Hoverboard Scooters Market Size

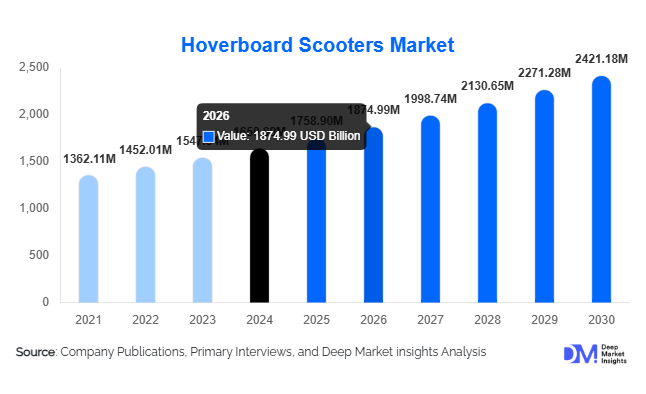

According to Deep Market Insights, the global hoverboard scooters market size was valued at USD 1,650 million in 2024 and is projected to reach around USD 1,758.90 million in 2025 (estimate) to arrive at approximately USD 2,421.18 million by 2030, expanding at a CAGR of about 6.6 % during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for personal micro-mobility devices, advances in battery and motor technologies, and the growing appeal of adult and commuter use cases beyond traditional recreational segments.

Key Market Insights

- Dual-wheel, self-balancing hoverboards dominate the product type segment, thanks to their ease of use, broad appeal among teens and casual users, and established distribution channels.

- Compact wheel-size (6.5″) models hold the largest share globally, owing to their affordability and suitability for urban, smooth-surface use in recreational settings.

- Recreational/leisure use continues to lead demand, but personal mobility (adult commuting) and commercial/rental applications are gaining traction and opening new growth avenues.

- Asia-Pacific is the largest regional market, driven by manufacturing base, a rising youth population, improving e-commerce access, and rising disposable income in countries such as China and India.

- Emerging regions such as Latin America and the Middle East & Africa are the fastest-growing, supported by under-penetration, growth in youth demographics, and the shift to online retail channels.

- Product innovation in smart/connected hoverboards, including integration of Bluetooth, app controls, improved battery safety, and off-road capability, is reshaping the competitive landscape.

Latest Market Trends

Product Innovation and Smart Features

Manufacturers are increasingly incorporating smart technologies into hoverboard scooters, Bluetooth speaker systems, mobile app integration, LED lighting, advanced self-balancing sensors, and improved battery management systems. These enhancements are not only attracting tech-savvy consumers but also enabling manufacturers to command premium pricing. At the same time, improved battery chemistries and motor systems are enabling longer range and higher load capacities, making the devices more viable for adult commuting and commercial applications, rather than purely recreational use.

Shift Towards Adult Mobility and Commercial Use-Cases

While hoverboards originated as recreational gadgets primarily for teens, the market is evolving. A growing number of adult users are adopting hoverboards for short-distance travel, campus mobility or rental fleets (tourism resorts, corporate campuses). This shift is driving demand for models with larger wheels (8″ & 10″), higher power output and greater durability. Rental/commercial applications are also prompting manufacturers to build rugged variants with service-friendly design, presenting a meaningful extension beyond the core leisure segment.

Hoverboard Scooters Market Drivers

Urbanization and Micro-Mobility Adoption

Rapid urbanization, increasing traffic congestion, and a growing preference for compact personal mobility solutions are supporting demand for hoverboard scooters. Consumers look for lightweight, portable, battery-powered devices for short-distance travel (last-mile), campus use, or leisure, and hoverboards fit this trend well.

Technology Advancements in Battery, Motor, and Safety

Advances in lithium-ion battery technologies (greater energy densities, better safety, reduced costs), electric motor efficiencies, and certification (e.g., fire-safety standards) have improved product reliability and user confidence. This is particularly important in mitigating one of the key market restraints (safety concerns) and enabling higher-performing models targeted at adults and commercial use.

