Household Insecticides Market Size

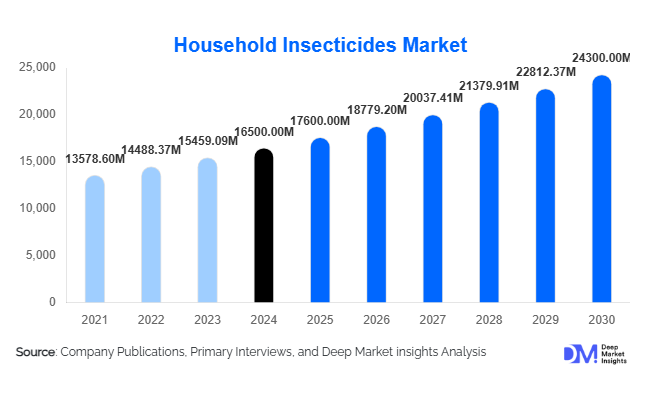

According to Deep Market Insights, the global household insecticides market size was valued at USD 16,500 million in 2024 and is projected to grow from USD 17,600 million in 2025 to reach USD 24,300 million by 2030, expanding at a CAGR of 6.7% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of hygiene and health risks, increased prevalence of vector-borne diseases, and growing adoption of eco-friendly and plant-based formulations across both developed and emerging regions.

Key Market Insights

- Consumer preference is shifting toward natural, plant-based, and DEET-free insecticides, driven by health-conscious buyers seeking safe and eco-friendly household pest solutions.

- Smart insecticide devices, including IoT-enabled vaporizers and sensor-driven dispensers, are gaining traction, enabling subscription-based refill models and automated pest control.

- Asia-Pacific is emerging as the fastest-growing region, fueled by urbanization, tropical climate conditions, and rising middle-class purchasing power in India, China, and ASEAN countries.

- North America dominates the market, with high adoption of premium sprays, vaporizers, and innovative delivery systems in households.

- Online retail channels are expanding rapidly, allowing consumers to conveniently purchase insecticide solutions and refill packs, particularly during high mosquito and pest seasons.

- Government public health programs and vector control initiatives are increasing demand for household insecticides in tropical and disease-prone regions, especially in Africa and South Asia.

Latest Market Trends

Rise of Eco-Friendly and Plant-Based Formulations

Manufacturers are increasingly investing in clean-label, natural insecticide formulations derived from citronella, lemongrass, pyrethrin, and other botanical ingredients. These products appeal to health-conscious consumers and households with children and pets, offering safer alternatives to chemical-heavy insecticides. Growth of D2C channels and eco-friendly packaging further strengthens adoption. Retailers are bundling these products with home hygiene solutions to increase cross-sell potential and encourage brand loyalty.

Smart Insecticide Devices

IoT-enabled and sensor-driven household insecticide devices, such as smart vaporizers, connected coils, and automated dispensers, are transforming usage patterns. Integration with mobile apps allows users to control pest management remotely, track insect activity, and schedule refill deliveries. Subscription-based consumables are emerging, offering manufacturers recurring revenue opportunities while improving user convenience and reducing wastage. This trend is particularly strong in North America and Europe, where smart-home adoption is high.

Household Insecticides Market Drivers

Increasing Vector-Borne Disease Awareness

Rising incidences of malaria, dengue, Zika, and chikungunya in tropical regions are significantly driving the demand for household insecticides. Government campaigns and educational programs encourage households to adopt mosquito repellents, sprays, and traps, boosting overall market penetration. Consumers are increasingly proactive in preventing pest-related health hazards, particularly in urbanized and high-density residential areas.

Urbanization and Rising Disposable Income

Rapid urbanization in Asia-Pacific, Latin America, and Africa is increasing the exposure of households to pests. Growing disposable income allows consumers to purchase premium insecticide products, including smart devices, vaporizers, and natural repellents. Affluent households in North America and Europe continue to adopt advanced household pest solutions, contributing to high growth in the premium segment.

Expansion of E-Commerce Channels

Online retail channels, including D2C and marketplaces, provide convenience, variety, and price transparency, accelerating market growth. Seasonal and subscription-based offerings for insecticides (e.g., coils, refillable vaporizers) help maintain consistent revenue streams while increasing product visibility and accessibility for consumers in both urban and rural areas.

Market Restraints

Stringent Regulatory Environment

Household insecticide manufacturers face strict regulations related to chemical content, labeling, and safety standards. Compliance with regional standards (EPA in North America, REACH in Europe) requires investment in testing and certification, which can increase production costs and create barriers to entry, particularly for smaller companies.

