Hunting Rifles Market Size

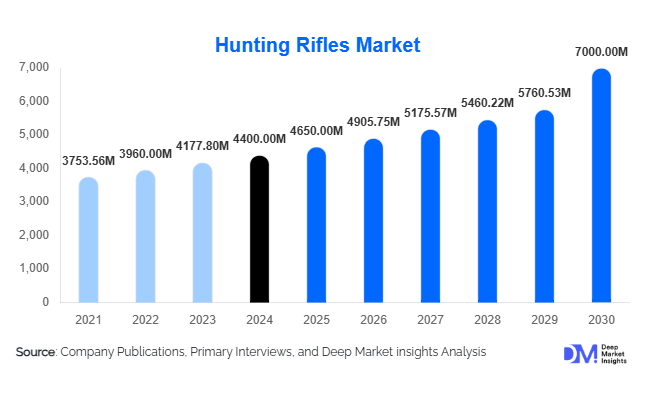

According to Deep Market Insights, the global hunting rifles market size was valued at USD 4,400 million in 2024 and is projected to grow from USD 4,650 million in 2025 to reach USD 7,000 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Growth in the hunting rifles market is primarily driven by sustained participation in outdoor sports, rising interest in precision shooting, the expansion of hunting tourism, and technological advancements in materials and optics.

Key Market Insights

- Bolt-action rifles dominate the market, capturing nearly 30–35% of global share in 2024 due to their accuracy, reliability, and popularity in big game hunting.

- North America leads globally, accounting for approximately 45% of market share in 2024, supported by strong hunting traditions and high firearm ownership rates.

- Asia-Pacific is the fastest-growing region, driven by expanding middle-class populations, growing outdoor tourism, and rising participation in shooting sports.

- Synthetic and polymer-stocked rifles are leading material choices, representing around 45% of demand due to lightweight, durability, and weather resistance.

- Mid-range rifles hold the largest price-tier share, representing about 50% of global demand, balancing affordability and quality for the mass market.

- Technological integration, including advanced optics, modular designs, and smart accessories, is redefining hunting rifle innovation and consumer preferences.

Latest Market Trends

Integration of Smart Optics and Accessories

Manufacturers are increasingly partnering with optics and tech companies to integrate smart scopes, ballistic calculators, and digital rangefinders into hunting rifles. This trend appeals to precision hunters who demand high accuracy and customization. Such integration also drives premium pricing, creating higher-value revenue streams across mature and emerging markets alike.

Lightweight and Synthetic Material Adoption

Hunters are shifting from traditional wooden stocks to polymer and composite alternatives that offer durability, weather resistance, and reduced weight. Carbon-fiber barrels, modular stocks, and hybrid components are becoming mainstream, particularly in mid- and premium-tier rifles. This trend not only improves functionality but also reduces long-term maintenance costs.

Hunting Rifles Market Drivers

Growing Outdoor Recreation and Hunting Participation

Increasing disposable incomes, demand for leisure sports, and expanding hunting tourism worldwide are driving higher adoption of hunting rifles. Regions such as North America and Africa benefit from strong hunting traditions, while the Asia-Pacific region is witnessing rising participation in outdoor recreation and shooting clubs.

Technological Advancements Enhancing Performance

Precision engineering, modular platforms, lightweight designs, and optics integration are improving user experience and differentiating products. Premium rifles with superior performance capabilities are seeing robust adoption, especially in competitive shooting and long-range hunting.

Wildlife Management and Conservation-Driven Demand

Governments and agencies increasingly integrate regulated hunting into conservation strategies. Licensed hunting supports wildlife management, generating steady demand for hunting rifles. Hunting tourism in Africa and North America further drives purchases of premium models for regulated safaris and guided hunts.

Market Restraints

Stringent Firearms Regulations

Ownership laws, import/export restrictions, and licensing complexities act as significant barriers in several countries. These regulations increase compliance costs for manufacturers and limit consumer access, slowing growth in highly regulated regions such as parts of Europe and Asia.

High Costs of Premium Rifles

Premium hunting rifles equipped with advanced optics and customized builds often exceed affordability for middle-income buyers. High upfront costs and recurring expenses such as ammunition and maintenance restrain mass adoption, especially in emerging economies.