E-commerce Expansion and Distribution Reach

The growth of e-commerce platforms globally has made hoverboard scooters more accessible to end-users in emerging and remote markets. Online retail enables aggressive pricing, wider model selection, faster time-to-market for new features, and direct-to-consumer models, thereby fueling market growth, especially in geographies where traditional retail penetration was low.

Market Restraints

Safety and Regulatory Challenges

Hoverboard scooters have faced battery fire risks, accidents due to misuse, and regulatory ambiguity (in terms of where they can legally be ridden, imported, and certified). These concerns raise consumer hesitation, liability issues for manufacturers, and increased cost of compliance. Overcoming safety perception remains a key challenge.

Price-Sensitivity and Competitive Commoditization

In mature markets such as North America and Western Europe, hoverboard scooters face strong price competition from generic imports, other micro-mobility devices (electric scooters, e-skateboards), and a plateau in recreational novelty. This limits margin growth, and companies must differentiate or move into adjacent segments (commuter, commercial) to sustain growth.

Hoverboard Scooters Market Opportunities

Emerging Geographies and Urbanizing Regions

Regions such as India, Southeast Asia, Latin America, and parts of the Middle East & Africa remain under-penetrated for hoverboards. Rising disposable income, expanding urban youth populations, growing acceptance of personal mobility devices, and expanding online retail present significant upside. For existing players, this means geographic expansion, tailored low-cost models, and localized manufacturing, while new entrants can achieve early-mover advantage before saturation sets in.

Smart / Connected Product Differentiation

Integrating IoT/connected features (Bluetooth, app control, GPS, diagnostics), premium design, and safety certifications offers manufacturers an avenue to move up-market, improve margins, and build brand loyalty. Services such as anti-theft monitoring, firmware updates, and subscription-based connectivity open recurring revenue potential. Given that the core devices are becoming commoditized, this technological edge is a key differentiator.

Commercial & Shared-Mobility Applications Beyond Recreation

Beyond consumer leisure use, hoverboard scooters are increasingly suitable for commercial use-cases: rental fleets (tourism resorts, theme parks), corporate campuses, university/hospital mobility, and last-mile cargo/warehouse logistics. These segments require more robust, higher-duty devices and often involve B2B sales, leasing models, and service contracts – all of which present higher margin business opportunities than pure consumer retail.

Product Type Insights

Two-wheel self-balancing hoverboards dominate the global hoverboard scooters market, capturing approximately 67% of the market share in 2024. These models are preferred for their intuitive design, stable ride, and widespread availability across both online and offline retail platforms. Their balanced price-performance ratio and ease of learning make them the go-to option for youth and first-time riders. Single-wheel and off-road hoverboards are emerging as niche segments, gaining traction among enthusiasts seeking sportier and terrain-capable options. As technology improves, particularly in motor torque and battery safety, these specialized formats are expected to gain momentum, though the two-wheel category will continue to hold the majority share through 2030 due to its broad consumer appeal and strong brand presence.

Wheel Size Insights

Compact 6.5-inch hoverboards lead the market, accounting for around 63% of total market revenue in 2024. Their popularity stems from lightweight construction, affordability, and suitability for urban environments and smooth indoor surfaces. These models appeal strongly to children and teenagers, making them a popular choice in the recreational segment. Meanwhile, 8.5-inch and 10-inch models designed for adults and off-road riders are showing steady growth due to enhanced durability and versatility. As consumers increasingly adopt hoverboards for commuting and campus mobility, demand for larger wheel sizes is expected to rise; however, compact 6.5-inch boards will remain the global volume driver due to their price accessibility and portability.

Application Insights

Recreational and leisure use remains the leading application in the hoverboard scooters market, representing approximately 53% of total market value in 2024. Hoverboards continue to be viewed primarily as entertainment or lifestyle gadgets, especially among youth demographics and as gift items. However, new application areas are expanding rapidly. Personal mobility applications, including short-distance urban commuting and campus movement, are gaining adoption, supported by improvements in load capacity, range, and battery efficiency. Additionally, commercial and enterprise uses such as theme park rentals, logistics assistance in large facilities, and tourism-based fleet rentals are emerging as promising growth avenues, diversifying the market beyond consumer recreation.

