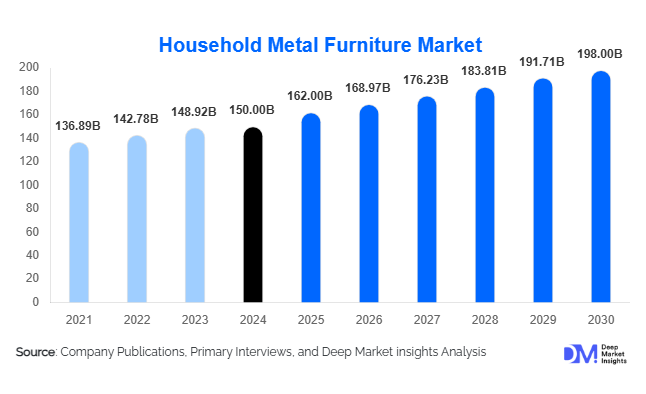

Household Metal Furniture Market Size

According to Deep Market Insights, the global metal furniture market was estimated at USD 150.0 billion in 2024 and is projected to reach around USD 162.5 billion in 2025. Over the forecast horizon from 2025 to 2030, the market is expected to grow to about USD 198.0 billion, corresponding to a CAGR of 4.3 %. The market is thus poised for steady growth driven by urbanization, rising middle-class incomes, increased online furniture purchases, and demand for durable, multifunctional metal furnishings.

Key Market Insights

- Metal furniture is shifting from purely utilitarian to design-forward, multifunctional forms, combining aesthetics with durability and versatility.

- E-commerce and direct-to-consumer distribution are gaining ground, reducing dependence on showrooms and enabling customization at scale.

- North America holds a significant share due to high per capita spending on premium furniture and replacement cycles.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising incomes, and penetration of organized retail.

- Steel (mild + stainless) remains the dominant material for its strength, availability, and finish adaptability.

- Modular, foldable, and multifunctional metal furniture is emerging as a design trend favored by consumers in smaller urban dwellings.

Latest Market Trends

Rise of Multifunctional & Space-Saving Designs

In many major cities, rising housing costs and shrinking living spaces have pushed consumers toward furniture that can adapt. Metal furniture designers are now introducing foldable beds, convertible tables, storage-integrated units, and modular components that allow flexible reconfiguration. Such designs preserve strength while saving footprint. This trend is especially evident in apartment markets in Asia, Europe, and North America, where consumers prioritize utility and aesthetics equally.

Hybrid Material & Mixed Finish Options

To combine the warmth of wood and sleekness of metal, manufacturers are increasingly offering hybrid furniture-metal frames with wooden or glass surfaces, mixed finishes, decorative perforations, and powder-coat accents. These combinations appeal to customers who want a premium look without compromising on the strength or durability advantages of metal. The strategy helps manufacturers differentiate in a crowded market and command higher margins.

Market Drivers

Durability, Low Maintenance & Hygiene Appeal

Metal furniture resists pests, warping, and weathering when properly finished, making it a long-lasting and low-maintenance choice. In the wake of heightened hygiene awareness, consumers favor materials that are easier to clean and maintain. Especially for beds, dining furniture, and storage units, metal surfaces offer benefits over porous materials or untreated wood.

Growth in Real Estate, Renovation & Urbanization

New residential construction, urban redevelopment, and interior renovations are fueling demand for home furnishings. As more middle-income households buy or upgrade homes, the replacement and upgrade cycle for furniture picks up, boosting metal furniture demand. In high-growth markets in APAC and Latin America, rapid urban housing projects provide significant new demand.

Surge in E-Commerce & Direct Sales Models

The shift to online buying has accelerated. Metal furnitureonce considered too bulky for long-distance shipping now being modularized, flat-packed, or shipped in welded subassemblies. Brands are also leveraging AR/VR tools to let consumers visualize furniture in their homes, reducing uncertainty and boosting conversions.

Market Restraints

Fluctuating Raw Material & Coating Costs

The price volatility of steel, aluminum, coatings, and finishing chemicals can erode margins, especially for mid- and low-tier manufacturers. Tariffs, trade restrictions, and supply chain disruptions further exacerbate cost risk.

Competition from Alternative Materials & Design Perceptions

Consumers still often perceive metal furniture as “cold,” impersonal, or industrial. Competing materials like engineered wood, plastics, or composite panels may offer warmth, texture, or lower upfront cost. Overcoming these perception barriers requires superior design, finish, and marketing.

Opportunities in the Household Metal Furniture Market

Expansion into Emerging & Secondary Cities

Most metal furniture demand is currently concentrated in major metropolitan areas. Yet, in many countries, secondary and tertiary cities are underpenetrated. New entrants or incumbents can target these areas via local manufacturing or assembly, reducing logistics costs and import burdens. Government housing or social residential projects in such cities often require cost-effective, durable furniture ideal use case for metal furniture suppliers.

Green & Circular Economy Models

Consumers and regulators are increasingly demanding sustainable products. Metal furniture manufacturers can adopt recycled steel/aluminum, low-VOC coatings, take-back or upgrade programs, and transparent supply chains. Offering “green certified” or modular upgradeable metal furniture is a differentiator. In markets with stricter environmental regulation (e.g. EU), this also helps compliance.