Hunting Rifles Market Opportunities

Expansion in Emerging Markets

Asia-Pacific and Latin America represent significant untapped potential. Rising middle-class wealth, expanding outdoor sports participation, and supportive tourism policies in countries such as India, Brazil, and South Africa are likely to open up new demand avenues for rifle manufacturers.

Digital and Direct-to-Consumer Distribution

The growth of online retail and direct sales platforms is reshaping how rifles are marketed and sold. Manufacturers are leveraging digital campaigns, online customization tools, and transparent pricing models to build brand loyalty and bypass traditional distribution barriers.

Premiumization through Smart Rifle Technologies

The integration of advanced optics, electronic aids, and modularity creates opportunities for premium pricing. Companies that successfully innovate with tech-enabled rifles are poised to capture higher margins and attract affluent consumer segments globally.

Product Type Insights

Bolt-action rifles dominate the product segment with nearly 35% market share in 2024, owing to their proven accuracy, reliability, and suitability for big game hunting. Semi-automatic rifles are gaining traction but face regulatory limitations, while lever-action and pump-action rifles continue to serve niche enthusiasts. Single-shot rifles remain marginal but appeal to traditionalists and collectors.

Application Insights

Big game hunting leads global applications, representing 35–40% of market value in 2024. The segment benefits from hunting tourism in Africa and North America, and the demand for larger calibers and premium builds. Small game and target shooting are also important segments, with sports and precision shooting witnessing the fastest growth, particularly in Europe and the Asia-Pacific.

Distribution Channel Insights

Specialty gun stores and sporting goods retailers remain the dominant sales channel, accounting for nearly 60% of global sales in 2024. Online channels are expanding rapidly, especially in North America and parts of Europe, where regulations allow, while auctions and gun shows continue to serve secondary markets for collectors and budget buyers.

End-Use Insights

Individual hunters are the largest end-use segment globally, followed by hunting clubs and wildlife tourism operators. Competitive sports and shooting events represent the fastest-growing end-use segment, driving premium rifle sales. Export-driven demand from Africa and parts of Asia also supports market expansion, with growing inbound hunting tourism fueling rifle purchases for outfitters and guides.

| By Product Type | By Material Type | By Price Tier | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global hunting rifles market, with an approximate 45% market share in 2024, valued at over USD 2.0 billion. The U.S. dominates, supported by widespread firearm ownership, hunting traditions, and well-developed retail channels. Growth is steady at 3–5% CAGR, with premium rifle sales driving higher revenues.

Europe

Europe accounts for 25–30% of the global market share, driven by strong demand in Germany, Finland, and Sweden. Premium craftsmanship, safety regulations, and hunting culture support growth, although regulations limit broader expansion. Demand is stable but concentrated in high-value rifle categories.

Asia-Pacific

Asia-Pacific holds 10–15% of the global market in 2024 and is the fastest-growing region, with demand rising at over 7% CAGR. China, India, and Australia are leading markets, supported by growing middle-class affluence, outdoor sports participation, and expanding hunting tourism.

Latin America

Latin America represents 5–8% of the market, led by Brazil, Argentina, and Mexico. Although limited by regulations and economic constraints, the region shows rising demand for mid-range rifles as outdoor recreation grows in popularity.

Middle East & Africa

MEA accounts for 3–5% of global revenue in 2024, with Africa contributing most through hunting tourism. South Africa, Tanzania, and Namibia drive premium rifle demand for safari hunting. The Middle East, particularly the UAE and Saudi Arabia, is emerging as a growing consumer base due to luxury travel and hunting tourism abroad.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hunting Rifles Market

- Sturm, Ruger & Co.

- Remington Arms Company

- Browning Arms Company

- Winchester Repeating Arms

- Smith & Wesson

- Heckler & Koch GmbH

- SIG Sauer

- FN Herstal

- Beretta Holding

- Sako (part of Beretta Group)

- Steyr Arms

- Howa Machinery

- Weatherby Inc.

- Mauser Jagdwaffen

- Blaser Jagdwaffen GmbH

Recent Developments

- In May 2025, Browning Arms launched a new line of lightweight polymer-stock hunting rifles, integrating modular scope mounts for precision shooting.

- In March 2025, Sturm, Ruger & Co. expanded its production facilities in the U.S. to enhance supply for growing domestic demand in bolt-action rifles.

- In January 2025, Beretta announced a new partnership with an optics manufacturer to co-develop smart scope-compatible rifles for the premium hunting market.