Household Gas Stoves Market Size

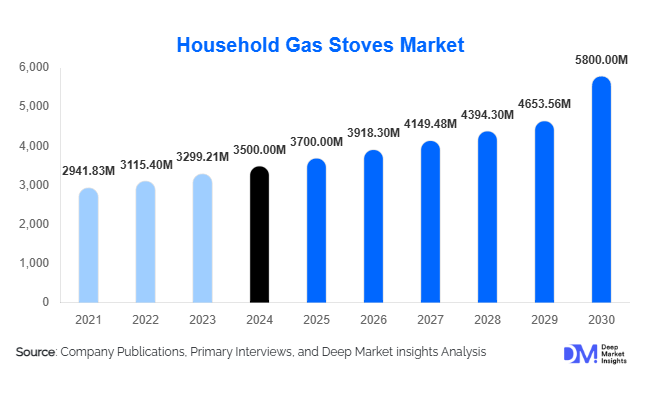

According to Deep Market Insights, the global household gas stoves market size was valued at USD 3,500 million in 2024 and is projected to grow from USD 3,700 million in 2025 to reach USD 5,800 million by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). The market growth is primarily driven by rising urbanization, increasing preference for energy-efficient and technologically advanced cooking appliances, and growing disposable incomes in emerging economies, which collectively fuel the adoption of modern household gas stoves globally.

Key Market Insights

- Technological innovations are reshaping consumer preferences, with IoT-enabled gas stoves and features like auto-ignition, precise flame control, and safety mechanisms gaining traction among households seeking convenience and efficiency.

- LPG gas stoves remain the most widely used globally, especially in regions lacking natural gas infrastructure, due to their portability, ease of installation, and cost-effectiveness.

- Asia-Pacific dominates the market, with India and China leading demand due to rapid urbanization, expanding middle-class populations, and a shift toward modern cooking solutions.

- North America maintains a steady demand, driven by a preference for gas cooking appliances and well-established retail networks.

- Europe shows growing adoption of energy-efficient and environmentally compliant stoves, aligning with stricter regulations and sustainability goals.

- Offline retail remains the dominant distribution channel, as consumers prefer physical inspection of stoves, although online sales are rising rapidly, particularly for premium models.

Latest Market Trends

Smart and Energy-Efficient Gas Stoves

Household gas stove manufacturers are increasingly integrating smart technologies, such as IoT connectivity, flame failure safety devices, and energy-efficient burners, to enhance cooking precision and reduce fuel consumption. Smart gas stoves with automated ignition and temperature control are particularly appealing to urban households seeking convenience. The focus on energy efficiency also aligns with environmental sustainability goals and reduces household energy costs, thereby encouraging adoption across both developed and developing markets.

Shift Towards Eco-Friendly and Durable Materials

Consumers are prioritizing stoves made from stainless steel and tempered glass due to their durability, ease of cleaning, and long-term value. Manufacturers are increasingly using high-quality materials to differentiate products, offering premium stoves that combine functionality with aesthetics. This trend has encouraged companies to invest in R&D to develop environmentally friendly coatings and fuel-efficient burners, strengthening their market position.

Household Gas Stoves Market Drivers

Urbanization and Changing Lifestyles

The expansion of urban populations and busier lifestyles has led to a higher demand for quick, efficient, and safe cooking appliances. Gas stoves provide instant heat and precise flame control, making them a preferred choice for modern households where convenience and speed are essential.

Technological Advancements

Innovations such as smart stove integration, IoT-enabled controls, and safety mechanisms are driving market growth. These features enhance user experience, reduce risks of accidents, and cater to consumers’ increasing appetite for connected and intelligent appliances.

Energy Efficiency and Cost Savings

LPG and natural gas stoves are more energy-efficient than conventional electric stoves, offering lower operating costs. Households are increasingly adopting gas stoves to minimize energy consumption and reduce monthly utility expenses, supporting steady market growth.

Market Restraints

Health and Environmental Concerns

Combustion of gas in stoves releases pollutants like nitrogen dioxide, contributing to indoor air pollution and potential health risks. Consumers are becoming increasingly aware of these effects, prompting some to explore electric or induction alternatives.

