Household Robots Market Size

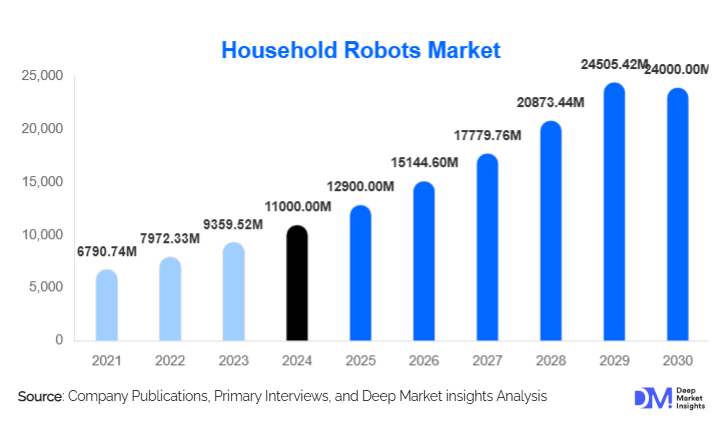

According to Deep Market Insights, the global household robots market size was valued at USD 11,000 million in 2024 and is projected to grow from USD 12,900 million in 2025 to reach USD 24,000 million by 2030, expanding at a CAGR of 17.4% during the forecast period (2025–2030). The household robots market growth is primarily driven by rapid advancements in artificial intelligence, increasing consumer adoption of smart home technologies, and growing demand for convenience-driven lifestyle solutions. As automation becomes central to modern living, domestic robots are emerging as essential tools for cleaning, maintenance, security, and companionship in connected households.

Key Market Insights

- Cleaning and vacuuming robots dominate the market, accounting for nearly 35% of global revenue in 2024, supported by widespread affordability and consumer familiarity.

- Asia-Pacific leads the global market with a 40–45% share, driven by strong manufacturing capacity, rising disposable incomes, and robust smart home penetration.

- AI and IoT integration is reshaping product functionality, enabling autonomous navigation, adaptive learning, and cross-device connectivity within smart homes.

- Personal assistance and elderly care robots are emerging as the fastest-growing segment, supported by aging populations in Japan, Europe, and China.

- Online retail channels dominate distribution, contributing over 55% of sales as consumers increasingly prefer e-commerce and direct-to-consumer models.

- Hardware remains the core revenue source, representing 45–50% of total market value, though software and service subscriptions are growing faster.

Latest Market Trends

AI-Driven Autonomy and Multi-Functional Robots

Technological convergence of AI, sensors, and edge computing is enabling robots to perform multiple domestic tasks with higher accuracy. The latest models combine vacuuming, mopping, and air-quality monitoring, while next-generation robots integrate with smart assistants like Alexa and Google Home for voice-based control. AI-based mapping and obstacle detection ensure better performance in complex home environments. Manufacturers are emphasizing upgradable software, allowing devices to evolve through periodic updates, creating a subscription-based revenue model.

Integration of Robotics with Smart Home Ecosystems

Household robots are increasingly designed to work within a connected ecosystem of devices. Integration with IoT platforms enables robots to communicate with thermostats, lighting, and security systems for coordinated home automation. For instance, vacuum robots can operate when motion sensors detect absence, or surveillance robots can trigger alerts linked to smart locks. This interoperability is fostering ecosystem-based purchasing behavior, where users invest in a cohesive suite of interconnected products rather than standalone robots.

Rise of Elderly Assistance and Companionship Robots

With global aging trends accelerating, particularly in Japan, Germany, and China, demand for robots capable of companionship, mobility support, and health monitoring is increasing. These robots use natural language processing, facial recognition, and sensor-based tracking to assist with daily routines, medication reminders, and emergency alerts. Governments and healthcare institutions are piloting programs to subsidize such technologies, enhancing adoption among senior populations. The segment is expected to register a CAGR exceeding 20% during 2025–2030.

Household Robots Market Drivers

Advancements in Artificial Intelligence and Sensor Technologies

Continuous improvements in AI algorithms, combined with cost-effective sensors and LiDAR technologies, have dramatically enhanced the capabilities of household robots. Robots can now map environments in real time, recognize objects, and optimize cleaning or assistance routines autonomously. These technological breakthroughs have lowered operational errors and increased consumer trust, directly accelerating adoption rates across developed and emerging markets.

Growing Smart Home Adoption and Connected Living

The rise of smart homes has created fertile ground for household robots. With over 400 million smart home devices sold globally in 2024, consumers are increasingly seeking automation that extends beyond lighting and temperature control. Robots serve as key components of connected ecosystems, offering both functionality and status appeal. Integration with mobile apps and voice assistants allows seamless operation, aligning with the global trend toward convenience and personalization.

Rising Disposable Income and Lifestyle Automation

Urbanization, dual-income households, and time constraints are propelling consumers toward automated solutions that reduce domestic workload. Robots performing cleaning, mowing, and pool maintenance have become aspirational consumer electronics products. In fast-growing economies such as India, China, and Brazil, increasing affordability and localized manufacturing are expanding market reach beyond affluent demographics, turning household robotics into a mainstream lifestyle utility.

Market Restraints

High Initial Cost and Maintenance Challenges

Despite falling prices, high-end household robots remain expensive, limiting accessibility in price-sensitive markets. Advanced cleaning and assistance robots require costly sensors and software components, contributing to elevated retail prices. Maintenance expenses, including replacement parts and software upgrades, further increase the total cost of ownership. This cost barrier continues to restrain large-scale penetration in emerging economies.