Integration of Smart & Tech Features

Embedding features such as built-in USB/USB-C ports, wireless charging, LED lighting, sensor-based controls, or IoT-enabled tracking in metal furniture is an emerging trend. Such “smart metal furniture” can command premium pricing and appeal to tech-savvy consumers. This is especially attractive in home offices or multifunctional living areas.

Product Type Insights

Bed frames (metal beds) dominate the segment because of their high unit value, durability, and long lifecycle. As one of the essential furniture items, metal beds often carry premium finishing and customization premiums. Tables and storage units follow, benefitting from modular design and multifunctionality. Chairs and stools offer volume but lower value per unit, making margins tighter in that category. The trend toward hybrid materials, foldable or extendable tables, and storage-integrated pieces is notable and accelerating.

Application Insights

Residential use is the primary application for household metal furniture, spanning bedrooms, living rooms, dining areas, and home offices. Growth is being amplified by niche applications such as balcony/terrace/outdoor metal furniture, compact city living (micro-apartments), and home offices. In addition, metal furniture is being adopted in “prefab homes,” modular homes, and studio apartments, where strength, low-maintenance, and compactness matter. The boundary between household and light commercial sometimes blursfor example, in co-living spaces or serviced apartments, metal furniture is frequently used due to its durability.

Distribution Channel Insights

The majority of metal furniture is still sold via offline showrooms, specialty retailers, and big-box stores, especially for larger items where consumers prefer to see and feel finishes and strength. However, online (e-commerce, brand D2C) is growing rapidly. Many brands now offer custom ordering, virtual visualization, and flat-pack delivery. Hybrid models, showroom + online ordering also gaining traction. Some companies offer membership or subscription programs for furniture upgrades or rentals in urban markets.

End-Use / Household Type Insights

Urban apartments and single-family homes represent the largest share of demand, with growing interest in smart, space-efficient metal furniture. Younger demographics (25–45) are driving demand for modular and multifunctional pieces, prioritizing a combination of utility and design. In contrast, older segments may favor more classic or ornate metal styles with stronger build quality. Multi-generational households or those seeking flexible configurations (e.g., for guests) increasingly turn to convertible or foldable metal furniture.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a substantial share of the global metal furniture market, driven by high disposable incomes, a strong culture of home renovation, replacement cycles, and design awareness. In 2024, the region’s share is estimated at 40 %. The U.S. leads demand, particularly in premium metal furniture, both for new homes and refurbishments. Consumers expect premium finishes, warranties, and customization. Growth is steady but not explosive, with a continued move toward e-commerce and modular designs.

Asia-Pacific

Asia-Pacific is likely the fastest-growing region, with a 2024 share estimated at 30 %. Countries such as China, India, Vietnam, and Southeast Asian markets are urbanizing rapidly, driving demand for metal furniture. China is a major consumption and export hub. Manufacturers in the region benefit from lower costs and proximity to growth markets. In India, growing urban housing and rising incomes push demand across income strata. ASEAN countries, as middle-income markets, are increasingly adopting modern metal furniture via both local producers and imports.

Europe

Europe accounts for 20 % of the market in 2024. Western Europe leads in premium, design-forward metal furniture, especially in Germany, the UK, France, and Italy. Demand is shaped by regulatory pressures (recycled content, emissions) and consumer preference for sustainability and design. Eastern Europe is a growing segment, catching up with modern furniture trends and benefiting from lower-cost production hubs.

Latin America

Latin America represents 5–8 % of the global market. Brazil and Mexico dominate regional demand. Growth is moderate; import costs, currency fluctuations, and infrastructure limitations inhibit faster expansion. However, growing middle classes in urban centers drive demand for better furnishings, and domestic manufacturing is expanding to meet local demand.

Middle East & Africa

In MEA, the share is modest ( 5 %). Gulf countries (UAE, Saudi Arabia, Qatar) generate demand for luxury coastal, outdoor, and indoor metal furniture, while Africa’s urbanization and housing expansion offer long-term potential. Constraints include import duties, logistics, and infrastructural bottlenecks. Some sub-Saharan countries are slowly adopting modern metal furniture in rising urban markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Metal Furniture Market

- Steelcase Inc.

- MillerKnoll (Herman Miller + Knoll)

- HNI Corporation

- Godrej Interio

- Haworth

- Chyuan Chern Furniture Co.

- Meco Corporation

- Foshan Kinouwell Furniture

- Xinyue Holding Group

- Oliver Metal Furniture

- KI (Krueger International)

- Aldermans

- Okamura Corporation

- Vitra International

- Weiling Steel Furniture

Recent Developments

- 2024–2025: Some leading firms announced shifts toward sustainable steel and “green metal” manufacturing (e.g., using recycled inputs or low-carbon production lines).

- 2025: Several manufacturers rolled out modular/foldable metal furniture lines targeting urban dwellers, reducing packaging footprint and freight cost.

- 2025: Several direct-to-consumer metal furniture brands introduced AR/VR room-placement apps to reduce returns and improve buyer confidence.