Market Restraints

High Manufacturing and R&D Costs

The development of hybrid devices involves significant investment in research, component integration, and advanced battery systems, which can increase product costs. High manufacturing expenses limit affordability for price-sensitive consumers, especially in emerging economies.

Complexity of Technological Integration

Integrating multiple functionalities, dual operating systems, and advanced connectivity features presents design and reliability challenges. Device performance, software compatibility, and maintenance requirements can hinder adoption if not properly managed, restricting market expansion in certain segments.

Hybrid Devices Market Opportunities

Expansion in Emerging Economies

Regions such as India, China, and Southeast Asia offer significant opportunities due to rising middle-class income, increasing smartphone penetration, and urbanization. Companies can target affordable hybrid devices for education, healthcare, and consumer electronics, tapping into unmet demand while localizing features for regional preferences.

Integration with IoT and Smart Automotive Systems

Hybrid devices in connected vehicles and industrial IoT applications present lucrative growth prospects. Adoption of hybrid automotive devices, IoT-enabled industrial sensors, and AI-powered wearables is increasing in smart factories, electric vehicles, and healthcare monitoring systems. Strategic partnerships with automotive and industrial players can further accelerate market penetration.

Technological Innovation and Product Differentiation

Investments in foldable displays, dual OS platforms, and hybrid battery systems enable companies to differentiate their offerings. Advanced AI capabilities, predictive analytics, and multifunctional design attract premium consumers and enterprise clients, enhancing brand positioning and profitability.

Product Type Insights

Hybrid laptops continue to dominate the market, accounting for approximately 28% of the 2024 market. Their strong adoption is primarily driven by the enterprise and educational sectors, where professionals and students increasingly require versatile devices to handle multitasking and productivity tasks. This growth is reinforced by the popularity of convertible hybrid devices, which offer enhanced productivity features by allowing seamless switching between laptop and tablet modes, catering to professionals seeking flexibility and efficiency. Foldable smartphones and hybrid wearables are rapidly gaining traction, particularly among tech-savvy consumers and premium segments who value portability and multifunctionality. Detachable hybrid devices, with their lightweight and adaptable designs, appeal to users who prioritize mobility, providing a perfect solution for on-the-go use. Meanwhile, hybrid automotive devices, though smaller in market share (15%), are expanding steadily due to the rising adoption of connected vehicles, government incentives for electric mobility, and demand for infotainment and vehicle control modules.

Application Insights

Consumer electronics remain the largest application segment, with multifunctional laptops, smartphones, and wearables capturing the majority of market demand. Automotive applications are emerging as the fastest-growing segment, fueled by increasing integration of infotainment systems, hybrid vehicle control devices, and connected car solutions. Industrial and healthcare applications are gaining significant momentum as well, leveraging hybrid IoT devices for automation, monitoring, predictive maintenance, and remote healthcare solutions. The demand in healthcare is particularly supported by wearable medical devices and hybrid health monitors, addressing rising health awareness and digital health initiatives.

End-Use Insights

The IT & Telecom and Consumer Electronics sectors collectively account for over 50% of the market in 2024, reflecting strong adoption of laptops, smartphones, and wearables. Automotive and Industrial sectors are experiencing the fastest growth, propelled by smart factories, connected vehicles, and industrial automation initiatives. Healthcare is an emerging end-use segment, driven by increasing adoption of wearable health monitoring devices, hybrid medical equipment, and telemedicine solutions, which are further reinforced by government digital health initiatives and rising consumer awareness.

| By Device Type | By Technology | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held the largest market share in 2024 (32%), driven by strong adoption of hybrid laptops, automotive devices, and wearables. The U.S. leads demand due to high disposable income, early technology adoption, and supportive government policies for electric vehicles and smart infrastructure. Technological advancements in the region, including robust infrastructure and high R&D investment, are enabling integration of advanced features in hybrid devices, further accelerating adoption. Canada is contributing steadily, particularly in industrial and healthcare applications, supported by digital transformation initiatives in enterprises and public sectors.

Europe

Europe accounts for 25% of the 2024 market, with Germany, France, and the U.K. driving growth in hybrid devices across the automotive and consumer electronics sectors. Digitalization initiatives by governments and educational institutions are increasing the demand for flexible hybrid solutions, including convertible and detachable devices for professional and academic use. Regulatory support for electric mobility, IoT-enabled industries, and high digital literacy levels are additional drivers supporting adoption. Europe represents the fastest-growing mature market, particularly for automotive and industrial applications, as businesses and institutions continue to adopt hybrid solutions for efficiency and productivity.

Asia-Pacific

Asia-Pacific is emerging as the highest-growth region, led by China, India, Japan, and South Korea. Rising middle-class incomes, urbanization, and smartphone penetration are boosting the adoption of hybrid laptops and wearables. A growing internet user base and mobile connectivity in countries like India and China are key drivers for portable hybrid devices. Automotive and industrial hybrid devices are also gaining traction due to government initiatives promoting electric mobility, smart manufacturing, and digitalization. The region is expected to register the highest CAGR during 2025–2030, supported by technology adoption and increasing consumer demand for multifunctional devices.

Latin America

Latin America shows gradual market growth, particularly in Brazil and Mexico. Consumer electronics hybrid devices dominate demand, while automotive applications are emerging steadily. Infrastructure development and improvements in digital connectivity across key economies are enabling broader adoption. Market growth is further supported by rising technology adoption among middle-class populations and expanding e-commerce channels, making hybrid devices more accessible.

Middle East & Africa

MEA is witnessing steady adoption of hybrid devices, particularly in the UAE, Saudi Arabia, and South Africa. High-income populations, enterprise adoption of hybrid solutions in healthcare and industrial sectors, and ongoing government investments in digital infrastructure are driving market growth. Infrastructure improvements, including smart city projects and connectivity expansion, are creating favorable conditions for wider hybrid device adoption across both consumer and industrial applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hybrid Devices Market

- Apple Inc.

- Samsung Electronics

- Dell Technologies

- HP Inc.

- Lenovo Group

- Microsoft Corporation

- ASUS

- Acer Inc.

- Sony Corporation

- LG Electronics

- Huawei Technologies

- Panasonic Corporation

- Google LLC

- Intel Corporation

- Qualcomm Inc.

Recent Developments

- In June 2025, Samsung launched a new series of foldable hybrid smartphones with dual OS support targeting APAC markets.

- In May 2025, Lenovo introduced AI-enabled hybrid laptops optimized for industrial and educational applications in Europe and North America.

- In March 2025, Apple released a new hybrid wearable combining health monitoring, AI fitness tracking, and dual connectivity features for global consumers.