Distribution Channel Insights

Online retail channels dominate hoverboard scooter sales globally, driven by the widespread presence of e-commerce giants such as Amazon, Alibaba, and Walmart. These platforms offer consumers the advantage of price transparency, detailed product comparisons, and customer reviews. Direct-to-consumer (D2C) brand websites are also growing as manufacturers strengthen their digital presence and leverage influencer marketing and social media to build brand identity. Offline distribution channels such as electronics stores, sports retailers, and department stores remain relevant, particularly in markets with safety-conscious consumers preferring physical inspection before purchase. The increasing integration of omnichannel retailing is expected to further blur the lines between online and offline sales by 2030.

End-Use Insights

Recreational and youth-oriented segments continue to dominate end-use demand, supported by strong interest from younger consumers and gift buyers. However, a notable market evolution is occurring as hoverboards transition from leisure products to practical mobility tools. The adult personal mobility segment, including users in urban areas, college campuses, and large industrial sites, is the fastest-growing category, supported by enhanced product designs, improved battery range, and ergonomic safety features. Additionally, commercial applications such as corporate campus fleets, tourism rentals, and intra-facility transport solutions are expanding the industry’s scope. Export-driven demand, primarily from Asian manufacturing hubs to Western consumer markets, is strengthening as hoverboards find broader use in mobility and enterprise settings, marking a shift toward diversified global adoption.

| By Product Type | By Battery Capacity | By Wheel Size | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Analysis

North America

North America remains a significant market, with the United States as the key country. High disposable income, widespread e-commerce penetration, and strong brand presence support demand. We estimate North America at roughly 25 % of the 2024 market (USD 412 million). However, growth is moderate (approx 3-5 % CAGR) because the novelty of hoverboards has matured, and price competition is intense.

Asia-Pacific

Asia-Pacific is both the largest and fastest-growing region. With manufacturing hubs (China), rising youth populations, growing urbanization, and rapidly expanding e-commerce access, this region is estimated to have a 40 % share of the 2024 market (USD 660 million). Countries like China and India are leading contributors: China as a manufacturer and large domestic consumer base; India as a rapidly growing low-base market with increasing interest in micro-mobility. Growth rates in this region could exceed 7-10% annually.

Europe

Europe holds a sizeable share (estimated 20-25 % the global market) in 2024 (USD 330-400 million). Demand is supported by strong regulation and consumer interest in eco-friendly mobility devices, but growth is moderate (4-6 % CAGR) due to market maturity and alternative micro-mobility options (e-scooters, bikes).

Latin America (LATAM)

Latin America is currently a smaller share market (approx 5-10 %, USD 80-150 million in 2024) but holds strong growth potential due to low penetration, rising youth population, improving online retail networks, and interest in affordable personal mobility devices. Growth rates may outstrip mature regions as penetration rises.

Middle East & Africa (MEA)

MEA currently has the smallest share (approx 2-9 % of the global market, USD 50-150 million in 2024). Key growth drivers include high-income Gulf countries (UAE, Saudi Arabia), where leisure and rental markets are expanding, and early-stage uptake in African urban centers. Growth is uneven because of infrastructure and regulatory variance, but opportunity exists in tourism resort mobility and leisure segments.

Fastest-Growing Region/Country

The fastest-growing region is Asia-Pacific, particularly countries like India and Southeast Asian nations, where the base is low and growth tailwinds are strong. India emerges as one of the fastest-growing markets thanks to rising youth/urbanization, improving purchasing power, and expanding e-commerce.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key players in the Hoverboard Scooters Market

- Segway Inc.

- Ninebot Ltd.

- Razor USA LLC

- Airwheel Technology Co., Ltd.

- Gyroor Technology Co., Ltd.

- TOMOLOO Technology Industrial Co., Ltd.

- Smart Balance (parent company)

- Hetechi Ltd.

- Chic Intelligent Technology Co., Ltd.

- Megawheels (parent)

- Jetson Electric Bikes LLC

- Phunkeeduck (parent)

- HoverRobotix (parent)

- Uboard India Limited

- SWAGTRON (brand/parent)