Hunting Rifle Scope Market Size

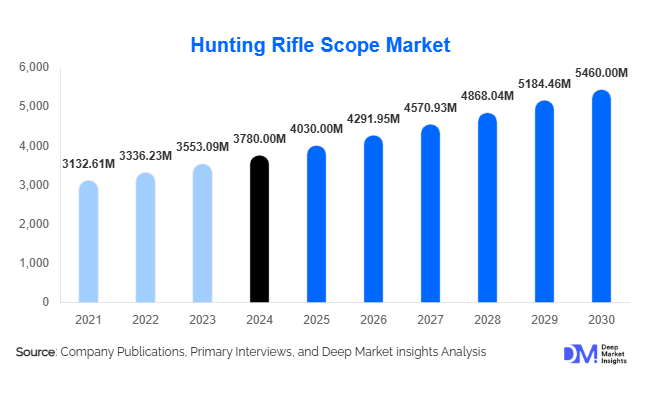

According to Deep Market Insights, the global hunting rifle scope market size was valued at USD 3,780 million in 2024 and is projected to grow from USD 4,030 million in 2025 to reach USD 5,460 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of advanced optics technology, increasing popularity of recreational hunting and shooting sports, and the expanding penetration of online retail channels for premium and mid-range scopes.

Key Market Insights

- Variable power scopes are increasingly dominating the market, offering flexibility for both short-range and long-range hunting, and are preferred for their versatility across hunting scenarios.

- Night vision and thermal scopes are witnessing strong adoption in professional and tactical applications, particularly in defense, law enforcement, and high-end hunting segments.

- North America holds the largest market share, driven by high disposable income, strong hunting culture, and advanced firearm regulations that promote safe recreational use.

- Asia-Pacific is the fastest-growing regional market, fueled by rising interest in outdoor activities, emerging recreational hunters, and growing e-commerce adoption.

- Online retail channels are rapidly expanding, offering greater access to premium scopes in emerging markets and driving consumer preference toward high-tech optics.

- Technological integration, including digital reticles, app-enabled scopes, and laser rangefinders, is reshaping the hunting experience and increasing willingness to invest in premium optics.

Latest Market Trends

Smart and Tech-Integrated Scopes Gaining Traction

Hunting rifle scopes are increasingly integrating digital technology, including app-controlled reticles, GPS assistance, and augmented reality enhancements. These innovations help hunters improve target acquisition, track environmental variables, and calculate ballistic data in real time. Smart scopes are particularly appealing to professional hunters and tactical users, while also attracting recreational consumers seeking modernized, high-precision hunting equipment. Manufacturers are investing in R&D to introduce scopes with features such as automatic zeroing, night vision capabilities, and thermal imaging, driving premium segment growth.

Rising Preference for High-Quality Optics

Hunters globally are prioritizing fully multi-coated lenses, superior magnification clarity, and lightweight, durable materials. Mid- and high-magnification scopes (5–9x and 10x+) have grown in demand due to their versatility and precision for various hunting scenarios. Trends indicate a shift from entry-level scopes toward technologically advanced optics that offer better reliability in low-light and long-range conditions. This movement is complemented by increasing participation in outdoor sports and shooting competitions, particularly in North America and Europe.

Hunting Rifle Scope Market Drivers

Technological Advancements in Optical Systems

Innovations such as multi-coated lenses, laser range-finding integration, and digital reticles are enhancing hunting accuracy and versatility. Variable power scopes, which accounted for 45% of market share in 2024, are particularly benefiting from these advancements, driving widespread adoption across professional and recreational segments.

Growing Recreational Hunting and Shooting Activities

Globally, hunting and shooting sports are becoming more popular as leisure activities. In regions like North America and Europe, rising disposable income and outdoor lifestyle trends are increasing the scope of purchases. Younger demographics are participating in shooting sports, while experienced hunters are upgrading to advanced optics for improved performance, boosting overall market growth.

Expansion of E-Commerce Channels

Online sales have accounted for approximately 30% of total market revenue, providing convenient access to premium and specialty scopes. Digital platforms allow consumers to compare products, read reviews, and access features not easily available in traditional retail stores. This trend is particularly prominent in emerging markets, where offline retail penetration is limited.

Market Restraints

Stringent Firearm and Hunting Regulations

Strict regulations in certain countries on firearm ownership and hunting licenses act as a significant barrier. Compliance costs, licensing requirements, and regional restrictions can limit market penetration, particularly in Asia-Pacific and certain European countries.

High Costs of Advanced Scopes

Premium scopes, including thermal and night vision optics, are expensive, limiting adoption among casual hunters and budget-conscious buyers. Companies need to balance cost and feature offerings to expand their customer base while maintaining profitability.

Hunting Rifle Scope Market Opportunities

Emergence of Smart and Digital Scopes

The integration of smart technology such as app-enabled reticles, AR targeting, and automated ballistic calculations is creating new avenues for premium product development. Hunters and tactical users increasingly seek digitally-enhanced scopes that improve accuracy and offer high-tech functionality, providing opportunities for companies to differentiate offerings and increase margins.

Expansion into Emerging Markets

Regions such as India, Brazil, and Eastern Europe are witnessing growing interest in recreational hunting. Loosening restrictions, rising disposable income, and increased exposure to global hunting culture are creating demand for mid-range and entry-level scopes. Manufacturers can leverage local partnerships, e-commerce platforms, and targeted marketing to capture these untapped segments.

Government and Law Enforcement Procurement

Public safety initiatives and military modernization programs in North America, Europe, and the Middle East are driving demand for night vision and tactical scopes. Long-term procurement contracts for armed forces and law enforcement agencies represent a stable growth opportunity for established manufacturers and new entrants targeting the defense sector.