Regulatory Challenges

Strict environmental and safety regulations in developed regions are pushing manufacturers to adopt cleaner, safer designs. Compliance requirements can increase production costs, slowing growth and limiting market accessibility in certain areas.

Household Gas Stoves Market Opportunities

Expansion in Emerging Economies

Rapid urbanization and rising incomes in countries such as India, China, and Southeast Asian nations present substantial growth opportunities. There is an increasing shift from traditional cooking methods to modern gas stoves, particularly among middle-class households seeking convenience and energy efficiency.

Smart Kitchen Integration

Integration of household gas stoves with smart home ecosystems offers a significant opportunity. IoT-enabled stoves with remote monitoring, app-based controls, and safety features appeal to tech-savvy consumers, providing manufacturers with avenues to capture premium market segments.

Sustainable Cooking Solutions

Growing environmental awareness is driving demand for fuel-efficient stoves with reduced emissions. Companies developing stoves that meet eco-friendly standards and consume less fuel can differentiate themselves, attracting environmentally conscious households globally.

Product Type Insights

Double-burner gas stoves dominate the global market, accounting for a significant portion of sales in 2024. Their versatility allows simultaneous cooking of multiple dishes, saving time and energy. Single and triple-burner models are growing in niche segments but remain less prevalent. LPG stoves are preferred globally for portability and ease of use, while natural gas stoves see higher adoption in regions with pipeline infrastructure.

Application Insights

Residential households are the primary end-use segment for gas stoves, accounting for the majority of demand. Commercial applications, including small restaurants, cafés, and catering services, contribute to market growth, especially in urban centers. Export-driven demand is notable, particularly from manufacturing hubs like China to developing regions where gas stoves are increasingly essential for household cooking.

Distribution Channel Insights

Offline retail continues to lead as the preferred distribution channel due to consumer preference for product inspection before purchase. However, online sales are growing, particularly for premium smart stoves. E-commerce platforms provide convenience, wider product visibility, and direct-to-consumer access, enabling brands to expand their reach and improve margins.

| By Product Type | By Fuel Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The U.S. and Canada represent a stable market, driven by urban households favoring energy-efficient and technologically advanced stoves. North America accounted for approximately 20% of the global market in 2024. Consumers prefer premium stoves with smart features and high safety standards, supported by established retail and e-commerce networks.

Europe

Germany, France, and the U.K. dominate demand in Europe, collectively accounting for 18% of the 2024 market. Strict environmental standards drive the adoption of fuel-efficient and safe appliances. The region is witnessing a gradual shift toward smart, energy-saving gas stoves.

Asia-Pacific

India and China are the largest markets, fueled by rising middle-class incomes and urbanization. Rapid adoption of modern cooking solutions, coupled with government initiatives promoting domestic manufacturing, supports growth. APAC is also the fastest-growing region, with an annual growth rate exceeding 6%, driven by both residential demand and exports.

Middle East & Africa

Saudi Arabia, the UAE, and South Africa are key contributors, where traditional cooking methods coexist with modern gas stove adoption. Availability of natural gas and government incentives for energy-efficient appliances drive market growth in this region.

Latin America

Brazil, Mexico, and Argentina are witnessing rising adoption due to urbanization and increasing awareness of energy-efficient cooking technologies. The market is still developing but shows potential for growth in urban and semi-urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Gas Stoves Market

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- Godrej Appliances

- Haier Group

- Bajaj Electricals

- IFB Industries

- Electrolux AB

- Rinnai Corporation

- Faber Appliances

- Eurochef

- Super Asia

- Arcelik A.Ş.

- Prestige

- Panasonic Corporation

Recent Developments

- In March 2025, LG Electronics launched a smart gas stove with IoT-enabled controls and energy-saving features in India, targeting tech-savvy urban households.

- In February 2025, Whirlpool Corporation introduced a new range of stainless steel, fuel-efficient gas stoves in Europe, aligned with EU energy-efficiency regulations.

- In January 2025, Haier Group expanded its production facility in China to boost exports of modern gas stoves to Southeast Asia and the Middle East.