Rising Raw Material Costs

Fluctuations in the prices of active ingredients such as pyrethroids, DEET, and botanical extracts can impact product pricing and profitability. Manufacturers need to manage cost volatility carefully to maintain competitive pricing while ensuring efficacy and compliance with safety regulations.

Household Insecticides Market Opportunities

Premiumization and Plant-Based Formulations

The shift toward natural, eco-friendly insecticides provides opportunities for premium product launches. Plant-based sprays, lotions, and coils cater to health-conscious consumers, allowing companies to charge higher prices and achieve better margins. Certifications, such as organic or third-party safety validations, enhance brand credibility and consumer trust.

Smart Insecticide Device Adoption

Connected vaporizers, sensor-triggered dispensers, and app-integrated devices are emerging as growth avenues. These devices enable subscription-based consumables, automated deployment, and real-time pest monitoring, creating recurring revenue and increasing user engagement. Companies integrating smart technology gain differentiation and long-term customer loyalty.

Government Vector Control Programs and Regional Expansion

Public-private partnerships in malaria and dengue-prone regions present large procurement opportunities. Manufacturers aligning with health agencies and donor-funded initiatives can secure stable contracts while expanding market presence. Rapid urbanization in South Asia and Africa supports demand for affordable coils, sprays, and gels, making regional production a strategic growth lever.

Product Type Insights

Mosquito repellents, particularly coils and liquid vaporizers, dominate the market, accounting for approximately 32% of the 2024 market share. The segment’s leading position is due to high mosquito prevalence in tropical and subtropical regions, ongoing disease control awareness campaigns, and consumer familiarity with these products. Ant and cockroach killers hold a strong position in urban households, driven by high-density living and growing hygiene consciousness.

Application Insights

Indoor household applications remain the largest segment, comprising 58% of the 2024 market share. Indoor sprays, gels, and vaporizers are widely adopted for daily pest management, with consumers prioritizing safety and efficacy. Outdoor applications, such as garden sprays and perimeter treatments, are growing steadily due to landscaping trends and backyard gardening in urban homes.

Distribution Channel Insights

Offline retail dominates, accounting for 65% of total sales in 2024, particularly through supermarkets, hypermarkets, and specialty stores. However, online channels are the fastest-growing, driven by convenience, seasonal demand, and direct-to-consumer refill models. E-commerce penetration is particularly strong in North America, Europe, and parts of Asia-Pacific.

| By Product Type | By Formulation | By Distribution Channel | By Application Area |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share at 28% of the global market in 2024, driven by widespread adoption of advanced insecticides and smart devices. High disposable incomes, awareness campaigns, and the prevalence of mosquitoes in coastal and subtropical regions support growth.

Europe

Europe accounts for approximately 22% of the 2024 market share, with Germany, the U.K., and France leading consumption. Demand is concentrated on eco-friendly sprays, aerosols, and vaporizers in urban households. Consumers are increasingly focused on safety, compliance, and sustainable ingredients.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by India, China, and ASEAN countries. High mosquito and pest prevalence, rapid urbanization, and rising middle-class purchasing power drive strong demand for coils, liquid vaporizers, and gel baits. Public health campaigns also support household adoption, making the region a major growth engine.

Latin America

Brazil and Mexico lead demand in LATAM, with growth supported by mosquito-borne disease prevalence and urban population expansion. Affordable coils and aerosols dominate consumption, with increasing adoption of vaporizers in premium households.

Middle East & Africa

In Africa, high malaria incidence drives widespread use of household insecticides. South Africa, Kenya, and Nigeria represent key markets. GCC countries in the Middle East focus on premium repellents and smart devices for expatriate and affluent households. Regional public health initiatives significantly influence demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lifestyle Concierge Services Market

- SC Johnson

- Reckitt Benckiser

- Godrej Consumer Products

- Sumitomo Chemical

- Bayer AG

- SCM Corporation

- Kalina Group

- ADAMA Agricultural Solutions

- Kemira Oyj

- Syngenta AG

- Hindustan Unilever

- Pidilite Industries

- Nippon Soda

- FMC Corporation

- UPL Limited

Recent Developments

- In January 2025, SC Johnson expanded its eco-friendly household insecticide portfolio in Asia-Pacific, launching plant-based coils and aerosols with biodegradable packaging.

- In March 2025, Reckitt Benckiser introduced IoT-enabled mosquito vaporizer devices in North America and Europe, integrating subscription refill services.

- In June 2025, Godrej Consumer Products scaled up local production in India to meet increasing demand from vector control programs and urban households, reducing dependency on imports.