Technical Limitations and Data Privacy Concerns

Although robots are becoming more intelligent, issues such as navigation in cluttered environments, limited battery life, and software reliability persist. Moreover, as robots use cameras and microphones for operation, privacy concerns around data collection and transmission have emerged as major challenges. Regulatory frameworks on data protection remain uneven across regions, necessitating stronger compliance and consumer transparency measures from manufacturers.

Household Robots Market Opportunities

Elderly Care and Healthcare Assistance Robots

The global elderly population is expected to surpass 1.5 billion by 2050, creating a massive opportunity for robots designed for personal care, monitoring, and companionship. Governments and healthcare institutions are investing in pilot programs to integrate assistive robots in home care settings. Companies that innovate in safety, emotion recognition, and medical integration stand to capture strong early-mover advantages in this segment.

Expansion in Emerging Markets

With urbanization and rising middle-class incomes across Asia-Pacific, Latin America, and the Middle East, demand for affordable domestic robots is expanding. Localization of production, especially in China, India, and Southeast Asia, is reducing costs and import tariffs. Tiered pricing models and modular product offerings are enabling penetration into mid-income households, while e-commerce distribution ensures wider reach. Emerging markets are expected to contribute over 35% of incremental market growth through 2030.

Integration with IoT and Cloud-Based Services

The shift toward cloud connectivity presents opportunities for subscription-based business models, allowing users to receive software upgrades, predictive maintenance, and data analytics insights. Manufacturers are focusing on interoperability with IoT platforms, creating ecosystems that connect robots with home energy management, security, and entertainment systems. This trend enhances customer retention while opening recurring revenue streams for companies.

Product Type Insights

Among product types, vacuuming and cleaning robots dominate the market, accounting for approximately 35% of global revenue in 2024. Their popularity is attributed to convenience, affordability, and continuous product innovation, such as self-emptying bins and hybrid mop features. Lawn-mowing and pool-cleaning robots follow, capturing around 15% market share combined. Emerging categories like companion and elderly care robots are witnessing the highest growth momentum, forecast to expand at over 20% CAGR as health-tech integration deepens.

Component Insights

Hardware remains the leading revenue contributor, representing nearly 45–50% of the total market value in 2024, driven by robust sales of robotic devices, sensors, and batteries. However, the software and services segment is growing rapidly, fueled by demand for app-based controls, AI updates, and maintenance subscriptions. As hardware prices fall, recurring service revenues are expected to become the primary profitability lever for manufacturers.

Distribution Channel Insights

Online sales dominate the household robots market, generating more than 55% of total revenues in 2024. E-commerce platforms and direct-to-consumer websites provide consumers with competitive pricing, detailed comparisons, and convenient delivery options. Offline channels, including electronics retailers and specialty appliance stores, continue to serve premium customers seeking hands-on product demonstrations. Hybrid models where consumers test offline and purchase online are gaining prominence across developed regions.

| By Product Type | By Technology | By Price Range | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global household robots market, commanding a 40–45% share in 2024. Strong domestic manufacturing in China, Japan, and South Korea, coupled with high smart home adoption, underpins regional dominance. India and Southeast Asia are emerging as high-growth markets, supported by declining robot prices and rising middle-class adoption. The region is expected to maintain its leadership through 2030, growing at a CAGR exceeding 18%.

North America

North America represents around 25–30% of global demand, with the U.S. leading the adoption of cleaning and security robots. High disposable incomes, widespread smart home penetration, and early technology adoption contribute to market maturity. The region also hosts several leading manufacturers and startups focused on personal assistance robots for elderly care, a segment gaining strong traction due to demographic trends.

Europe

Europe holds a 20–25% share of the global market, driven by demand in Germany, the U.K., and France. The region’s aging population, emphasis on energy-efficient products, and strict safety standards foster growth for certified and sustainable robot models. Government support for elderly assistance technology and smart home innovations further strengthens regional adoption.

Middle East & Africa

MEA accounts for 3–5% of market share, led by the UAE and Saudi Arabia, where high-income consumers are investing in luxury smart home solutions. Adoption in Africa is slower but expanding through government-led technology programs and distribution partnerships.

Latin America

Latin America represents 3–6% of the global market, with Brazil and Mexico at the forefront. Market expansion is supported by the growth of e-commerce platforms and the increased affordability of entry-level robots. The region is expected to witness accelerated adoption beyond 2026 as manufacturing partnerships and import substitution policies reduce product costs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Robots Market

- iRobot Corporation

- Ecovacs Robotics

- Samsung Electronics

- Dyson Ltd.

- Xiaomi Corporation

- LG Electronics

- Roborock

- Neato Robotics

- Miele

- SharkNinja

- PANASONIC Corporation

- Bissell Inc.

- Dreame Technology

- Anker Innovations (Eufy)

- Yujin Robot Co., Ltd.

Recent Developments

- In March 2025, iRobot unveiled its new AI-enabled Roomba Vision series featuring adaptive mapping and real-time obstacle detection, targeting premium smart home users.

- In February 2025, Ecovacs Robotics announced its first modular multi-function home robot integrating cleaning, air purification, and surveillance capabilities.

- In January 2025, Dyson launched a household robot vacuum equipped with solid-state LiDAR and AI-based learning algorithms for dynamic navigation.