Product Type Insights

Variable power scopes continue to lead the global hunting rifle scope market due to their adaptability across short-range, medium-range, and long-range hunting scenarios. The increasing preference for versatility among hunters is driving this segment, as it allows one scope to handle multiple hunting environments efficiently. Fixed power scopes remain popular among entry-level and budget-conscious hunters due to their simplicity, reliability, and affordability. Night vision and thermal scopes are experiencing strong growth, particularly in professional hunting, security, and law enforcement applications, where low-light visibility and enhanced target detection are critical. The growing demand for premium scopes with fully multi-coated lenses is further boosting high-value sales, especially in North America and Europe, where advanced optics are a key consideration for serious hunters and tactical users.

Application Insights

Civilian hunting dominates the application segment, accounting for 60% of the 2024 market share. This growth is fueled by rising disposable incomes, increased recreational interest in outdoor activities, and participation in hunting as a leisure sport. Recreational hunters are driving demand for mid-range and premium scopes, particularly variable power and long-range optics. Military and law enforcement applications, while smaller in volume, are rapidly expanding the adoption of night vision and thermal scopes, reflecting rising procurement budgets for tactical and defense purposes. Demand in these segments is particularly strong in North America and parts of the Middle East, where security operations require high-performance, technologically advanced scopes.

Distribution Channel Insights

Offline retail remains the dominant distribution channel with a 55% market share, as many hunters prefer in-store product testing, expert guidance, and installation support. However, online retail is expanding at the fastest rate, driven by e-commerce penetration, the availability of a broader product range, and competitive pricing. Direct manufacturer sales to clubs, military units, and law enforcement agencies also contribute significantly, especially for high-end tactical and thermal optics. The online channel is increasingly important in emerging regions such as Asia-Pacific and Latin America, where consumers gain access to premium and specialized scopes that may not be widely available locally.

| By Product Type | By Magnification | By Lens Coating | By Mount Type | By Application | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America dominates the global hunting rifle scope market, with the U.S. and Canada leading demand. This is driven by a combination of a strong hunting culture, favorable hunting laws in many rural states, and high consumer spending on outdoor gear and recreational equipment. The popularity of variable power and premium scopes is particularly high, with hunters investing in advanced optics for versatility and long-range precision. Regulatory frameworks that support safe firearm ownership and recreational hunting further encourage scope purchases. North America accounts for nearly 40% of global sales, with online retail and specialty sporting goods stores facilitating wide access to technologically advanced hunting optics.

Europe

Europe, particularly Germany, the U.K., France, and Nordic countries, represents a significant market for hunting rifle scopes. Traditional hunting practices in Nordic countries, combined with a rising interest in eco-tourism and hunting tourism, drive sustained demand. Hunters increasingly prefer variable power and fully multi-coated scopes for enhanced performance across diverse terrains and lighting conditions. The adoption of sustainable and technologically advanced optics is gaining traction, reflecting growing environmental awareness. Europe accounted for approximately 25% of the 2024 market, and continued growth is supported by strong disposable incomes, hunting associations, and an appreciation for outdoor sports culture.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the hunting rifle scope market, led by India, China, Japan, Australia, and New Zealand. Growth is driven by expanding defense and paramilitary procurement of advanced rifle optics, as well as a rise in shooting sports and recreational hunting activities. Variable power scopes and tactical optics are highly sought after in these markets. E-commerce adoption and exposure to global hunting trends are enabling wider access to premium scopes. Growth in shooting clubs, organized hunting events, and recreational ranges supports both mid-range and premium scope sales. The region is expected to witness a CAGR of 8–9% during the forecast period.

Latin America

Latin America, particularly Argentina, Brazil, and Mexico, is experiencing a gradual growth in hunting rifle scope demand. Expanding wildlife hunting tourism, coupled with increased interest in outdoor adventure sports, drives scope purchases among affluent consumers. Variable power and long-range scopes are gaining preference due to their versatility and suitability for diverse hunting environments. Niche markets for recreational hunting and wildlife observation are also emerging, encouraging retailers to offer a broader range of optics. Government support for regulated hunting tourism in countries like Argentina further reinforces growth.

Middle East & Africa

The Middle East and Africa remain important markets for high-range precision scopes, driven by big-game hunting, safari tourism, and tactical security requirements. Countries such as the UAE, Saudi Arabia, and Qatar show strong demand for premium tactical scopes, while African nations rely on high-precision scopes for professional hunting and safari operations. Growth is fueled by government investments in defense modernization, increasing disposable incomes in affluent populations, and the sustained popularity of safari and recreational hunting tourism. Night vision and thermal optics are especially sought after in low-light hunting conditions and by security agencies across these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hunting Rifle Scope Market

- Leupold & Stevens

- Vortex Optics

- Zeiss

- Burris Optics

- Nightforce Optics

- Nikon Sport Optics

- Bushnell

- Swarovski Optik

- Sig Sauer

- Hawke Optics

- Trijicon

- ATN Corporation

- Leica Camera AG

- Barska

- Meopta

Recent Developments

- In March 2025, Vortex Optics launched a new series of smart variable-power scopes integrating app-enabled ballistic calculators and AR reticles.

- In January 2025, Zeiss introduced fully multi-coated high-magnification hunting scopes for North American and European markets, emphasizing long-range precision and low-light clarity.

- In November 2024, Leupold & Stevens expanded its distribution network in Asia-Pacific, targeting emerging hunters in India and China with mid-range optical scopes.